However, expected gains in average carcass weights, a function of gains in steer and heifer weights, and a shift in the slaughter mix toward fed cattle will more than offset the decline in cow slaughter. Higher fed cattle slaughter is based on year-over-year larger 2018 – and expected 2019 – calf crops that will likely increase cattle placements in feedlots in late 2019 and early 2020. As a result, marketings of those fed cattle would support higher fed cattle slaughter in 2020.

The 2019 beef production forecast was reduced fractionally from the previous month at 27.3 billion pounds. The second-quarter 2019 forecast is reduced based on lower expected carcass weights that more than offset an increase in anticipated fed cattle slaughter.

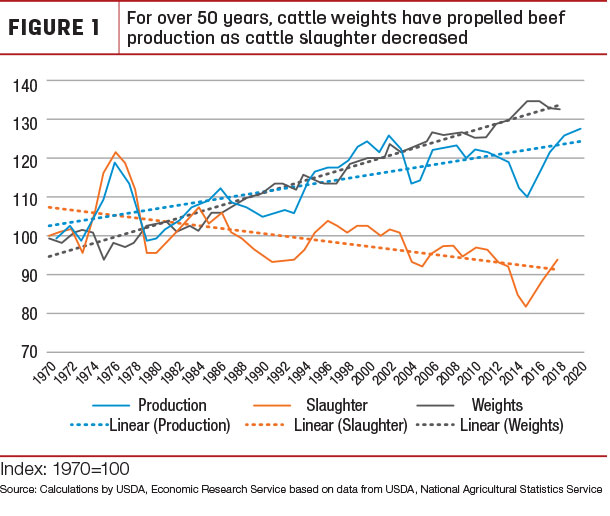

Improved genetics, feeding efficiencies and management grow beef production

Over the last 50 years, production has steadily increased while the number of cattle slaughtered has decreased. To best illustrate these changes over time, the figure shows commercial beef production, commercial cattle slaughter and the inferred carcass weights as indices from 1970 to 2020. In 1975, the U.S. cattle herd’s growth had peaked, with all cattle and calves topping out at 132 million head. The next year, as the herd contracted, it gave way to the largest number of cattle slaughtered commercially at 42.7 million head and produced a then-record of 25.7 billion pounds of beef.

Since then, record beef production has been achieved with fewer animals as the result of an industry that has changed dramatically over time. For example, improved breeding practices have helped produce more efficient cows that have offspring with better growth rates and feed conversion efficiencies. Enhanced cattle performance on grass and in feedlots has provided faster turnover of feeder cattle with heavier carcass weights. These cattle make their way through the value chain as a better and more consistent product thanks to improved feeding technologies and better husbandry practices, enabling the industry to produce more beef per cow.

The number of fed cattle in the slaughter mix has increased over time – upward of 80% of the animals harvested – also supporting an increase in average carcass weights. The current record level of beef produced commercially occurred in 2002 and stands at 27.1 billion pounds, derived from 35.7 million head. The 2019 and 2020 beef production forecasts are expected to surpass that level with about 6% fewer animals.

Large market-ready supplies of cattle available

Based on the April Cattle on Feed report, it was estimated there were 4.9% more net placements but 3.4% fewer cattle marketed year-over-year in March. However, when adjusted for the difference in slaughter days in March, marketings were about 1% higher. The Cattle on Feed report also showed that placements of 800-pounds-or-heavier feeder cattle in March 2019 were nearly equal to year-earlier levels. Any additional heavy cattle remaining on wheat pasture will likely be placed on feed in April and into early May.

The April 1 Cattle on Feed number reached nearly 12 million head, which is the largest number of cattle on feed for the month of April since reporting began in 1996. The number of cattle held on feed over 150 days also continued to build. The percentage of cattle on feed over 150 days on April 1 climbed over 2 percentage points from last year as marketings lagged.

Weaker fed cattle prices to pressure feeder calf prices

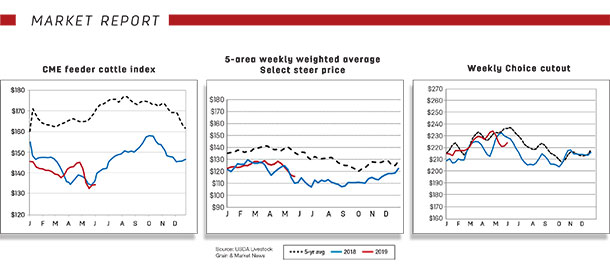

Fed steer prices in the 5-area marketing region appear to have reached the seasonal peak the week of March 24, 2019, at $128.96 per hundredweight (cwt) and have since retreated to $120.34 per cwt for the week ending May 12, 2019. This decline may be due to the fact that there are large supplies of market-ready cattle, and it appears the spring low in carcass weights may be near.

Seasonally, fed cattle carcass weights are at the low point in late May and early June. As the lingering effects from this winter’s weather events subside, fed cattle weights have stabilized to the point that they are above year-earlier levels. For the week ending April 27, 2019, steer carcass weights were 4 pounds above and heifer weights were 6 pounds above year-earlier levels.

Based on recent price data and the number of fed cattle that will likely be available for marketing this year, the forecasts for second- and third-quarter 2019 fed steers were lowered $3 and $2 to $121 per cwt and $113 per cwt, respectively. This equates to an annual price of $118.5 per cwt for 2019. The 2020 annual price forecast for fed steers is over 2% higher at $121 per cwt, based on an improved outlook for feed input prices.

On April 1, 2019, there were almost 1% more cattle sitting outside feedlots according to the table “Feeder Cattle Supplies Outside Feedlots” on the ERS webpage Livestock and Meat Domestic Data. Based on the weekly National Feeder and Stocker Cattle Summary reports, for the month of April there was a nearly 22% year-over-year increase in total sales. These sales likely supported the seasonal bounce in feeder steer prices exhibited at the Oklahoma National Stockyards. There, feeder steers weighing 750 to 800 pounds averaged about $146.72 per cwt in April, up from the March estimate of $139.96 per cwt. However, sale prices over the last three weeks have been under pressure.

The lower fed cattle prices are likely squeezing feedlot margins and making feedlots less willing to bid up the price for placing feeder cattle in their feedlots. However, for the week ending May 5, 2019, only 8% of U.S. pastures were in poor or very poor condition – down 14 percentage points compared to the same time last year. This improvement in pasture conditions should provide some demand for feeder calves to be placed on summer grass. Nonetheless, based on recent price data and expectations of feedlots being less likely to bid up the price, the second-quarter 2019 feeder steer price was lowered by $2 to $145 per cwt. The fourth-quarter 2019 price was raised $1 to $147 per cwt based on expected fall demand. As a result, May’s annual price forecast for 2019 was $145.50 per cwt, close to the previous month’s forecast.

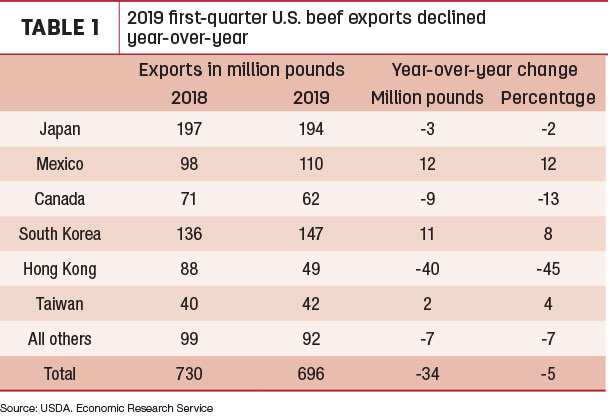

Lower beef exports in first-quarter 2019

U.S. beef exports in first-quarter 2019 were down 5% from year-earlier levels at 696 million pounds. Among major destinations, notable declines were to Hong Kong and Canada (see table). Both Hong Kong and Canada reported lower imports from all major sources during the first quarter. In regard to Canada, higher domestic beef production in Canada may be offsetting potential U.S. exports.

Japan was the largest buyer of U.S. beef with 28% of total U.S. exports in first-quarter 2019. However, U.S. exports to Japan in March were 9% lower from year-earlier levels, and FAS weekly export sales reports for April also showed weaker shipments to Japan. U.S. beef is facing competition from Canada, which has a tariff advantage to supply beef to Japan.

Based on lower-than-expected first-quarter exports and a slower expected pace of exports, the 2019 annual forecast was revised downward by 84 million pounds to 3.171 billion pounds. The 2020 beef forecast is 3.245 billion pounds, up just over 2% from 2019 levels. Greater domestic production in the U.S. should support the export growth. Most of the increased exports are likely to be driven by strong demand from Asian markets. Moreover, U.S. beef is likely to face lower competition from Oceania, given tighter exportable supplies expected in the region in 2020.

U.S. beef imports increased in first-quarter 2019

The 2019 March U.S. beef imports were 6% higher year-over-year by 270 million pounds, resulting in a 2.3% year-over-year increase for first-quarter 2019 imports to 738 million pounds. In first-quarter 2019, imports were higher from major suppliers except those from New Zealand, which were down 30% year over year for the period. As New Zealand shifted its exports to Asian markets, the decline in imports was in part offset by Mexico and Canada. Increased domestic production in Canada and Mexico is likely helping to support higher shipments.

Oceania is a major source of beef that in first-quarter 2019 continued to contribute more than one-third of U.S. imports. Expected tighter supplies in this region will likely dampen U.S. imports in remaining quarters of 2019, which are adjusted slightly downward from the previous month’s forecasts. Coupled with the higher-than-expected first-quarter import estimate, the 2019 beef import forecast is relatively unchanged from the previous month’s forecast at 3.013 billion pounds. Based on expected tighter exportable supplies in Oceania and demand from other buyers, the 2020 U.S. beef import forecast is about 2% lower at 2.96 billion pounds.

Cattle imports and exports higher

U.S. cattle imports in March 2019 were 235,085 head, 18% higher than year-earlier levels. Higher imports in all three months in first-quarter 2019 resulted in year-to-date cattle imports of 567,085 head, about 100,000 head higher than year-earlier levels. AMS weekly reports for April 2019 suggest stronger year-over-year imports. Better pasture conditions in the U.S. are likely to pull more feeder cattle shipments from Mexico. Canadian shipments of slaughter-ready cattle to the U.S. were also higher than year-earlier levels. The 2019 cattle import forecast was revised upward by 30,000 head to 2.03 million head. The 2020 import forecast is at 2.09 million head, 3% higher than the above current-year levels.

Year-over-year higher cattle exports in all the first three months of 2019 resulted in first-quarter U.S. cattle exports of 61,708 head, up 64% from year-earlier levels. Despite Canadian feedlots lacking a price incentive for sourcing feeder cattle from the U.S., U.S. feeder cattle exports to Canada remained stronger than year-earlier levels, and demand is expected to remain firm in the coming months. As a result, the U.S. cattle export forecast for 2019 is revised upward by 10,000 head to 255,000 head. The 2020 cattle export forecast is at 265,000 head, up 4% from the current year. ![]()

Analyst Lekhnath Chalise assisted with this report.

Russell Knight is a market analyst with the USDA – ERS. Email Russell Knight.