U.S. average all-milk price halted a six-month downward trend. California Class 4a/4b milk prices increased from June. The Margin Protection Program for Dairy will pay at the $6 per hundredweight coverage level and above. With slumping milk prices through much of the first half of 2016, U.S. quarterly dairy herd replacement cow prices weakened. This and other U.S. dairy economic news can be found here.

U.S. average milk price finally halts downward trend

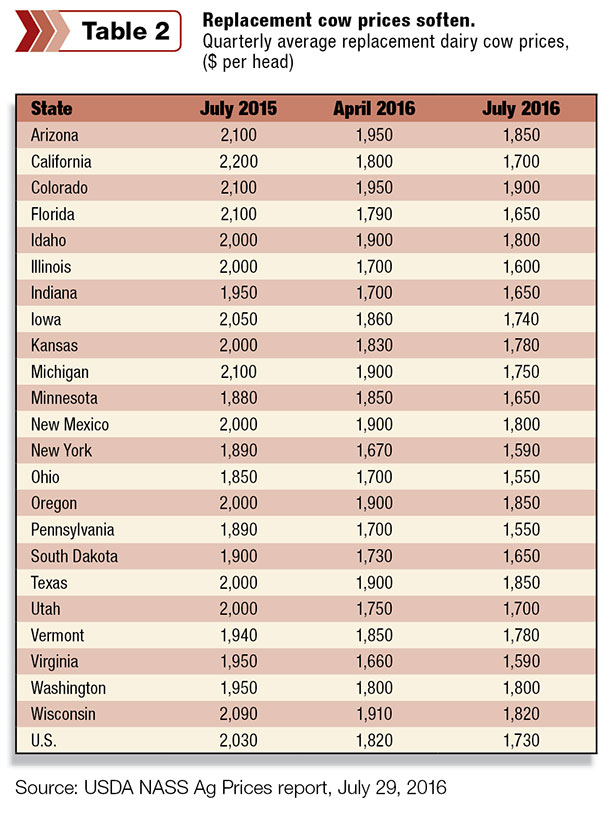

It’s not much to write home about, but the U.S. average all-milk price halted a six-month downward trend, according to the USDA NASS Ag Prices report, released July 29.

USDA estimated the June 2016 U.S. average all-milk price at $14.80 per hundredweight (cwt), up 30 cents from May, but still $2.20 less than June 2015’s average of $17 per cwt (Table 1).

California posted the largest month-to-month increase, up 91 cents per cwt. Idaho, Oregon and South Dakota had gains of 40 cents per cwt.

Compared to a year earlier, average prices were down $3 per cwt or more in South Dakota and Wisconsin.

Through the first 6 months of the year, 2016 prices averaged $15.23 per cwt, about $1.65 (10 percent) less than the same period a year earlier.

July federal order prices rally

Federal milk marketing order (FMMO) Class III and Class IV minimum prices continued to rally in July. The Class III rose $2.02 from June, and is the highest since November 2015. The Class IV price was up $1.07, to its highest level since December 2015.

FMMO Class III ($ per cwt)

July 2016 – $15.24

June 2016 – $13.22

June 2015 – $16.33

January-July 2016 – $13.73

January-July 2015 – $16.04

FMMO Class IV ($ per cwt)

July 2016 – $14.84

June 2016 – $13.77

June 2015 – $13.15

January-July 2016 – $13.42

January-July 2015 – $13.62

Source: USDA Ag Marketing Service

California Class 4a/4b milk prices improve

California's July 2016 Class 4a/4b milk prices were announced Aug. 1. The Class 4a price rose 72 cents per cwt from June and is the highest since December 2015. The Class 4b price rose $1.64 and is the highest since October 2015.

California Class 4a ($ per cwt)

July 2016 – $14.23

June 2016 – $13.51

July 2015 – $13.03

January-July 2016 – $13.11

January-July 2015 – $13.42

California Class 4b ($ per cwt)

July 2016 – $14.67

June 2016 – $13.03

July 2015 – $14.98

January-July 2016 – $13.02

January-July 2015 – $14.41

July FMMO Class III/IV prices will be announced Aug. 3.

MPP-Dairy payout at $6 per hundredweight coverage level and above

The Margin Protection Program for Dairy (MPP-Dairy) will provide indemnity payments to dairy producers with milk-income-over-feed-cost margins insured down to $6 per cwt level, according to the USDA Farm Service Agency (FSA).

USDA’s latest Agriculture Prices report provided milk and feed price factors for June, the second half of the May-June pay period margin calculations.

When combined with May milk and feed prices, the two-month margin was calculated at $5.76 per cwt, down $1.39 from the March-April pay period and the lowest in the program’s short history.

The May-June payment rates (per cwt) calculated by FSA at eligible insured margin trigger levels are:

• $8.00: $2.24

• $7.50: $1.74

• $7.00: $1.24

• $6.50: 74 cents

• $6.00: 24 cents

Eligible farmers will receive payments on one-sixth of the annual milk production history. Payments will be determined by the individual producer coverage level and percentage of annual production covered under MPP-Dairy, minus a 6.8 percent federal budget sequestration in place until 2023.

Under the 2016 MPP-Dairy program, 4,427 dairy herds have margins insured at $6 per cwt or higher, about 19 percent of the 23,328 total MPP-Dairy participants.

Read the full Progressive Dairyman article.

April organic premium averages $21.36 per hundredweight

The national average organic milk mailbox price premium over conventional milk was $21.36 per cwt for April, according to USDA’s Dairy Market News.

The organic mailbox price is derived from a national processor’s currently prevailing 12-month average mailbox price from 17 regions. The national average as of April was $36.25 per cwt, ranging from a low of $33.43 per hundredweight in the Midwest for organic milk to a high of $39.68 per cwt in New England for organic grass-fed milk.

The most recently released monthly conventional milk mailbox price for April 2016 for all federal milk order areas was $14.89 per cwt, with a low of $13.29 per cwt in New Mexico to a high of $16.30 per cwt in New England. California, not included in the federal milk order system, had an April 2016 mailbox milk price of $13.27 per cwt.

GDT index jumps

Overall dairy prices rose 6.6 percent at the Global Dairy Trade (GDT) auction, Aug. 2.

Whole milk powder prices led all gainers, up 9.9 percent. With the exception of cheddar cheese, nearly all other prices were higher. Skim milk powder increased 2.1 percent, and butter increased 6.6 percent. Cheddar cheese was down 0.8 percent.

The next GDT auction is Aug. 15.

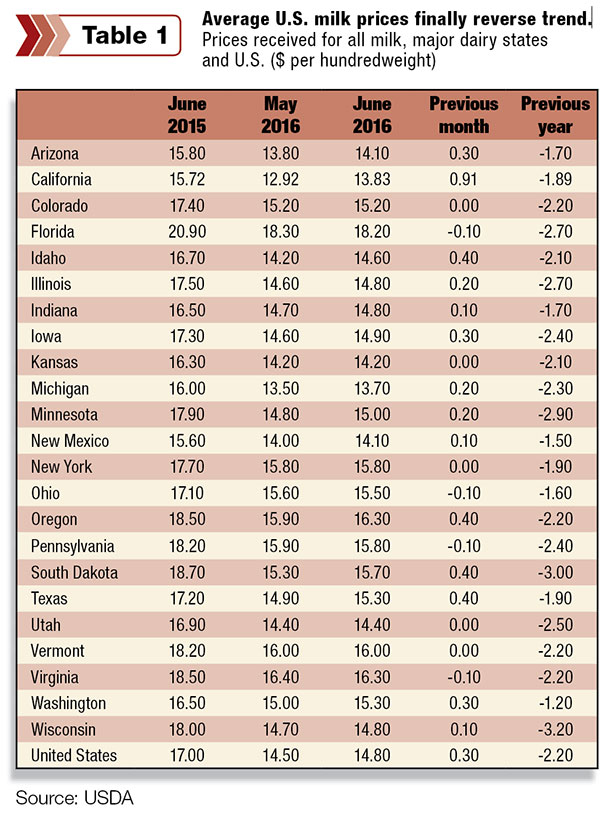

Replacement cow prices weaken

With slumping milk prices through much of the first half of 2016, U.S. quarterly dairy herd replacement cow prices declined to the lowest average since January 2014, based on data in USDA’s monthly Ag Prices report, released July 29.

Preliminary July 2016 U.S. quarterly replacement dairy cow prices averaged $1,730 per head, down $90 from April 2016 and $300 less than July a year ago.

July 2016 average prices ranged from a high of $1,900 per head in Colorado to lows of $1,550 in Ohio and Pennsylvania (Table 2).

June cull cow prices up a little

U.S. average cull cow prices improved slightly in June, according to the USDA NASS Ag Prices report.

June 2016 cull cow prices (beef and dairy combined) averaged $80.90 per cwt, up $1.30 from May, but $32.10 per cwt less than June 2015.

Year-to-date, the cull cow price average is $78.95 per cwt, down $33.72 from January-June 2015.

Alfalfa hay prices lower

Hay supplies generally exceeded demand as August began, pressuring prices lower, based on weekly state, regional and national hay market summaries.

The excess hay supplies were mostly reported for lower-quality hay. Many areas reported little dairy-quality hay offered for sale during the last week of July.

The June 2016 U.S. average price paid to alfalfa hay producers at the farm level was $142 per ton, down $5 from May and $36 less than a year earlier. Based on USDA records, U.S. average alfalfa prices are the lowest since March 2011.

The June U.S. average price for other hay was $116 per ton, down $6 from May and dipping to lows last seen in December 2014.

Read the full Progressive Forage article.

Fonterra sticks to price forecast

Fonterra kept its projected current-season milk price paid to New Zealand farmers unchanged at $4.25 per kilogram ($ NZ). However, with a slightly higher earnings forecast, farms could see a total payout of $4.75 to $4.85 per kilogram.

According to published sources, the breakeven price for New Zealand dairy farmers is about $5.28 per kilogram.

Milk collections are forecast to decline 3 percent. PD

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke