Editor’s note: Estimated monthly MPP-Dairy indemnity payments have been adjusted from the original article to account for federal budget sequestration deductions. Dairy farmers who enroll in the 2018 Margin Protection Program for Dairy (MPP-Dairy) and elect $7, $7.50 or $8 per hundredweight (cwt) margin coverage are guaranteed indemnity payments for February and March. And, based on the two-month indemnity payment estimates, producers who can stick to Tier I premium payments at the $8 margin level will cover full-year program costs in February-March alone.

March numbers released

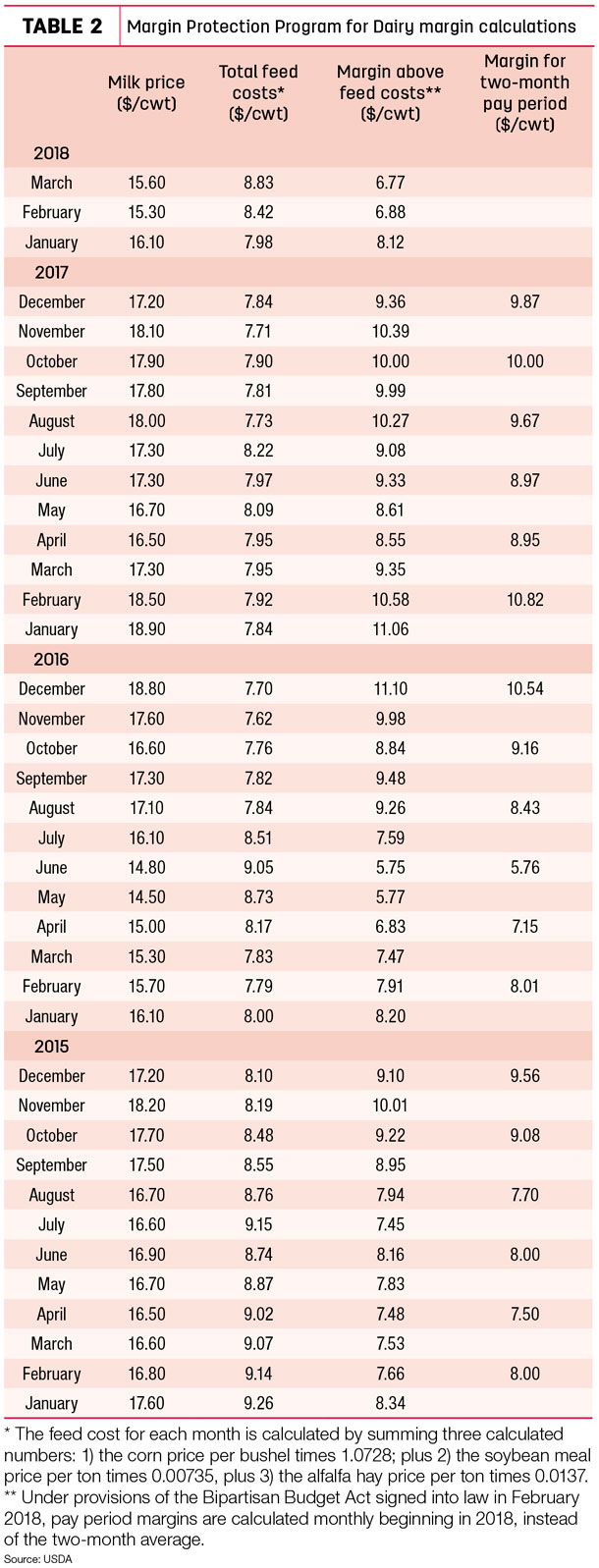

The USDA released March 2018 MPP-Dairy details on April 27. While milk prices rose slightly, feed costs rose more, dropping the national average margin to $6.77 per cwt, the lowest level since June 2016.

Dairy producers have until June 1 to enroll in MPP-Dairy for 2018, with margin coverage retroactive to January. MPP-Dairy changes in the Bipartisan Budget Act of 2018, signed into law in February, included calculating pay-period margins monthly and significantly reducing the buy-up Tier I premium rates.

March milk prices post minimal gain

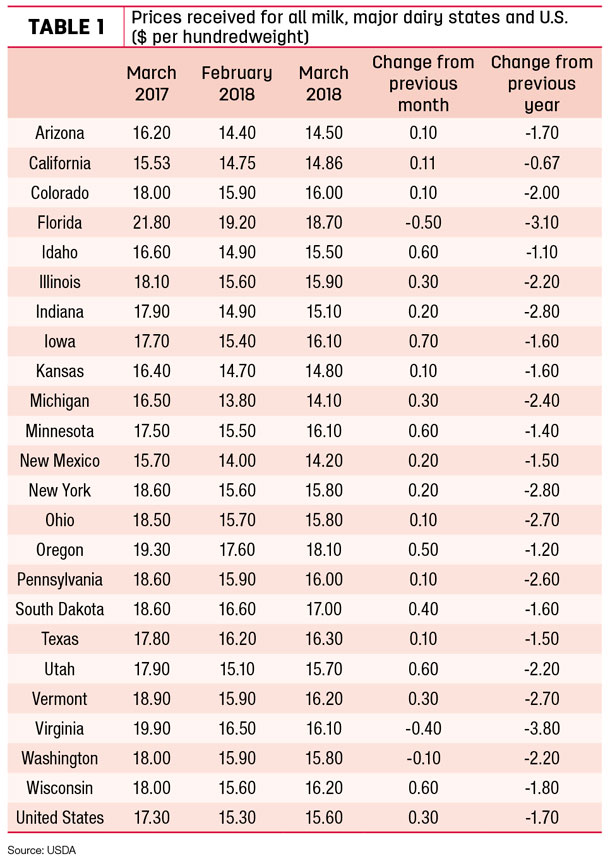

Milk prices halted their fall in March, according to the USDA’s monthly Ag Prices report. The March 2018 U.S. average milk price was $15.60 per cwt, up 30 cents from February 2018 but $1.70 less than March 2017. Through the first quarter of 2018, the average milk price stands at $15.67 per cwt, compared to $18.23 per cwt in the first quarter of 2017 and $15.70 per cwt in January-March 2016.

Among the 23 major dairy states (Table 1), March prices were mixed in a narrow range compared to a month earlier, with a 50-cent decline in Florida countered by 60- to 70-cent increases in Idaho, Iowa, Minnesota, Utah and Wisconsin. Michigan and New Mexico again had the low milk prices among major states, at $14.10 and $14.20 per cwt, respectively. Florida’s average of $18.70 per cwt remained the nation’s high.

Compared to a year earlier, March 2018 milk prices were down $2.40 or more in eight states.

Feed costs at 22-month high

National average prices for all feeds included in the MPP-Dairy ration continued to move higher in March. Soybean meal rose to $379.85 per ton, up more than $60 per ton since December 2017 and the highest since June 2016. Corn, at $3.51 per bushel, was up 13 cents from February and is the highest since July 2016. Alfalfa hay was up $11 from February, to $166 per ton, and the highest since July 2015. Together, total March feed costs of $8.83 per cwt of milk sold were up 41 cents from February and the highest since June 2016 (Table 2).

Based on milk and feed futures prices as of April 30, the Program on Dairy Markets and Policy projects monthly MPP-Dairy margins will start to improve slightly, but remain below $8 per cwt into June.

Bozic MPP-Dairy cash flow calculations

Marin Bozic, assistant professor in dairy foods marketing economics at the University of Minnesota, updates MPP-Dairy cash flow estimates for example dairy herds using the Margin Protection Program Decision Tool. This week, Bozic’s “Predicted MPP-Dairy Cash Flow for 2018” calculated MPP-Dairy premium costs and estimated monthly indemnity payments for a dairy operation producing 6.25 million pounds of milk annually and covering 80 percent (the maximum 5 million pounds under Tier I) at the $8 per cwt margin level.

For this sample herd, total premium costs for 2018 would be $7,100. (The premium would not be due until Sept. 1, 2018.)

Based on actual margins already announced and milk and feed price estimates as of May 1, Bozic’s projections indicate February-March indemnity payments for the example dairy farm would surpass total annual premium costs.

The example operation would receive MPP-Dairy indemnity payments of $4,345 for February and $4,793 for March. Going forward, estimated payments would be $6,087 for April, $3,340 for May, $1,735 for June and $469 for July.

(The estimates are slightly lower than previous forecasts, adjusted down 6.6 percent due to federal budget sequestration.)

Gross indemnity payments for February-June would be $20,768, or $13,668 more than the premium costs.

Bozic also issues his own forecast, predicting smaller monthly indemnity payments beginning in July through the end of 2018. In his forecast, 2018 indemnity payments would total $26,305, or $19,205 more than premium costs.

According to the forecast, February and March MPP-Dairy payments would be issued to eligible dairy farmers on about June 1, with subsequent checks issued three months after the affected month (July 1 for April milk, Aug. 1 for May milk, Sept. 1 for June milk, etc.).

Individual producers can calculate their own potential margins, premiums and indemnity payments using the Margin Protection Program Decision Tool.

Dairy operations likely to see diminished returns from MPP-Dairy are large herds producing more than 20 million pounds of milk per year. Under current MPP-Dairy rules, a dairy operation must cover a minimum of 25 percent of annual milk production. While able to buy up coverage at the $8 margin level for just 14.2 cents per cwt on the first 5 million pounds, those herds would be required to pay the Tier II premium of $1.36 per cwt on any milk above 5 million pounds, up to the 25 percent minimum.

For those holding out for even more evidence before signing up at their USDA Farm Service Agency office, April’s MPP-Dairy margin is scheduled to be announced on or about May 30, a day before the June 1 enrollment deadline.

Margins improve to end April

Dairy margins improved slightly over the last half of April as increased milk prices more than offset the impact of rising feed costs, according to Commodity & Ingredient Hedging LLC (CIH).

While margins are still only about average from a historical perspective, with the exception of spot Q2, they are projected positive into early 2019.

Milk prices are drawing support from a delayed spring flush following unseasonably cold weather in the Upper Midwest. A recent surge in nonfat dry milk prices has lifted Chicago Mercantile Exchange Class IV milk futures.

Meanwhile, the USDA Cold Storage data reflected more modest growth in product inventories. At the end of March, butter stocks totaled 273.6 million pounds, up 2.9 percent from February and just 0.4 percent higher than last year. The 10-year February-to-March increase averaged 3.8 percent.

Total cheese in cold storage was 1.328 billion pounds, up 0.8 percent from February, compared to the 10-year average increase of 1.6 percent between February and March. Total cheese stocks were also up 5.2 percent from March 2017.

Feed costs have continued to advance on strong demand combined with ongoing planting delays, according to the CIH update.

California 4a, 4b prices improve a little more

California’s April 2018 Class 4a (butter) and 4b (cheese) milk prices improved somewhat, but remain below levels a year earlier.

The April Class 4a price is $13.29 per cwt, up 28 cents from March, but 44 cents less than April 2017. The year-to-date 2018 average stands at $12.99 per cwt, compared to $14.69 per cwt a year ago.

The April 4b price is $14.27 per cwt, up 31 cents from March and the highest since November 2017, but 3 cents lower than April 2017. The January-April 2018 average stands at $13.75 per cwt, compared to $14.97 per cwt a year ago.

April Class III, IV prices show improvement

April 2018 federal order Class III and Class IV milk prices posted modest gains, and are now at the highest levels of the year.

The April Class III price is $14.47 per hundredweight (cwt), up 25 cents from March but 75 cents less than April 2017. The year-to-date Class III price average stands at $14.02 per cwt, down $2.615 from the same period a year earlier.

The April Class IV price is $13.48 per cwt, up 44 cents from March but 53 cents less than April a year ago. The January-April Class IV price average is $13.13 per cwt, down $1.90 from the same period a year earlier. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke