The U.S. trade deficit reached a six-month high in February, but don’t blame agriculture. U.S. agriculture, including dairy, remains an industry producing a trade surplus.

The February U.S. agricultural trade surplus was estimated at about $1.1 billion. Total agricultural exports were valued at about $10.7 billion, compared to $9.6 billion in agricultural imports.

According to the U.S. Department of Commerce Census Bureau, the fiscal year 2016 (October 2015-February 2016) dairy trade surplus stands at $495 million.

Currency exchange rates continue to challenge U.S. agricultural exporters, but February trade estimates provided some bright spots.

February dairy product exports offer few surprises

U.S. dairy export performance in February showed few surprises, according to Alan Levitt, with the U.S. Dairy Export Council.

Year-long trends continued, with exports of nonfat dry milk/skim milk powder (NDM/SMP) holding up, cheese and dry whey in low gear, and butterfat, whole milk powder (WMP) and milk protein concentrate (MPC) just a fraction of what they were at their 2014 peak. One bright spot in February was a bump in exports of whey protein concentrate (WPC).

U.S. exporters shipped 143,069 tons of milk powders, cheese, butterfat, whey and lactose in February, which was up by 4 percent from last year's depressed levels when West Coast port slowdowns limited shipments. When adjusted for leap day, February shipments were about even with last year.

Overall exports were valued at $375.2 million, down 13 percent from last year and down 16 percent adjusted for leap day.

Nearly half of NDM/SMP sales volume went to Mexico. Aggressive pricing is aiding sales, with NDM/SMP prices the lowest since August 2009.

Cheese exports were below year-earlier levels for the 17th straight month.

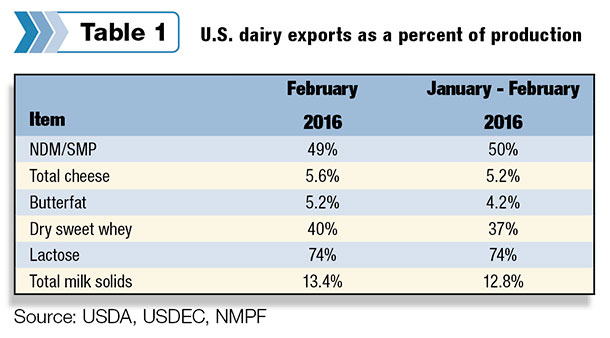

On a total milk solids basis, U.S. exports were equivalent to 13.4 percent of U.S. milk production in February, the highest figure since October (Table 1). Imports were equivalent to 3.8 percent of production.

Read the full USDEC report.

February U.S. dairy genetics exports improve

The U.S. dairy cattle export market improved somewhat in February, with exports of female replacement cattle hitting their highest total since July 2015.

February 2016 foreign sales of live female dairy animals were estimated at 1,206 head, according to latest trade figures released by USDA’s Foreign Ag Service (FAS).

Mexico was the leading destination at 887 head. Thailand, an intermittent buyer in the U.S. market, purchased 205 head, followed by Canada at 113.

The U.S. female dairy cattle export market has been on a roller coaster since late 2014, when annual totals fell about 50 percent from 2013. That downturn continued in 2015, when exports declined another 50 percent, to 16,168 head, far below the record-high of 73,442 head exported in 2011.

February exports were valued at $2.36 million, also the highest since July 2005.

Dairy embryo exports

Foreign sales of U.S. dairy embryos did not see the same increase. Exports totaled 339 in February 2016, the lowest since November 2015. Monthly exports were valued at $468,000.

Japan was the leading market for the month, purchasing 129 dairy embryos, followed by the United Kingdom at 84.

Genetics export factors

Although Mexico was the leading market for dairy replacements in February, a weaker peso against the U.S. dollar has additional Mexican buyers on the fence, according to Tony Clayton, Clayton Agri-Marketing Inc., Jefferson City, Missouri.

Like the dairy product export market, the slowdown in China’s economy has had a ripple effect on the dairy cattle replacement market. With China purchasing fewer dairy replacements from Australia, New Zealand and Uruguay, cattle from those countries are competing against U.S. replacements in remaining markets at lower prices. The strong U.S. dollar relative to other currencies makes the United States less competitive.

The political rift between the U.S. and Russia, combined with low oil prices hampering Russia’s purchasing ability, are keeping U.S. dairy replacements out of that market. However, Clayton said interest from Russia remains, and he anticipates exports to pick up there later this year.

Clayton also expects exports to pick up in Southeast Asia. His company sent 1,427 head to Vietnam last November (not recorded in USDA’s numbers). Early reports are the cattle have adjusted well to their new homes, paving the way for potential purchases later this year.

Gerardo Quaassdorff, DVM, sales and management consultant with TK Exports Inc., TKE Agri-Tech Services Inc., Culpeper, Virginia, said he’s seeing an increase in international demand for fattening cattle. Inquiries regarding beef and dairy replacement cattle are primarily targeting orders for later in the year, with negotiations ongoing.

The strong U.S. dollar continues to hinder foreign sales, Quaassdorff said.

China, UAE help boost U.S. hay exports

With China and the United Arab Emirates more active buyers, February U.S. alfalfa hay exports were the highest since November 2015, according to latest estimates from USDA’s Foreign Ag Service. February 2016 alfalfa hay exports were estimated at 175,962 metric tons, up more than 24,350 metric tons from January.

Chinese alfalfa hay shipments totaled 76,790 metric tons in February, up nearly 30,000 metric tons from both January 2016 and February 2015. For the second month in a row, the United Arab Emirates also made a substantial investment in the U.S. alfalfa hay, purchasing 30,991 metric tons, up more than 27,400 metric tons compared to February 2015.

With the higher volume, the value of alfalfa hay exports also rose. February exports were valued at $54.2 million, up from $38.5 million a year earlier.

Read China, UAE help boost U.S. hay exports PD

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke