- July Class III milk price tops $24.50; PPDs will be negative

- Global Dairy Trade index drops

- Ag Economy Barometer reveals business changes due to COVID-19

- Chapter 12 bankruptcy news is mixed

- USDA extends RMA deadlines, defers interest accrual

July Class III milk price tops $24.50; PPDs will be negative

July’s Federal Milk Marketing Order (FMMO) Class III milk price jumped another $3.50 from June to $24.54 per hundredweight (cwt). It’s $6.99 higher than a year ago. The last time the Class III price was above $24.50 per cwt was in September 2014.

The July 2020 Class IV milk price rose just 86 cents from June to $13.76 per cwt. It’s down $3.14 from July 2019.

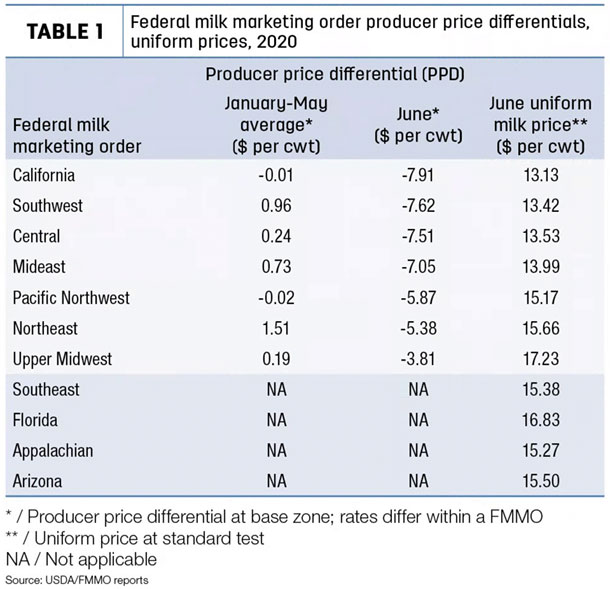

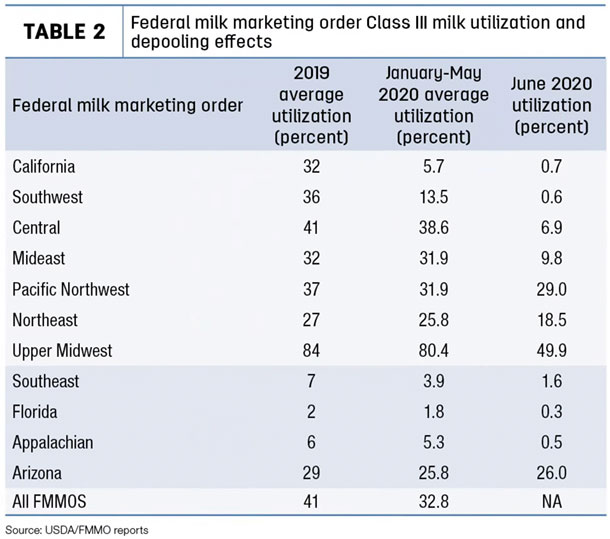

Final July uniform prices and producer price differentials (PPDs) will depend on the level of depooling in each Federal Milk Marketing Order (FMMO). The class price disparity will again provide ample incentive for Class III depooling.

As in June, the July Class III milk price is substantially higher than the Class I base price ($16.56 per cwt), the Class II price ($13.79 per cwt) and the Class IV milk price ($13.76 per cwt). While the difference between the Class III and Class I base price in July ($7.98 per cwt) shrunk a little from June ($9.62 per cwt), the difference between the July Class III price and the Class IV price grew to $10.78 per cwt.

July FMMO information, including uniform price and PPD calculations will start to be announced late next week. Here’s a reminder of June data. Read: Negative PPD impact will likely vary by order, handler.

Through the first seven months of 2020, the Class III price averaged $17.30 per cwt, the highest for that period since 2014. The January-July 2020 Class IV price averaged $13.78 per cwt, down $2.23 for the same period a year ago.

Global Dairy Trade index drops

After posting steady to stronger prices since the end of May, the index of Global Dairy Trade (GDT) dairy product prices was down 5.1% in the latest auction, held Aug. 4.

A price summary of individual product categories follows:

- Skim milk powder was down 4.6% to $2,583 per metric ton (MT).

- Butter was down 2.8% to $3,438 per MT.

- Whole milk powder was down 7.5% to $3,003 per MT.

- Cheddar cheese was down 5.3% to $3,568 per MT.

The next GDT auction is Aug. 18.

Ag Economy Barometer reveals business changes due to COVID-19

The Purdue University/CME Group “Ag Economy Barometer” provides a monthly snapshot of farmer sentiment regarding the state of the agricultural economy. In addition, it reveals producer insights into other topics impacting their businesses.

The monthly survey collects responses from 400 producers whose annual market value of production is equal to or exceeds $500,000. Minimum targets by enterprise are as follows: 53% corn/soybeans, 14% wheat, 3% cotton, 19% beef cattle, 5% dairy and 6% hogs.

The latest survey, released Aug. 4, indicates overall farmer sentiment is improving, but still hasn’t reached levels of optimism seen before the COVID-19 pandemic began in February. The survey was conducted from July 20-24.

The July survey found farmers were less concerned about the current economic situation on their farms but were also less optimistic about the future. Two-thirds of those responding said they believe Congress should provide additional economic assistance to farmers in 2020 to help offset the pandemic's impact on agriculture.

Four out of 10 respondents said they are conducting more business online as a result of COVID-19.

Just two out of 10 farmers said they have a marketing adviser to help them make marketing decisions. Of those who utilize marketing advisers, about 36% said they chose their adviser based on advice from another producer, while 16% recommendations from an agribusiness firm.

The impact of COVID-19 has changed the way producers get their information. Over half of farmers responding to the July survey said they were less likely to attend in-person educational events in 2020 as a result of COVID-19 concerns. When asked what their top information source would be in lieu of attending in-person events, 36% chose farm magazines, 19% chose online webinars, 17% chose farm radio and 17% chose websites.

Looking ahead, 56% of producers reported they plan to reduce their farm machinery purchases compared to a year ago, while 38% of surveyed producers reported they plan to keep machinery purchases about the same as last year.

Chapter 12 bankruptcy news is mixed

There was mixed news in the latest analysis of Chapter 12 farm bankruptcy filing data from the American Farm Bureau Federation (AFBF).

While the number of Chapter 12 filings slowed in the first six months of 2020 to 284, filings were up 8% (to 580) for the 12-month period ending June 30, 2020, according to AFBF chief economist John Newton.

The lower number of filings through the first half of 2020 – at a time when farmers and ranchers are struggling with the impact of COVID-19 – is due in large part to federal financial assistance, Newton said. With provisions of the Coronavirus Aid, Relief and Economic Security (CARES) Act, including direct payments to agricultural producers through the Coronavirus Food Assistance Program (CFAP), there’s a high likelihood the number of Chapter 12 filings will increase without additional financial assistance.

Bankruptcy rates over the previous 12 months were the highest in the Midwest, Northwest and Southeast. Farmers in these regions filed a combined 464 bankruptcies, representing 80% of the filings across the U.S.

At nearly 300 filings, a 23% increase, more than 50% of the Chapter 12 filings were in the 13-state Midwest region. The Southeast had 122 Chapter 12 filings, an increase of 22% over prior-year levels. Chapter 12 farm bankruptcies were the highest in Wisconsin at 69, 24 more than the prior 12-month period.

USDA extends RMA deadlines, defers interest accrual

The USDA’s Risk Management Agency (RMA) announced it will authorize approved insurance providers (AIPs) to extend deadlines for premium and administrative fee payments, defer the resulting interest accrual, and allow other flexibilities to help farmers, ranchers and insurance providers due to the COVID-19 pandemic.

Specifically, the USDA is authorizing AIPs to provide policyholders additional time to pay premium and administrative fees and to waive accrual of interest to the earlier of 60 days after their scheduled payment due date or the termination date on policies with premium billing dates between Aug. 1, 2020, and Sept. 30, 2020. In addition, the USDA is authorizing AIPs to provide up to an additional 60 days for policyholders to make payment and waive additional interest for written payment agreements due between Aug. 1, 2020, and Sept. 30, 2020. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke