Some of the factors impacting hay growers and marketers come around every year: New crop harvest is well underway, with quality and quantity affected by the weather.

Other factors are a short-term response to the times: Higher fuel prices and tight truck availability are adding costs at multiple levels of production and transportation. Dairy cows are making a lot of milk although the feed costs to produce it are at multiyear highs.

Here’s a look at things affecting hay markets during early June 2021.

Hay exports remain strong

April 2021 alfalfa hay exports totaled 245,922 metric tons (MT), down 36,574 MT from March but still the second-highest monthly total since May 2020. Shipments were valued at about $345 per MT, up $6 from March.

Based on USDA reports tracked by Progressive Forage, April 2021 sales to China at 111,908 MT were about 32,000 MT off the record high in March. Year-to-date, China has purchased about 47% of all U.S. alfalfa hay exports.

April alfalfa hay exports to the second-leading market, Japan, were about equal to March at 58,677 MT.

April exports of other hay were down just slightly from March at 143,376 MT and were the second highest since March-April 2015. Exports of other hay were valued at about $349.60 per MT, up $5 from March.

About two-thirds (92,281 MT) of the month’s sales went to Japan, down about 6,000 MT from March. Shipments to another major customer South Korea were down 4,000 MT from a month earlier at 29,900 MT.

Dry conditions remain

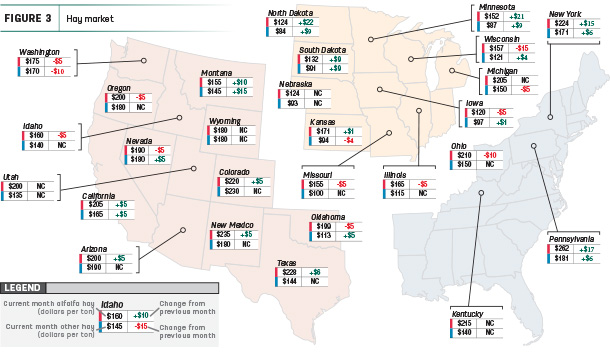

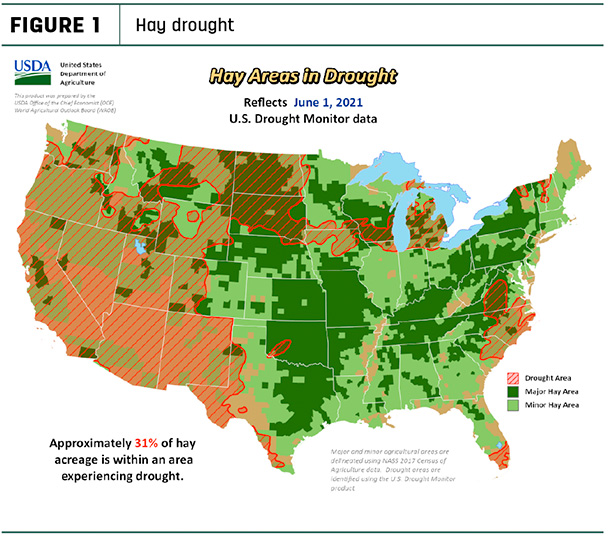

With hay harvest underway in nearly every region of the country, moisture conditions remain a concern, based on U.S. Drought Monitor maps. As of June 1, about 31% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, unchanged from a month earlier. The area of drought-impacted alfalfa acreage (Figure 2) improved 2% during the month to 53% and tracks closely with major dairy areas of the country. The USDA estimated about 51% of the nation’s 9.49 million dairy cows were in areas impacted by some levels of drought.

Eastern New Mexico and western Montana received some precipitation to allow for some improvements to their drought status. While moisture conditions also improved somewhat in Oklahoma, western Kansas, western Nebraska and eastern Colorado, new drought areas emerged in several Mid-Atlantic states.

Not all the moisture relief news was great. The Texas A&M AgriLife Extension Service reported areas of eastern Texas lost much of the first cutting of dry hay due to excessive rain. Heaviest rain amounts fell in the south and east, with reports of 10-12 inches in some areas causing some flooding concerns. Other regions also received rain ranging mostly from 2 to 6 inches.

Hay harvest in some other states was hampered by cool, wet conditions, hurting quality.

Price movement mixed

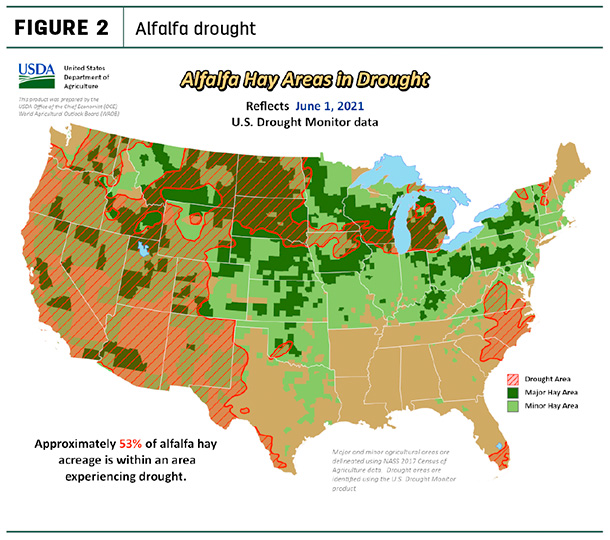

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Click here or on the map above to view it at full size in a new window.

Dairy hay

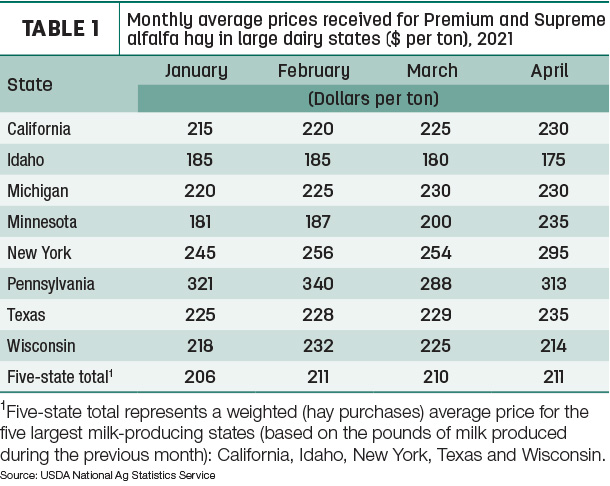

The average price for Premium and Supreme alfalfa hay in the top milk-producing states averaged $211 per ton in April, up $1 from March (Table 1) and equaling a 23-month high. Compared to a month earlier, dairy-quality hay prices were substantially higher in Minnesota, Pennsylvania and New York but slightly lower in Idaho and Wisconsin.

Alfalfa

The national average price for all alfalfa hay rose $6 per ton for a second consecutive month to $187 per ton. April’s average was $18 per ton higher than December 2020.

Compared to a month earlier, average alfalfa hay prices increased in 12 of 27 major forage states, led by double-digit increases in North Dakota, Minnesota, Pennsylvania, New York and Montana. April prices declined in 10 states, led by Wisconsin and Ohio.

Pennsylvania alfalfa hay prices remained the highest in the country at $262 per ton.

Other hay

The U.S. average price for other hay rose $1 in April to $143 per ton, equaling the average in February 2021 for a 20-month high. April prices moved higher in 11 states, led by a $15 jump in Montana. Price declines were reported in just three states, led by a $10 drop in Washington. Colorado had the top monthly average of $230 per ton; average prices were under $95 per ton in North Dakota, Minnesota, South Dakota, Nebraska and Kansas.

Organic hay

The USDA’s latest organic hay price report offered a small sample of price summaries for spot transactions (free on board [f.o.b.] farm gate). For the two-week period ending June 2, Supreme alfalfa in large square bales averaged $250 per ton, while Good small square bales of ryegrass averaged $210 per ton. There were no price quotes for delivered organic hay.

Regional markets

Here’s a look at local markets during the first week of June:

- Southwest: In Texas, hay prices were steady to firm to end May, but the bigger story was the rain. New crop prices will be in line with old crop pricing until a larger supply can be established.

In Oklahoma, hay trade remained very slow following weeks of cooler-than-average temperatures and heavy rainfall. Many brome fields were getting mature and most will be used as grinding-type hay. Cool nights were leaving alfalfa fields in rough condition and also likely yielding mostly grinder hay. Demand remained moderate as most feedyards and dairies seemed current with needs.

In New Mexico, alfalfa hay prices were mostly steady. Second cutting was in full swing in the southern and southwestern parts of the state; first cutting was done in the eastern part of the state. Some hay farmers are storing hay for their livestock. Water was finally released from the dam this week, making it down the Rio Grande.

In California, prices remained steady over all regions with moderate demand.

Lake Mead was 37% full, below the critical 1,075-foot level, triggering cutbacks to Arizona, Nevada and Mexico.

- Northwest: In Montana, hay sold generally steady with very light sales volume to close out May. Most producers were completely out of hay, and ranchers had turned out cows on range and pasture for the summer.

In Idaho, new crop domestic alfalfa sold steady in a light test, while old crop domestic alfalfa sold firm in a light test as some producers needed forage to carryover till green grass was available. Baling was expected to be heavy moving into the second week of June.

In Colorado, trade activity was light on good demand for stable-quality hay in the northeast, but feedlot and dairy hay markets were inactive.

In the Washington-Oregon Columbia Basin, exporter orders for high-testing supplies firmed up prices. Most supplies of high-testing, first-cutting export and domestic alfalfa have been spoken for, leaving lower-testing supplies. A heat wave across the trade area may have adverse effects on quality tests. In Washington, conditions continue to dry out, and abnormally dry and both moderate and severe drought conditions continued to expand.

In Wyoming, end-of-May hay growth was slowed by dry and cool conditions, and producers were busy running water to aid in the hay growth. Sun-cured alfalfa pellets and hay cubes sold steady.

- East: In Pennsylvania, the end of May brought moderate demand for alfalfa, alfalfa-grass blends and straw, and lighter demand for grass hay, with some strengthening of demand as the calendar changed to the first week of June.

In Alabama, hay prices were fully steady, with trade moderate on light supply and moderate demand.

- Midwest: In Missouri, rain made making haying difficult. The cool wet weather improved conditions for clover and some fields of mixed grasses. Hay prices were steady with support as prices for alterative feeds move drastically higher. The supply of hay was moderate, and demand was light to moderate.

In Nebraska, forages sold steady on a light test, with demand mostly moderate as May came to a close. Some first cutting indicated large weevil infestations.

In Kansas, prices were steady for alfalfa and mostly steady for grass hay. Demand was good for alfalfa on limited supply. Rainy and cool weather across the state kept many producers from getting new crop hay baled, and alfalfa fields were starting to bloom. Lots of inquiries for new crop hay were reported from both in-state and out-of-state buyers.

In Iowa, bedding sold steady, and the hay market ended steady after a week start.

In Michigan, a warm, dry spring combined with strong winds from the Gulf of Mexico during the last week in May had crop advisers warning producers to scout for potato leafhopper feeding and damage in second-cutting alfalfa.

In South Dakota, demand was very good for all types of hay as the drought continued across the state. No sales of new crop alfalfa had been reported as producers were busy cutting and baling. Although dry conditions were a concern, high temperatures, low humidity and a nice breeze made for quick curing of alfalfa.

In Wisconsin, prices were steady for dairy-quality hay; lower-quality or higher-moisture hay was being discounted.

In Minnesota, first cutting moved northward as May came to a close.

Other things we’re seeing

- Dairy: Dairy cow numbers continue to build on what is the largest U.S. dairy herd since the mid-1990s. Since bottoming out in June 2020, the nine-month growth spurt has added about 135,000 cows to the U.S. herd.

The U.S. average milk price rose $1 in April to $18.40 per hundredweight (cwt). However, with a contribution from hay, higher feed costs ate up more than half of that increase, resulting in another substantial indemnity payment for dairy producers participating in the 2021 Dairy Margin Coverage (DMC) program. It marked the third straight month in which the DMC milk price over feed cost margin was below $7 per cwt. The average price for a blend of Premium and all alfalfa hay used in DMC calculations was $199 per ton, up $3.50 per ton from March and the highest since June 2019.

- Fuel: U.S. average regular gasoline and diesel prices continued to increase. As of May 31, the U.S. average regular gasoline retail price increased nearly 1 cent compared to a week earlier to $3.03 per gallon. It was $1.05 higher than the same time last year. Average prices ranged from a low of $2.72 per gallon in the Gulf Coast to a high of the $3.72 per gallon on the West Coast.

The U.S. average diesel fuel price increased less than 1 cent to $3.26 per gallon but was 87 cents higher than a year ago. Average prices ranged from a low of $3.03 per gallon in the Gulf Coast to a high of $3.76 per gallon on the West Coast.

-

Trucking: Analysis from DAT Trendlines indicates that while May 2021 fuel prices were up about 35% over May 2020, flatbed spot hauling rates were up more than 63% and averaged $3.14 per mile nationally to start June. By region, rates were highest in the Southeast ($3.43) and Midwest ($3.39), while lower in the South ($3.02) and West ($2.68).

-

Dave Natzke

- Editor

- Progressive Forage

- Email Dave Natzke