- Cropp-Stephenson outlook more optimistic

- NMPF lays out road map for FDA ‘dairy’ labeling rules

- Dairy margins started February flat

- MPP-Dairy margin dips below $8 per cwt

- Class I base price inches closer to $16

- Interest rates start year higher

- USDA dairy export outlook mixed

- New York: 2018 dairy financial numbers reviewed

- Minnesota offers school milk cooler grants

Cropp-Stephenson outlook more optimistic

Two University of Wisconsin – Madison dairy economists found more long-term positives for dairy producers as 2019 progresses.

Mark Stephenson, director of dairy policy analysis, and Bob Cropp, dairy economics professor emeritus, reviewed recent USDA reports and the impact on dairy markets in their monthly podcast.

Cropp and Stephenson said the USDA’s belated report, reflecting December 2018 milk production estimates, provided some good news for milk price prospects, based on lower cow numbers and a slowdown in U.S. milk production growth. (Read: December milk production growth slows, milk prices lower.)

Cropp said he was more optimistic than current Chicago Mercantile Exchange (CME) futures prices reflect. He expects exports to improve, with domestic demand remaining “decent.” With international milk production also slowing, both Cropp and Stephenson see milk price improvements in the second half of the year.

“Normally, you can handle about 1 percent growth in production with domestic demand,” Cropp said. “With production at this level, and exports, we have to have some strength in prices.”

The USDA, still catching up on reports following the government shutdown, is set to release final 2018 milk production data on March 12.

NMPF petition lays out road map for FDA ‘dairy’ labeling rules

The National Milk Producers Federation (NMPF) filed a citizen petition with the FDA outlining a labeling solution to the use of dairy terms on nondairy products. FDA closed a public comment in late January and is considering the input to formulate use of dairy terms and other food labeling rules.

NMPF’s petition reinforces and clarifies current FDA labeling regulations. It also addresses several arguments raised by marketers of vegan foods as part of the ongoing debate on dairy labeling. It also cites previous court cases involving First Amendment arguments.

“The FDA comment docket gave us the chance to explain why there is a compelling need to resolve this labeling issue to address consumer confusion over nutritional content,” said Tom Balmer, NMPF executive vice president. “This petition lays out a constructive solution to the false and misleading labeling practices existing in the marketplace today and provides clear, truthful and understandable labeling options for marketers of plant-based imitation dairy products.”

In its petition, NMPF urges FDA Commissioner Scott Gottlieb to “take prompt enforcement action against misbranded nondairy foods that substitute for and resemble reference standardized dairy food(s) (e.g., milk, yogurt, cheese, ice cream, butter), yet are nutritionally inferior to such reference standardized dairy foods.”

“Marketers of plant-based foods that are designed to resemble standardized dairy foods actually have several labeling options under current FDA regulations, as we point out in this petition,” Balmer said.

The NMPF petition notes that any manufacturer not wishing to use modifiers such as “imitation,” “substitute” or “alternative” may simply eschew the use of dairy terms altogether – an approach that’s already common in the rest of the world and practiced by some companies in the U.S., including Chobani, Trader Joe’s and Quaker.

“Our approach does not advocate for any so-called “bans,” Balmer said. “It simply relies on proper disclosures that allow for appropriate, truthful, nonmisleading messaging. In the end, products that are ‘milklike’ or ‘yogurtlike’ are not actual milk or yogurt – and the nutritional distinctions are critical to informed consumer decisionmaking. That’s what our petition is all about.”

Dairy margins started February flat

Dairy margins were relatively flat over the first half of February, and they’re projected to remain below breakeven over the first half of the year, according to Commodity & Ingredient Hedging LLC.

Fourth-quarter 2018 U.S. milk production was up only 0.5 percent from the same period in 2017, the lowest year-over-year growth for any quarter in five years. While the milking cow herd has become more efficient to allow for modest production gains, the report reflected continued herd contraction as the tough margin environment is prompting more producers to cull cows.

Based on USDA estimates, December 2018 cow numbers dropped 3,000 head from November and are down 49,000 head from the previous year, to 9.351 million head. That’s the fewest since November 2016.

Dairy cow slaughter was above 70,000 head for the week ending Jan. 19, 2019, the largest single week of dairy cow slaughter since January 2013. Fourth-quarter dairy cow slaughter was up 8 percent from the same period a year earlier, with slaughter rates nearing 15 percent higher year over year.

Early February feed markets continued to be subdued, although the USDA announced China had committed to purchasing an additional 10 million metric tons of U.S. soybeans, which could pressure soybean meal prices higher.

MPP-Dairy margin dips below $8 per cwt

In case you missed our article posted on the website late last week (December milk production growth slows, milk prices lower), the USDA released U.S. average milk and feed prices for December 2018, impacting dairy producers insuring income margins under the Margin Protection Program for Dairy (MPP-Dairy).

The December U.S. average milk price fell 60 cents from November to $16.40 per hundredweight (cwt). With higher corn, soybean meal and alfalfa hay prices, December 2018 U.S. average feed costs increased to $8.55 per cwt of milk sold.

The combination of a lower milk price and higher feed costs resulted in a national average milk income over feed cost margin of about $7.85 per cwt in December, the smallest margin since August. That means MPP-Dairy participants insured at the $8 margin level will see an indemnity payment of about 15 cents per cwt on their milk marketings.

Class I base price inches closer to $16

The March 2019 Federal Milk Marketing Order (FMMO) Class I base price is $15.98 per cwt, stubbornly holding under $16 for a fifth straight month. However, it is up 68 cents from February 2019 and $2.62 more than March 2018, which was the low for last year. Through the first quarter of 2019, the Class I base price is $15.47 per cwt, up about $1.10 from the same period a year ago.

Interest rates start year higher

The Federal Reserve board has taken a pause on interest rate hikes, but left doors open for possible increases in the months ahead. The board’s Federal Open Market Committee meets again on March 19-20.

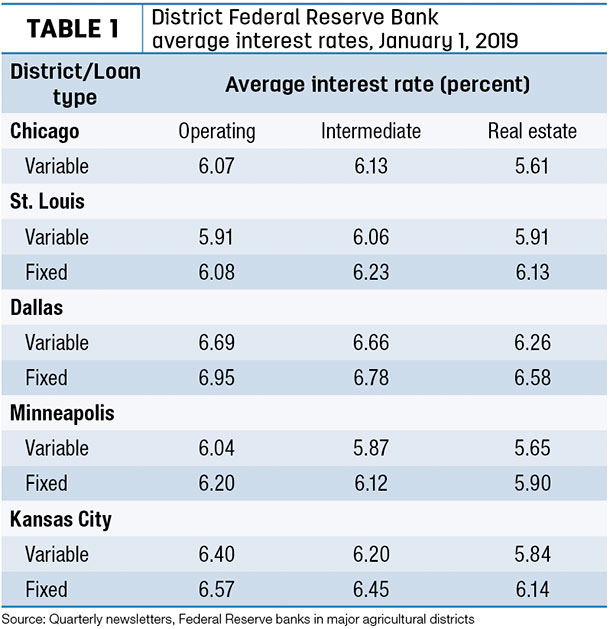

As farmers sought operating loans to begin spring planting, lender surveys from Chicago, Dallas, Kansas City, Minneapolis and St. Louis Federal Reserve districts showed interest rates continued to move higher, in some cases to decade-high levels (Table 1). By district:

• Minneapolis: Fixed and variable interest rates on operating, machinery and real estate loans each increased slightly from the previous quarter. A strong majority of lenders reported no change in collateral requirements on loans, while 11 percent said collateral requirements increased.

• Dallas: Fourth-quarter 2018 interest rates on variable-rate loans are now the highest since 2008, led by feeder cattle, operating and intermediate loans, all near 6.7 percent; interest rates on variable-rate real estate loans averaged 6.3 percent. Interest rates on fixed-rate loans are the highest since 2011, topped by operating loans at 6.95 percent. Interest rates on fixed-rate real estate loans averaged nearly 6.6 percent. In addition to higher interest rates, more bankers indicated continued tightening of credit standards.

• Kansas City: Interest rates on all types of agricultural loans rose, but at a slower pace than other benchmark interest rates. In fact, the spread between variable rates charged on farm loans and the prime lending rate has narrowed recently, reached the lowest margin since 2007, as farm loan interest rates have been slower to rise. In addition to placing downward pressure on farmland values, higher interest rates also have increased financing costs for some farm borrowers, but only modestly.

• St. Louis: Interest rates on all six of the fixed- and variable-rate loan categories rose. On average, interest rates increased the most for variable-rate machinery/intermediate-term loans (36 basis points), while rates increased the least for fixed-rate machinery/intermediate-term loans (19 basis points). Across all categories, fixed-rate loans increased by an average of about 20 basis points in the fourth quarter, while variable-rate loans increased by an average of 31 basis points.

• Chicago: As of Jan. 1, 2019, the average interest rates for farm operating loans (6.07 percent) and feeder cattle loans (6.13 percent) were at their highest levels since the second and third quarters of 2010, respectively. The average interest rate for agricultural real estate loans (5.61 percent) was last higher during the second quarter of 2011. About 44 percent of the survey respondents reported their banks tightened credit standards for agricultural loans in the fourth quarter of 2018 relative to the fourth quarter of 2017; 56 percent reported their banks kept credit standards essentially unchanged. Some bankers linked financial difficulties to pressures from higher agricultural interest rates.

USDA dairy export outlook mixed

A new USDA export outlook forecasting higher U.S. dairy exports in fiscal year 2019 (FY19) is mixed news: The increase will be due to higher global dairy prices, which boosts value. Volumes of U.S. dairy products moving into export markets are expected to decline.

The agency’s quarterly Outlook for U.S. Agricultural Trade report, released Feb. 21, raised projected FY19 (Oct. 1, 2018-Sept. 30, 2019) dairy exports to $5.4 billion, up $100 million from November’s forecast.

U.S. exporters sold products valued at about $5.6 billion in FY18. Due to the mixed nature of products, the report does not provide an estimate of estimated volumes.

The USDA also forecast FY19 U.S. dairy imports to remain steady with both the previous year and the November forecast at $3.4 billion, including $1.3 billion in cheese.

New York: 2018 dairy financial numbers reviewed

Initial analysis of 34 dairy farms participating in the Dairy Farm Business Summary and Analysis Project shows that average total costs to produce milk rose about 10 cents per cwt in 2018, while the gross milk price declined $1.06 per cwt. The preliminary progress report of the project, supported by Cornell University, Cornell Cooperative Extension and Cornell CALS PRO-DAIRY, reviews on-farm changes from 2017 to 2018.

Highlights from the first preliminary report include:

- Milk shipped per farm increased by 6 percent. The increase came from more cows per herd, as milk sold per cow was down by 15 pounds.

- Labor efficiency increased 4 percent.

- Average cost per hired worker equivalent increased 2 percent.

- Total cost of producing milk in 2018 ranged from $17.44 to $23.27 per cwt.

- Gross milk price decreased $1.06 per cwt to $17.47 per cwt.

- Net farm income per cow (without appreciation) decreased from $500 to $167 per cow.

- Labor and management income per operator turned negative, averaging -$113,125 per owner-operator.

- Debt per cow increased 7 percent to $4,049 per cow.

- Reflecting decreased asset values, net farm income averaged -$76 per cow in 2018.

Minnesota offers school milk cooler grants

The Minnesota Department of Agriculture (MDA) is awarding up to $50,000 in grants to eligible institutions to increase the use of Minnesota dairy in their nutrition programs. Application deadline is April 4.

The Agricultural Growth, Research and Innovation (AGRI) Milk Cooler Grant Program assists schools and early care and education organizations in purchasing milk coolers and related dairy equipment. Each school or organization may apply for up to $1,500 per milk cooler. A maximum of three proposals will be accepted for each organization or school district. Eligible expenses include the cost of the milk cooler and associated installation expenses.

The first round of AGRI milk cooler grants last fall helped install 39 milk coolers across the state. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke