In this column, Progressive Dairy summarizes issues in the news and attempts to describe how they might affect dairy farmers. Look for more extensive background, details and updates online. Items in this column are compiled from Progressive Dairy staff news sources. Send news items to Progressive Dairy Editor Dave Natzke.

Interest rates

What happened?

The Federal Reserve’s Open Market Committee (FMOC) adjusted its benchmark lending rate up another 75 basis points in early November, boosting the rate in a range of 3.75% to 4%, the highest in 15 years.

What’s ahead?

In a statement, Jerome Powell, chair of the Federal Reserve, suggested that it would begin to take a more deliberate approach to rate hikes, likely leading to smaller increases in borrowing costs when it meets again Dec. 14-15. Latest estimates indicate the inflation rate may be slowing. Critics are increasing their calls for the Fed to stop raising interest rates.

Bottom line

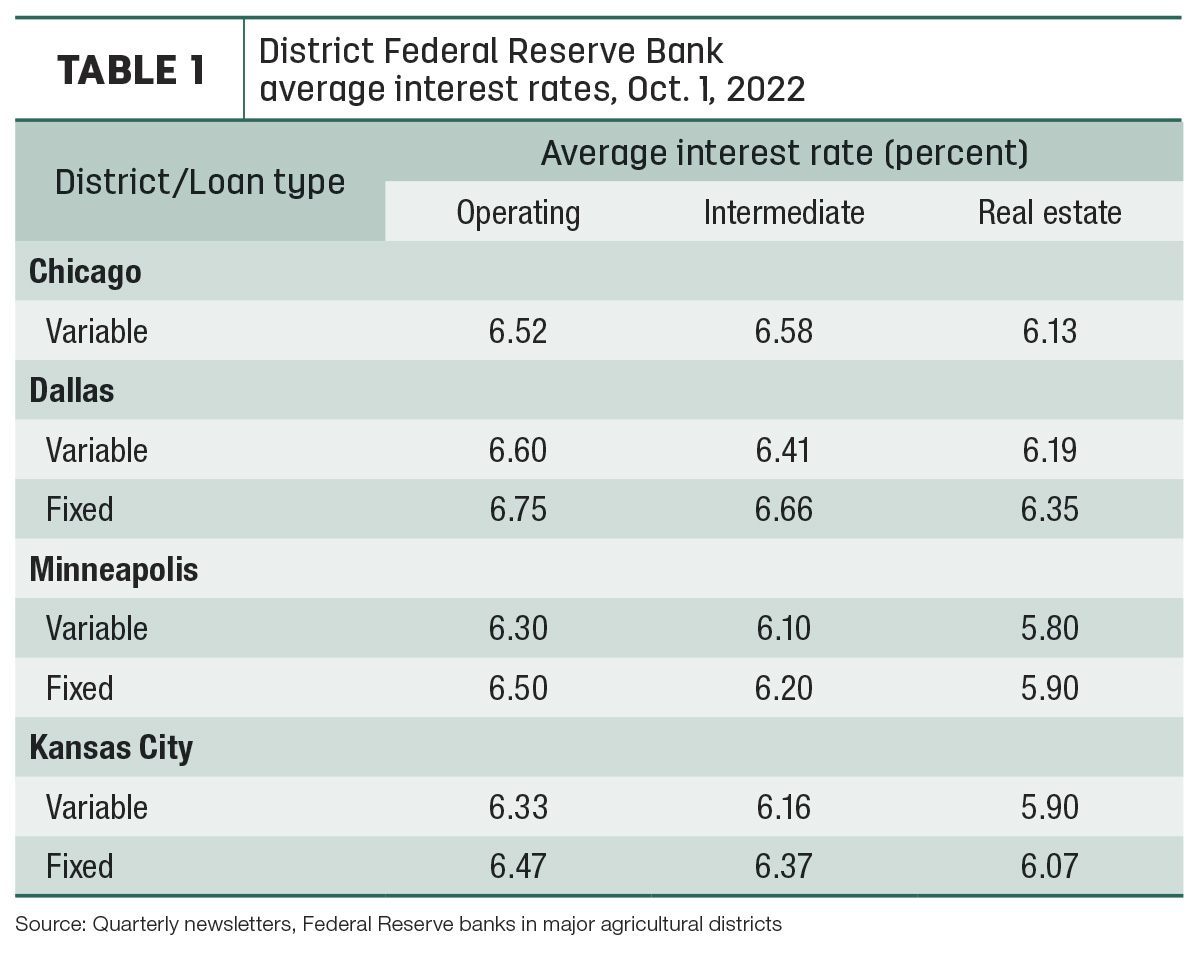

Even before the Fed’s latest interest rate hike, the sixth this year, agricultural lenders have also increased rates on variable- and fixed-rate loans, based on quarterly surveys in Federal Reserve districts with heavy agricultural lending portfolios (Table 1):

- Chicago: Interest rates on all variable-rate loans were up about 1% from the previous quarter and highest in more than a dozen years. As of Oct. 1, the district’s average nominal interest rates on new operating loans and feeder cattle loans were at their highest levels since the third quarter of 2008. In addition, its average nominal interest rate on farm real estate loans was last higher in the second quarter of 2009.

- Dallas: Interest rates on variable and fixed loans were up 0.75% to 0.9% from the previous quarter and the highest since the second half of 2019.

- Kansas City: Interest rates on all types of loans were about 75 and 65 basis points higher than the quarter, respectively. About two-thirds of survey respondents in the district indicated that higher interest rates had a negative effect on financial conditions for borrowers, with about one-third reporting a significant negative effect.

- Minneapolis: Interest rates for all loan categories continued to increase, with largest increases for operating loans. Respondents continued to report concerns about inflation and soaring input costs.

Writing in a recent AFBF Market Intel report, Roger Cryan, chief economist with the American Farm Bureau Federation (AFBF), warned that higher interest rates and continuing inflation negatively impact farmers on several fronts.

Cryan said interest expense has been about 5% of farm cash production expenses in recent years. Interest rates double and triple what they were just a few years ago also increases interest expense. If history is a guide, it could take years for long-term interest rates to come back down to where they were for the last decade. Higher interest expenses would have biggest impacts on any farmer already committed to new investments, beginning farmers or farmers forced to borrow for succession.

Higher interest rates also tend to lower property values, undermine the real value of USDA programs and strengthen the dollar against other currencies, negatively impacting U.S. agricultural export competitiveness.

2022 elections and the 2023 Farm Bill

What happened?

With one Senate seat still up for grabs at Progressive Dairy’s deadline, vote counts from the 2022 election indicated Democrats would maintain the slimmest of majorities in the Senate while Republicans would take a narrow majority in the House.

What’s ahead?

With each party controlling one legislative branch, the process of writing – if not the actual provisions of the 2023 Farm Bill – will likely be impacted. The same holds true for committees with oversight on appropriations, immigration and environmental issues.

Congressional committee positions are generally assigned early in the next congressional session. The 118th Congress is scheduled to start on Jan. 3, 2023. Watch Progressive Dairy early in 2023 for comprehensive coverage of committee assignments.

Bottom line

In the Senate, a runoff election in Georgia, scheduled for Dec. 6, pits Sen. Raphael Warnock, a Democrat and current Senate Ag Committee member, against Republican Herschel Walker.

Regardless of the outcome, with Vice President Kamala Harris serving as the president of the Senate, Democrats will hold leadership of Senate committees with oversight on agricultural issues. Sen. Debbie Stabenow (D-Michigan) will likely again serve as chair of the Senate Ag Committee, and Sen. John Boozman (R-Arkansas) will remain as ranking member.

In the House, the change of leadership means Republicans will take over as chairs of committees. On the House Ag Committee, U.S. Rep. Glenn “GT” Thompson (R-Pennsylvania) and Rep. David Scott (D-Georgia) will likely flip roles, becoming chair and ranking member, respectively. Republicans would gain some committee seats and be in the driver’s seat for the farm bill process to play out next year in the House.

Paul Bleiberg, National Milk Producers Federation (NMPF) senior vice president for government relations; and Alan Bjerga, NMPF senior vice president of communications, discussed the election results, the balance of power, committee leadership and the impact on dairy policy priorities in a “Dairy Defined Podcast.” Regardless of the balance of power, Bleiberg said NMPF’s basic policy priorities would remain the same but require different strategies when working with congressional leaders.

Other topics

Other topics followed by Progressive Dairy:

FMMO data for October. Administrators of the 11 Federal Milk Marketing Orders (FMMOs) reported October 2022 prices and pooling data. Uniform or blend prices were mixed, producer price differentials (PPDs) were positive but lower, the Class I mover formula affected Class I prices, and the spread between Class III-IV milk prices continued to affect pooling.

Largest declines in October uniform prices were in Appalachian 5, Florida 6 and Southeast 7 FMMOs; largest increases were in Upper Midwest 30 and 51 California.

The spread in the monthly advanced Class III skim milk pricing factor ($7.04 per cwt) and advanced Class IV skim milk pricing factor ($12.67 per cwt) was $5.63 per cwt, the widest since July 2020. Based on Progressive Dairy calculations, the Class I mover calculated under the “higher of” formula would have resulted in a Class I base price of $24.71 per cwt, $2 more than the actual price determined using the “average of plus 74 cents” formula.

Supporting the stronger October Class III and IV milk prices, the value of both butterfat and protein rose from the month before.

Class IV pooling across all FMMOs increased slightly from September, but still represented under 7% of the total milk pooled. It was the eighth month so far in 2022 that Class IV pooling was below 10% of total milk pooled.

Looking ahead, November uniform prices and pooling totals will be announced around Dec. 11-14. The Class I price is up. The spread in the monthly advanced Class III skim milk pricing factor ($9.17 per cwt) and advanced Class IV skim milk pricing factor ($12.61 per cwt) is $3.44 per cwt, the narrowest since July 2022. The Class I mover calculated under the “higher of” formula would have resulted in a Class I base price 95 cents higher than the actual price determined using the “average of plus 74 cents” formula.

Current Class III-IV milk futures indicate those prices will be lower in November. The November spread in Class III-IV milk prices will tighten another $1, to about $2.16 per cwt. Heading into December and beyond, that spread and depooling incentives will all but disappear.

Dairy Margin Coverage (DMC) program. Pending a USDA extension, the enrollment and coverage election period for the 2023 DMC program will be closed (Dec. 9) by the time you get Progressive Dairy in your mailbox. We’ll also know whether there were any indemnity payments on October milk marketings. DMC program indemnity payments on August and September 2022 milk marketings were estimated at about $84.6 million.