On the positive side, prices for all individual classes of milk were up from September, as were protein and butterfat values. Average October butterfat and protein tests were higher among all FMMOs providing test results.

However, the higher protein values and a larger spread between Class III and Class IV milk prices led to more depooling and a return of negative PPDs.

Here’s Progressive Dairy’s monthly snapshot of the FMMO numbers and their potential impact on your milk check.

Negative PPDs return

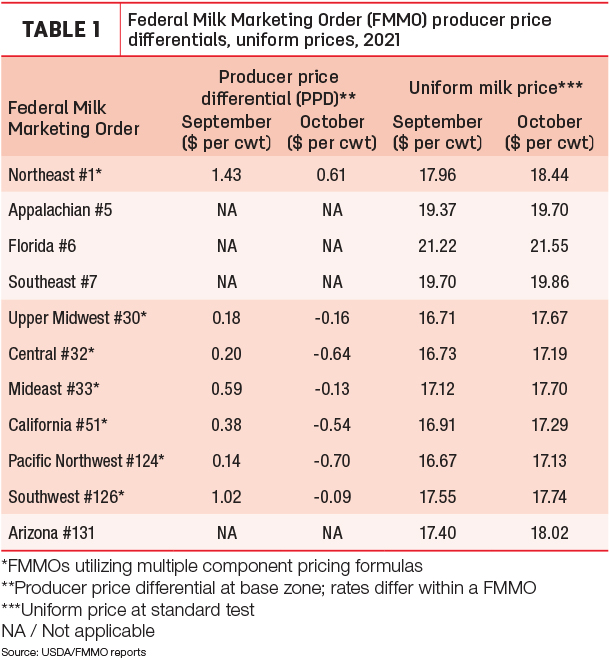

After four months in positive territory, October baseline PPDs turned negative in six of seven applicable FMMOs (Table 1). The lone exception was in the Northeast FMMO #1. Compared to September, the base PPDs dipped about 80 cents per hundredweight (cwt).

When evaluating your individual milk check, remember that PPDs have zone differentials within each FMMO. For example, depending on location, October PPDs were as much as -$1.04 in California FMMO #51 and -89 cents in Central FMMO #32.

Also, whether positive or negative, individual milk handlers may apply PPDs differently.

‘Uniform’ prices improve

October 2021 uniform or “blend” prices at standardized test improved slightly from September (Table 1) and were the highest since June.

Factoring into the price calculations, October Class I prices were up 49 cents per cwt from September. Class II, III and IV prices were up 19 cents, $1.30 and 68 cents per cwt, respectively. When multiplied by milk class utilization in each FMMO, October uniform prices increased in a range of 19-96 cents per cwt across all 11 FMMOs. The high uniform price was $21.55 per cwt in Florida FMMO #6; lows of under $18 per cwt remained in six FMMOs.

Average cheese and butter prices both improved in October, yielding higher values for both protein and butterfat used in monthly milk price calculations and contributing to the higher uniform prices. At about $3.01 per pound, the value of milk protein in October FMMO milk price calculations rose about 41 cents from September and was the highest since May but was $2 per pound less than October 2020. The value of butterfat rose less than a penny in October to just over $1.94 per pound. Despite the meager increase, it was the highest since June and 30 cents higher than October 2020.

Those higher values yielded a Class III milk price of $17.83 per cwt, the highest since May. At $17.04 per cwt, the October 2021 Class IV price was an 83-month high dating back to November 2014.

While contributing to improvements in uniform prices, the spread between October Class III-IV prices widened to 79 cents per cwt, the largest gap since June.

Depooling rises

That Class III-IV spread, along with the fact the Class III prices was higher than the Class I base price for in October, provided incentives for Class III depooling in several FMMOs.

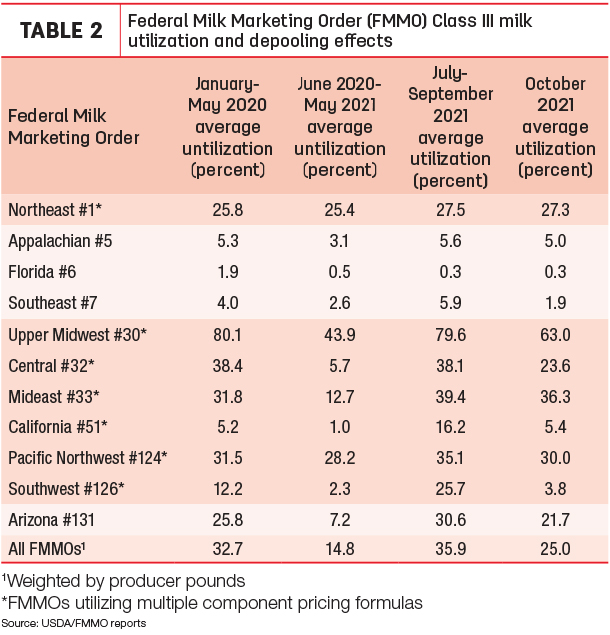

On a percentage basis (Table 2), Class III utilization was about 25% of all FMMO milk marketings in October 2021, down from about 36% in July-September, when Class III pooling had returned more closely to 2020 pre-pandemic “normal.”

By volume, total Class III milk pooled across all FMMOs in October 2021 was about 2.8 billion pounds, the smallest volume since June. Class III pooling averaged 4.4 billion pounds during July-September 2021.

Class III milk pooled on the Upper Midwest FMMO #30 in October fell to nearly half that pooled in September, down 952 million pounds. After topping 810 million pounds in August, October Class III pooling on the California FMMO #51 fell to 103 million pounds in October.

Class I mover

Despite the wider spread in October Class III-IV prices, the gap between the advanced Class III-IV skim milk price factor used to calculate the advanced Class I prices was thin, just 3 cents per cwt. That continued a four-month trend in which the “average-of plus 74 cents” Class I mover pricing formula provided a net benefit compared to the previous “higher-of” formula.

Looking ahead to next month, we already know the November 2021 advanced Class I base price is $17.98 per cwt, up 90 cents from October. The spread in the advanced Class III-IV skim milk price factor for November is 92 cents.

Arithmetically, the trigger point for when the higher-of formula yields a net benefit over the average-of plus 74 cents formula is $1.48 per cwt (2 X $0.74), regardless of whether the Class III of Class IV price is higher. So, the average-of formula will yield a net benefit of about 27 cents per cwt over the higher-of formula in November. Through November, the average-of plus 74 cents formula would yield a 3-cent benefit over the average-of formula.

That number must be multiplied by the Class I utilization rate to determine the impact on the uniform or blend price within each FMMO.

What’s ahead?

Looking at November milk prices and beyond, there’s a paradigm shift coming, although how it affects your milk check remains to be seen.

Near term, the November 2021 advanced Class I base price is $17.98 per cwt, up 90 cents from October. November Class III-IV prices won’t be announced until Dec. 1, but current milk futures prices project a small increase in the Class III price and a large jump in the Class IV price.

Based on Chicago Mercantile Exchange (CME) milk futures prices at the close of trading on Nov. 12, Class IV milk futures prices will be higher than Class III prices beginning in November 2021 and lasting into the first quarter of 2023. That bucks recent historical trends: Class IV milk prices were higher than Class III prices in just two months each in 2016, 2017 and 2018, and five months in 2019.

The Class III-IV price spread is the widest in December 2021 and January 2022. Depending on near-term market changes, the impact on Class III-IV advanced skim values could affect net benefits using the average-of plus 74 cents formula compared to the higher-of formula.

Markets change, of course. Beyond January, a narrow Class III-Class IV price spread through most of 2022 isn’t likely to cause FMMO marketing disruptions to the extent we saw during the COVID-19 pandemic. It should be noted, however, that Class IV handlers can depool like their Class III handler counterparts did.

Longer term, recent USDA Cold Storage and Dairy Product reports show a slowdown in butter production and a draw on inventories. Will the current demand for butter (domestically) or milk powders (exports) continue to boost Class IV prices and reduce Class III skim values through the butterfat factor?

The U.S. is adding cheese processing capacity in large chunks in the next couple of years. Without an equal investment in marketing, will cheese inventories grow and apply downward pressure on Class III prices?

Coming up: There are plenty of dairy numbers to digest. The December Class I base price is announced Nov. 17. The USDA releases October 2021 milk production estimates on Nov. 18. The October Dairy Margin Coverage (DMC) program margin and potential indemnity payments are announced on Nov. 30. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke