May 2017 U.S. dairy product exports hit a two-year high, but U.S. agriculture turned in a rare trade deficit during the month. And, a new trade agreement between the European Union (EU) and Japan threatens U.S. dairy sales to one of its major buyers.

First, the good news. Robust sales to Mexico, including record shipments of cheese, drove May 2017’s U.S. dairy export value to $508.9 million, up 34 percent from a year ago. On a volume basis, exporters shipped 15 percent more milk powder, cheese, butterfat, whey and lactose compared to May 2016, according to Alan Levitt, vice president of communications and market analysis at the U.S. Dairy Export Council (USDEC).

May 2017 dairy product exports to Mexico were valued at $152 million, 71 percent greater than last year. Cheese exports were 13,565 tons, the most ever, were up up 75 percent, and nonfat dry milk/skim milk powder (NDM/SMP) volume was 29,772 tons, the second-most ever, up 62 percent.

Total U.S. cheese exports in May reached 35,409 tons, up 48 percent from last May and the most since March 2014. Besides Mexico, shipments were above year-ago levels to South Korea, Japan and Central America.

Exporters shipped 58,598 tons of NDM/SMP in May, up 31 percent year-over-year. In addition to increased sales to Mexico, exporters boosted NDM/SMP exports to China, Peru and Japan, but shipments to Southeast Asia were below year-ago levels for the fourth straight month.

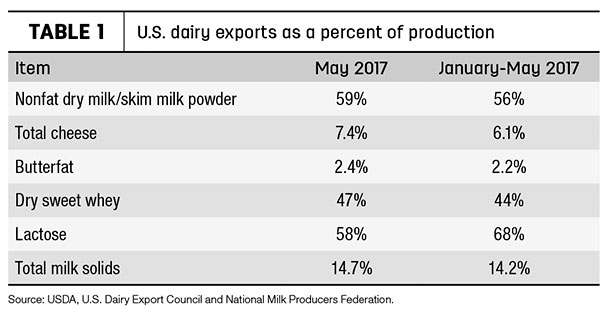

On a total milk solids basis, U.S. exports were equivalent to 14.7 percent of U.S. milk production in May (Table 1). Imports were equivalent to 3.1 percent of production.

Dairy replacement sales slump

Exports of dairy replacement heifers fell off sharply in May, to 943 head, the smallest monthly total since October 2016. The heifers were valued at $1.7 million.

Mexico was the leading market for the month, taking 635 head.

Despite the lower monthly total, year-to-date 2017 dairy replacement heifer exports stand at 12,978 head and have already surpassed the total of 12,216 for all of 2016.

Foreign sales of U.S. dairy embryos totaled 910 in May, the highest monthly total of the year. The embryos were valued at a total of $714,000. The United Kingdom, Italy and Japan were leading buyers.

Alfalfa hay exports remain strong

Alfalfa hay exports continued at a strong level. Aided by sales to China, May U.S. alfalfa hay exports topped 268,000 metric tons (MT) for a third consecutive month. China purchased about 117,000 MT, about 43 percent of the monthly total. The alfalfa hay exports were valued at about $76.8 million.

May 2017 sales of other hay totaled just over 116,818 MT, the lowest total since July 2016. Japan and South Korea remained top buyers. The other hay exports were valued at about $35.6 million.

U.S. ag trade deficit

Overall May 2017 U.S. ag exports were valued at $10.668 billion, the lowest total since last July. Monthly U.S. ag imports were valued at $10.685 billion. As a result, May’s U.S. ag trade deficit was $17 million, the first deficit since May 2016.

The deficit was due in part to timing of soybean marketing patterns, said the USDA’s Bryce Cooke. The primary export marketing season for U.S. soybeans has passed, and Argentina and Brazil are starting to sell their soybeans on the global market.

U.S. ag exports for the first eight months of this fiscal year are at $98.9 billion, $12 billion more than the same time in 2016, and still nearly $19 billion more than imports. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke