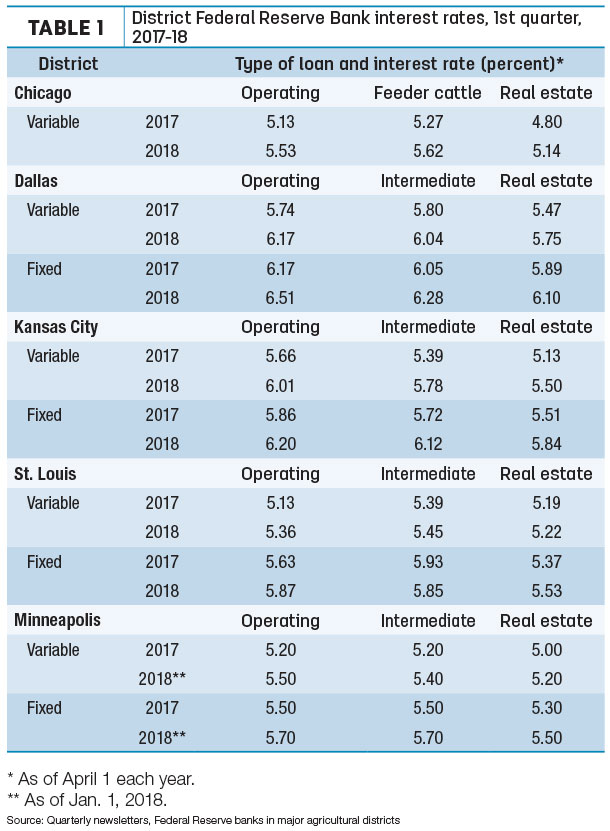

Interest rates on farm loans continued to increase in the first quarter of 2018, based on quarterly reports from Federal Reserve district banks in the U.S. heartland (Table 1). In most cases, average interest rates on all loan types were the highest since mid-2011 to early 2012.

In addition to the steady increase in average interest rates, the percentage of loans made at higher interest rate levels are also rising. For example, very few first-quarter 2018 loans in the Kansas City Federal Reserve district were made at an interest rate of less than 4 percent, according to Nathan Kauffman and Ty Kreitman, writing in the Ag Finance Databook. In 2015, more than 40 percent of farm loans used to finance non-real estate purchases were originated with an interest rate of less than 4 percent. At that time, only about 10 percent of these farm loans carried an interest rate of more than 6 percent. In the first quarter of 2018, only 21 percent of non-real estate loans, by volume, were originated with an interest rate less than 4 percent. About 22 percent of loans had an interest rate greater than 6 percent.

Download information on interest rates, credit conditions, and land and rental rates within individual Federal Reserve districts (Chicago, Dallas, Kansas City, Minneapolis and St. Louis). ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke