The prices for many farm inputs, such as fertilizer, are determined more so by conditions on global or national rather than local markets. However, the industrial organization (i.e., businesses that sell the products) and geographical characteristics (e.g., infrastructure, presence of irrigation) can be more important factors for determining the prices of other factors, such as farm labor (wages) and irrigation water assessments and can lead to variation in the nationally traded inputs across different locations. Thus, for this article, current prices for several Idaho crop inputs are presented.

Irrigation and labor

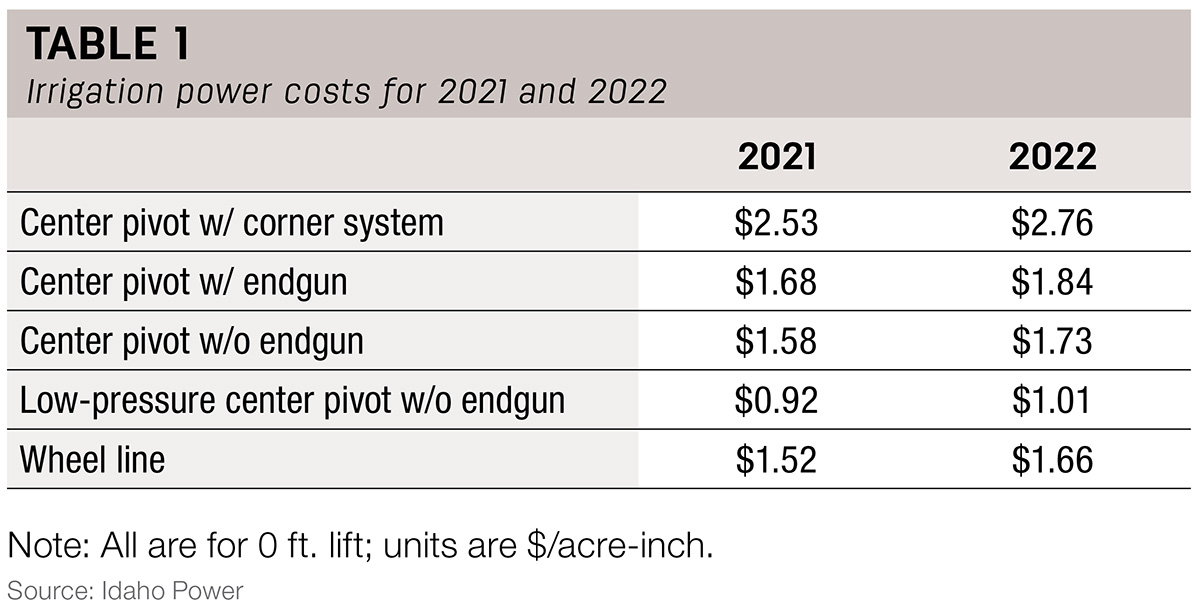

Irrigation and labor – these two cost components are reported first because they comprise a relatively high share of total costs of crop enterprises on a per-acre basis. Table 1 shows data for irrigation power costs for 2021 and 2022 for a variety of different irrigation systems. Irrigation power costs increased from 2021 to 2022 for every irrigation system, and the year-to-year increase was about 9% for all.

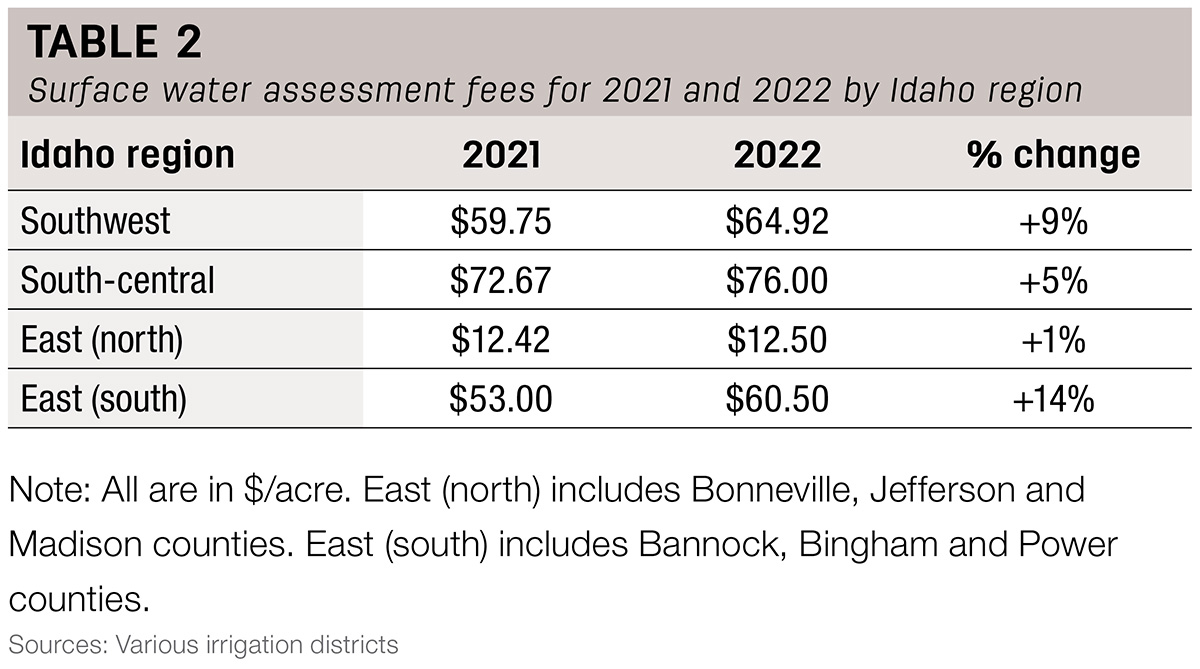

Unlike irrigation power costs, surface water assessments vary greatly across regions, and there were substantial differences in the year-to-year changes between 2021 and 2022 in different regions (Table 2). The south-central region retained the highest surface water assessment fees across the regions, but the largest increase between 2021 and 2022 was for the east (south) counties, and the smallest was for the east (north) counties.

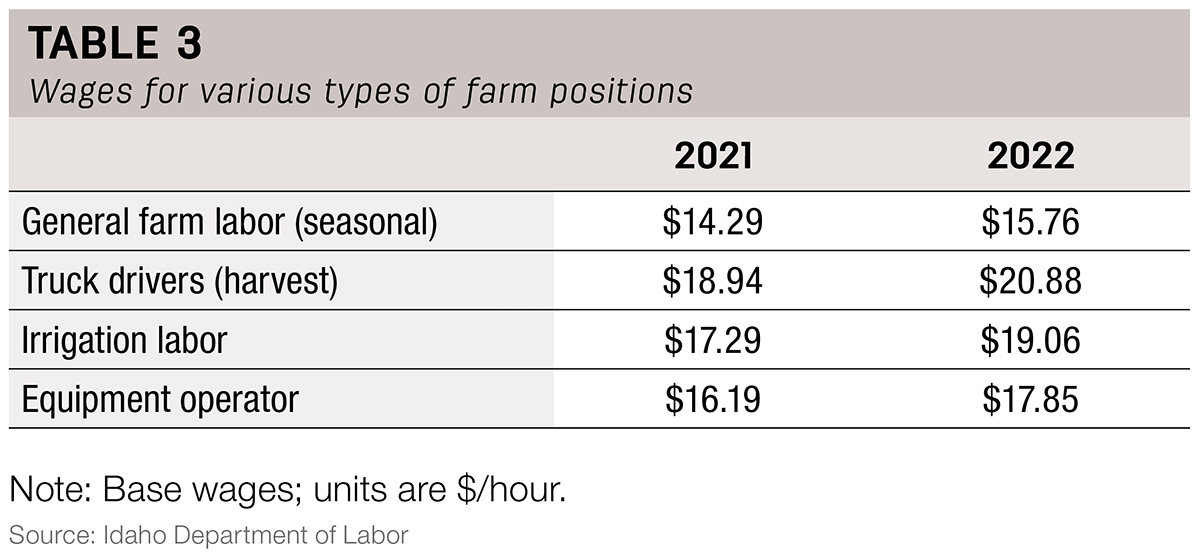

Labor can be one of the most substantial cost segments for a farm business, especially for those that have labor-intensive production activities. Table 3 includes data on wages for several types of farm positions for 2021 and 2022. The data show that wages increased between 2021 and 2022 for all positions, and the increase was about 10% for all.

Fertilizer, fuel and interest rates

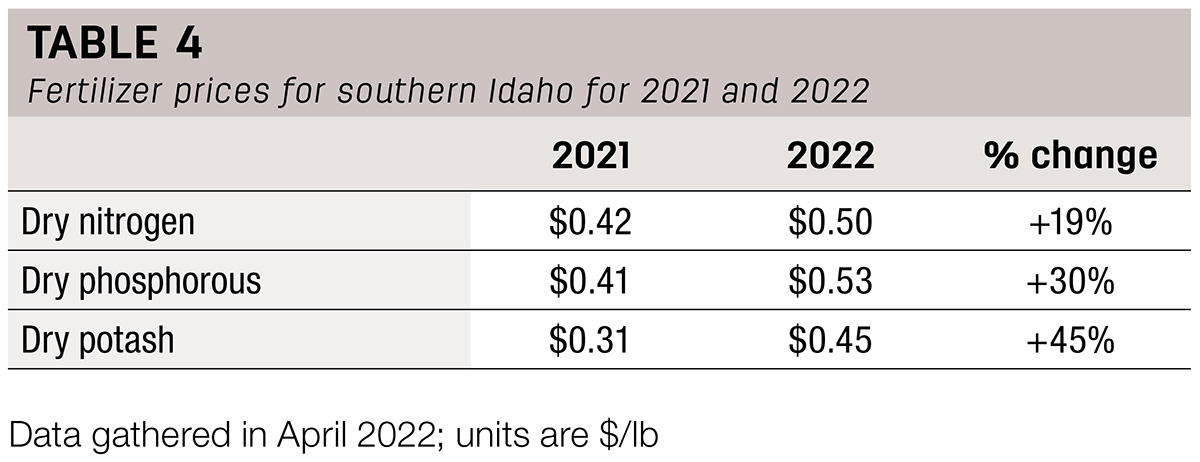

These three cost components have been discussed widely in agricultural and general media in recent months due to their prices increasing substantially on global or national markets. Table 4 includes fertilizer prices for dry nitrogen, phosphorous and potash for southern Idaho for 2021 and 2022, as of April 2022. Prices for all types of fertilizer have increased substantially between 2021 and 2022, with the largest increase for potash. Phosphorus became the most expensive fertilizer on a dollars-per-pound basis in 2022.

The U.S. Federal Reserve started to raise interest rates from a base of 0% in March 2022 and has continued to raise rates at each of its policy meetings through September 2022. These interest rate increases are expected to eventually lead to increases in operating (less than 12 months), intermediate term (three-seven year) and long-term (15-30 year) farm loans. The U.S. Federal Reserve target interest rate as of the end of September 2022 is 3% to 3.25%, which is higher than the target range of 2.25% to 2.5% observed in 2019.

To illustrate the potential impact of the return to higher interest rates on operating loans, one quote for an operating loan for a prominent lender in April 2022, when the U.S. Federal Reserve target interest rate was between 0.25%-0.5%, was 3.25%, while the one used in most enterprise budgets for 2019 was 7%. While many factors such as business size and borrowing history can influence a business’ operating loan rates, these differences are indicative that interest expenses are likely much higher as of September 2022 than they were earlier in 2022 and in 2021.

Summary

This overview of a select set of Idaho crop input prices for 2022 shows that all analyzed cost segments observed increases between 2021 and 2022. Some of the cost segments, such as fertilizer and fuel, had the most substantial increases. Our forthcoming more-comprehensive “Idaho Crop Input Price Summary for 2022” (expected for publication on the University of Idaho Ag Biz website during fall 2022) will have prices on more farm input types and for more regions. It will be interesting to see if the trends observed for the analyzed costs segments for this report are like those for which data gathering remains ongoing.

Pat Hatzenbuehler contributed to this article. Hatzenbuehler is an extension specialist in crops economics at the University of Idaho. He can be reached by email.