• Volume basis: Suppliers shipped 152,952 tons of milk powders, cheese, butterfat, whey products and lactose in December, the lowest figure in nearly two years and down 21 percent from December 2017. Despite the fourth-quarter weakness, total 2018 volumes were up 9 percent compared to 2017.

• Value basis: Total U.S. exports were worth $428.9 million in December 2018, down 9 percent from December 2017. For the year, dairy exports totaled $5.59 billion, 2 percent more than 2017. On a value basis, sales to China were down 40 percent in December, while sales to Southeast Asia were down 27 percent. This was only partially offset by a 17 percent increase in sales to Mexico.

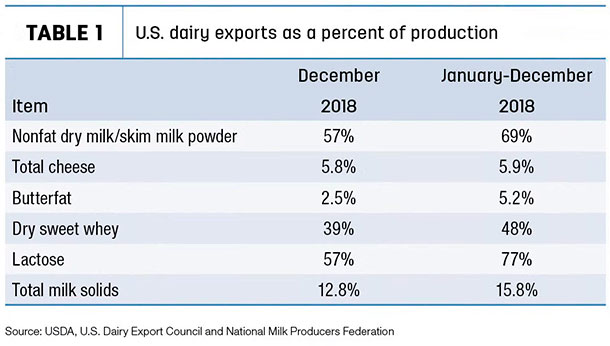

• Total milk solids basis: U.S. exports were equivalent to 12.8 percent of U.S. milk production in December, bringing the full-year percentage to 15.8 percent (Table 1).

Mexico in dairy replacement market

December 2018 U.S. dairy replacement heifer exports rebounded from November, setting the stage for a stronger 2019. The month’s shipments were estimated at about 2,484 head valued at nearly $4.86 million.

At 27,914 head, total 2018 sales fell slightly from 2017’s total of 31,513 head but was still the second strongest year in the past four years. It remained well off the pace of nearly 67,000 head in 2013 and the record high of more than 73,000 in 2011.

Mexico was the leading destination for U.S. dairy replacement heifers in 2018 at 7,241 head, with 365 head in December. With a strong December shipment of 1,775 head, Qatar was the second-leading market for the year at 5,968. The U.S. neighbor to the north, Canada, took 175 head in December to end the year at 3,609 head.

Heifer-buying interest remains strong in Mexico, according to Tony Clayton, Clayton Agri-Marketing Inc., Jefferson City, Missouri. Buyers are visiting the U.S. and selecting cattle, and export pens at the U.S.-Mexico border have to be booked 16 to 18 days ahead of time.

Dairy semen exports

International demand for U.S. dairy genetics continues to expand. The National Association of Animal Breeders (NAAB) reported a new record for dairy semen exports in 2018, helping offset some of the declines in the domestic market. Just over 24.5 million units of dairy semen were exported in 2018, representing an increase of 2.5 million units (11.4 percent) over 2017.

China back in the alfalfa market

The U.S. access to the hay export market in China is becoming more settled now that the threat of additional retaliatory tariffs has been diminished. As a result, China is coming back to the U.S. for alfalfa hay, according to Christy Mastin with Eckenberg Farms Inc., Mattawa, Washington.

U.S. alfalfa hay exports improved in December, bringing the 2018 total to the second-highest total on record. Overall sales totaled 219,512 metric tons (MT) in December, the ninth month sales topped 200,000 MT in 2018. 2018 alfalfa hay exports totaled about 2.55 million MT, behind last year’s record-high total of 2.66 million MT.

China was the top destination for U.S. alfalfa hay in December at 65,693 MT, the highest volume since August. Total shipments to China were estimated at 877,960 MT.

Shipments to Japan remained strong at 51,660 MT in December. Japan was also the second-largest market in 2018 at 583,106 MT. Sales to Saudi Arabia hit 35,232 MT in December for a 2018 total of 480,888 MT, the third-leading market.

December 2018 exports of other hay totaled 122,691 MT, bringing the 2018 total to 1.35 million MT, the lowest annual total in more than a decade.

Pacing December sales were shipments to Japan at 57,063 MT and South Korea at 42,909 MT. Those two were also the leading markets for the year at 721,154 MT and 398,953 MT, respectively.

2018 export sales of alfalfa cubes and alfalfa meal were down from the year before.

U.S. ag trade surplus shrinks

December 2018 U.S. agricultural exports were estimated at $11.3 billion, down $900 million from November. Imports were valued at $10.7 billion, yielding a December 2018 trade surplus of $597 million, the smallest monthly surplus since January.

With December’s numbers, 2018 U.S. ag exports were valued at $139.7 billion, up about $1.5 billion from 2017. Imports were valued at $128.8 billion, up nearly $7.8 billion from the year before. The 2018 ag trade surplus was $10.9 billion, down from $17.2 billion in 2017. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke