One responsibility of my first full-time job was to survey fluid milk cases in supermarkets. I gathered information with regard to products on the shelves, their placement and price.

That early responsibility started a life-long interest in observing supermarket milk cases, an interest which has proven useful in my dairy career.

A trend I see occurring, especially in the newer supermarkets, is more and more products in the fluid milk case. Today’s milk case is more than just gallon jugs of white milk and a little chocolate milk and some buttermilk. As an example, one supermarket close to our home lists it carries 87 fluid milk products and 39 “milk alternatives,” for a total of 126 different products in their milk case.

Let me clarify by pointing out some may consider whole milk in four different-sized containers as one product, but supermarkets consider it four different products. Or, in their terminology, four different stock-keeping units. Plus, the 126 number does not include any cultured dairy products other than buttermilk, such as cheese or cream products. It just includes products consumed as a beverage.

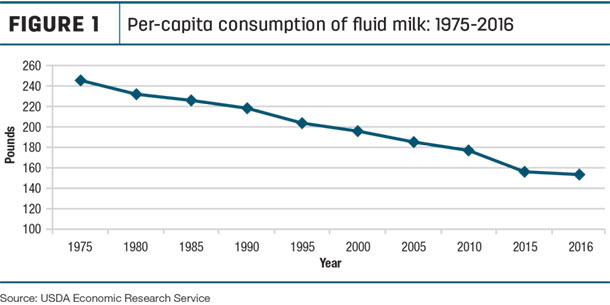

This large variety of products is both good and not-so-good news for dairy farmers. With fluid milk consumption continuing its steady downhill drop (Figure 1), hopefully, a greater variety of fluid products helps increase consumption.

However, on the other hand, those “alternatives” right next to milk products could be doing the opposite. Using my close-to-home supermarket as an example, let’s take a look at those products – remembering the milk case is a major outlet for dairy farmers’ milk production.

Fluid milk beverages

For simplification, I divide the 87 fluid milk products into three categories: conventional, organic and specialty milks. Conventional milks are those products we would expect to be in the milk case, such as white milk in various-sized containers – gallons, half-gallons, quarts and single-serve (16 ounces). These products come in varying fat contents, from whole to skim.

Out of the 87 milk products at my local grocery store, 29 were conventional. The bulk of conventional products carry the store’s own private label, but there are three local and national brands represented. Up until the late 1970s, local and national brands dominated most milk cases.

Even though the number of conventional products is only about one-fourth of the total milk case, in this supermarket as well as most supermarkets, conventional milk occupies one-half or more of the space in the total milk case.

The next category is organic milk, a category in which total sales increased 22 percent from 2010 to 2016 while conventional milk sales declined 12 percent during the same period. There are 21 different organic products in the milk case. Unlike conventional, about two-thirds of the organic milk carries the label of two national organic brands.

The other third is the supermarket’s private organic label. All of the national organic brands are in half-gallon paper cartons and ultra-pasteurized for longer shelf life. The store brand offers organic milk in a gallon jug using conventional pasteurization. There is also organic milk in chocolate and lactose-free.

The third category is specialty milks, which includes 37 different products, some of which are new to the milk case in the past couple of years. All are national or multi-regional brands.

The specialty products include lactose-free milk; organic milk produced from cows that are 100 percent grass-fed and given no grain; milk produced only from Jersey cows, which naturally contains more protein and calcium; chocolate milk with added sweetness but not from high-fructose corn syrup; milk with more protein and calcium, and less sugar, processed using ultrafiltration; milk containing A2 not A1 protein, which many believe is more easily digested; an energy-boosting milk that contains almost four times as much protein as conventional milk; and fat-free milk with more protein and calcium that advertises it tastes like whole milk.

All of the specialty products are ultra-pasteurized and are only produced in one or maybe two plants. Ultra-pasteurization extends the shelf life until opened and allows these products to be distributed over a larger area.

It will be interesting to watch the long-term demand for these newer specialty milks. If demand grows for these milks, look for some supermarkets to begin offering them under their own store brand and for local processors to start bottling and distributing them as well.

Plant-based beverages

As stated earlier, in the same milk case with fluid milk products this supermarket, as well as most, offers what they call “milk alternatives.” I prefer to call these alternatives “plant-based beverages.” It takes a mammary gland to produce milk, and I do not know of any plants with mammary glands. The 39 plant-based beverages include: almond, cashew, hazelnut, soy, walnut, coconut and rice.

Some are flavored with vanilla and chocolate. In this particular milk case, there are seven different companies represented other than the supermarket’s private label. As a comparison, nine companies plus the supermarket label have fluid milk products.

Are plant-based beverage products taking sales away from cow’s milk? An article in the September 18, 2017 Livestock, Dairy, and Poultry Outlook titled “On Different Trajectories: A Look at Sales of Cow’s Milk and Plant-Based Analogs” addresses this question. The article reports plant-based products are taking more space in the milk case.

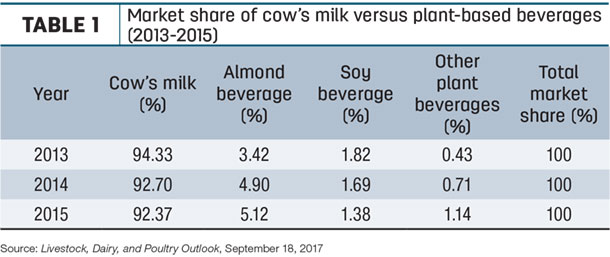

Using household scanner data for the years 2013-2015 (most recent available), the study shows the market share of milk (cow) versus plant-based beverage products declined about 2 percent from 2013 to 2015 (Table 1).

Better news is 2015 scanner data that shows 92.2 percent of consumers purchased milk, while 32.2 percent purchased plant-based beverages some time during the year. Of the 89.7 percent of households who purchased plant-based beverages, they also purchased milk.

While only 3.3 percent of households only bought plant-based beverages and no milk. Plus, milk has a cost advantage over plant-based beverages. In 2015, the average price for a half-gallon of milk was $2.42 while the various plant-based beverages averaged from $2.87 to $3.03 per half-gallon.

It is discouraging to think 30 percent of the total products in a milk case (39 out of 126 in this supermarket) are plant-based beverages but still carry the word “milk” on their labels. Hopefully, efforts underway to change this misconception, such as congressional legislation, known as the Dairy Pride Act, will be successful in preventing non-dairy products, such as these milk alternatives, from being labeled as milk.

In conclusion, let’s be optimistic the increased variety of milk products in the milk case will increase fluid milk consumption. And consumers will realize those plant-based beverages, even though they are in the milk case, are not milk. ![]()

Calvin Covington is a retired dairy cooperative CEO and now does some farming, consulting, writing and public speaking.

-

Calvin Covington

- Retired Dairy Co-op Executive

- Email Calvin Covington