September’s U.S. average milk price rose a dime while average feed costs fell slightly, providing a small boost to monthly dairy producer milk income margins calculated under the Dairy Margin Coverage (DMC) program.

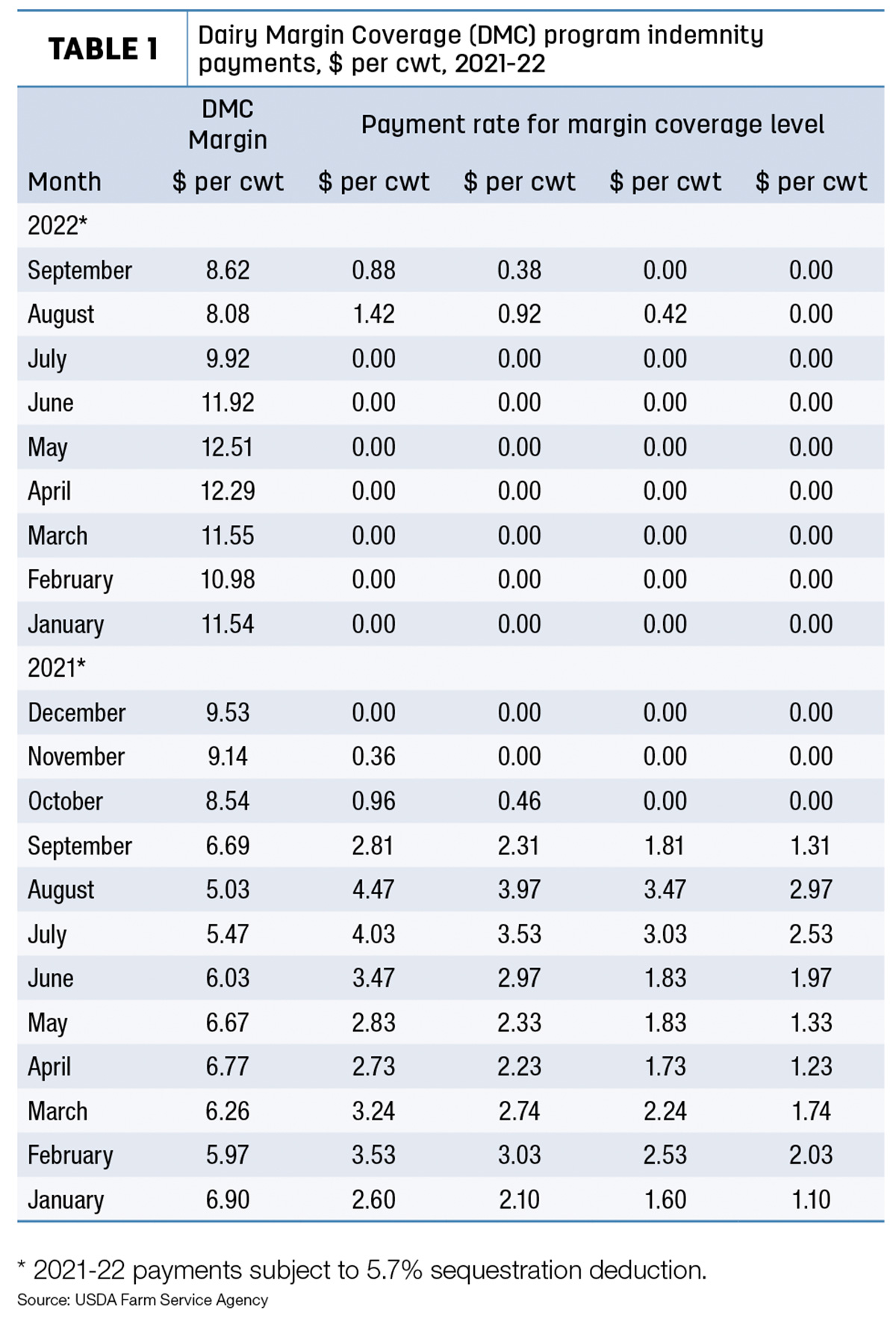

The USDA released its latest Ag Prices report on Oct. 31, including factors used to calculate September DMC margins and potential indemnity payments. The DMC margin for the month is $8.62 per hundredweight (cwt), up 54 cents from August, triggering indemnity payments for Tier I producers covered at the $9 and $9.50 per cwt levels (Table 1).

Producers insured at the top Tier 1 level of $9.50 will see a payment of 88 cents per cwt on eligible milk, while those insured at $9 will see payments of 38 cents. Both payments are subject to a 5.7% sequestration deduction.

Milk prices steady but mixed

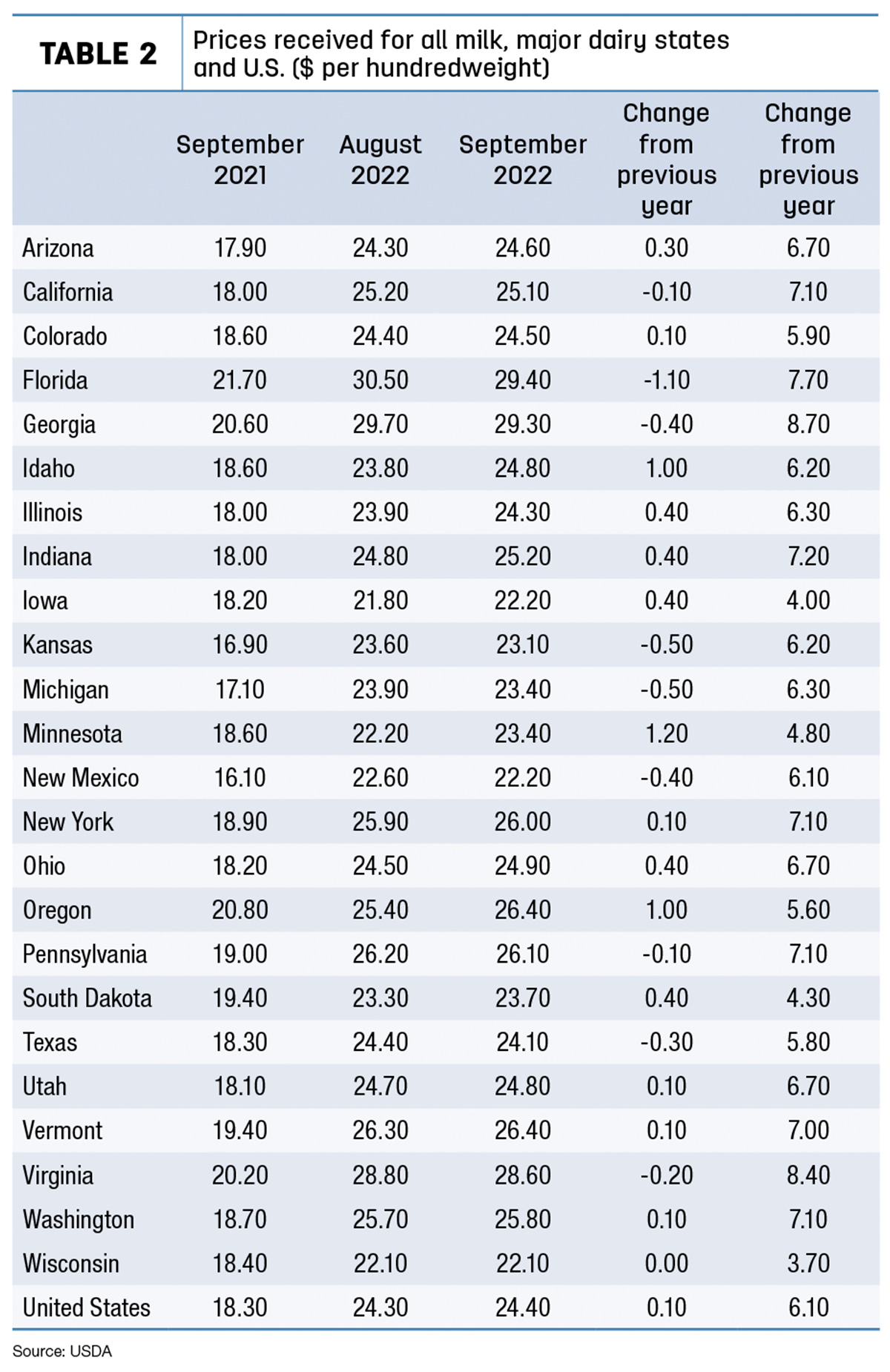

The September 2022 announced U.S. average milk price rose 10 cents from August to $24.40 per cwt. The milk price average was still $6.10 higher than September 2021, leaving the year-to-date average at $25.61 per cwt, the highest January-September average on record.

September milk prices were higher than the month before in 14 of 24 major dairy states (Table 2), lower in nine states and unchanged in Wisconsin. Largest month-to-month increases were in Minnesota ($1.20) and Idaho and Oregon (both $1). Largest declines were in Florida (-$1.10) and Kansas and Michigan (both -50 cents).

Compared to a year earlier, September 2022’s U.S. average milk price was up $7 per cwt or more in nine states, led by Georgia and Virginia.

Feed costs dip

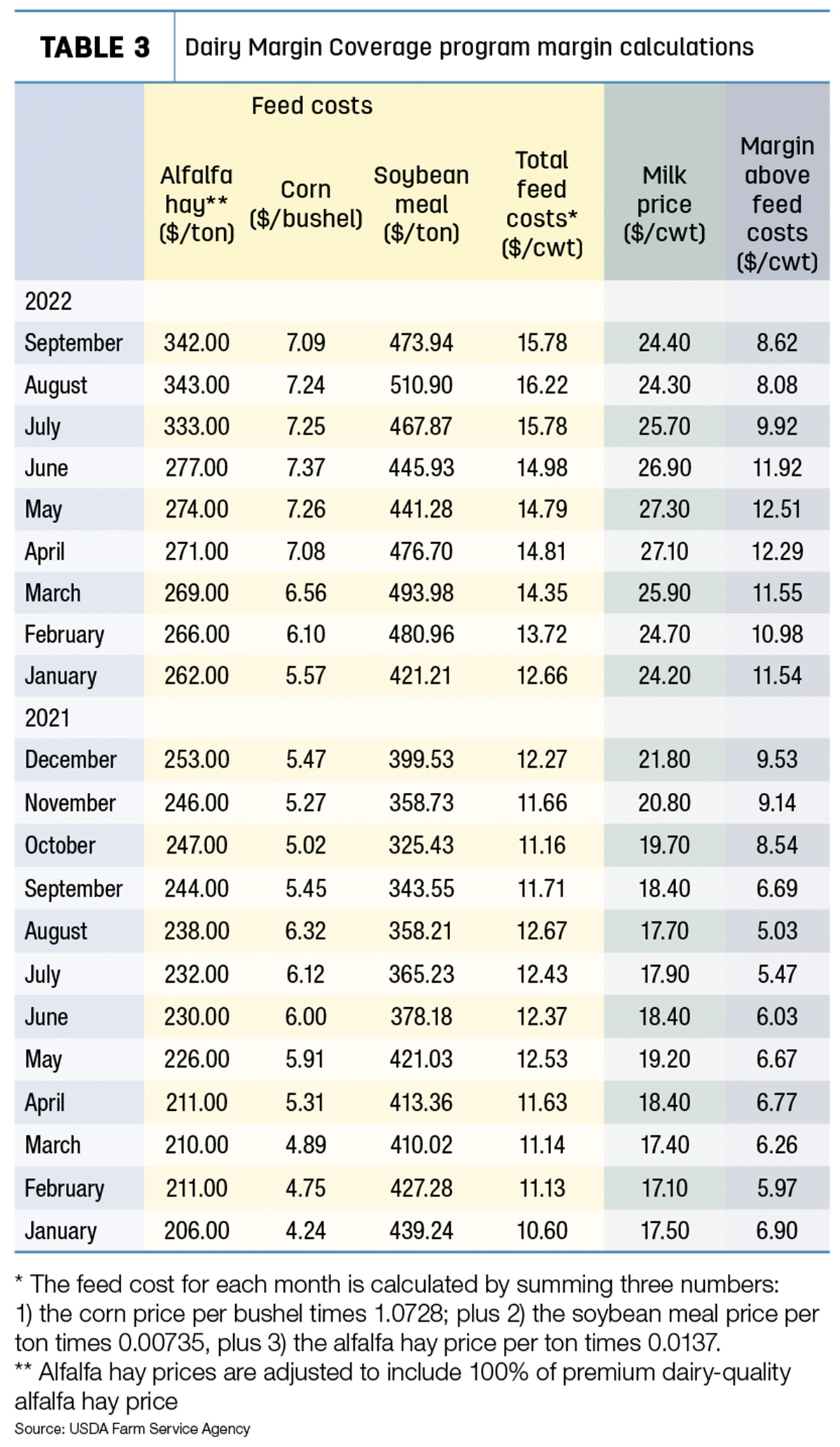

In addition to the higher average milk price, the DMC margin also was affected by lower overall average feed costs (Table 3):

- At $7.09 per bushel, the average price for corn was 15 cents lower than the August average and the lowest since April.

- The September average price for dairy-quality alfalfa hay was $342 per ton, down $1 from August and the first month-to-month decline since November 2021.

- The average cost of soybean meal (SBM) fell to $473.94 per ton, down nearly $37 from August.

September feedstuff prices yielded an average DMC total feed cost of $15.78 per cwt of milk sold.

August payments recapped

The August 2022 DMC margin of $8.08 per cwt triggered indemnity payments for those insured at $8.50, $9 and $9.50 per cwt coverage levels. According to latest USDA estimates, payments of $43.3 million were distributed to about 17,855 dairy operations.

Last updated on Oct. 25, the DMC decision tool projected the October margin at $9.52 per cwt. The actual margin will be announced Nov. 30.

The November margin was projected at $9.34 per cwt; and the December margin at $8.22 per cwt.

Looking ahead to 2023, the DMC decision tool projects margins to fall below $8 per cwt through the first seven months of the year and stay below $8.90 per cwt through the end of the year. That would yield a 2023 average margin of $8.12 per cwt.

Operating costs mixed

Outside of feed – and not factored into DMC margins – other costs were mixed. Lower prices for services, liquid propane gas and gasoline more than offset higher prices for complete feeds, supplements and concentrates.

The September index of prices paid for commodities and services, interest, taxes and farm wages was down 0.1% from August 2022 but 13% from September 2021. Machinery costs rose 0.2% from August and were up 15% from September 2021. The September fuel cost index was down 2.9% from August but 28% more than September 2021.

2023 enrollment deadline is Dec. 9

Dairy producers can enroll and make 2023 DMC coverage elections through Dec. 9 at USDA Farm Service Agency offices.

Producers will need to certify to commercially marketing milk, pay the $100 administrative fee and sign the DMC contract, selecting the annual milk volume and coverage level for the year.

Recent adjustments to DMC continue in effect in 2023. Small and midsized dairies can enroll in the Supplemental DMC and adjust annual milk production histories to 2019 levels, up to the 5-million-pound Tier I cap. Supplemental DMC coverage is applicable to calendar years 2021, 2022 and 2023.

Producers who did not enroll in Supplemental DMC last year should complete that enrollment before enrolling in the 2023 general DMC program. For producers who enrolled in Supplemental DMC in 2022, the supplemental coverage will automatically be added to the 2023 DMC contract.