All hay stored on U.S. farms as of Dec. 1, 2018, totaled 79.1 million tons, down 6 percent from a year ago, according to the USDA’s Crop Production report, released Feb. 8. This marks the lowest Dec. 1 hay stocks since the drought of 2012 and second-lowest inventory for that date since 1977.

Based on preliminary 2018 hay estimates, last year’s acreage, yields and total production were down from 2017. About 64 percent of all hay produced last year was in storage on Dec. 1, 2018.

The smaller inventories resulted even though “disappearance,” a measure of use, totaled 59.9 million tons for the period May 1-Dec. 1, 2018. That compares with 68.2 million tons for the same period a year earlier.

Whereas last year much of the hay inventory declines were located in the drought-stressed West, this year’s numbers are more geographically diverse. One common theme is many of the states where hay inventories are down are also states where the nation’s 9.4 million dairy cows reside.

Among the 23 “major” dairy states listed by the USDA, 17 had less hay in storage compared to a year ago. Decliners were led by Texas, where hay stocks were down by a whopping 2.05 million tons. Wisconsin and Missouri hay stocks were each down 900,000 tons. Hay inventories slipped by 450,000 to 550,000 tons in Minnesota, Pennsylvania and California.

States with largest hay inventory increases compared to a year ago were North Dakota, Montana and Nebraska in the Northern Plains, and Tennessee and North Carolina in the Southeast.

Demand from Japan boosts export sales

U.S. alfalfa hay exports improved in November, despite continued downward pressure from China. Overall sales totaled 212,429 metric tons (MT), up nearly 15,000 MT from October and the eighth month sales topped 200,000 MT in 2018.

Japan was the top destination for U.S. alfalfa hay in November at 56,377 MT, the highest volume of alfalfa hay shipped there in at least five years. At 47,904 metric tons, alfalfa exports to China were up slightly from October but still the second-lowest monthly total since January 2016.

Shipments to the United Arab Emirates hit 43,850 MT, the highest total since December 2013. Sales to Saudi Arabia were also up compared to October.

Year-to-date alfalfa hay exports now total about 2.3 million MT, behind last year’s record-high pace, but ahead of 2016.

November 2018 exports of other hay also showed some improvement, with volumes the highest since November 2017. Pacing the increased sales were shipments to Japan at 67,249 MT, the highest since April 2017. At 48,772 MT, sales to South Korea were the highest in 12 months.

Despite the resurgence in November, exports of other hay through 11 months of the year are still the smallest for that period in more than a decade.

Drought areas

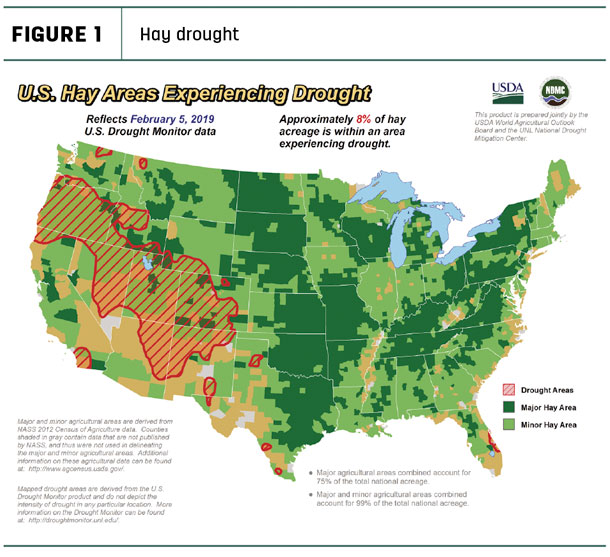

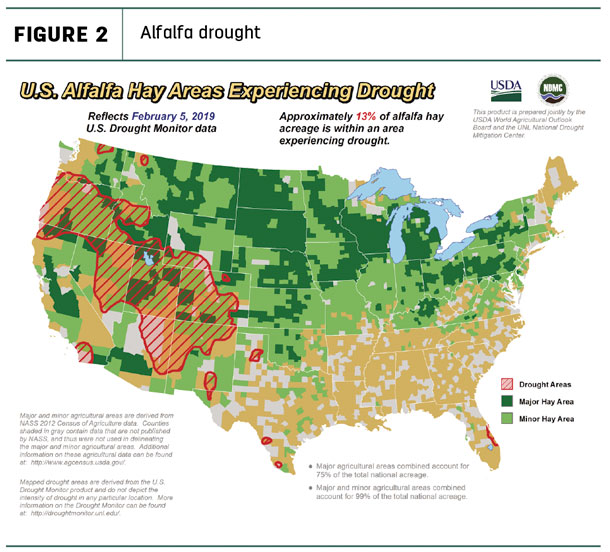

The USDA World Agricultural Outlook Board’s latest drought maps indicate percentages of hay and alfalfa-producing areas considered under drought conditions continue to be at the lowest level since late spring of 2017.

About 8 percent of U.S. hay-producing acreage (Figure 1) and about 13 percent of alfalfa hay acreage (Figure 2) was located in areas experiencing drought at the start of February.

Regional markets

A summary of early February conditions and markets follows:

• Midwest: Marketing of hay in Kansas remained in a “weather-induced lull”: Hay has been sold, but moving it remains an issue due to mud and wintry weather. Demand remains moderate, especially for grinding alfalfa and good-quality grass hay.

In Missouri, cold temperatures and mud have forced livestock producers to push hay-feeding levels to the maximum. There’s hay to be found, but locating it takes time and prices are higher. Some cattlemen are considering moving calves rather than purchasing hay, and most everyone is ready to put this feeding season in the history book, hoping a new growing year brings something closer to normal.

In Iowa, sales of hay and bedding were extremely light, with limited quality hay available.

In Nebraska, hay producers are getting a few more calls from prospective buyers inquiring about available hay types and supplies, with an uptick in more hay going out of state. If weather improves, there may be more activity baling cornstalks.

In South Dakota, high-quality hay is becoming harder to find, and transportation continued to be a problem as cold weather and snow made moving hay difficult.

In southwest Minnesota, prices were steady, with only lower-quality hay available.

In Wisconsin, prices were steady to strong for quality hay, but supplies were limited. Some buyers are beginning to lower their standards and purchase what was available.

• Southwest: In Oklahoma, colder weather spawned a spike in demand for grass and wheat hay. Increased local movement throughout central and eastern parts of the state is emptying barns for some grass hay sellers. Dairy demand for alfalfa hay is light to moderate at best.

In Texas, alfalfa hay sold steady to $5 lower as producers clean out barns in preparation for a new crop; coastal bermuda hay sold steady to $10 higher due to low supplies and freight costs. The Panhandle is in need of moisture to benefit local wheat pastures.

Rain and snow impacted areas of California, with producers in the southern part of the state having issues with getting enough time between storms to accurately cure hay, or in some cases, causing damage to hay that has been laid down.

• East: In Alabama, hay prices were firm, with moderate supply and good demand.

Snowstorms and cold temperatures affected hay markets in Pennsylvania, with supplies and demand weakening as weather worsened.

• Northwest: A two-tier market for alfalfa hay has developed in Montana. Supplies of square bales are very tight in western and central parts of the state, and prices have pushed higher as a result. Meanwhile, supplies of round bales remain very heavy, especially in central and northern Montana. However, the round bale market has inched up in recent weeks as Idaho buyers of square bales have started to accept rounds.

Local hay sales have been fairly light, as many ranchers have already purchased hay needed for the year. A majority of the hay being sold in recent weeks is destined for other states: square bales are being delivered south to Texas and Colorado; west to Idaho and Washington; and east as far as Pennsylvania.

Idaho hay trade is near a standstill, with most supplies already sold. Demand remains good, especially for feeder and higher-testing dairy hay. The state’s transportation department has issued temporary permits boosting allowable lengths and weights for trucks hauling large round bales of hay. The 90-day permits restrict movement of large round bales of hay to designated highways during daylight hours.

A lot of the hay across Wyoming has been spoken for or sold, and producers are waiting for trucks to haul it. Some producers noted this is the earliest they have been ever sold out of hay. Others have been selling some hay via video auctions, hoping to expand their client base for next year. Some areas continue to be dry for this time of year. A light snow pack could be troublesome for alfalfa irrigation needs through next summer.

In the first Valley Video Hay Market timed internet auction since November, demand was good to very good. Hay offered was first- through fourth-cutting alfalfa consigned from eastern Wyoming and the Nebraska Panhandle. Most alfalfa sold to dairies in the Corn Belt states, with limited amounts of cow hay to Colorado and some horse hay to Tennessee.

In the Washington-Oregon Columbia Basin, prices for remaining supplies of alfalfa for domestic and export markets were steady. Some dairies have chosen to go out of state to contract cheaper first-cutting new-crop alfalfa. Exporters expect the 2019 alfalfa market to be stronger, but new-crop timothy could be steady to lower due to larger carryover supplies.

Catching up on price reports

USDA staff began the task of collecting and reporting a mountain of data that went unreported during the partial government shutdown. One of the first reports updated was November 2018’s Ag Prices report, which included a summary of monthly hay prices. A summary of December 2018 hay prices was set for release on Feb. 20.

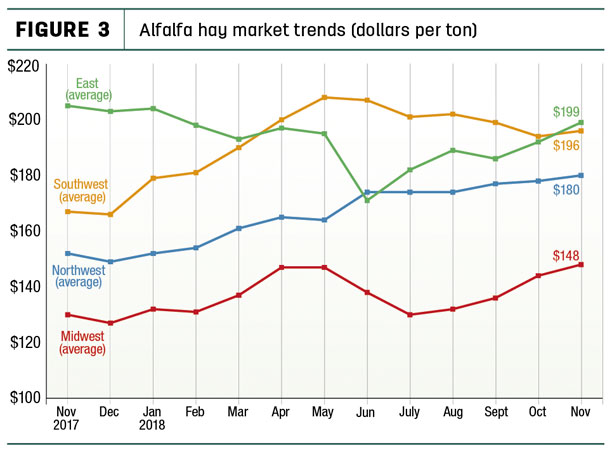

Alfalfa

At $175 per ton in November, the national average alfalfa hay price was down $3 from October and the lowest since March 2018. Although the national average was lower, regional averages for states highlighted here were all slightly higher (Figure 3).

Compared to a year earlier, alfalfa hay prices were up $70 per ton in New Mexico and $40 to $55 higher in Colorado, Kansas, Wisconsin and Oklahoma. New York reported a substantial price drop, down $59 per ton from November 2017.

High monthly alfalfa hay prices were in New Mexico ($250) and Colorado ($225); the low price for the month, at $92 per ton, was in North Dakota.

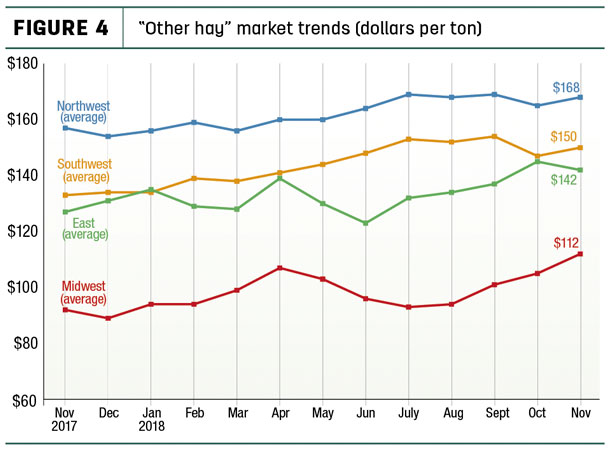

Other hay

The U.S. average price for other hay was estimated at $137 per ton, up $5 per ton from October and, based on USDA data, the highest since July 2014.

Looking at regional breakouts, November 2018 average prices were all higher (Figure 4).

Highest average prices for other hay were in Colorado ($225 per ton) and Arizona ($200 per ton). Oklahoma, South Dakota, Nebraska and North Dakota saw monthly lows of $88 per ton or less.

Among individual states, Wisconsin, Idaho and New York saw the largest monthly increases, up $20 per ton or more. Compared to a year earlier, price declines of $30 per ton or more were seen in Pennsylvania, Minnesota, Illinois, Kentucky, Colorado and Wisconsin.

Figures and charts

Progressive Forage tracks regional hay price trends using average monthly prices reported for selected states by the USDA’s National Agricultural Statistics Service (NASS). The USDA report does not provide hay quality classes in its price reports. By region, states included:

• Southwest – Arizona, California, Nevada, New Mexico, Oklahoma, Texas

• East – Kentucky, New York, Ohio, Pennsylvania, Tennessee, Virginia

• Northwest – Colorado, Idaho, Montana, Oregon, Utah, Washington, Wyoming

• Midwest – Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Wisconsin

Organic hay prices

According to the USDA’s Organic Hay report, released Jan. 30, free on board (f.o.b.) farm gate prices paid for Premium alfalfa small square bales averaged $250 per ton.

Dairy: A glimmer of sunlight

Citing declining milk cow numbers and slower growth in milk per cow, the USDA trimmed its 2018 milk production estimate and also cut the 2019 production forecast, lending support for somewhat higher prices.

According to the latest World Ag Supply and Demand Estimates (WASDE) report, the 2018 milk production estimate now stands at 217.6 billion pounds. That would be up less than 1 percent from 2017’s production total of 215.5 billion pounds. The final 2018 U.S. average all-milk price was estimated at $16.20 per hundredweight (cwt), $1.45 less than 2017’s average of $17.65 per cwt and slightly below the 2016 average of $16.30 per cwt.

For 2019, the USDA cut its milk production forecast to 220.1 billion pounds. If realized, it would be up about 1.1 percent from the 2018 estimate. The 2019 price will improve, although not dramatically. USDA projected the all-milk price could average $17.25 per cwt.

Fuel costs: Mixed news

Budgeting fuel costs for the year ahead? For what it’s worth, the U.S. Energy Information Administration (EIA) forecasts that Brent crude oil prices will increase at a relatively modest pace in 2019 and 2020, but stay lower than the 2018 annual average. Based on January projections, Brent crude oil prices will average $61 per barrel in 2019 and $65 per barrel in 2020, down from the 2018 average of $71 per barrel.

EIA forecasts that oil prices will remain lower than levels seen for much of 2018 because relatively strong global oil supply growth over the next two years outpaces growth in consumption.

U.S. regular gasoline retail prices will average $2.47 per gallon in 2019 and $2.62 per gallon in 2020 in EIA’s forecast, which would be a decrease from an average of $2.73 per gallon in 2018.

Wildcards include government stability in Venezuela and interest rates. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke