The transition into 2022 is well underway, with no shortage of questions related to supply and demand, domestic and export supply chains, input costs and growing conditions. We’re still waiting on some final numbers from 2021.

The USDA’s latest estimate of hay inventories and production updates will be released after the Progressive Forage newsletter deadline, so check back later. In the meantime, here’s a look at what we do know entering the second week of January 2022.

Moisture outlook improves

Heavy precipitation and a generous snowpack in mountainous areas are leading to an improved moisture outlook. According to the National Weather Service’s drought outlook, conditions should improve during the first quarter of 2022 across the northern half of California, Oregon, Washington, northern Idaho and much of Montana, as well as south-central Texas and portions of Arizona. Above-normal precipitation is also forecast for most Great Lakes states.

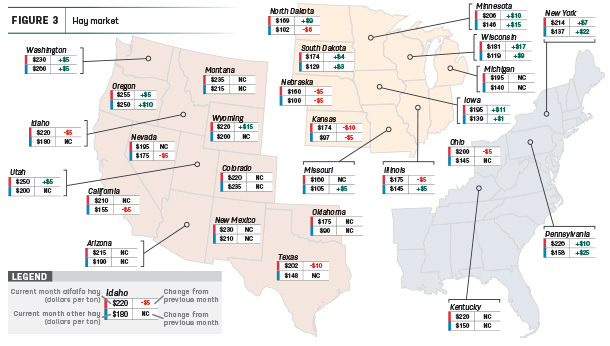

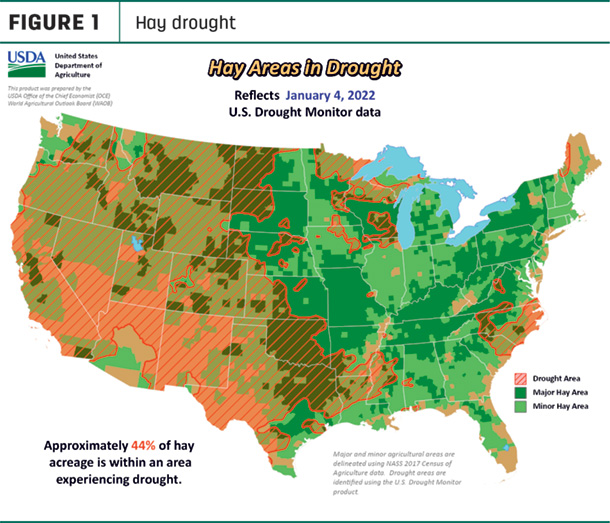

The improved conditions haven’t been fully reflected in the latest drought maps. U.S. Drought Monitor maps estimated about 44% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions in early January, up 3% from a month earlier. Conditions worsened slightly in Texas and the Central Plains. The area of drought-impacted alfalfa acreage (Figure 2) declined 4% over the previous month to 56%, with some improvement in Arizona.

Alfalfa hay prices continue to climb

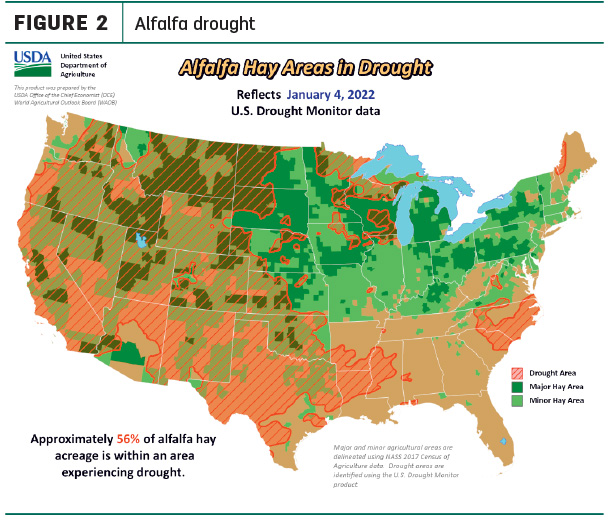

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Dairy hay

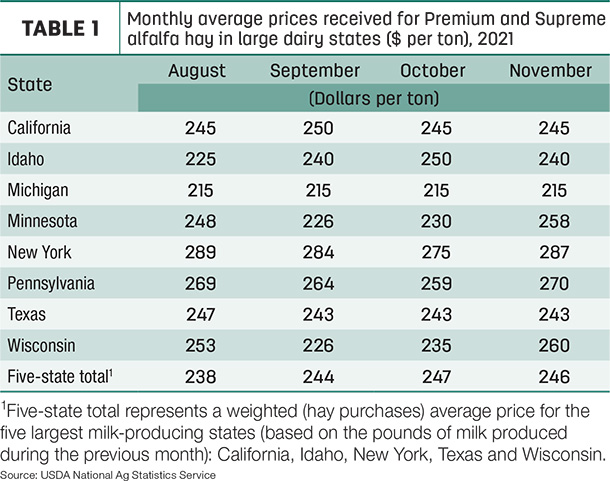

The average price for Premium and Supreme alfalfa hay in the top milk-producing states dipped $1 from October to $246 per ton (Table 1), the first month-to-month decline since March. Despite the decline in the overall average price, November dairy-quality hay prices were up substantially in Minnesota, New York, Pennsylvania and Wisconsin. November 2021’s average was up $46 per ton from a year ago.

Alfalfa

After hitting a seven-year high in October, the national average price for all alfalfa hay declined for the first time in a year, down $4 to $210 per ton in November. Monthly prices increased in 11 of 27 major forage states, with double-digit increases in five states, led by Wisconsin. Average prices decreased in just five states, led by Kansas and Texas.

Other hay

The U.S. average price for other hay rose $2 in November to $147 per ton. Compared to October, average prices moved higher in 10 of 27 major hay-producing states. Largest increases were in Pennsylvania and New York, up $25 and $22 per ton, respectively. Other hay prices were about $5 per ton lower in five states, led by North Dakota.

Exports soften

Hay exporters continue to struggle with logistical challenges, and those issues showed up in November’s shipments. Exports of alfalfa hay totaled 231,258 metric tons (MT), a four-month low.

Alfalfa sales to China totaled 126,972 MT, down about 22% from October and a seven-month low. China’s volume represented about 55% of all alfalfa hay exports during the month. Shipments to Japan, Saudi Arabia and South Korea were up slightly from October.

January-November 2021 alfalfa hay exports total nearly 2.64 million MT, the highest volume on record for the first 11 months of the year.

The USDA estimated the value of November alfalfa hay exports averaged about $378 per MT, up about $1.70 from October’s average.

November exports of dehydrated and sun-dried alfalfa cubes were stronger.

At 106,799 MT, November exports of other hay were on par with the average over the second half of 2021. Shipments to Japan hit a six-month high and represented about 60% of total volume. Shipments to South Korea and the United Arab Emirates were down from October.

The USDA estimated the value of November other hay exports averaged about $366 per MT, $4 more than the October average.

Year-to-date exports of other hay have now topped 1.28 million MT, up about 40,000 MT compared to January-November 2020 and the largest volume for that period since 2017.

Regional markets

- Southwest: In Texas, prices were steady in all regions, with trade activity and demand moderate. South Texas received its first frost of the season, halting growth of warm-season grasses. Cool-season grass pastures were still in good condition, and more rain was in the forecast. The rest of the state was in desperate need of some moisture.

In Oklahoma, hay movement was slow as warm weather conditions allowed cattle to stay on free-standing grass.

In California, hay trade activity was moderate on good demand. Retail hay prices were steady to firm; dairy hay was steady.

- Northwest: In Montana, bitter cold had some ranchers going through supplies quickly and searching for more. Hay offerings remained light with sales limited. Traders buying hay from surrounding states said hay was being delivered into Montana for $300-$325 per ton, $25 more than last month.

In Idaho, trade activity remains slow with good demand but limited supplies.

In Colorado, activity was light on good demand for all hay markets.

In the Columbia Basin, trade remained slow with very good demand, especially for retail customers. Export demand was light to start the month after a major winter storm closed mountain passes to the ports. Exporters report they have at least 25% less inventory on hand this year than in previous years.

In Wyoming, all hay sold steady. Demand was good with livestock owners continuing to look for hay. Snowpack was a popular topic with some accumulation over 80% in several basins.

- Midwest: In Nebraska, baled hay sold steady; ground and delivered hay sold steady to $5 lower. Demand was sporadic, with some inquiry from states west and north. Most cattle can continue to graze cornstalks and have had needed limited supplemental feed.

In Kansas, prices remained steady for alfalfa and grass hay; movement was still slow. Although buyers were not panicked, concern increased as the drought continued to deepen.

In South Dakota, all classes of hay sold steady on good to very good demand. With light snow cover, beef cows were able graze cornstalks, and there was good demand for cornstalk bales to blend with rations to stretch forage supplies.

In Missouri, extremely cold temperatures had cattle waiting for the feed truck. Most hay inquires seemed to be for a few small squares or a round bale or two to set out for equine or small animals. The supply of hay was moderate, and demand was light to moderate, and prices were mostly steady.

In Iowa, alfalfa sold steady with a weak undertone, and grass sold $4-$7 lower. Buyer attendance was light due to colder temperatures for a moderate sale supply.

In Wisconsin, prices are steady to strong for dairy-quality hay.

- East: In Pennsylvania, demand and supply were moderate with prices weaker on nearly all classes of hay.

In Alabama, hay prices were steady with light supply and moderate demand.

Other things we’re seeing

- Dairy: The USDA formally implemented a change in hay price calculations used in the Dairy Margin Coverage (DMC) program, incorporating the dairy-quality hay price in total feed cost estimates beginning with November 2021 DMC margin and indemnity payments. The USDA also provided retroactive indemnity payments for January 2020-October 2021 based on the new price formula.

Higher milk prices offset an increase in overall feed costs, boosting November’s DMC program income margin to $9.14 per hundredweight (cwt), the highest since November 2020.

Meanwhile, the U.S. dairy herd continues to shrink, and milk production is tightening. Declining cow numbers and stagnant milk production per cow held total U.S. milk production below year-ago levels in November (the latest available). Cow numbers declined for a sixth consecutive month and are now down 122,000 head since peaking in May 2021.

The USDA’s World Ag Supply and Demand Estimates (WASDE) report reduced milk production forecasts and raised projected milk prices for both 2021 and 2022. If realized, 2021 production will be up about 1.1% from 2020, with 2022 production up less than 0.7% from the 2021 forecast. Annual average milk futures prices for 2022 are now the highest since 2014.

- Beef cattle: Cattle and calves on feed for the slaughter market in the largest U.S. feedlots totaled 12 million head In December, slightly below a year earlier. Higher feed costs are pushing some fed cattle to market sooner; marketings during November totaled 1.87 million head, 5% above 2020 and the highest for any November since the USDA began reporting numbers in 1996.

Drought and higher feed costs have been driving beef and dairy cow culling rates higher for most of the second half of the year, about 5.3% more than the same period a year earlier.

-

Fuel: With December in the books, the 2021 average Brent crude oil price of $70 per barrel was the highest nominal (not adjusted for inflation) average since 2018. Crude oil prices are the largest determinant for gasoline prices, which were at their highest nominal levels since 2014. The U.S. average regular gasoline retail price averaged $3.28 per gallon on Jan. 3, $1.03 higher than a year earlier; the U.S. average on-highway diesel fuel price was $3.61 per gallon, up 97 cents.

- Trucking: National average spot flatbed hauling rates increased to $3.07 per mile to end December, with highest rates nearing $3.35 per mile in the Upper Midwest, according to DAT Trendlines. Progressive Forage has heard of hay hauling quotes of $4 per mile (Wisconsin to North Dakota, if the driver can find a back haul). If you’d like to share what you’re paying to haul hay, email me.