U.S. ag exports were valued at $11.4 billion in May, while ag imports were estimated at $11.7 billion, leading to a $251 million trade deficit. Combined with the deficit of more than $865 million in April, the two-month deficit topped $1 billion.

Historically, May has been a trade deficit month in three of the last four years; 2016 was the last time the trade balance was negative for both April and May. Through the first five months of 2019, U.S. ag imports ($57 billion) have now moved ahead of exports ($56.9 billion), leading to a calendar year deficit of $65 million.

Dairy export value up, but China drags volumes lower

Despite restricted sales to China, increasing cheese exports and improving world prices helped push the value of May 2019 U.S. dairy exports to a four-year high, according to monthly data from the U.S. Dairy Export Council (USDEC). Here’s a summary of May 2019 numbers:

- Volume basis: Overall volume trailed the strong levels of May 2018, but nearly all the shortfall came from lost sales to China. Shipments of milk powders, cheese, butterfat, whey products and lactose to China were down 67%, while exports to the rest of the world were down just 1%. In total, U.S. export volume was off 13% from a year ago.

Cheese remains a bright spot, with year-to-date volume the highest in five years, even though exports to Mexico are down. May exports of nonfat dry milk/skim milk powder were the most in 12 months, offsetting continued declines in exports to China and Pakistan. The whey category is where the lost sales to China show up most dramatically.

-

Value basis: Total U.S. exports were worth $539.1 million, up 6% year over year and the highest monthly total in four years.

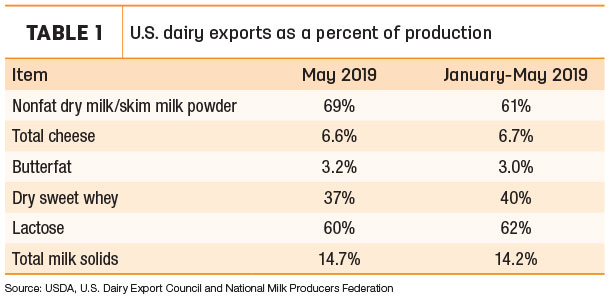

- Total milk solids basis: May exports were equivalent to 14.7% of U.S. milk solids production (Table 1). During the first five months of the year, exports were equivalent to 14.2% of production compared with an average of 14.7% from 2014-18.

Dairy heifer exports remain in slump

Dairy replacement heifer export activity remains in a slump. May exports totaled just 642 head, the lowest number since June 2018. Of the monthly total, 246 went to Mexico and 240 moved to Kazakhstan. Canadian buyers took 107 head, and the first shipment of the year to Thailand tallied another 49 head.

Through the first five months of 2019, dairy replacement heifer exports stand at 5,832 head, the smallest total for that period since 2016.

May total shipments were valued at $1.2 million, also the lowest since last June.

On a side note, January-May 2019 exports of U.S. beef heifers hit 4,549 head and has already topped the annual total for 2016, 2017 and 2018.

Global milk production continues to outpace demand, slowing the dairy heifer export market, said Gerardo Quaassdorff, T.K. Exports Inc., Boston, Virginia.

Inquiries for U.S. dairy cattle from Commonwealth of Independent States (CIS, former members of the Soviet Union) remain strong, but are hindered by long-standing regulations, demand and pricing for registered U.S. dairy cattle. Due to 1940s-era regulations, cattle imported into many of those countries must be enrolled in a breed association going back at least four generations, Quaassdorff explained. Finding adequate numbers of registered U.S. cattle to meet those requirements – enough to fill a boat of 2,500 head every two months – is difficult.

With uncertainty over whether cattle will be accepted, exporters take the risk of purchasing animals meeting those registration qualifications and then face immediate depreciation of 30%-40% if those cattle are rejected by foreign buyers and then must be put back on the domestic market. Increased acceptance of genomically tested animals would help reduce some of that risk, he said. The Livestock Exporters Association (LEA) is working with buyers to boost that acceptance.

While the dairy heifer market has been softer, animal protein remains in strong demand, stabilizing demand for beef heifers, Quaassdorff said. Festival-related celebrations in Muslim countries are adding to the demand for beef cattle, he added.

Tony Clayton, Clayton Agri-Marketing Inc., Jefferson City, Missouri, said a window of opportunity for U.S. sales may be opening this fall, as buyers move to beat escalating shipping costs. On Dec. 1, all sea vessels must use cleaner burning fuel, adding 5%-10% to shipping costs, he said.

Heifer inventories from Australia have dried up and prices are rising. In addition, large markets like Egypt have implemented bans on cattle sourced from Germany, turning instead to Dutch cattle despite higher freight costs. Those higher freight costs are making prices for U.S. cattle more competitive.

Increased tensions with Iran are playing a role in limiting or eliminating some markets over fears of ships entering the Persian Gulf, said Clayton, reporting from Pakistan while traveling in Africa and the Middle East.

May hay exports steady

Although down slightly from March, U.S. hay exports maintained recent trends in April.

At 114,588 metric tons (MT), May shipments of other hay were about average so far in 2019; monthly sales were valued at $38.9 million.

Japan remained the most prolific buyer of other hay, topping 60,000 MT for the fifth consecutive month. May sales to South Korea and Taiwan were steady with April, with sales of other hay to the United Arab Emirates (UAE) up slightly.

May alfalfa hay shipments totaled 228,558 MT, an eight-month high, and were valued at $73.4 million, the high for the year.

Among leading markets for alfalfa hay, China retained the top spot despite the ongoing trade and tariff war with the U.S. At 66,451 MT, it was China’s largest purchase on a volume basis since last September.

Japan wasn’t far behind, buying 63,468 MT. At 46,910 MT, sales to Saudi Arabia were the strongest since last September, and volumes to South Korea at 20,448 MT were the highest of the year.

January-May 2019 exports of alfalfa and other hay are now slightly ahead of last year’s pace, but trail five-month sales in 2017. Alfalfa hay sales total 1.03 million MT.

Exports of alfalfa meal and cubes remain mixed.

Limited U.S. supplies of old-crop hay and a slow start to the new harvest season limited May export potential, according to Christy Mastin, international sales manager with Eckenberg Farms Inc., Mattawa, Washington.

An oversupply of timothy and other hay in both South Korea and Japan has suppressed U.S. sales of other hay, putting downward pressure on prices. However, less-than-ideal weather conditions during the current hay harvest season in those two countries is yielding hay of questionable quality, Mastin said. That may draw down inventories in the next couple months, helping boost U.S. sales.

Currency exchange rates are favorable for Japan, but South Korea’s rates are less stable. China’s exchange rate remains stable and has little effect on the purchasing power of their currency. However, trade policy continues to add uncertainty to the market there.

Chinese customers have stated they have the ability to apply for a waiver of import tariffs imposed on U.S. hay. If approved, those waivers may help increase sales to China, Mastin said. Short term, buyers are seeking to build inventories in case the U.S.-China trade picture becomes even cloudier.

If the tariffs continue or are increased, other countries may step in to fill the void. There have been reports of Spanish alfalfa entering markets in China and Japan over the last year. While the quality is lower, the dehydrated hay is more affordable.

Back home, the new crop harvest in the Pacific Northwest was hampered by rain and did not start well, Mastin said. Overall hay quality was lower than needed for domestic or export dairy farmers. Second cutting is much better, and quality is more in line with dairy demand. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke