There’s good news for a change. The fluid milk sales slide may be ending. USDA’s outlook raises prices for the last half of 2016. California’s July Class 1 milk prices are up. This and other U.S. dairy economic news can be found here.

Has fluid milk sales decline ended?

One or two months does not a turnaround make, but April 2016 national fluid milk sales were virtually the same as a year earlier, based on a monthly summary from USDA’s Dairy Market News.

April packaged fluid milk sales totaled 4.09 billion pounds, nearly identical to April 2015. Sales of conventional products totaled 3.88 billion pounds, down 0.2 percent, while sales of organic products, at 213 million pounds, were up 3.3 percent. Organic represented about 5.2 percent of total sales for the month.

Whole and flavored whole milk sales continued to outpace last year’s sales. April sales of conventional whole milk were up 5.5 percent compared to the previous year, with flavored whole milk sales up 5 percent. Sales of organic whole milk were up 15.6 percent compared to a year earlier.

Conventional and organic fat-free milk varieties had some of the largest sales declines.

Year to date, total packaged fluid sales totaled 16.63 billion pounds, just down 0.4 percent from a year earlier. Conventional fluid milk sales totaled 15.78 billion pounds, down 0.7 percent from a year earlier. January-April organic milk sales totaled 858 million pounds, up 4 percent. Organic represents 5.2 percent of total fluid sales for the period.

The figures represent consumption of fluid milk products in federal milk order marketing areas and California, which account for approximately 92 percent of total fluid milk sales in the U.S.

More milk coming, but a slight improvement in prices, too

USDA’s June World Ag Supply & Demand Estimates (WASDE) report (PDF, 257KB) raised 2016 and 2017 U.S. milk production and marketing estimates, but also saw reason to brighten the 2016 price outlook.

• 2016 milk production and marketings were raised about 200 million pounds from last month’s forecast, to 212.6 billion pounds and 211.6 billion pounds, respectively. If realized, both would be up about 1.9 percent from 2015.

• 2017 milk production and marketings were raised about 100 million pounds from last month’s forecast, to 215.3 billion pounds and 214.3 billion pounds, respectively. If realized, both would be up about 1.3 percent from 2016’s estimates.

The increased milk production forecasts were based on the growth of cow numbers.

Class III and Class IV price forecasts were raised for 2016. Compared to last month, the 2016 all-milk price was forecast $.25 to $.35 higher at $14.95 to $15.35 per hundredweight, but unchanged at $15.25 to $16.25 per hundredweight for 2017.

Read the full Progressive Dairyman story.

California Class 1 milk prices start 2016’s second half stronger

California's 2016 Class 1 minimum milk prices started the second half of 2016 on an upnote.

Class 1 North and South prices are up about $.52 from June 2016, but about $3.55 less than July 2015. Through the first seven months of 2016, both are down about $2.22 from the same period a year earlier.

USDA will announce the July 2016 federal order Class I base price on June 22.

Class 1 North ($ per hundredweight)

July 2016 – $14.87

June 2016 – $14.35

July 2015 – $18.42

January-July 2016 – $15.37

January-July 2015 – $17.59

Class 1 South ($ per hundredweight)

July 2016 – $15.14

June 2016 – $14.62

July 2015 – $18.70

January-July 2016 – $15.64

January-July 2015 – $17.86

Source: California Department of Food and Agriculture

Organic milk price premium tops $21 per hundredweight

The national average organic milk mailbox price premium over conventional milk was $21.12 per hundredweight for February, according to USDA’s Dairy Market News.

The premium is calculated by comparing publicly released data from a national organic dairy brand for each of the 14 regions based on geography or whether the organic milk is 100 percent grass-fed or not. The processor’s 12-month average national mailbox price is $36.60 per hundredweight, ranging from a low of $34.10 per hundredweight in the Midwest and Colorado, to a high of $40.35 per hundredweight in New England for organic grass-fed milk.

In contrast, the most recently released monthly conventional milk mailbox price for February 2016 for all federal milk order areas was $15.48 per hundredweight, ranging from a low of $13.96 per hundredweight in New Mexico to a high of $17.06 per hundredweight in New England. California, not included in the federal milk order system, had a February 2016 mailbox milk price of $13.99 per hundredweight.

Organic milk farm gate prices in the European Union (EU) are trending higher than a year ago. Average organic milk farm prices in Germany for March 2016, at $48.83 (euros) per 100 kilograms, are 4.36 percent higher than a year ago. In Bavaria, the March price, $49.39, is up 4.4 percent from a year earlier. In France, the March average price of $43.66 is up 5.36 percent from a year earlier.

Organic milk volumes produced in the EU are believed to be increasing since the March price reporting. Preliminary expectations are that April data will show continuing price strength over a year earlier, but uncertainty as to the magnitude of increased spring EU organic milk production leaves some uncertainty as to where April and May pricing will finalize.

Northeast: 2015 among least profitable in three decades

Following 2014, a year for the record books, 2015 was a difficult year for Northeast producers, according to the Farm Credit Northeast Dairy Farm Summary (DFS).

Farm Credit’s 2015 DFS assesses the financial health and progress of 487 dairy farm businesses in seven states: Connecticut, Maine, Massachusetts, New Hampshire, New Jersey, New York and Vermont. The majority of the farms are in New York.

Most producers entered the year in good financial shape. However, milk prices fell sharply, while some costs decreased as well. Total 2015 expenses decreased $2.37 per hundredweight to $22.13, not enough to offset falling milk prices. The average farm milk price declined by $7.34 to $18.24 per hundredweight.

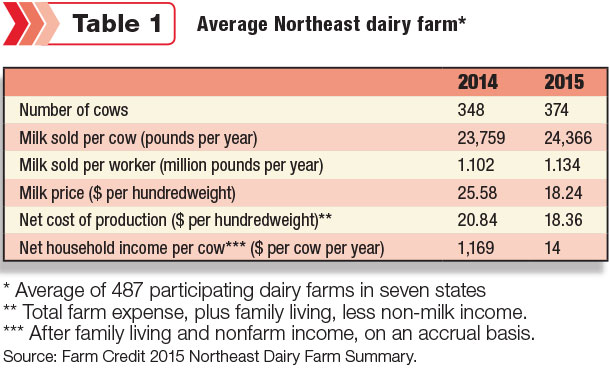

As a result, profitability declined by 99 percent in 2015 from the prior year. Net household earnings fell to an average of $14 per cow in 2015, down from $1,169 per cow in 2014 (Table 1). When non-farm income is subtracted, farms lost an average of $30 per cow.

2015 was the least profitable year since the $386 loss per cow in 2009. In the 36-year history of the DFS, 2015 ranks 29th in terms of profitability.

The report also shows the wide variation in financial results. The top 25 percent of farms in the summary averaged earnings of $291 per cow, compared to a loss of $245 per cow for the bottom quartile.

Feed expense decreased from $1,897 per cow in 2014 to $1,733 in 2015, due to falling grain and oilseed prices. Labor, the second-largest expense, was 2.1 percent lower per hundredweight due to productivity gains. Per cow production rose by 2.5 percent, and milk sold per worker increased 2.9 percent.

Debt-per-cow increased from $3,354 per cow in 2014 to $3,681 in 2015.

For a copy of the 2015 Northeast Dairy Farm Summary, visit FarmCreditEast.com/DFS, or contact your local Farm Credit East office.

Next ‘Protecting Your Profits’ conference call is June 22

Pennsylvania's Center for Dairy Excellence will host the next “Protecting Your Profits” conference call on Wednesday, June 22, 12-12:15 p.m. (Eastern time). Alan Zepp, risk management program manager, will provide an overview of current dairy markets and margins, including opportunities through Livestock Gross Margin for Dairy (LGM-Dairy).

The next LGM-Dairy policy sale period is June 24-25.

Anyone can participate in the free monthly conference call series, but preregistration is required. To register, call the center at (717) 346-0849 with a name, phone number and email address. Once registered, participants will receive the call-in number and information.

In addition to participating live, calls are hosted in a webinar format and recorded, available for later viewing. Past Protecting Your Profits calls can be accessed under “Dairy Information.”

CIH plans dairy margin management seminar at Lake Tahoe

Dairy producers looking to reduce market volatility through risk management are invited to a Commodity and Ingredient Hedging (CIH) Dairy Margin Management Seminar, June 22-23, at Harrah's Hotel and Casino, Lake Tahoe, Nevada.

Participants will learn how to identify margin opportunities ahead of the marketing period, protect forward profit margins and minimize risk exposure.

The event includes breakfast and lunch as well as an evening cocktail reception.

For registration information, contact CIH or call Tom Brooker, business development manager, CIH Dairy Margin Management Service, at (866) 299-9333.

Fonterra, Synlait forecast slightly higher New Zealand milk prices

Fonterra Cooperative Group forecast a farm gate milk price of $4.25 (New Zealand dollar) per kilogram of milk solids for the 2016-2017 season, an increase of $.35 from the 2015-2016 season. There was no change to the 2015-2016 season forecast price of $3.90 per kilogram of milk solids.

Under the Dairy Industry Restructuring Act, Fonterra is required to announce its forecast milk price at the beginning of each season, which started June 1.

New Zealand dairy company Synlait Milk said it will pay slightly more, $4.50 per kilogram of milk solids.

Fonterra chairman John Wilson said the co-op’s forecast took into account a range of factors, including the high New Zealand and U.S. dollar exchange rate, supply volumes from other major dairying regions, current global inventory levels and the economic outlook of major dairy importers.

Chief executive Theo Spierings said the long-term fundamentals for global dairy remain positive, with demand expected to increase by 2 to 3 percent a year due to the growing world population, increasing middle classes in Asia, urbanization and favorable demographics. China dairy consumption growth remains positive and its demand for imports has been steady over recent Global Dairy Trade events. PD

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke