It’s been quite a while since dairy operators have had to budget for interest rate expenses. But the Federal Reserve raised interest rates six times in 2022, and policymakers expect more to come in 2023 in an effort to slow inflation by increasing the cost of borrowing. That means as your cost of production increases due to inflation, the rising interest rate environment in response to that inflation adds to the pressure on your margins. While rates are sharply higher, how it impacts your operation’s cost of production may differ greatly depending on several factors.

Your debt mix

The first factor is the amount of debt you have. Interest cost is like milk revenue; it is a function of both volume and price. In mid-November, the prime rate was 7%; a year ago it was 3.25%. For every $1 million of debt, the move from 3.25% to 7% results in your interest cost going from $32,500 per year to $70,000 – more than double. In today’s capital-intensive agriculture industry, the impact of that rising cost adds up quickly. With current markets, it may make sense to take a walk through the machinery shed. If it has rust or dust, it should go. The conversion of unused assets to pay down debt can help reduce your exposure to higher rates and improve margins.

Managing the risk

Calculating the impact is further impacted by how you deployed interest cost risk management strategies in the past. That is, what is your mix of fixed and variable rates? While both current long-term rates and variable rates have increased in the past year, when and how you used fixed rates in the past could significantly impact your interest rate costs.

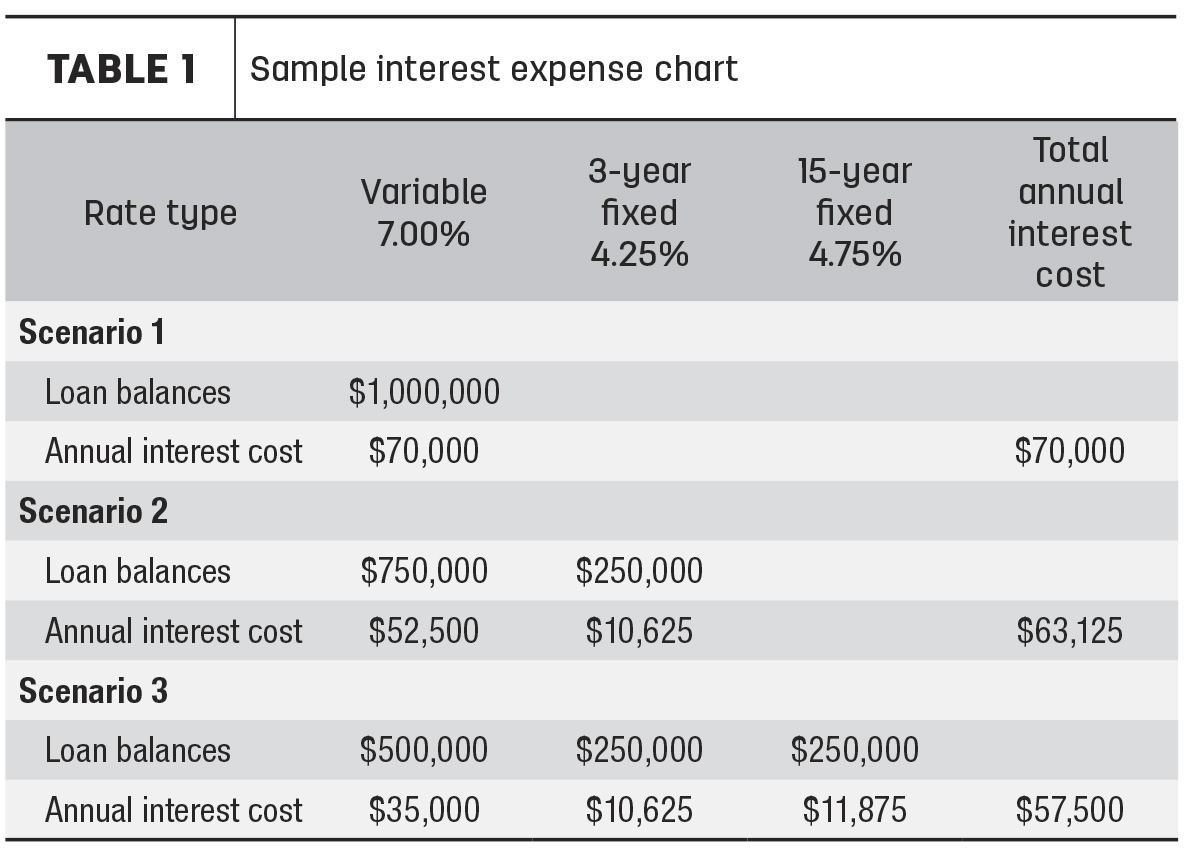

Table 1 illustrates the impact of various strategies and their impacts on total interest rate costs, noting that for the $1 million borrowed, the difference from the highest cost to the lowest is $13,750.

Using the example above on the impact of rising variable rates on interest costs, the placing of the debt in various rate buckets cut the operation's exposure to the $40,000 rate increase in half. It should be noted that this strategy in a falling interest rate market also makes sense, as it allows the operation to take advantage of declining variable rates while still managing the upside risk.

An additional advantage to this strategy is that not all interest rates mature at the same time. With the interest rate market’s ability to both rise and fall, having all of your debt maturing at the same time could put you at risk for repricing all your debt at a high. How you manage interest risk is much like managing all of your pricing risks – the more you leave variable, the larger the impact could be on your working capital needs in a tight margin year. That is, if margins are at or below breakeven, you’ll need your working capital to fund the $37,500 increase in costs if you remained 100% variable rate. Like all portions of your risk management plans, being proactive typically wins.

Another area to consider going forward is the impact of the higher interest costs on future capital spending plans. Smart use of leverage to improve your operation’s efficiency and profitability are still wise choices, but the return now needs to be higher to offset the higher cost of funds. This is especially important to consider on longer-term investments such as buildings.

Fortunately, we have come into this rising interest rate environment from a good place. That is, most farms have a strong working capital position, including strong balance sheets with higher cash and prepaid balances going into 2023. Staying vigilant and proactive with all of your risk management plans will maintain that strong position and put you in a position to absorb the tighter margins we all know are coming.