The Federal Reserve’s Open Market Committee (FMOC) adjusted its benchmark lending rate up another 75 basis points in early November, boosting the rate in a range of 3.75% to 4%, the highest in 15 years. The sixth rate hike this year, agricultural lenders have increased rates alongside the historically sharp rise in the federal funds rate.

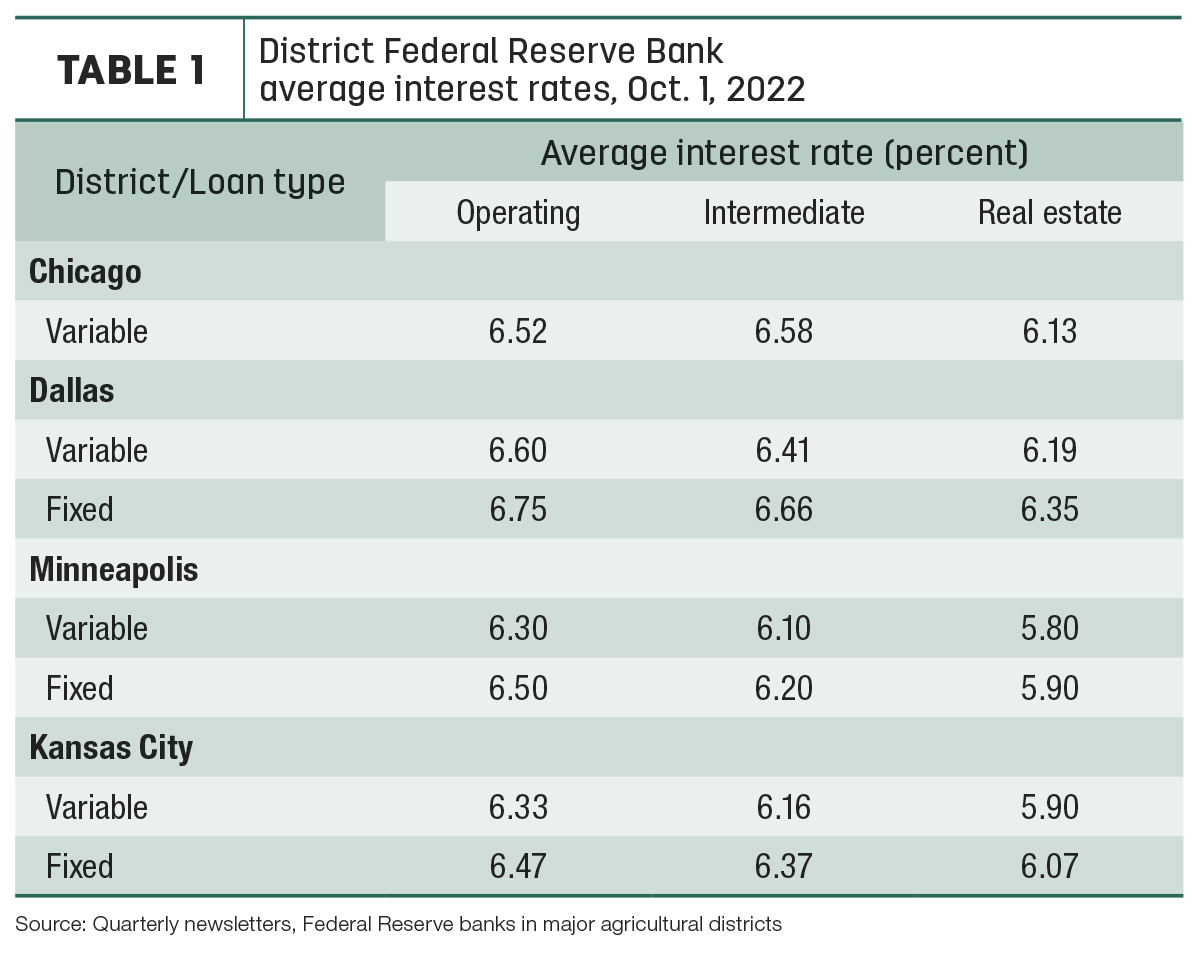

Based on quarterly lender surveys from Chicago, Dallas, Kansas City and Minneapolis Federal Reserve districts, interest rates on all agricultural loans rose in the third quarter of 2022 (Table 1).

Chicago

Interest rates on all variable-rate loans were up about 1% from the previous quarter and are the highest in more than a dozen years.

Agricultural interest rates – in both nominal and real terms – increased rapidly during the third quarter of 2022. As of Oct. 1, the district’s average nominal interest rates on new operating loans and feeder cattle loans were at their highest levels since the third quarter of 2008. In addition, its average nominal interest rate on farm real estate loans was last higher in the second quarter of 2009.

While net cash earnings (which include government payments) for crop, hog and beef producers were expected to be up during the fall and winter from their levels of a year earlier, the district’s dairy industry was expected to do less well, with 17% of responding bankers forecasting higher net cash earnings for dairy farmers over the next three to six months relative to a year earlier and 20% forecasting lower such earnings.

Dallas

Interest rates on variable and fixed loans were up 0.75% to 0.9% from the previous quarter and are the highest since the second half of 2019. Demand for agricultural loans decreased for the third consecutive quarter in third quarter 2022. Loan renewals or extensions fell for the seventh quarter in a row; loan volume decreased for all categories compared with a year ago.

Kansas City

Interest rates on farm loans increased sharply in the third quarter. Variable and fixed rates on all types of loans were about 75 and 65 basis points higher than the quarter, respectively.

About two-thirds of survey respondents in the district indicated that higher interest rates had a negative effect on financial conditions for borrowers, with about one-third reporting a significant negative effect.

At the same time, collateral requirements increased at a slightly faster pace than recent quarters, and renewal and extension activity moderated following more than a year of declines. The impact could be more pronounced for operations with higher debt needs.

While strong agricultural prices continued to support the farm economy, the rapid rise in production expenses could pressure profit margins and has shown initial signs of pushing demand for financing higher. Larger-sized operating loans continued to boost farm lending activity, according to Nate Kauffman and Ty Kreitman, economists with the Kansas City district.

Minneapolis

Interest rates for all loan categories continued to increase, with largest increases for operating loans. Collateral requirements on loans were unchanged according to a vast majority of lenders surveyed. Respondents continued to report concerns about inflation and soaring input costs.

What’s ahead?

In a statement, Jerome Powell, chair of the Federal Reserve, suggested that it would begin to take a more deliberate approach to rate hikes, likely leading to smaller increases in borrowing costs when it meets again, Dec. 14-15.

Critics are increasing their calls for the Fed to stop raising interest rates. Writing in a recent AFBF Market Intel report, Roger Cryan, chief economist with the American Farm Bureau Federation (AFBF), warned that higher interest rates and continuing inflation impact farmers on several fronts:

- Cryan said interest expense has been about 5% of farm cash production expenses in recent years. Interest rates double and triple what they were just a few years ago also increases interest expense. If history is a guide, it could take years for long-term interest rates to come back down to where they were for the last decade. High interest rates, caused by both high inflation and the Fed’s steps to address inflation, led to the farm debt crisis in the 1980s. Higher interest expenses now could cause similar pressures, especially for any farmer already committed to new investments, beginning farmers or farmers forced to borrow for succession.

- Higher interest rates tend to lower property values, including farmland values, which would make worse the debt trap of higher interest rates and lower farm returns.

- Rising interest rates will raise the cost of all debt, including government debt, which will ultimately cost the taxpayer and limit the government’s flexibility to provide assistance in a debt crisis.

- Inflation is slashing the purchasing power of American consumers and weakening the economy, which both undercut demand for farm products and lowers prices.

- Inflation undermines the real value of USDA programs, including the value of reference prices and budgets for most commodity programs.

- The aggressive interest rate increases by the Fed are making the dollar attractive to foreign investors and strengthening the dollar, which undermines U.S. agricultural export competitiveness.

- A Fed-driven recession in the U.S. is bad for the global economy, which will also undermine U.S. agricultural exports.