A slow start to the 2022 growing season means delays in new-crop hay production and price discovery.

Drought conditions better in spots

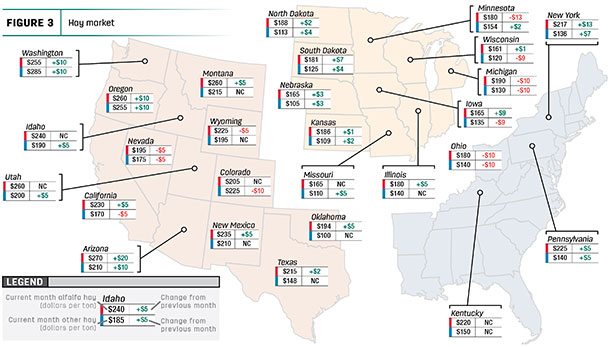

U.S. Drought Monitor maps indicate moisture conditions improved to end April. As of May 3, about 40% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, down 6% from a month earlier.

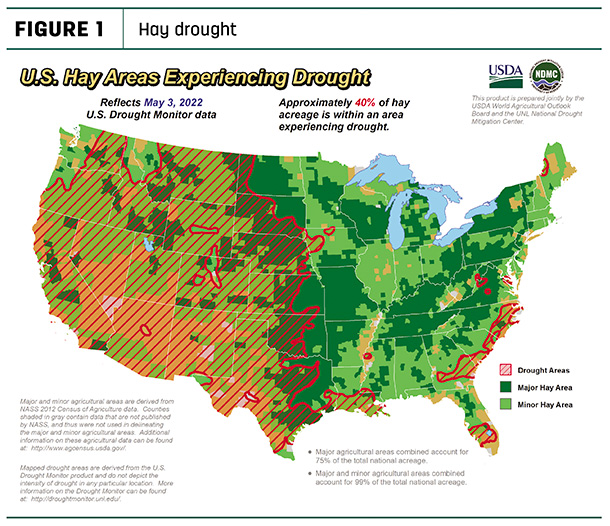

The area of drought-impacted alfalfa acreage (Figure 2) also decreased 6% to 57%. Significant spring-time precipitation removed lingering drought concerns for most areas of the Upper Midwest. Further west, the drought map improvement will be spotty.

The area of drought-impacted alfalfa acreage (Figure 2) also decreased 6% to 57%. Significant spring-time precipitation removed lingering drought concerns for most areas of the Upper Midwest. Further west, the drought map improvement will be spotty.

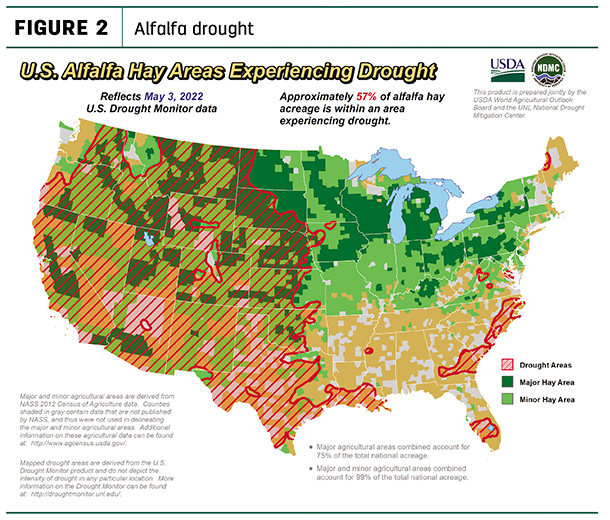

Hay prices mostly tracked

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Click here or on the map above to view it at full size in a new window.

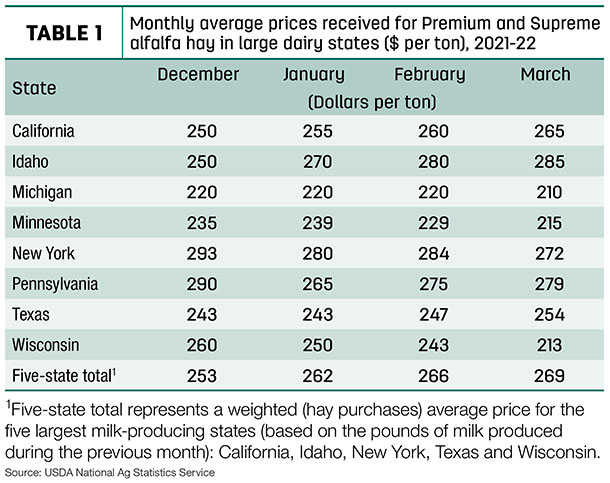

Dairy hay

March average prices for Premium and Supreme alfalfa hay in the top milk-producing states rose another $3 from February to $269 per ton (Table 1), up $59 per ton from a year ago. Month-to-month prices increased $4-$7 per ton in California, Idaho, Pennsylvania and Texas. Elsewhere, prices were down $10-$14 in Michigan, Minnesota and New York, and $30 lower in Wisconsin.

Alfalfa

The average price for all alfalfa hay increased $7 in March to $221 per ton. Compared with February 2022, prices increased in 16 of 27 major forage states, up $10-$20 in Arizona, New York, Oregon and Washington. Average prices decreased in just five states, led by $10-$13 declines in Michigan, Minnesota and Ohio.

Year-over-year price changes were large: Montana alfalfa hay prices were up $115 per ton compared to March 2021, with March 2022 prices at least $75 higher than a year earlier in North Dakota, Arizona, Idaho and Washington. In contrast, average prices were down $40 and $20 per ton in Ohio and Pennsylvania, respectively.

Other hay

The U.S. average price for other hay was unchanged from February at $146 per ton. Prices moved higher in 13 of 27 major hay-producing states, led by Arizona, Oregon and Washington. Prices declined in six others, led by Colorado, Michigan and Ohio.

Year-over-year average prices for other hay were again substantially higher in Northern tier and Western states, up $105 and $85 per ton in Washington and Montana, respectively, and $65-$76 In Minnesota, Oregon and Utah. Pennsylvania and New York led decliners, down $35 and $29 per ton, respectively.

Organic hay

The USDA’s latest organic hay price report offered a small sample of price summaries for spot transactions (free on board [f.o.b.] farmgate). For the two-week period ending May 4, Good alfalfa in 3X4 bales averaged $260 per ton. There were no price quotes for delivered organic hay.

Hay exports remain strong

With March numbers in the books, first-quarter 2022 U.S. alfalfa hay exports are just slightly behind last year’s record-setting pace.

March alfalfa hay exports hit a five-month high at 251,719 metric tons (MT). Shipments to Saudi Arabia hit an 11-month high at 17,603 MT, offsetting a slight decline in sales to China. Nonetheless, China remained the leading market for alfalfa exports at 116,382 MT, about 46% of the month’s total. At 67,717 MT, Japan was the second-leading market and represented 27% of the month’s total. Alfalfa hay exports were valued at about $393 per ton, down $6 from February.

At 123,974 MT, March exports of other hay also rebounded. Sales to Japan were estimated at 80,636 MT, representing 65% of the U.S. total for the month. Sales to South Korea at 24,8804 MT represented 20% of March sales. Other hay exports were valued at about $390 per MT, down about $5 from February.

Looking ahead, Christy Mastin, sales representative with Eckenberg Farms, Mattawa, Washington, expects April export numbers to be strong, but some shipping delays and canceled sailings were being reported for May.

All shippers and customers were concerned about the contract negotiations between the Pacific Maritime Association and the International Longshore and Warehouse Union.

Additionally, with high prices and new-crop hay supplies still unknown, exporters are concerned currency exchange rates will make U.S. products too expensive for foreign markets.

Regional markets

Here’s a snapshot of regional markets during the first week of May:

- Southwest: In Texas, demand for hay was very good as moisture deficits slowed the start of first-crop production; cutting on irrigated acreage in South Texas was underway. Price increases were attributed to higher freight rates.

In Oklahoma, moisture finally provided much-needed encouragement, but more is needed. Old-crop hay was being moved out to make room for first cuttings.

In New Mexico, hay prices were steady, and demand was very good, with supplies limited. Prices were higher due to high fertilizer and fuel costs. First cutting was underway in the south and east.

In California, trade activity and demand were good. Retail hay prices were steady. Dairy and export hay prices were steady with good demand. First cutting of alfalfa was underway in the Sacramento Valley; in Tulare County, alfalfa was being cut for silage and greenchop.

In Nevada, water levels in Lake Mead had dropped to historic low levels to end April. The reservoir, as well as the downstream Colorado River, provides water for Arizona, Nevada, California, several Native American tribes and Mexico.

- Northwest: In Montana, hay sold fully steady, but volumes were mostly light, with ranchers buying hay on an as-needed basis. Neighboring states continue to sell hay into Montana with delivered prices ranging from $305-$345 per ton. Producers are mostly cleaning up stacks and selling the tail end of their old-crop hay. New crop contracts continue to be discussed, but so far, no takers have been found. South-central and eastern Montana saw beneficial rainfall, and grass had started to green up.

In Idaho, old-crop alfalfa sold steady on light supplies; new-crop alfalfa contracts for domestic use were also steady. Market sources indicated it had been the coolest spring in seven years, putting crops behind.

In Colorado, trade activity was light on good demand for horse hay and retail markets but inactive on all other hay markets.

In Washington, cool spring temperatures had the hay crop about two weeks behind schedule, especially alfalfa. Some producers in the southern Columbia Basin were unable to harvest during the first week of May due to widespread heavy rains. Producers indicated they have multiple offers for new crop coming in.

In Wyoming, all forage products sold steady. Demand continued to be very good with livestock owners looking to buy feed. Hay producers were still on the fence regarding contracts for new-crop hay.

- Midwest: In Nebraska, all reported forages sold steady on light to moderate demand. Widespread rain arrived to end April and, combined with an upswing in temperatures, should boost the outlook for range conditions.

In Kansas, overall alfalfa hay and grass hay were mostly steady, while movement remained slow to moderate. Late frost and low rainfall delayed first cuttings of alfalfa. Reports of new-crop prices were still few and far between due concerns about the ongoing drought and increased input costs.

In South Dakota, very good demand remained for all types and qualities of hay, but supplies were limited. Rain finally arrived and temperatures warmed up, but there was still an area west and northwest of Pierre where drought conditions remained.

In Michigan, forage growth got off to a slow start. Late freeze events should not be a problem since temperatures overall this spring have remained cool.

In Missouri, crop progress remained well behind schedule. Areas in south-central and southwest reported over 5 inches of rain, putting many fields under water. There had been no early haying done as below-average temperatures continue to prevent much grass or hay growth, but the forecast indicated some sun and warmer days might finally be a turning point.

In Wisconsin, dairy-quality hay prices were steady, and new-crop alfalfa was slow to get started. Lower-quality hay sold in a wide range in prices.

In Iowa, market overall sold strong in all classes of hay and straw. Buyer demand was moderate.

- East: In Pennsylvania, alfalfa and alfalfa-grass blends sold uneven at hay auctions, with buyer attendance light to moderate and light supplies.

In Alabama, hay prices were steady with light supply and moderate demand.

Other things we’re seeing

-

Dairy: Seemingly in a race to the top, record-high milk prices surpassed record-high feed costs in March to help buffer dairy producer milk income margins. U.S. cow numbers increased for a second consecutive month and were up about 28,000 head from January but were still down about 112,000 head from the peak in May 2021.

-

Fuel: At the beginning of May, the U.S. regular gasoline retail price averaged $4.18 per gallon, about $1.29 higher than a year earlier; the U.S. average on-highway diesel fuel price was $5.50 per gallon, up $2.37.

- Trucking: Flatbed prices were steady to start May, according to DAT Trendlines. The national average price was $3.42 per mile, but Progressive Forage heard reports of charges approaching $5 per mile, especially in the Upper Midwest. There are also reports that flatbeds are becoming less desirable among truckers because it’s more difficult to get backhauls and tarping is inconvenient. Some producers were utilizing “van” or enclosed trucks for hauling hay, generally requiring higher-quality loading and unloading docks.