U.S. dairy product exporters shipped 161,882 tons of milk powders, cheese, butterfat, whey and lactose in June, up 5 percent from a year ago and the highest volume since May 2015, according to Alan Levitt of the U.S. Dairy Export Council. Gains were led by record shipments of whey protein concentrate (WPC), offsetting declines in all the other major categories.

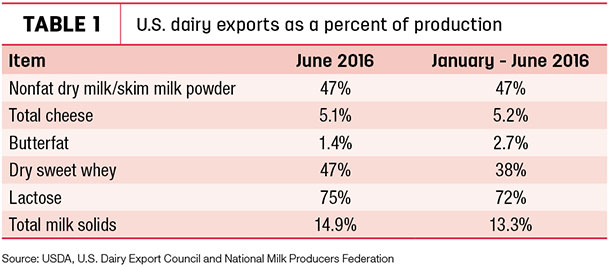

Thanks to whey products, U.S. exports were equivalent to 14.9 percent of U.S. milk production in June on a total milk solids basis, the highest since April 2015 (Table 1). Imports were equivalent to 4.1 percent of production.

WPC shipments were up 52 percent from a year ago, led by sales to China and Southeast Asia. Whey protein isolates also registered a double-digit gain, led by a boost in sales to Canada. Although exports of dry whey were down 2 percent from last year, total shipments of whey products were the most ever.

On the other hand, exports of nonfat dry milk/skim milk powder, cheese, butterfat and lactose continue to lag.

With U.S. cheese prices at a sizeable premium to the world market, cheese exports remained below year-earlier levels. Sales to South Korea and the Middle East/North Africa region were each off by more than a third.

Butterfat exports faced the same price-competitive pressure, with U.S. prices well above world market levels. Exports were down 33 percent from June 2015.

This year marks the second straight year of declining U.S. dairy exports. In the first half of 2016, overall U.S. export volume of milk powders, cheese, butterfat, whey and lactose was down 7 percent from last year and down 17 percent from two years ago. Total export value was $2.23 billion, down 22 percent from first half 2015 and 43 percent from first half 2014.

In the first half, U.S. exports were equivalent to 13.3 percent of U.S. milk solids production, down from 14.5 percent in the first half of 2015.

Other trade numbers

• The year-to-date milk equivalent of dairy products exported through the Cooperatives Working Together (CWT) topped 625 million pounds as of the week ending Aug. 5. As of that date, cheese exports topped 30 million pounds; butter exports topped 8 million pounds; and whole milk powder topped 21 million pounds.

• About 700 female dairy cattle replacements found homes outside the U.S. in June. Nearly all the total went to Mexico (619), with the other 81 going to Canada. June exports were valued at $1.325 million.

• Foreign sales of U.S. dairy embryos totaled 772 in June 2016, and were valued at $958,000. China was the leading market for the month, purchasing 315 dairy embryos, followed by Japan, at 265.

• U.S. exports of alfalfa and other hay-related products are suffering from lower values. June exports of alfalfa hay topped 200,450 metric tons, down about 12,000 metric tons from May, but about 40,000 metric tons more than June 2015. Despite the relatively strong volume, total values were estimated at $59.5 million, about $4 million less than a month earlier. June exports of other hay and alfalfa cubes were the lowest of the year, but shipments of alfalfa meal were the highest of the year. Lower prices hampered export values across the board.

• After three months of deficits, the U.S. agricultural trade balance turned in a surplus in June. Monthly ag exports were valued at $10.014 billion; imports were $9.252 billion, resulting in a trade surplus of about $762,000. Year-to-date fiscal year 2016 (October 2015-June 2016) exports stand at $96.72 billion, with imports at $85.92 billion, yielding a $10.8 billion ag trade surplus. PD

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke