With improving milk prices and margins and tightening cow numbers, average prices for U.S. replacement dairy cows moved to an eight-year high in October, according to latest USDA quarterly estimates. Meanwhile, average cull cow prices stayed strong as slaughter rates slowed.

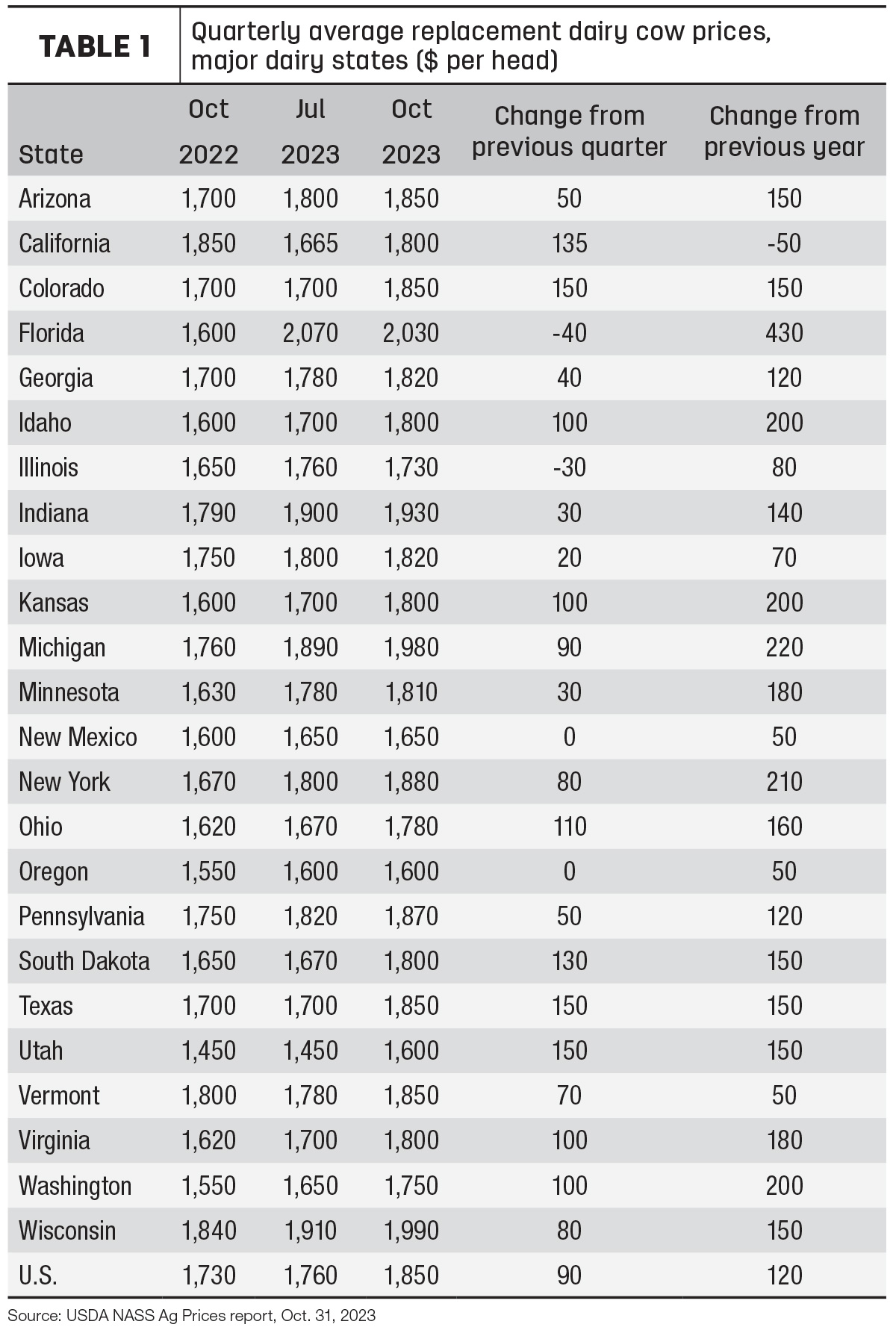

U.S. replacement dairy cow prices averaged $1,850 per head in October 2023, up $90 (5%) from July 2023 and up $120 (7%) from October 2022. While the highest since October 2015, quarterly average prices were still about 13% below the last peak of $2,120 per head in October 2014.

The USDA estimates are based on quarterly surveys (January, April, July and October) of dairy farmers in 24 major dairy states, as well as an annual survey (February) in all states. The prices reflect those paid or received for cows that have had at least one calf and are sold for replacement purposes, not as cull cows. The report does not summarize auction market prices.

Quarterly average prices for replacement cow prices were up in 20 of 24 major dairy states (Table 1). Largest increases were in Colorado, Texas and Utah, all up $150. Average prices were unchanged in New Mexico and Oregon, and lower in Florida and Illinois.

Compared to a year earlier, October 2023 replacement cow prices were up $430 per head in Florida and $200 or more in Idaho, Kansas, Michigan, New York and Washington. California was the only state to post a small decline, down $50 from October 2022.

Progressive Dairy’s Cattle Market Watch tracks dairy heifer prices from about 20 auction markets throughout the U.S., with price summaries updated about every two weeks. The listings cover top and medium springers, shortbred and open heifers, and heifer calves.

Based on preliminary September 2023 cow estimates in the USDA's Milk Production report, the U.S. dairy herd is now the smallest dating back 20 months to January 2022. September 2023 U.S. cow numbers were estimated at 9.37 million head, down 36,000 from a year earlier. Among the 24 major dairy states, September 2023 cow numbers were estimated at 8.911 million, down 16,000 from September 2022 and down 2,000 from the revised estimate for August 2023.

Read: September milk production lower as cow numbers decline

Market cow prices stay strong

With a month lag in reporting data, the USDA’s Ag Prices report indicated U.S. average prices received for cull cows (beef and dairy, combined) in September averaged $114 per cwt, down $1 from August but still near the highest average since mid-2015.

Latest USDA data, released Oct. 19, showed the number of dairy cull cows marketed through U.S. slaughter plants in September 2023 was 240,500 head, down 35,000 from August and 20,000 fewer than September 2022. While dairy cow culling slowed in September to a 15-month low, January-September culling numbers are still the highest nine-month total dating back to the whole-herd buyout year of 1986.

Read also: September DMC margin hits $8.44 per cwt