In particular, are there specific groups more at risk than others? And how does the dairy sector, which has higher-than-average debt loads, fare in comparison? This is an especially pertinent question since interest rates have nowhere to go but up in the future.

We set out answering these questions using the Ontario Farm Income Database, a collection of revenue and expense data on all tax-filing farms in Ontario.

Our investigation focuses on the interest coverage ratio – an operation’s net farm income (revenue minus expenses) over its interest expense – in 2013, the latest year for which data is available.

The ratio gives information about a farm’s ability to make its interest payments. Typically, a lender considers an operation to be in good health if this ratio is at or above 1.3. (The business’s net income is 30 percent above the annual interest it is obligated to pay back to the lender.)

The ratio gives information about a farm’s ability to make its interest payments. Typically, a lender considers an operation to be in good health if this ratio is at or above 1.3. (The business’s net income is 30 percent above the annual interest it is obligated to pay back to the lender.)

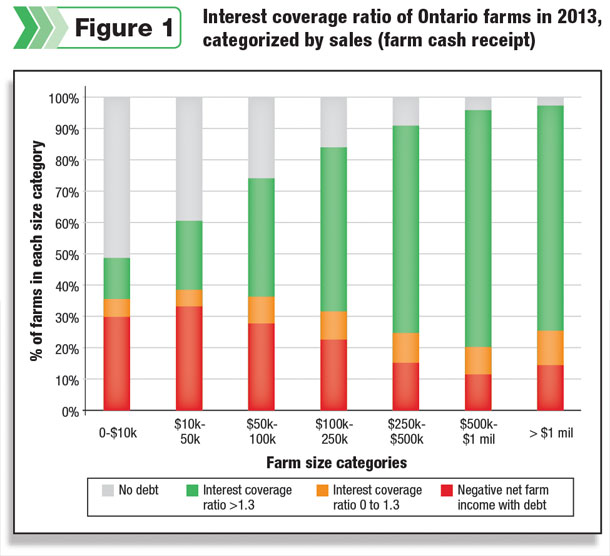

We found that a large portion of farm debt (proxied by interest expense) in Ontario is held by a small number of large commercial farms (greater than $1 million in farm cash receipt).

The majority (more than 95 percent) of these very large farms paid $109,455 in interest expense in 2013, just under three times the average interest expense reported by the next-largest size category ($500,000 to $1 million in sales).

What’s more, these very large farms have healthy cash flow – more than 85 percent reported positive net income.

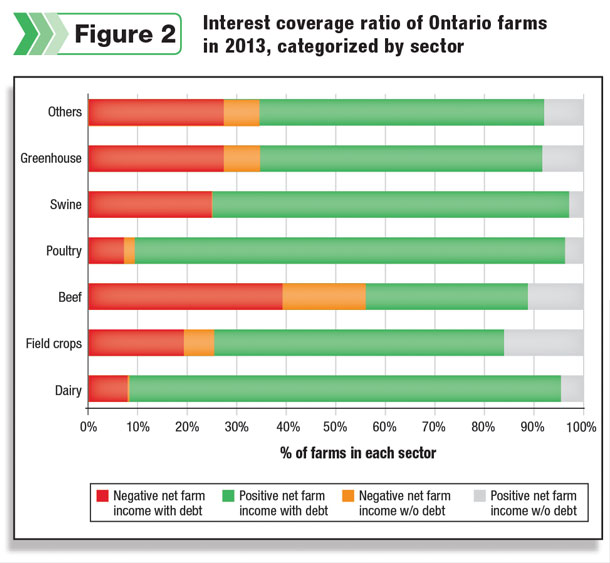

When we break down our analysis by farm sector, we find that dairy operators are in great shape.

Although the data tells us the sector on average has reported interest payments just less than $83,000 (three times higher than the average of all other sectors combined), dairy operators in general have great cash flow: More than 90 percent of dairy farms that reported interest expense also reported positive net farm income in 2013.

In comparison, 70 percent of farms in all other sectors reported positive net farm income in the same period.

Higher debt loads, however, means dairy operations will be more sensitive to rising interest rates compared to other sectors. There are only a few farms carrying debt with “poor” interest coverage ratios between zero and 1.3 – less than 8.4 percent of all farms in 2013.

The size of this group in the dairy sector, at 15 percent, is slightly higher. If we assume a rise of interest rate of 3 percent over two years, we expect to see another 7.4 percent of dairy farms falling into this category by 2015.

A more interesting group are those with interest payment obligations and negative net farm income, which made up about 22.6 percent of all farms in our sample.

More than half of these negative-income farms are small-scale operations with less than $100,000 in sales and averaged $6,115 in interest payments; however, there are also a small share of very large commercial operations with negative net farm income and high levels of interest payments.

More than half of these negative-income farms are small-scale operations with less than $100,000 in sales and averaged $6,115 in interest payments; however, there are also a small share of very large commercial operations with negative net farm income and high levels of interest payments.

Within the dairy sector, there are few operations with negative cash flow (8 percent of dairy operations on record). Dairy operations in Ontario tend to be much larger as well, with more than two-thirds of our sample reporting more than half a million in sales in 2013.

However, potentially higher input prices should not be ignored, even for a sector which has traditionally reported excellent cash flow.

Our results show that net farm income, rather than interest rate, may be a more important determinant of a farm’s ability to meet its farm debt obligations.

With low interest rates in recent years, even a modest rise of 3 percent over the next two years is not expected to impact the farm sector’s ability to pay its debt, though the dairy sector will feel the impact more than other sectors due to higher debt loads on average.

Instead, attention should be paid to net farm income, which is projected to fall with rising input prices and stable commodity prices. This may lead to more operations reporting negative income, potentially impacting their ability to meet their debt obligations. PD

Greg Pate is an economic policy analyst with the Ontario Ministry of Agriculture, Food and Rural Affairs.

-

Kenneth Poon

- Associate Director

- Institute for the Advanced Study of Food and Agricultural Policy

- Email Kenneth Poon