Continuing a three-month trend, milk prices declined and feed costs rose in August, cutting into monthly dairy producer milk income margins calculated under the Dairy Margin Coverage (DMC) program.

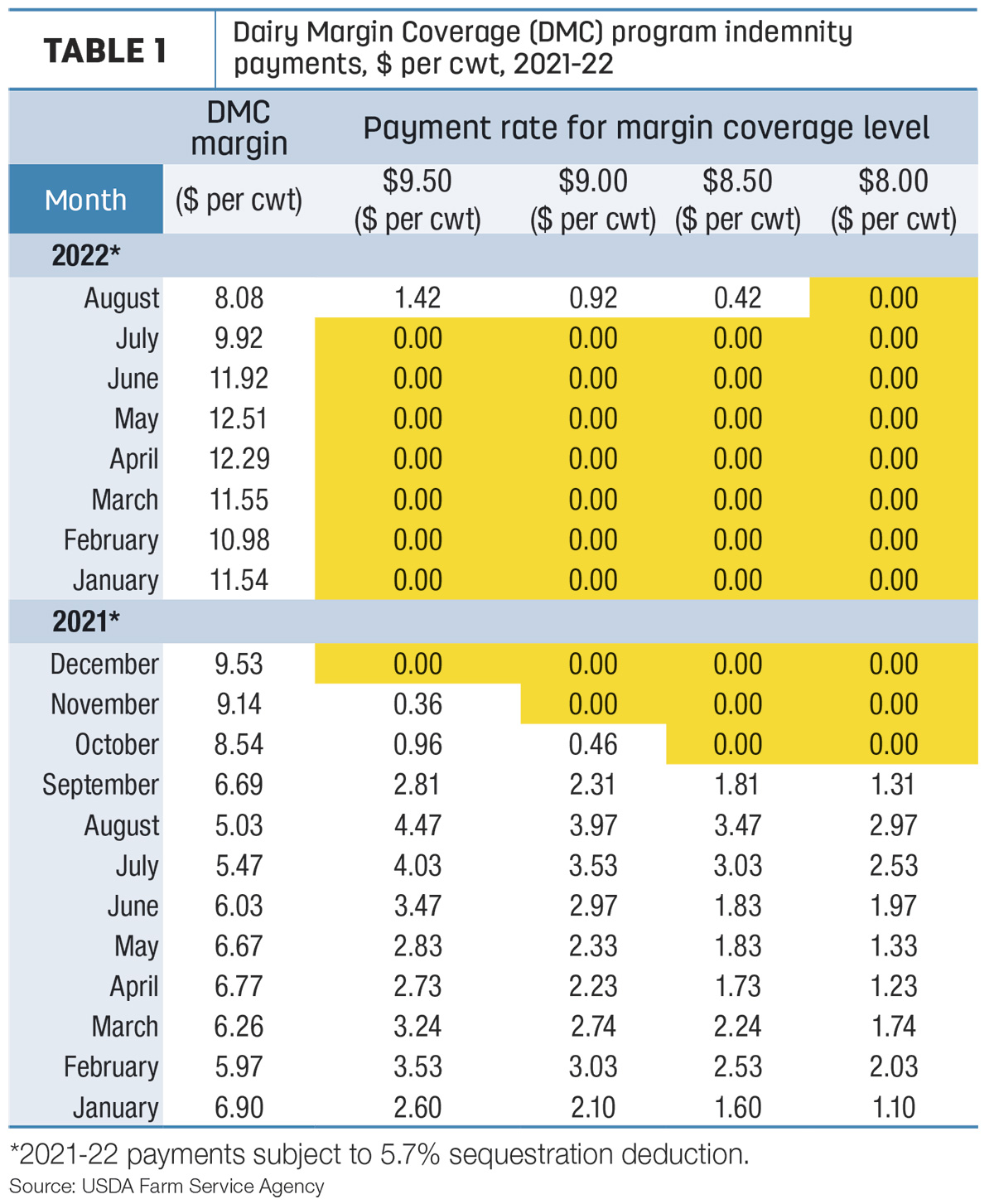

The USDA released its latest Ag Prices report on Sept. 30, including factors used to calculate August DMC margins and potential indemnity payments. The August DMC margin is $8.08 per hundredweight (cwt), down $1.84 from July and the first month the margin has fallen below the top Tier I insurable level of $9.50 per cwt (Table 1) in 2022, triggering indemnity payments at $9.50, $9 and $8.50 coverage levels.

Producers insured at the top Tier 1 level of $9.50 will see a payment of $1.42 per cwt on eligible milk. According to Erick Metzger with National All-Jersey, that equates to about $1,125. 2022 DMC indemnity payments are subject to a 5.7% sequestration deduction. Those insured at $9 and $8.50 levels will see payments of 92 cents and 42 cents, respectively, less the sequestration deduction.

Milk prices dip

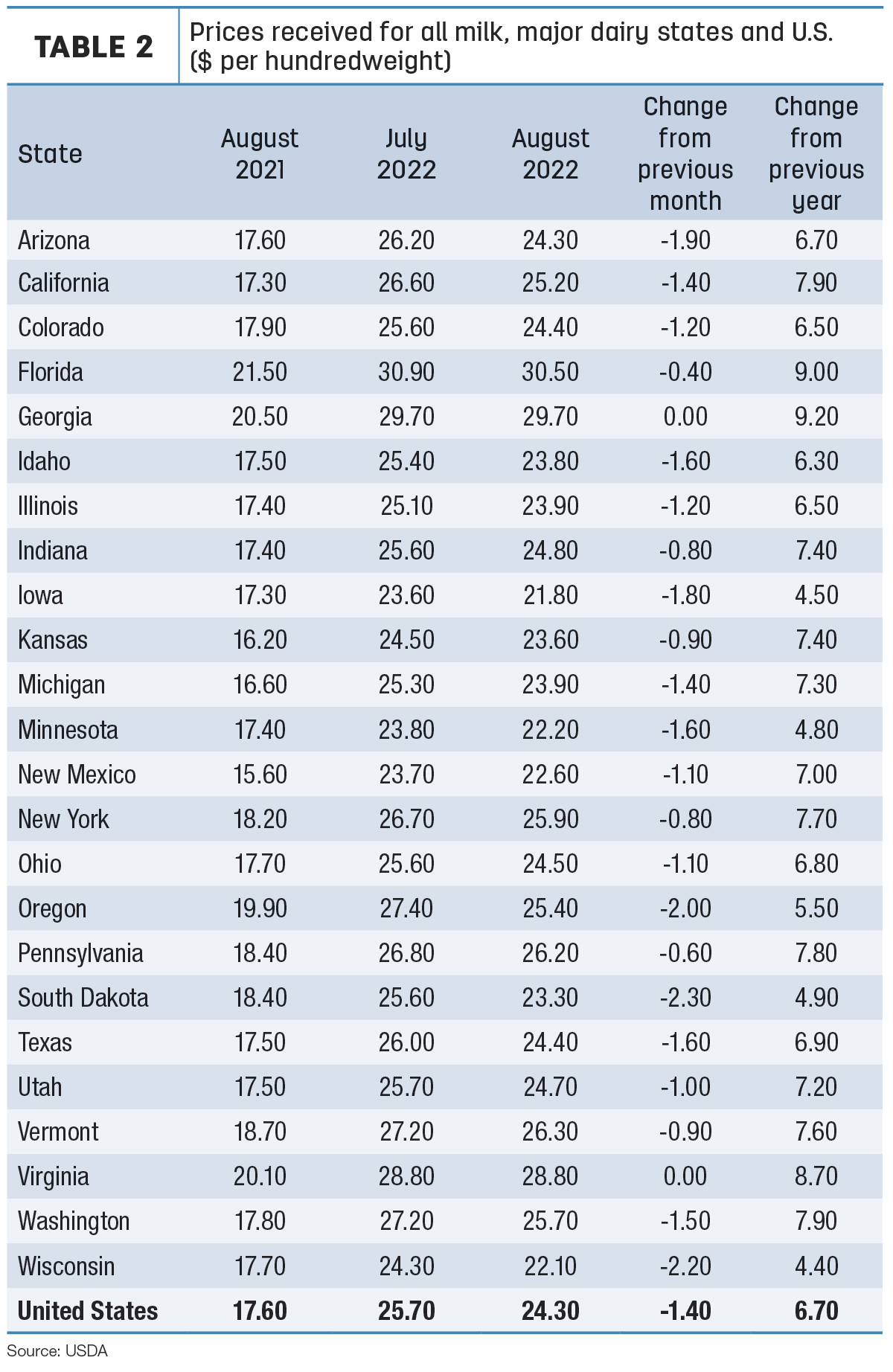

The August 2022 announced U.S. average milk price fell $1.40 from July to $24.30 per cwt, the lowest since January. With the decline, the average was still $6.70 higher than August 2021, leaving the year-to-date average at $25.76 per cwt, the highest January-July average on record.

August milk prices were lower than the month before in 22 of 24 major dairy states (Table 2), with prices unchanged in Georgia and Virginia. Largest month-to-month declines were in South Dakota (-$2.30), Wisconsin (-$2.20) and Oregon (-$2).

Compared to a year earlier, August 2022’s U.S. average milk price was up $7 per cwt or more in 17 states, led by Florida and Georgia.

Hay, SBM prices jump

In addition to the lower average milk prices, the shrinking DMC margin also was affected by higher overall average feed costs (Table 3):

- The average price for corn was just a penny lower than July at $7.24 per bushel, the fourth-highest on record since the inception of the DMC program or its predecessor, the Margin Protection Program for Dairy (MPP-Dairy).

- With the DMC change to include the price of dairy-quality alfalfa hay in feed cost calculations, the August average price for hay was $343 per ton, up $10 from July and setting a new record high in program history.

- The average cost of soybean meal (SBM) rose to $510.90 per ton, up more than $43 from July and the highest since September 2014.

August feedstuff prices yielded an average DMC total feed cost of $16.22 per cwt of milk sold, another all-time record high during the DMC or MPP-Dairy era dating back to March 2014.

Looking ahead, the USDA’s DMC decision tool has not been updated since late August, although current milk and feed futures prices suggest additional indemnity payments could be triggered in upcoming months.

Other payment, program news

The deadline to pay 2022 DMC and Supplemental DMC premiums was Sept. 1. With no indemnity payments on milk marketed prior to August, many producers had not paid premiums by that date. (Read: Weekly Digest: 2022 DMC premiums due Sept. 1.)

In an update notice to state and county Farm Service Agency (FSA) offices in late September, W. Scott Marlow, deputy administrator of farm programs with the USDA’s FSA, instructed offices to establish “receivables accounts” for those producers with remaining outstanding premium payments, beginning Oct. 4. The accounts automatically deduct premium payments from indemnity payments until all 2022 premiums are paid.

Failure to pay the DMC premium prevents affected producers from receiving indemnity payments and may affect a dairy operation’s ability to participate in the DMC program in future years. The USDA has not yet announced enrollment deadlines for the 2023 DMC and Supplemental DMC programs.

Operating costs mixed

Outside of feed – and not factored into DMC margins – other costs were mixed. The August index of prices paid for commodities and services, interest, taxes and farm wages was up 0.1% from July 2022 and up 12% from August 2021. Machinery costs rose 0.8% from July and were up 19% from August 2021. The August fuel cost index was down more than 8.8% from July but 37% more than July 2021. Higher prices in August for hay and forages, complete feeds and concentrates more than offset lower prices for fertilizer and fuels.

Cull cow prices lower

One additional factor affecting producer income: Prices for market cows dipped slightly in August, the first month-to-month decline since last December. U.S. prices received for cull cows (beef and dairy, combined) averaged $90.10 per cwt, down 50 cents from July but was still the third-highest monthly average since September 2015.