November exports of U.S. dairy replacement heifers softened after hitting a 12-month high in October, according to latest estimates from USDA’s Foreign Agricultural Service. Monthly exports totaled 1,986 head, which was still the third-highest monthly total for the year.

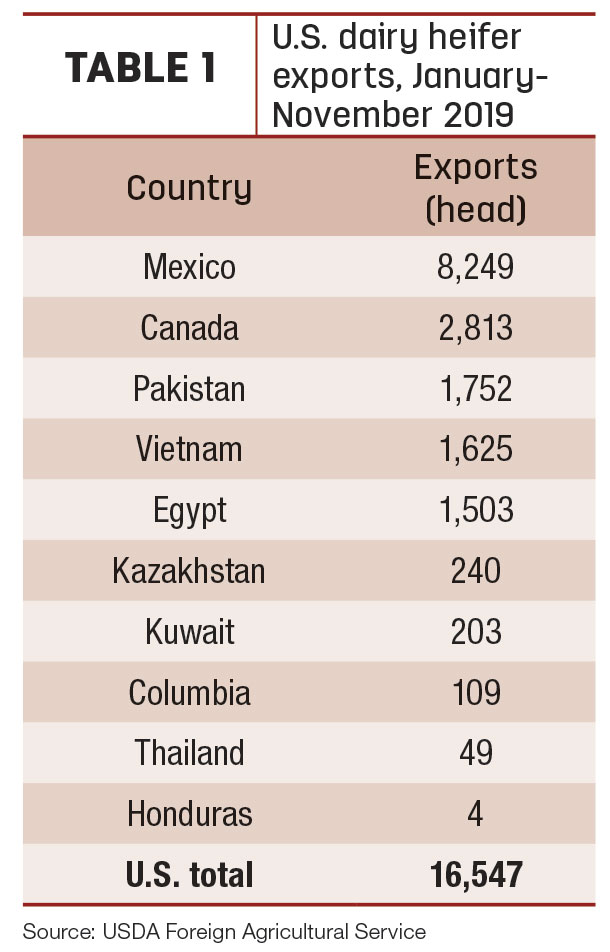

According to the USDA, all the exports remained close to home, with 1,590 moving to Mexico and the remaining 394 head relocating to Canada (Table 1). November’s sales pushed year-to-date dairy heifer exports to about 16,550 head, still the lowest 11-month total in three years.

November dairy heifer exports were valued at about $2.9 million, raising the year-to-date total to about $29.6 million.

2020 will start strong

Tony Clayton, Clayton Agri-Marketing Inc., Jefferson City, Missouri, expects U.S. dairy replacement heifer exports to remain strong in early 2020 before leveling off.

“The year of 2020 will start with multiple shipments of cattle off the West Coast to Vietnam,” Clayton said. In total, more than 3,000 head of Holstein heifers are bound for Southeast Asia in January and February.

Egypt will also see another shipment in January, bringing numbers exported there to well over 5,000 head in a three-month period.

Despite the strong start anticipated for 2020, U.S. dairy cattle exports may face longer-term supply constraints, as significant and growing management trends related to breeding and herd selection on U.S. dairy farms impact heifer availability.

“On the horizon, the numbers of cattle available for export will be limited because of the use of beef semen in dairy cows,” Clayton said. “Because of this, we will see export numbers fall off at some point.”

Gerardo Quaassdorff, T.K. Exports Inc., Boston, Virginia, said increased use of beef semen in conjunction with genetic selection technology plays a role.

“Genomic testing has allowed U.S. dairy producers to sort and cull heifers from their herd at an earlier age, and lower milk prices accelerated that practice," Quaassdorff said. The increased use of beef semen in average-quality genomic-tested heifers has reduced overall dairy heifer numbers available for export.

The impact of those factors goes beyond heifer numbers and could lead to a structural change in the export market – a trend toward smaller but more frequent export shipments of heifers.

“With earlier sorting, it will be more difficult to find bred dairy heifers with dairy semen at short notice,” Quaassdorff said. And while open heifers should remain readily available, shipment sizes and timetables could be impacted.

“If the buyer request is for [dairy] bred heifers, it might be necessary to buy open heifers at younger ages and custom breed them,” Quaassdorff said. “It will be necessary to educate foreign buyers to contract/order shipments several months in advance, based on negotiated installments to custom breed them.”

For buyers, the good news is the supply of U.S. dairy heifers is and will continue to be plentiful due to the use of sexed semen and in vitro fertilization embryos.

From a demand standpoint, Quaassdorff expects continued interest in U.S. dairy cattle. “In several instances, it will depend on the importing country’s economic status and on how U.S. exporters deal with higher transportation costs,” he said. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke