We ship certified grass-fed organic milk under the Organic Valley Grassmilk label. Basically, it’s the smallest commodity niche where a milk truck still shows up to take 100% of your production. We’re grass-only, which means freshly grazed or offered as baleage. No grain or corn silage – that’s a rule. We are also spring seasonal calving, with some cows receiving a four-month dry period. That’s more of a choice.

As far as costs go, even without grain, it costs close to $6 per day to feed a cow in the non-grazing season and over $3 per day to carry a heifer. If I produce 40 pounds per cow at $30 per cwt, and you produce 80 pounds per cow at $15 per cwt, wouldn’t we be working with a very similar budget even though the pay prices are completely different? This is a fact that is hard to see when milk prices are compared. Higher prices or lower costs are only good if current production is maintained or increased.

Since you have to plan around milk price fluctuation, and I have to plan around seasonal production, let me show you what I do to smooth out the months with smaller and even nonexistent milk checks.

During peak milk months of the grazing season, I’ll set aside about 5% of the net milk check and I’ll put it in the stock market with a target of using that money again in six months. That will be cash income when the cows are dry. If you don’t have any stock market experience, common perception is that the stock market is rigged. In my experience, that is completely true. But, so are commodity markets, bank loans and car sales. Anything that has to do with money is rigged. Once you accept that, it becomes easier to plan for.

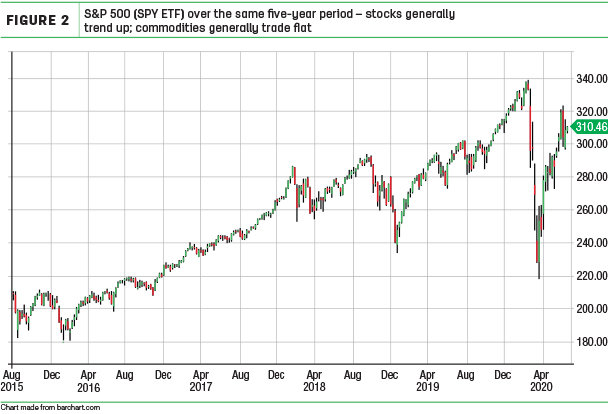

Commodities like milk, live cattle and grain are basic necessities of the world and are designed by their markets to be cheap and readily available. Class III milk has traded in a range of $12-$24 over the last 10 years. We may break that range for a few months at a time, but milk likes to trade mainly from $13-$17 per cwt, and you can go back 20 years to see that play out. Commodity futures markets even have a mechanism called “limit up” and “limit down” that caps how much the price can move up or down in a given day. This is supposed to eliminate trading volatility in any one trading day, but it essentially pushes the price constantly sideways.

Stocks do not have a limit up rule, only a limit down rule. If the S&P 500 moves up 5% in a day, that’s a good day! If it drops 7%,13% or 20% in a given day, they halt trading. Commodities tend to be flat, and stocks generally move up; that’s why I choose stocks as a vehicle to grow cash.

When you think of stocks, you think of buying a share of X company for Y price and you hold that share. If you buy shares at $100, $1,000 only gets you 10 shares. If the price moves $10 per share, you gain $100 on your $1,000 investment, which is nice, but this method requires a ton of cash to generate any real dollars in a few short months.

I use the options market instead. Options offer what’s called asymmetrical risk, which is a fancy way of saying your reward is far greater than the amount you risk. I don’t want $1,000 to turn into $1,100; I’m looking for $1,000 to turn into $5,000 or more. Options are the right to own or sell a set number of shares at a predetermined price within a set time frame. Option prices are derived from the stock’s share price and most stocks on the S&P 500 allow the buying and selling of option contracts. What I look to do is own the rights to a stock without ever owning the stock itself. If I buy those rights today for $300 on a stock that I expect to go up, I might be looking at selling those rights to the stock for $1,200 or $1,500 within the next 6 months, but sometimes it’s only a few days. The rights to the stock increase as the share price changes.

So how do you find an option?

Here are a few rules of thumb I use. You want well-known, popular companies. Think of the names on your debit or credit card, your cell phone, that box with a smile that comes to your door a few times a week, the truck that delivers those boxes, the stuff that you, I and thousands of other people use every day. You want share prices that are near or above $100. Higher share prices will help option contracts move more. If a stock price can move $10 in a day, the option contract can move $1-$2. Options trade in 100 share blocks, so that will net you $100-$200 per contract. A $20 stock will not move its option contract as much as a $100 stock would.

If you have a company in mind, and its share price is over $100, you can use a site like barchart and check that price over time. You want the current share price to be above the 10-month average on a monthly time frame. This means the stock price is increasing over time, and you are buying the price trend of the company instead of the company itself. This will give you a real good start in selecting proper options that can grow over the next few months.

Some advantages to this system that you may not realize is this becomes a natural economic hedge. If you produce milk, you are a commodity; you already own it, and it’s in your best interest to see the price of milk rise. Using a portion of your income to place into stocks is using a different asset class to diversify your total portfolio. Short-term pullbacks in the stock market are usually offset by short-term rises in commodities. Long-term rises in stocks are usually complemented with steady, to flat commodity prices. If both fall at the same time, the fall is overexaggerated and extremely short lived. The other advantage with using the option market as a hedge is you can completely control it. You can open any online brokerage account for a few hundred dollars, and if you enter a trade and you change your mind, you can exit on the spot. If your trade goes really well and you want to cash out, you can take that action immediately. Some of the government and insurance programs that are available to protect low milk prices don’t offer that same luxury. You have to decide several months in advance and then even, with a qualifying payout, you have to wait several weeks to months for your actual check.

Please start small; there is no reason to start with more than $1,000 while you learn. You can only lose what you put in, but there is no limit on the upside with options. During a recent run from March 2020 to May 2020, when stocks were falling sharply, $50 put into Boeing (BA) yielded $7,000 over two weeks, a $50 call in the volatility index (VXX) went over $4,000 in three months, and a one day $850 put into Shopify (SHOP) went to $7,500. Those results are completely possible with a little practice and only setting money aside when milk checks are good. I trade options daily for cash income but use longer-term positions to create cash reserves for those times of the year when the milk checks are small.

If you would like help getting started, I review commodity futures and the stocks I am using for option contracts through weekly email. ![]()

Editor's note: The risk of loss in market trading can be substantial. Investors should carefully consider the inherent risks in light of their financial condition. The information contained herein is strictly the opinion of the author and not necessarily of Progressive Dairy. Past performance is not indicative of future results.

-

Jim VanDerlinde

- Organic Dairy Producer

- Options Trader

- Email Jim VanDerlinde