Overall U.S. dairy product export performance in July was in line with recent months, according to Alan Levitt, with the U.S. Dairy Export Council.

Exporters shipped 159,025 tons of milk powders, cheese, butterfat, whey and lactose during the month, up 7 percent from the prior year. Shipments of milk powder and whey proteins made the strongest showing.

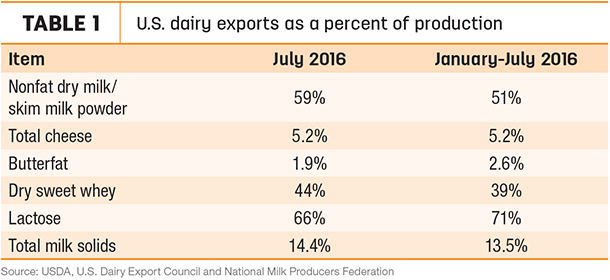

U.S. exports were equivalent to 14.4 percent of U.S. milk production in July on a total milk solids basis (Table 1).

Adjusted nonfat dry milk/skim milk powders exports in July were 53,246 tons, up 31 percent year-over-year. U.S. suppliers posted a large jump (+80 percent) in shipments to southeast Asia, led by Indonesia, the Philippines and Vietnam. Sales to China picked up as well (+51 percent). Meanwhile, adjusted whole milk powder exports in July were up 2 percent from a year ago.

Whey exports outpaced the depressed levels of last summer, with a significant gain in sales to China. In July, exporters shipped 22,934 tons of whey protein concentrate (WPC), up 18 percent from last year, and 3,027 tons of whey protein isolate (WPI), up 47 percent. They also moved 16,729 tons of dry whey, up 1 percent. Nearly half of U.S. whey exports went to China, where sales were up 29 percent from the prior year. China took nearly 7,000 tons of dry whey, the most since April 2014.

With U.S. cheese prices at a sizeable premium to the world market, cheese exports remained below year-earlier levels for the 22nd straight month. Shipments totaled 23,969 metric tons, 6 percent less than last year and 26 percent below two years ago. Sales to Mexico (-18 percent) and Japan (-21 percent) trailed prior-year levels, but exports to South Korea were up 11 percent.

Butterfat exports faced the same price pressure, with U.S. prices well above world market levels. Exports totaled just 1,244 tons, down 33 percent from July 2015.

Other trade numbers

• The year-to-date milk equivalent of dairy products exported through Cooperatives Working Together (CWT) reached nearly 675 million pounds as of the week ending Sept. 2. As of that date, cheese exports topped 34.7 million pounds; butter exports topped 8.8 million pounds; and whole milk powder topped 21.4 million pounds.

• About 878 female dairy cattle replacements found homes outside the U.S. in July. It’s the highest total in four months, but continues a lengthy trend of slumping sales. July exports were valued at $1.71 million. All of the cattle went to our closest neighbors: Mexico imported 489 head, with Canada taking 389.

• Foreign sales of U.S. dairy embryos totaled 908 in July 2016, and were valued at $799,000. Japan was the leading market for the month, purchasing 315 dairy embryos, followed by Canada, at 244, and China, with 192.

• U.S. alfalfa hay exports volume grew in July, topping 225,000 metric tons (MT) for the first time. July 2016 alfalfa hay exports were estimated at 225,619 MT, up from May and June totals of 212,213 MT and 200,452 MT, respectively. It’s the highest three-month total on record.

Alfalfa hay exports to China, which is building its domestic dairy herd, increased substantially compared to a year ago. Exports to Japan, the United Arab Emirates and Saudi Arabia also posted gains compared to July 2015.

Despite lower prices, the jump in volume pushed the value of July alfalfa hay exports to $67.3 million, the highest total of the year.

At 116,815 MT, July exports of other hay rebounded slightly from June, but still came in as the third-lowest total of the year.

• The U.S. agricultural trade balance turned in another surplus in July. Monthly ag exports were valued at $10.64 billion; imports were $8.91 billion, resulting in a trade surplus of about $1.73 billion. Year-to-date fiscal year 2016 (October 2015-July 2016) exports stand at $107.36 billion, with imports at $94.81 billion, yielding a $12.55 billion ag trade surplus.

Global Dairy Trade index takes another bullish jump

The Global Dairy Trade (GDT) overall dairy product price index jumped another 7.7 percent during the latest auction, held Sept. 6.

Prices for all products rose, led by the following: anhydrous milk fat (+15.4 percent, to $4,769 per MT); butter (+14.9 percent, to $3,764 per MT); butter milk powder (+6.8 percent, to $2,070 per MT); cheddar cheese (+9 percent, to $3,436 per MT); skim milk powder (+10 percent, to $2,224 per MT); and whole milk powder (+3.7 percent, to $2,793 per MT).

HighGround Dairy’s Eric Meyer called the auction neutral for whole milk powder and lactose, but bullish versus expectations for all other products.

The next GDT auction is Sept. 20. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke