Most PPDs turn positive

First, some numbers. FMMO monthly PPD and uniform price reports were released the week of Jan. 11.

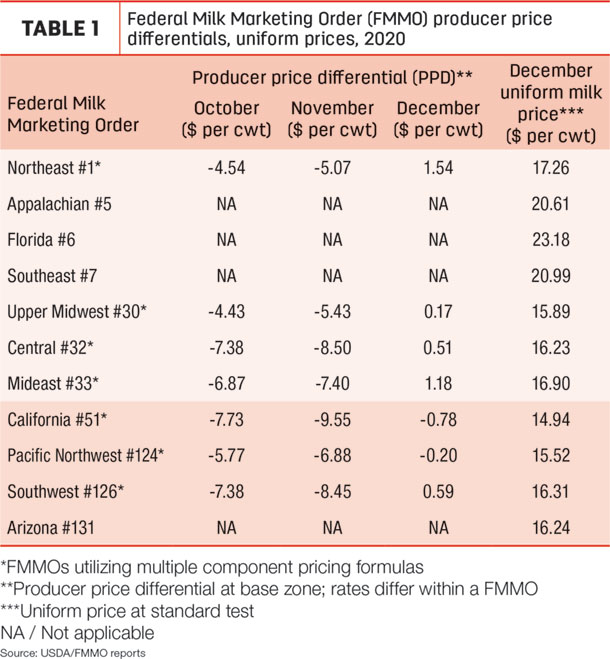

PPDs changed dramatically thanks to milk class price relationships that reduced incentives for depooling Class III milk (Table 1). December PPDs moved into positive territory in all but two FMMOs, the Pacific Northwest, which was -20 cents, and California, -78 cents. Elsewhere, PPDs ranged from between +17 cents in the Upper Midwest to +$1.54 in the Northeast.

Compared to November, the PPDs were $8.50-$9 per hundredweight (cwt) higher in California, Mideast, Central and Southwest FMMOs, about $6.60 higher in the Northeast and Pacific Northwest and $5.60 higher in the Upper Midwest.

As we’ve noted previously, PPDs have zone differentials, so they’ll vary slightly within each FMMO. In addition, PPD impacts on individual milk checks are based on individual milk handlers.

December uniform milk prices were higher in eight of 11 FMMOs (Table 1). Exceptions were the Northeast, Upper Midwest and Pacific Northwest. Uniform prices ranged from a high of $23.18 per cwt in the Florida FMMO to a low of $14.94 per cwt in California.

PPD factors

The factors driving PPD improvements included a return to some “normalcy” in milk class relationships, which reduced the incentives for depooling. The December Class I base price was $19.87 per cwt. The Class III price was $15.72 per cwt, and the Class IV milk price was $13.36 per cwt. That meant Class I was again atop the price ladder, and the Class III-IV price gap fell to $2.36 per cwt, the smallest difference since May 2020.

The bad news: The Class III price fell $7.62 per cwt from November due to a sharply lower milk protein value in the pricing formula. With weaker cheese prices, protein was valued at $3.03 per pound in December, down $2.59 from November.

Jump into the pools

As noted, those class prices led to more “normal” milk pooling of Class III milk.

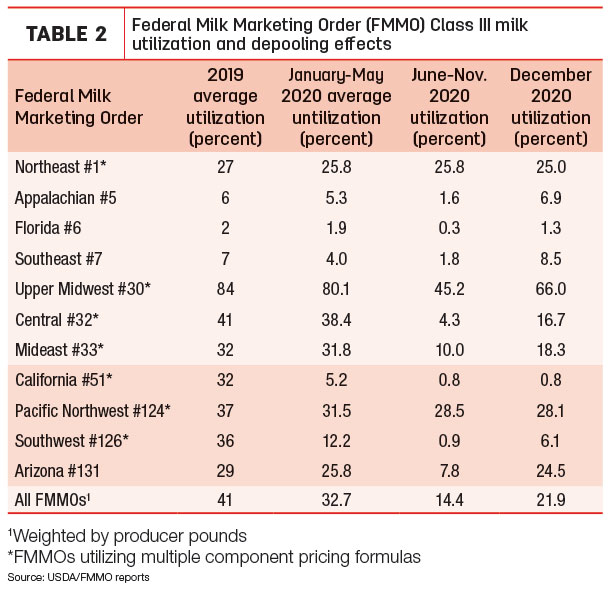

Since the amount of milk depooled is not reported, Table 2 shows Class III utilization in each order in attempt to capture depooling trends.

In our example used previously, Class III utilization averaged 84% of all milk pooled in 2019 in the Upper Midwest FMMO. That dropped to about 80% during January-May 2020, prior to the impact of the USDA’s cheese purchases under the Farmers to Families Food Box Program. Once those purchases kicked in, cash cheddar cheese prices skyrocketed, pushing Class III milk prices higher. With incentives to depool, Class III utilization in the Upper Midwest order fell to about 45% between June-November.

Prior to COVID-19’s impact on FMMO price formulas, Class III utilization as percentage of all milk pooled on FMMOs averaged about 33%. That fell to about 14% in June-November. The estimated percentage of all milk pooled in December utilized as Class III was about 22%.

Another way to estimate the extent of depooling is to monitor milk volume that was pooled. Pre-COVID-19, Class III milk pooled in all 11 FMMOs averaged about 4.34 billion pounds per month during January-May. With depooling in June-November, the volume of Class III milk pooled across all 11 FMMOs averaged just 1.44 billion pounds per month. The estimated Class III milk pooled in December totaled about 2.58 billion pounds.

Based on available reports, December Class III pooling was the highest since May in many FMMOs.

Will ‘negative’ environment return?

Market volatility to start the new year is making it more difficult to predict, but it’s likely the extreme negative nature of PPDs has subsided. That’s subject to change, of course.

The environment for potential depooling and negative PPDs may increase slightly in January due to the market impact of a fifth round of the Farmers for Families Food Box program. The announcement, on Jan. 4, sent cheese prices and Class III milk futures higher in the first quarter of 2021. Class III milk futures gave back some of the short-term gains early in the week of Jan. 11.

The Class I base price for January was previously announced at $15.14 per cwt. FMMO Class III and IV prices won’t be announced until Feb. 3, but as of Jan. 13, Chicago Mercantile Exchange (CME) Class III milk futures prices settled at $16.31 per cwt, with the Class IV futures price closing at $13.71 per cwt. That puts the January Class I base price below the expected Class III price, and widens the gap between Class III and Class IV prices, providing some depooling incentives.

The February Class I base price will be announced on Jan. 21, but Class III-IV prices won’t be announced until March 3. As of Jan. 13, the CME Class III future price for February was $18.90 per cwt, making it likely to be above the Class I base price. Additionally, based on current futures prices, the Class III-Class IV price gap widens to about $4.81 per cwt.

Call for reform growing

The negative PPDs, depooling and other factors seen in 2020 have led to increasing calls for FMMO reform.

Following a unanimous vote of the executive committee of the National Milk Producers Federation (NMPF) on Jan. 8, the organization’s leader said the organization would seek potential changes to the so-called “Class I fluid milk price mover.”

“We are seeking consensus across the dairy industry for changes to the Class I mover that remedy economic damage to dairy farmers who have disproportionately suffered as a result of this pandemic,” Jim Mulhern, NMPF president and CEO, said in a press release on Jan. 11.

Approved by Congress outside the normal FMMO hearing process, the current Class I mover used to price fluid (Class I) milk in FMMOs took effect in May 2019. It applies a 74 cent per cwt adjuster to the monthly average of Class III and IV prices.

However, because of the significant gap between Class III and IV prices – in large part to the implementation of the Farmers to Families Food Box program that supports cheese and Class III milk prices – the Class I mover was not as high as it would have been under the previous formula, which utilized the “higher of” either the Class III or IV price each month to determine the Class I mover. NMPF estimated dairy farmers may lose roughly $800 million in revenues under the current formula, making its reexamination necessary.

“The intent behind the current mover was a revenue-neutral solution to the concerns of fluid milk processors about hedging their price risk,” Mulhern said. “With that balance severely upended due to the pandemic, a modified approach is necessary. We need a solution that provides more equity and balance between farmers and processors.”

The NMPF executive committee also discussed other dairy pricing improvements as part of an ongoing examination of FMMO issues. NMPF leadership directed staff to convene an NMPF Cheese Pricing Task Force to further refine proposals involving both public and private sector organizations that could help address ongoing imbalances in the pricing of block and barrel cheese.

“These issues are challenging and complex, but also crucial to face if we are to best promote prosperity among dairy farmers, their cooperatives and the entire industry,” Mulhern said.

Grassroots efforts broader, deeper

Meanwhile, grassroots dairy producer organizations contacting Progressive Dairy are calling for more expansive FMMO reforms, saying current policies are creating two classes of dairy farmers – haves and have nots.

With depooling and negative PPDs, the pay price disparity has resulted in some farmers having the best year they’ve ever had, while their neighbors suffer and struggle to pay bills.

One idea being floated is to boost the Class I mover add-on, which would help keep the Class I base price higher than other milk class prices. The removes some depooling incentives, and because all Class I milk must be pooled, a higher Class I price benefits every dairy farmer in the U.S. and also provides for the equitable distribution of the dollars available in the marketplace.

Another idea is to require mandatory pooling of all milk, regardless of class.

In addition to pay price disparity, current risk management tools do not allow producers to capture lost revenues tied to negative PPDs, since current revenue protection programs are primarily based off of Class III prices.

Food box program adjustments requested

For Geoff Vanden Heuvel, director of regulatory and economic affairs with the California-based Milk Producers Council, the USDA’s Farmers to Families Food Box program is dividing dairy farmers into winners and losers. With cheese a required product in every food box, winners are those farmers selling their milk to cheese plants. For the other half of U.S. dairy farmers, however, the disparity in milk prices has created huge competitive disadvantages, he noted in a recent MPC newsletter.

“Picking winners and losers among dairy farmers runs completely contrary to the goal of maintaining stability in the dairy farming community,” Vanden Heuvel said.

Vanden Heuvel noted that California Dairies Inc. (CDI), the dairy cooperative which represents 40% of California milk supply and a large national butter maker, had asked the USDA to tweak food box requirements to help level the playing field for all dairy farmers. CDI said that food box vendors are required to provide cheese in every box, and that the current payment reimbursement structure provides financial advantages to purchase and distribute other higher-moisture products over butter. CDI asked the USDA to modify the program to make butter a separate and mandatory product category.

“In this very unstable period where government actions both caused and sought to repair massive economic damage that was done to many people – dairy farmers included – USDA should be willing to make a modest tweak in their food box requirements that would have a major restorative benefit to dairy farmers left out of the cheese price windfall,” Vanden Heuvel said.

Holiday blues

The holiday season provided some other marketing challenges: milk dumping and spot load price discounts.

With some milk processing schedules disrupted by holiday plant closures or cutbacks, several FMMO administrators approved requests to allow continued pooling of milk dumped in late December and early January:

- The Northeast FMMO approved dumping between Dec. 19, 2020, and Jan. 9, 2021.

- The Central FMMO approved dumping between Dec. 23 and Jan. 4, 2021.

- The Mideast FMMO approved dumping from Dec. 24, 2020, through Jan. 9, 2021.

- The Upper Midwest FMMO approved dumping from Dec. 23, 2020, through Jan. 4, 2021, and then extended to Jan. 18.

How much, if any, milk dumped during the holidays has not yet been reported. Each FMMO has different requirements regarding measuring and testing dumped milk remaining in the pool. That milk is generaly priced at the location the dumping occurred and at the lowest milk class price.

Also due to the holidays and some restrictions on processing capacity, spot milk loads were readily available and heavily discounted. As expected, the holiday weeks played havoc on cream and milk handlers, and there were reports of discounts ranging between $4.50 and $10 per cwt on Class III-IV milk, according to the USDA’s Dairy Market News. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke