It’s becoming a summer of monthly repeats, with drought, financial pressures and availability of inputs and rising interest rates serving as the main themes. Here’s Progressive Forage’s monthly look at market forces during the second week of August 2022.

Drought conditions spread

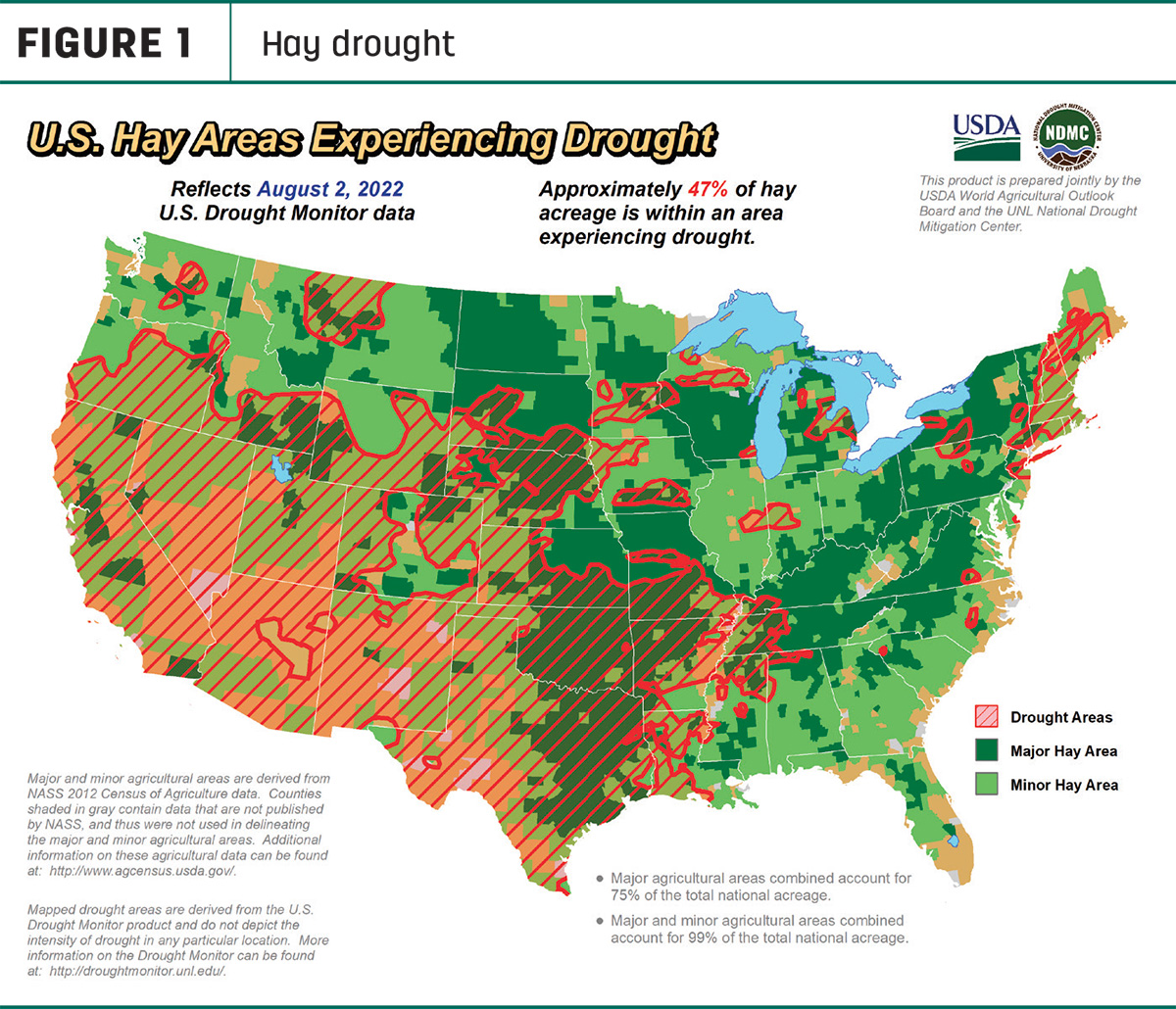

U.S. Drought Monitor maps indicate moisture conditions worsened over the past month. As of Aug. 2, about 47% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, up 8% from a month earlier.

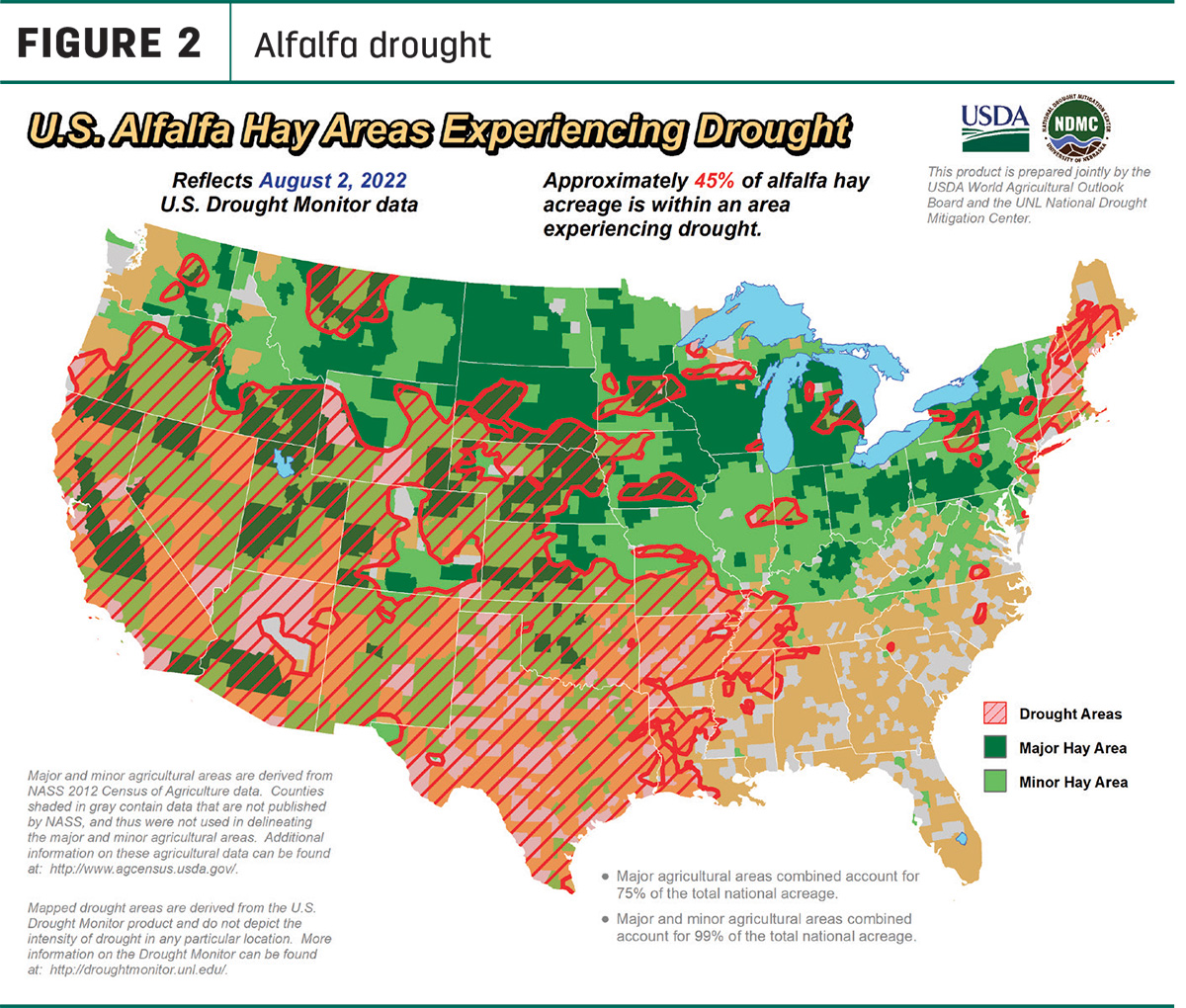

The area of drought-impacted alfalfa acreage (Figure 2) increased 3%, to 45%.

Hay prices tracked

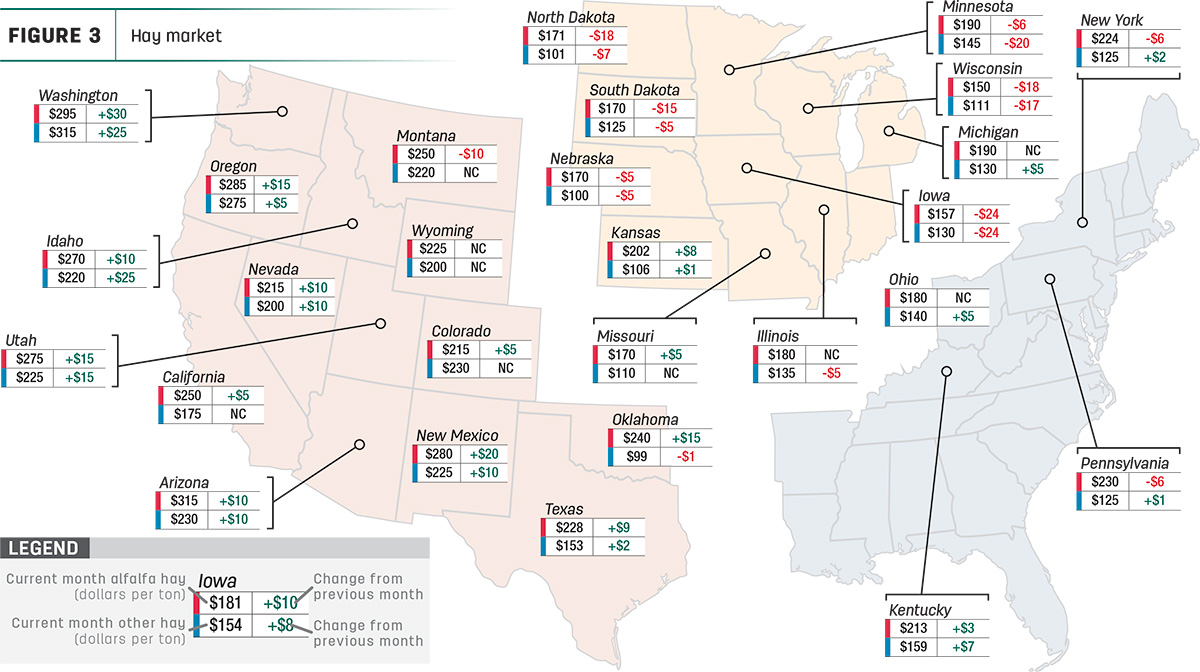

The wide gap between prices for alfalfa and other hay continues. Based on monthly USDA Ag Prices reports, U.S. average prices paid for alfalfa hay were $99 per ton more than average prices for other hay in June, down just $2 from the $101 spread in both April and May.

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change.

The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Dairy hay

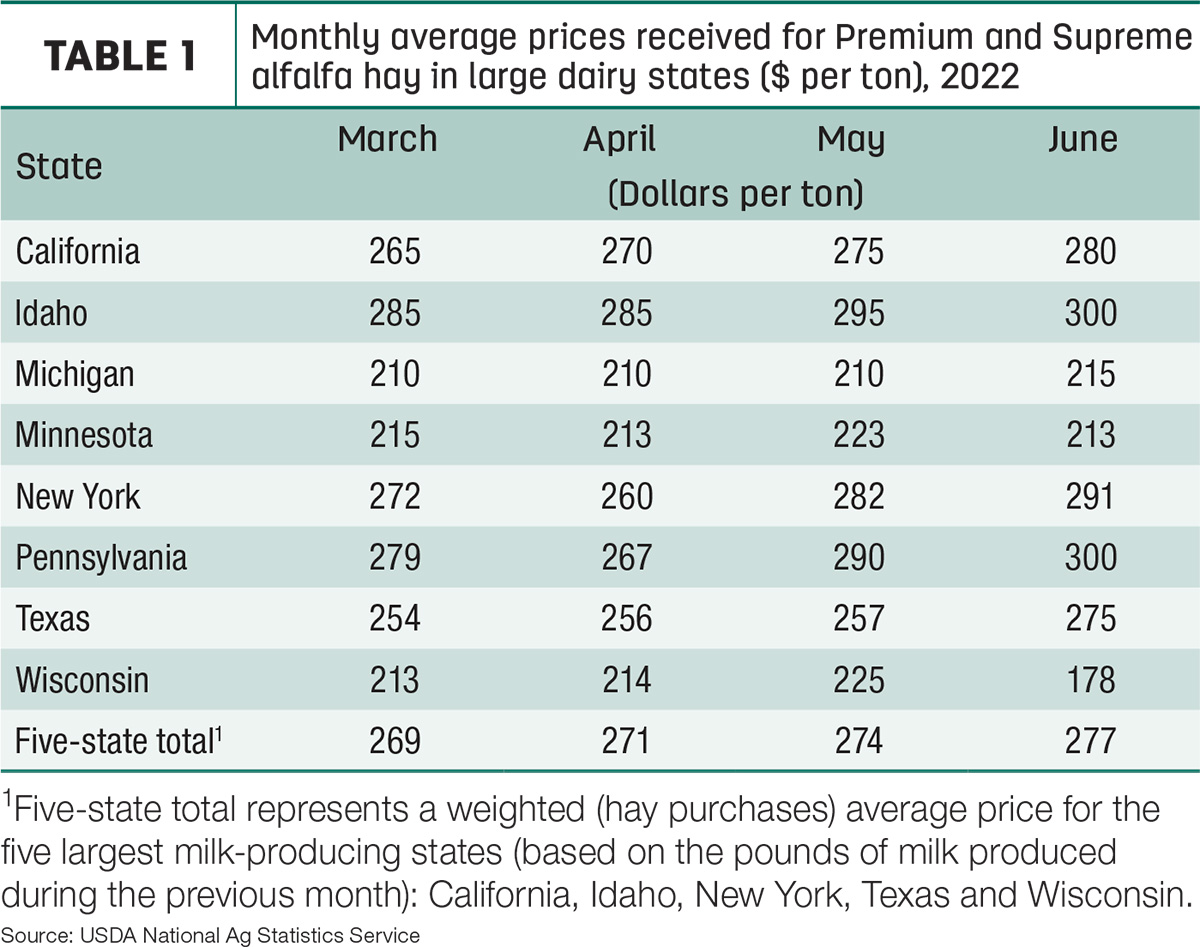

June average prices for Premium and Supreme alfalfa hay in the top milk-producing states rose another $3 from May to $277 per ton (Table 1) and are up $47 per ton from a year ago.

Alfalfa

The U.S. average price for all alfalfa hay rose $1 in June to $245 per ton. Prices increased in 14 of 27 major forage states, with double-digit increases in eight Western states. Prices declined in nine states, led by a $24 drop in Iowa. Year-over-year price changes remained large in the West: Arizona, Washington and Idaho alfalfa hay prices were up $90-$115 per ton compared to June 2021.

Other hay

At $146 per ton, the June 2022 U.S. average price for other hay was up $3 per ton compared to May. Prices increased in 14 of 27 major hay-producing states, with largest month-to-month increases in Idaho and Washington, up $25 per ton. Average prices for other hay remain $65 and $85 per ton higher than a year ago in Idaho, Montana, Utah, Washington and Oregon.

Organic hay

The USDA’s latest organic hay price report offered a small sample of price summaries for spot transactions (free on board [f.o.b.] farmgate). For the two-week period ending July 27, Premium alfalfa in large square bales for export averaged $400 per ton; Fair/Premium alfalfa in large square bales ranged between $370-$375 per ton.

Hay exports dip

Seasonally low hay inventories – the result of a smaller carryover from last year’s harvest and a slow start to the new-crop haying season – reduced hay supplies available for export, cutting into shipments in June.

At 202,700 metric tons (MT), June alfalfa hay exports were down 40,000 MT from May and the third-lowest monthly total in the past 18 months. China remained the leading market at 104,395 MT, about 52% of the month’s total, but sales there were the smallest since February 2021. Exports to Japan fell to an 11-month low at 38,000 MT, representing 19% of the month’s total. Alfalfa hay exports were valued at about $390 per ton, up about $3 from May.

Another explanation for the decline in alfalfa hay sales to Japan could be a huge increase in shipments of sun-dried alfalfa meal as a replacement. June sales to Japan were estimated at 9,598 MT. In comparison, monthly exports of sun-dried alfalfa meal averaged just 640 MT during the first five months of the year. Historically, exports of that product totaled 9,110 MT tons in February 2020, but otherwise topped 2,000 MT only nine times in history.

At 95,497 MT, June exports of other hay also fell from May, with sales down to both major markets. Shipments to Japan totaled 57,659 MT, the lowest since August 2021 but still representing about 60% of other hay exports. Sales to South Korea at 23,136 MT were the lowest since January and represented 24% of the month’s total. Other hay exports were valued at about $391 per MT, down about $8 from May.

The same factors that impacted June exports are likely to affect July sales volumes, according to Christy Mastin, sales representative with Eckenberg Farms, Mattawa, Washington. High prices will also play a deterrent.

“Some suppliers have no carryover, and new-crop harvest conditions were terrible,” Mastin said. In the Northwest, many growers were considering only four cuttings of alfalfa this year. Reduced volumes will keep prices high, and combined with unfavorable currency exchange rates, will prevent potential buyers from completing purchases.

Nonetheless, foreign buyers continue to call in search of lower and more stable prices, with hopes currency exchange rates will improve. Some foreign customers have been looking into securing lower grades of hay to match purchase budgets, Mastin said.

Regional markets

Here’s a snapshot of regional markets to start August:

-

Southwest: In Texas, hay prices remained mostly firm to $10 higher in all regions. Portions of the Panhandle received some moisture relief, but above-average temperatures continued to plague the state. Hay supplies continue to be very short as yields have been below average. Pasture and range conditions were rated poor to very poor, causing livestock producers to cull deeper into their herds and sell calves earlier than normal.

In Oklahoma, hay trade was slower due to a lack of truck drivers to deliver hay.

In New Mexico, alfalfa hay prices were steady with demand moderate to good. The southern and eastern parts of the state were finishing fourth cutting. Some hay producers were storing hay for the winter.

In California, trade activity and demand were good. Retail hay prices were steady; dairy and export hay prices were steady with good demand.

-

Northwest: In Montana, hay sold generally steady with demand moderate to strong. Most sales were reported in the central part of the state, with growers seeing interest from western exporters and dairies. Eastern Montana had an abundant supply of hay as many producers report some of the best yields in years. High freight rates continued to stifle hay sales in eastern Montana.

In Idaho, alfalfa for press hay sold firm. Northwest exporters were competing with other buyers to secure inventory.

In Colorado, trade activity was good on very good demand for horse hay; prices were steady to 75 cents higher per bale. There was less hay moving to feedlots and cattle ranches. Prices were firm on southeast Colorado hay being processed for hay cubes.

In the Columbia Basin, export hay sold steady to firm. Trade remained active with good demand from all sectors of the industry.

In Wyoming, a late start to the growing season was keeping hay inventories small and prices steady.

-

Midwest: In Nebraska, hay prices were fully steady on sporadic demand. Sellers were not budging from asking prices, and buyers were making mostly hand-to-mouth purchases. Tonnage across most of the state was down on the first two cuttings of alfalfa.

In Kansas, prices for alfalfa and grass hay bumped up but remained unsettled. Demand was high from in-state and out-of-state buyers as drought conditions in western Kansas and surrounding states continued to worsen.

In South Dakota, prices for alfalfa and grass hay remained firm on good demand. Second cutting of alfalfa was completed, with some producers working on third cutting. There were reports of reduced tonnage due to hot, dry conditions.

In Missouri, most areas in the southern half of the state were finally seeing some much-needed rain. Hay movement has been good as ranchers have been trying to hold on to as many cattle as possible. Finding hay locally, however, has been tough, and trucking costs haven’t been cheap either – if trucks could found to haul it.

In Wisconsin, prices for dairy-quality hay were steady to strong with lower-quality hay discounted.

-

East: In Pennsylvania, alfalfa sold strong; orchard and timothy sold steady; alfalfa-grass mixes and prairie-meadow grass sold weaker. Buyer demand was moderate on a moderate supply.

In Alabama, hay prices were fully steady, with moderate supply and demand.

Other things we’re seeing

-

Dairy: Milk prices plateaued but feed costs continued to rise in June, cutting into monthly dairy producer milk income over feed cost (IOFC) margins calculated under the Dairy Margin Coverage (DMC) program. Preliminary June 2022 U.S. cow numbers were up 4,000 head from May and up 55,000 head from January, but still down about 84,000 head from the peak in May 2021. Most of the growth so far this year has come in Texas, Georgia, South Dakota, Arizona, Iowa, Colorado and Kansas.

-

Cattle: In its semiannual cattle inventory report, the USDA estimated all cattle and calves in the U.S. on July 1, 2022, totaled 98.8 million head, 2% below the 101 million head on July 1, 2021. Smaller beef cow numbers are a sign that producers are liquidating herds in response to drought conditions in major production areas.

-

Fuel: There was good news regarding fuel costs to start August, with prices for both gasoline and diesel fuel down 13-14 cents per gallon compared to the week before. The U.S. regular gasoline retail price averaged $4.19 per gallon, about $1.03 more than a year earlier. The U.S. average on-highway diesel fuel price was $5.14 per gallon, up $1.77 from a year ago.

-

Trucking: Flatbed prices were slightly lower in early August, according to DAT Trendlines. The national average price was $3.16 per mile. Regionally, average prices per mile were: Southeast – $3.51, Midwest – $3.40, South – $3.37, Northeast – $3.15 and West – $2.81.

.png)