Export outlook challenged

The hay export picture has some bright elements but a cloudy outlook.

The latest-available USDA trade estimates, released the first week of May, showed March alfalfa hay exports totaled 257,363 metric tons (MT), the highest monthly total since October 2019. Sales to China were again robust, topping 100,900 MT, also the highest since last October and the second-highest monthly total in 33 months. Sales to Japan topped 60,000 MT for the first time since May 2019.

After sitting near two-year lows, March exports of other hay were also stronger. Shipments for the month totaled 131,224 MT, the second-highest volume in the past 16 months. Japan was the leading buyer at 82,966 MT, a five-year high, with South Korea taking 27,376 MT.

At the time of Progressive Forage’s deadline, hay exporters were working on sales for June and July. Going forward, shipping line schedules and reduced cargo capacity are among the biggest challenges facing U.S. hay exporters, said Christy Mastin, sales representative with Eckenberg Farms, Mattawa, Washington. West Coast vessel space is limited and is being booked five to six weeks out, with canceled services and unknown arrival and delivery times.

“The majority of cargo coming into the U.S. is from Asia,” she explained. “With all the port closings in China, South Korea, Japan and India, shipping lines lost less money if they diverted the ships or dry docked for repairs, instead of continuing with the same sailing schedule and less cargo.”

With no ships arriving from those ports, “blank sailings” have been announced through June, hurting U.S. hay exporters.

In Mastin’s home area in the South Columbia Basin, alfalfa cutting was expected to get underway during the first week of May. Marketing new-crop hay always brings unknown challenges, but with travel restrictions related to COVID-19, it will take even more creativity, and the marketing season is likely to get off to a slow start, Mastin said.

“With worldwide travel restrictions, customers will not be able to visit new-crop stacks and personally view and analyze the quality,” she explained. “We will have to rely on photos and samples, which can be expensive and takes time. We are all looking for the best way to evaluate hay in the stack without a physical inspection.”

Export sales are also heavily dependent on quality. Current demand is focused on higher grades for both alfalfa and timothy, both in shorter supply due to last year’s harvest conditions. Old-crop alfalfa inventories are moving out and should be completely sold before new-crop alfalfa is marketed, although there’s still a large carryover of timothy.

Drought areas, moisture conditions

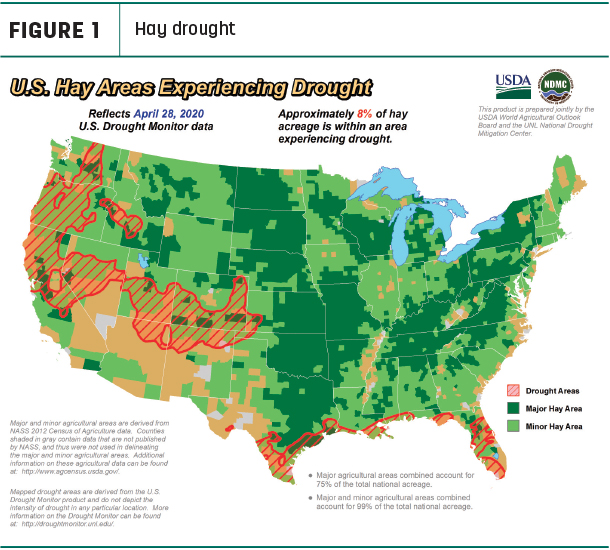

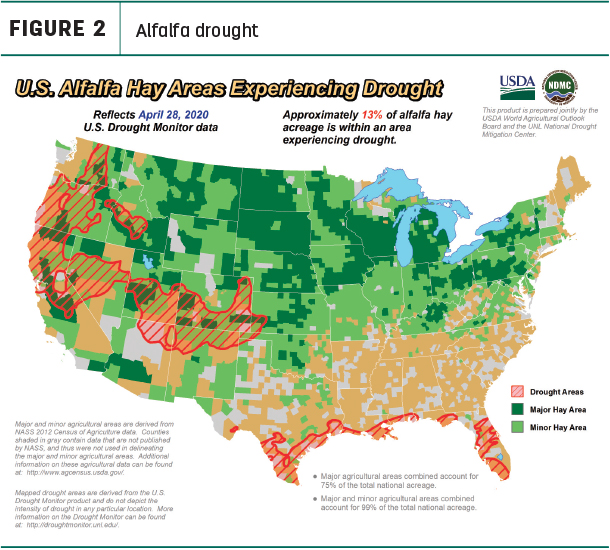

April didn’t provide much change in the overall hay production area impacted by drought. The drought maps showed a small improvement at the southern edge of central California, offset by drought area expansions in Idaho and northwestern Oregon. About 8% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions as of April 28, a 1% decline from four weeks earlier. At 13%, alfalfa-producing areas affected by drought increased 1% from late March (Figure 2).

Looking ahead, Eric Snodgrass, atmospheric scientist with Nutrien Ag Solutions, said current ocean water temperatures are showing signs not as dramatic but similar to 2010-12, years during which moisture levels improved in the Pacific Northwest during the April-October period.

Large sections of the Corn Belt faced the threat of frost moving into mid May as cold air lingers in the eastern half of the country. When it breaks, the possibility of severe weather grows.

March prices summarized

Alfalfa

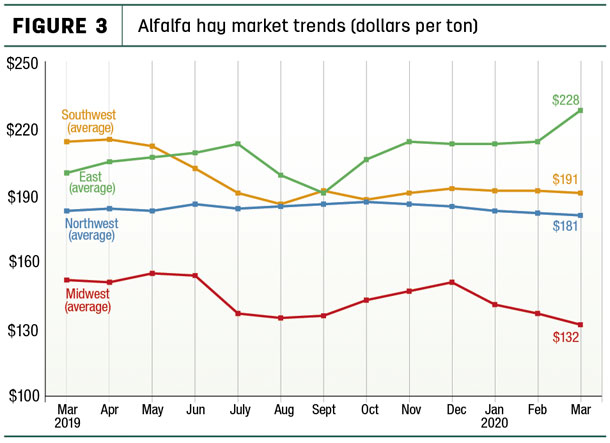

The U.S. average alfalfa hay price averaged $175 per ton in March 2020, up $4 from the month before but down about $9 from March 2019. Most of the month-to-month national increase can be attributed to higher prices in New York and Pennsylvania in the East; average prices were lower in three of four regions tracked by Progressive Forage (Figure 3).

Pennsylvania ($265 per ton), New York ($243) and Colorado ($225) had the highest alfalfa hay prices in March, with averages above $200 per ton in six other states. Lowest prices were again in North Dakota ($82 per ton) and South Dakota ($96).

Compared to a month earlier, average prices were down $10-$20 in Michigan, Minnesota, Ohio and South Dakota, but up $36 and $43 in Pennsylvania and New York, respectively.

Compared to a year earlier, average prices were down $34-$47 in Kansas, Minnesota, New Mexico and Oklahoma, but up $35 in Pennsylvania and $77 in New York.

Other hay

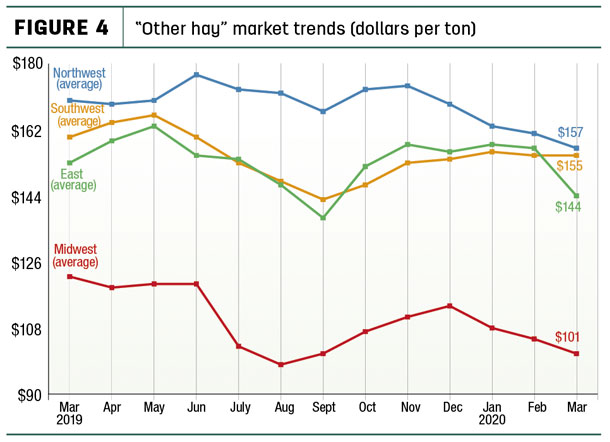

Compared to a month earlier, the U.S. average price for other hay fell $6 per ton in March, with only the Southwest holding steady (Figure 4). The U.S. average price was down $24 per ton from March 2019.

Highest average prices in March were in Colorado ($225 per ton), followed by Arizona ($200). Prices again averaged under $100 per ton in seven states: Kansas, Iowa, Minnesota, Nebraska, Oklahoma, North Dakota and South Dakota.

Compared to a month earlier, average prices were down $10-$20 in nine states in the northern tier of the U.S., and yet up $8 in Wisconsin.

Compared to a year earlier, prices dropped $51 in Iowa and $63 in Minnesota but rose $20-$25 in New Mexico and Ohio.

Dairy hay

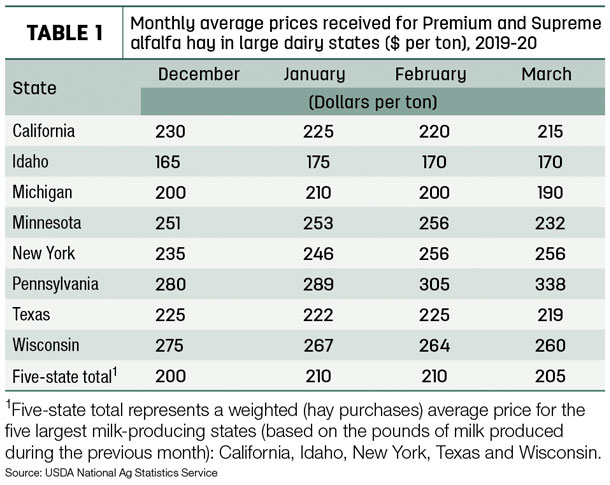

The average price for Premium and Supreme hay in the top milk-producing states averaged $205 per ton in March, down $5 from February (Table 1). Prices declined in all major dairy states except Pennsylvania.

Organic hay

According to the USDA’s organic hay report, FOB farm gate prices at the end of April were: Supreme alfalfa large square bales – $260 per ton; Utility alfalfa large square bales – $154 per ton; and Utility alfalfa-grass round bales – $135 per ton.

Regional markets

Here’s a regional summary of early May conditions and markets:

• Midwest: In Nebraska, demand was moderate for baled hay with good demand for alfalfa pellets. A slow start to pasture growth meant some cattle producers had to procure another load or two of hay to get them through.

In Iowa, hay offered at auction varied a great deal; demand was good for top-quality alfalfa, but there was little demand for poorer quality.

In Kansas, hay trade and prices are being influenced by outside forces, including freezing temperatures, insect damage, ethanol plant slowdowns or closures and low corn prices. Most alfalfa producers expect first cutting tonnage totals to be down this year due to freeze damage, insects and dry conditions.

Cooler temperatures slowed growth of pastures and hay fields in Missouri. The supply of hay is moderate, demand is light and prices are steady to weak.

In South Dakota, grass hay sold with a lower undertone. There was good demand for higher-quality alfalfa, with supplies limited.

In Wisconsin, prices were steady for quality hay. Lower dairy and livestock markets influenced the hay market.

In southwest Minnesota, prices were steady, with a limited supply of hay at the market.

• Southwest: In Oklahoma, movement of alfalfa and other hay remained at a standstill, and several growers were thinking of reducing prices on last year’s crop to get ready for new crop.

First cutting had started in southern and western Texas. Demand has been limited in the Panhandle, as feedlots and dairies are still buying hay on an as-needed basis until uncertainties in the cattle markets are better understood.

In California, alfalfa and other hay continued to grow well; first cuttings of alfalfa were being completed in Sutter County. Trade activity was moderate on moderate demand.

• Northwest: In Montana, ranchers continue to purchase hay on an as-need basis and are looking for higher-quality green hay to feed. Supplies of high-quality hay have become very tight in both rounds and squares.

In Idaho, demand remained light to moderate with producers and exporters trying to decide on new crop contracts. Dairies remain non-aggressive for new purchases as milk prices continue to falter. Cutworm infestation in new seeding is forcing some producers to reseed.

In Colorado, hay trade activity and demand was light. Dairy and feedlot hay market activity was mostly on previously contracted hay. Dry conditions are expanding in eastern Colorado, stretching into the Dakotas, southwest Nebraska and northwest Kansas. According to the late-April crop progress reports, alfalfa hay was rated 3% poor, 21% fair, 70% good and 6% excellent.

In Wyoming, baled hay, alfalfa cubes and sun-cured pellets sold steady on a thin test. Some cattle producers were getting hay shipped in from out of state. Some areas of the state are dry, and canal users will run some water on alfalfa in early May to get it up and going.

In Oregon, prices trended generally steady, although growers reported that demand for dairy hay was down significantly due to dairies having to dump milk.

In the Washington-Oregon Columbia Basin, trade remained very slow except for retail hay. Some 2020 new-crop alfalfa was reported in the windrows in the southern part of the trade area.

Other things we’re seeing

• Dairy continues to suffer. Dairy producers were still awaiting details regarding direct payments through the USDA’s Coronavirus Food Assistance Program (CFAP). After falling to levels not seen since the disastrous 2009, milk futures prices gained some support in early May as the USDA scheduled dairy product purchases for delivery to the growing list of unemployed and needy. Producers using the Dairy Margin Coverage (DMC) program began to receive indemnity payments on March milk production, and April, May, June and July will see the lowest milk prices of the year.

In addition, there are reports that more than 75% of U.S. milk production is now under some form of volume marketing restrictions, with producers forced to cut output by 10%-20%. While many will sell cows, there are also widespread advisories on using feed and other management steps to reduce milk production per cow, with the potential of directly impacting hay markets.

• Cattle markets disrupted. President Donald Trump issued an executive order requiring livestock slaughter plants to reopen, although production capacity was still slowed by worker absenteeism and social distancing requirements due to COVID-19. Compared to a year earlier, beef cattle slaughter was down nearly 37% during the first week of May. ![]()

Figures and charts

Progressive Forage tracks regional hay price trends using average monthly prices reported for selected states by the USDA’s National Agricultural Statistics Service (NASS). The USDA report does not provide hay quality classes in its price reports. By region, states included:

- Southwest – Arizona, California, Nevada, New Mexico, Oklahoma, Texas

- East – Kentucky, New York, Ohio, Pennsylvania

- Northwest – Colorado, Idaho, Montana, Oregon, Utah, Washington, Wyoming

- Midwest – Illinois, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Wisconsin

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke