Even though 2022 forages are in storage or on the market, there’s no shortage of factors facing growers and buyers as winter approaches. From transportation availability and cost to volatile fertilizer prices, higher interest rates and weather forecasts, here’s a look at conditions entering the second week of November.

Drought conditions worsen

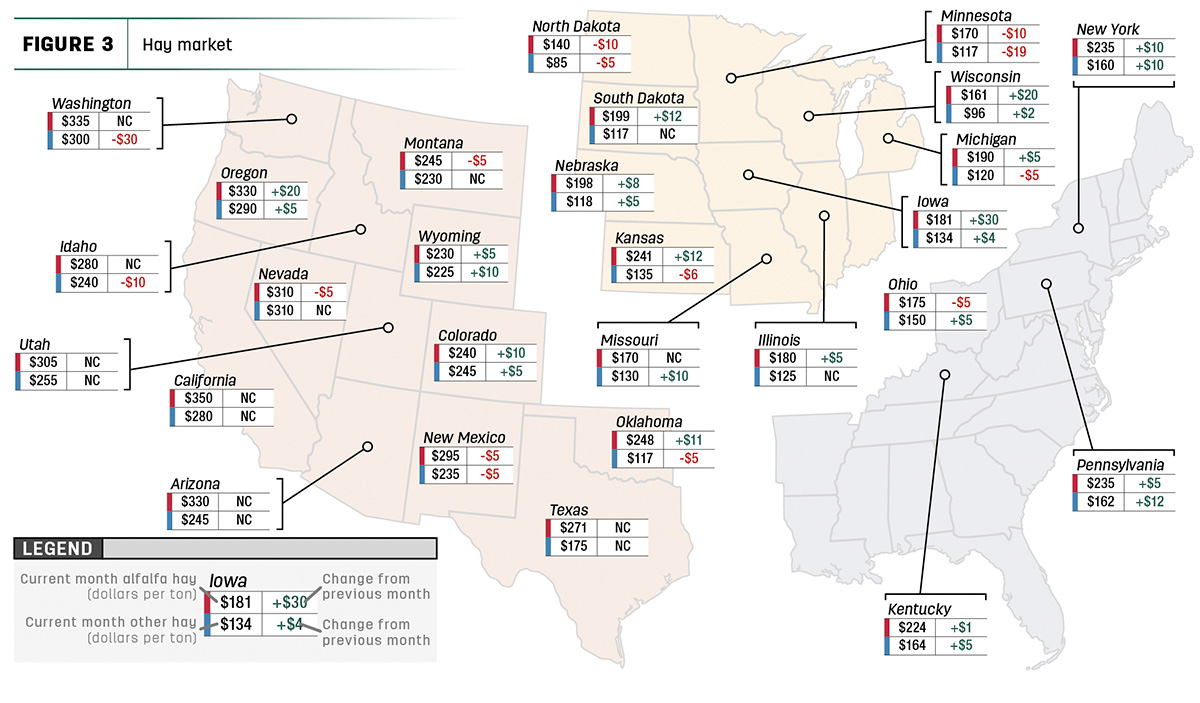

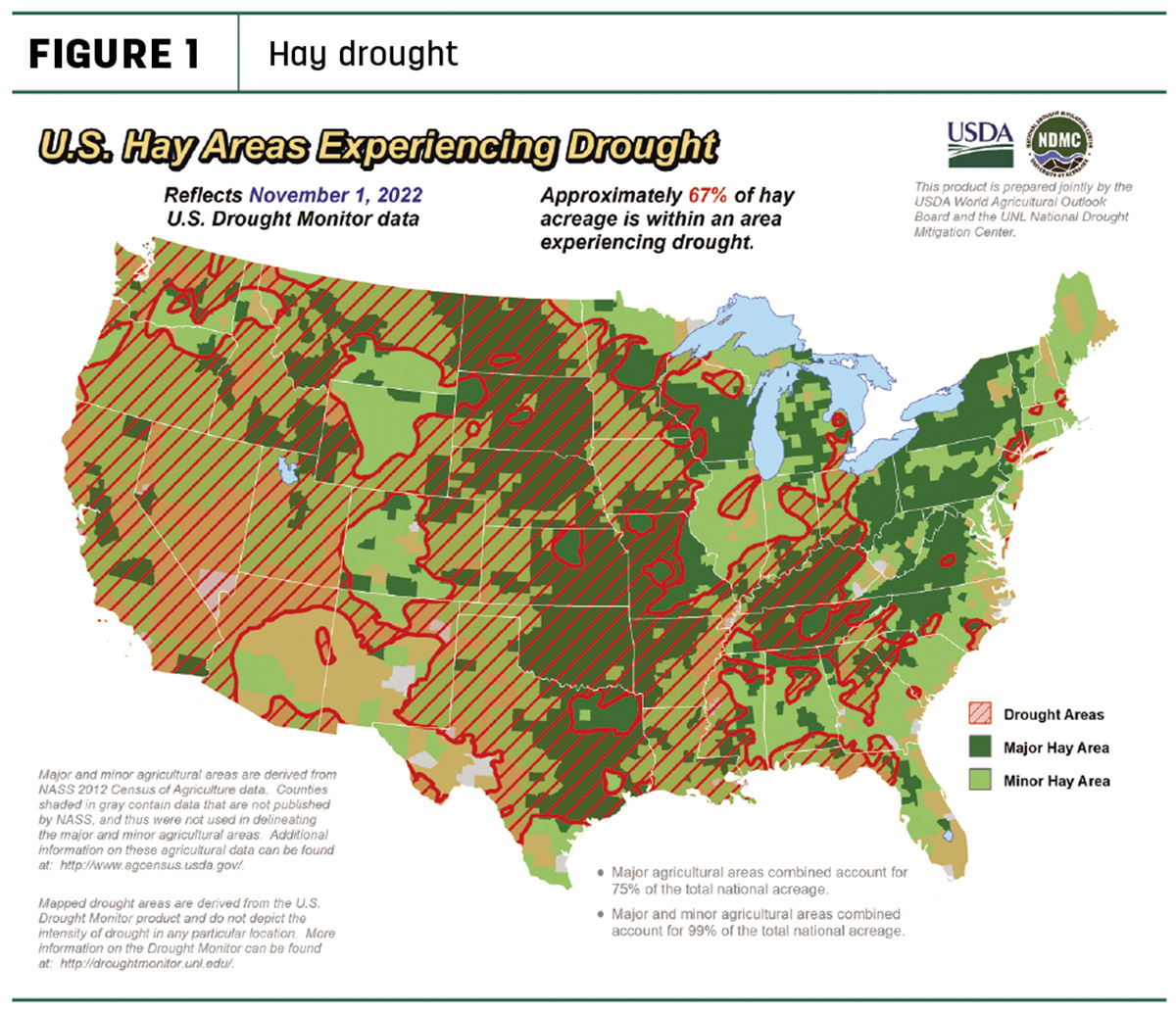

U.S. Drought Monitor maps indicate overall moisture conditions continued to worsen over the past month. As of Nov. 1, about 67% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, 12% more than a month earlier. The area of drought-impacted alfalfa acreage (Figure 2) was up another 10%, to 69%.

Low water levels in the Mississippi River and possible rail strike threaten movement of agricultural commodities, including fertilizer for next year’s growing season.

The National Oceanic and Atmospheric Administration (NOAA) predicts a third consecutive winter affected by La Nina, driving warmer-than-average temperatures for the Southwest and along the Gulf Coast and Eastern Seaboard.

Starting in December 2022 through February 2023, NOAA predicts drier-than-average conditions across the South with wetter-than-average conditions for areas of the Ohio Valley, Great Lakes, northern Rockies and Pacific Northwest.

Hay prices tracked

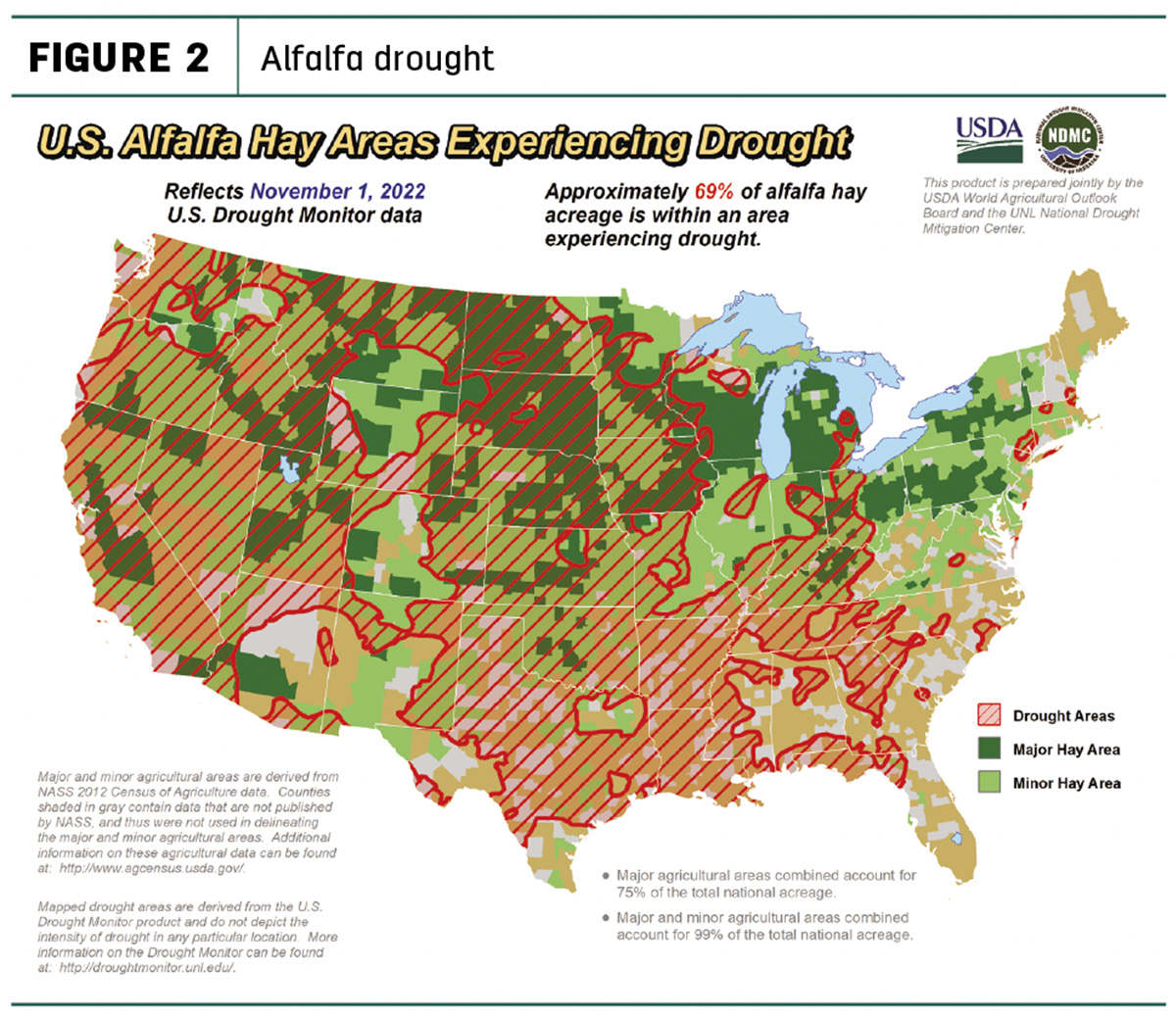

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Dairy hay

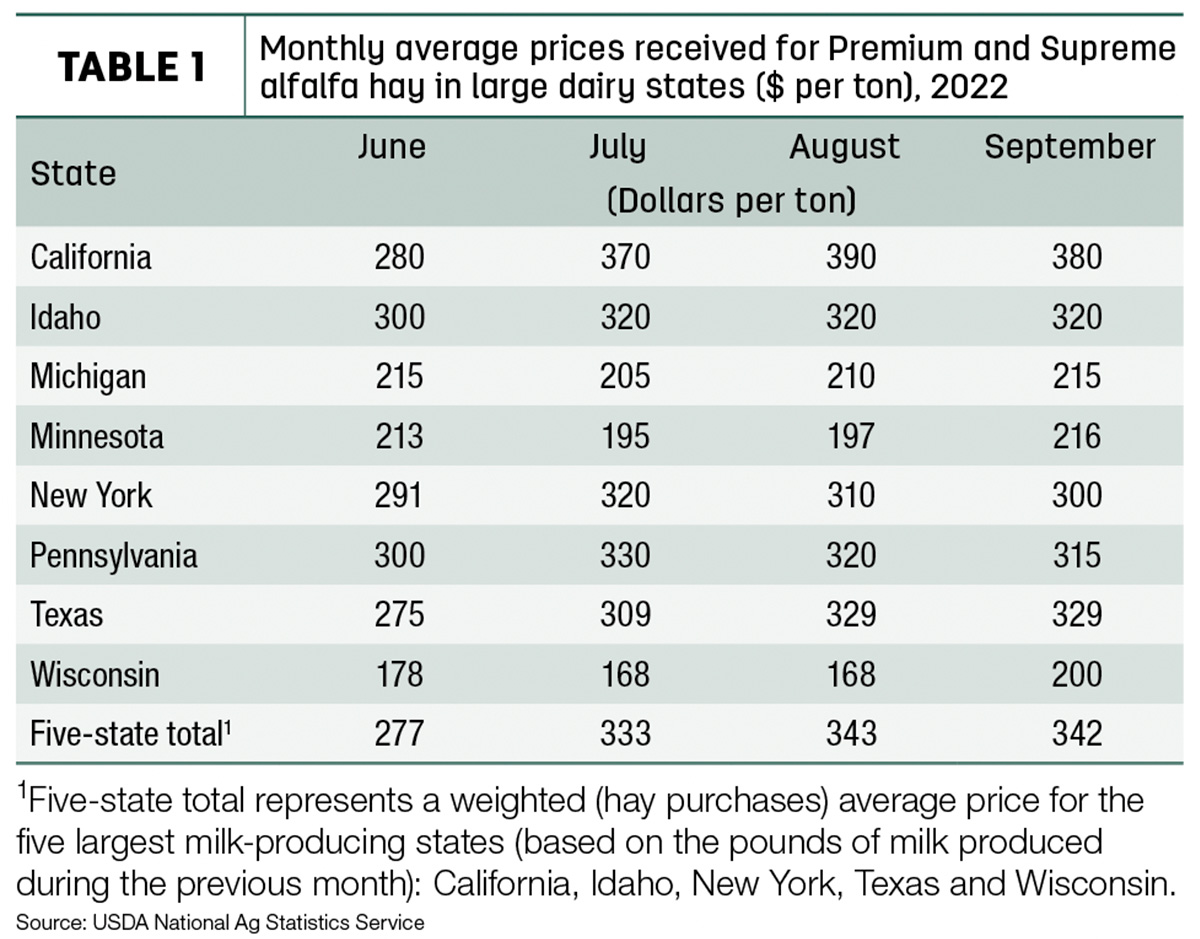

The average price for Premium and Supreme alfalfa hay in the top milk-producing states declined $1 from August’s record high to $342 per ton (Table 1), but it’s still about $92 more than a year ago. Higher prices in Michigan, Minnesota and Wisconsin offset small declines in California, New York and Pennsylvania.

Alfalfa

The U.S. average price for all alfalfa hay rose $2 in September to $277 per ton. Prices increased in 14 of 27 major forage states, led by a $30 increase in Iowa and $20 in Oregon and Wisconsin. Prices softened in six states, with Minnesota and North Dakota leading decliners. Year-over-year prices were up $100 or more in Arizona, Washington and California.

The spread between U.S. average alfalfa and other hay prices widened in September to $103 per ton.

Other hay

At $174 per ton, the September 2022 U.S. average price for other hay was down $9 per ton from August. Prices increased in 11 of 27 major hay-producing states, with largest month-to-month increases in Pennsylvania, Missouri, New York and Wyoming, up $10-$12 per ton. Average prices for other hay remained $70 or more higher than a year ago in Nevada, California, Oregon and Utah.

The high value of the U.S. dollar makes exporting hay difficult due to the exchange rate.

Alfalfa exports slip from August’s record

At 248,209 metric tons (MT), September alfalfa hay exports to foreign markets dropped from August’s record high. Monthly exports were down nearly 90,000 MT from the month before, with most of the decline attributed to lower sales to China.

At 164,821 MT, Chinese purchases of alfalfa hay were down about 63,000 MT from August. Nonetheless, sales to China represented 66% of all alfalfa hay exports in September. At 23,087 MT, sales to Japan fell another 9,366 MT from August’s seven-year low and represented just 9% of the month’s total.

Demand for U.S. alfalfa continued to show up in related categories. At 13,450 MT, September exports of dehydrated alfalfa cubes were the highest in 23 months, with a large increase in shipments to the United Arab Emirates. Monthly shipments of sun-dried alfalfa meal were the third highest of the year, thanks to stronger sales to Japan.

Export volume for other hay again continued to weaken. Foreign sales totaled 76,847 MT, the lowest monthly total since at least 2005. At 39,911 MT, September sales to Japan represented about 52% of the monthly total, but the volume was the lowest since at least 2013. September sales of other hay to South Korea were the third lowest of the year.

Regional markets

Here’s a snapshot of regional markets to start November:

- Southwest: In Texas, hay prices in October were steady to firm in all regions. Hay demand is mostly moderate to good.

In Oklahoma, local hay supplies were tight, and more hay was moving in from out of state.

In New Mexico, alfalfa hay prices were steady in active trading.

In California, trade activity and demand were moderate. Retail hay demand was good with tight supplies; export and dairy hay demand was moderate.

- Northwest: In Montana, heavy supplies continue to enter the state from North and South Dakota and Canada. This has allowed ranchers to be more selective as they buy hay for winter needs. Hay producers dropped asking prices in recent weeks, with prices in central Montana taking the biggest hit due to lighter demand.

In Idaho, all grades of alfalfa sold steady in a light test and light-to-moderate demand. Trade remains slow as most available supplies have been spoken for.

In Colorado, trade activity was moderate on very good demand for horse hay. Feedlot hay trades were light with light-to-moderate demand.

In the Columbia Basin, all grades of domestic and retail alfalfa sold steady in a light test. Trade remains slow as most available supplies have already been contracted.

In Wyoming, demand remains good for all classes and types of hay. Alfalfa on the eastern side of the state sold steady to $10 higher; all other hay sales across the state were steady.

- Midwest: In Nebraska, demand was good for all available forage. The bulk of the hay stayed within the trade area, with a few loads of square bales heading out of state. Several producers are baling cornstalks and any other forage that can be ground into livestock feed rations.

In Kansas, prices were mostly steady, and demand remained strong as supplies continued to dwindle. Yields of late-cutting alfalfa were light, and lots of corn and milo stalks were baled as feedyards were trying to stretch alfalfa supplies.

In South Dakota, alfalfa hay sold steady with very good demand for all classes of hay. Unseasonably warm weather meant beef cows were still grazing without need for supplemental feed. Many cornstalk bales were made to stretch winter feed supplies.

In Missouri, the supply of hay was light to moderate, demand was moderate, and prices were mostly steady.

In Iowa, buyer demand was moderate on a moderate supply. Alfalfa-grass mix hay sold steady; orchardgrass-timothy sold steady with a weak undertone.

In Wisconsin, prices for dairy-quality hay were steady. Overall forage supplies are good, but prices may change if more hay moves west.

- East: In Pennsylvania, alfalfa sold steady; alfalfa-grass mix sold steady with a strong undertone. Orchardgrass and orchard-timothy sold steady.

In Alabama, hay prices were fully steady, with moderate supply and demand.

Other things we’re seeing

- Dairy: September’s U.S. average milk price rose a dime while average feed costs fell slightly, providing a small boost to monthly dairy producer milk income margins calculated under the Dairy Margin Coverage (DMC) program.

September 2022 U.S. milk production was up moderately from a year ago, when cow numbers were in steep decline. Preliminary September 2022 U.S. cow numbers were estimated at 9.411 million head, up 6,000 from a year ago but 2,000 less than August 2022. Texas led all states in year-over-year growth in September 2022, up 30,000 head from a year ago, followed by South Dakota, (+25,000), Iowa (+12,000) and Georgia (+10,000). Declines were again heaviest in New Mexico and Michigan, down 16,000 and 11,000 head, respectively.

-

Cattle: The USDA’s 2022 beef production estimate was raised for the second half of the year with higher expected slaughter and heavier carcass weights. For 2023, the beef production forecast was raised, reflecting higher expected placements in late 2022, which will be marketed in the first half of 2023. Fed cattle price forecasts for 2022 were raised on current strength in demand. At about $143 per hundredweight (cwt), annual average prices would be about $21 higher than 2021.

- Fuel: The diesel market is tight and will likely remain so throughout the end of 2022, notes Veronica Nigh, senior economist with the American Farm Bureau Federation. The underlying increase in demand shows no sign of letting up, while it’s anyone’s guess when Russia’s actions in Ukraine will come to an end. According to the U.S. Energy Information Administration (EIA) on Oct. 31, the average U.S. on-highway price of diesel was $5.32 per gallon, 49 cents per gallon below peak on June 20 but $1.59 above October 2021.

Both supply and demand issues are driving prices. U.S. refining capacity has declined in the last two years, and several plants that closed at the onset of the coronavirus pandemic are being converted to produce cleaner-burning renewable diesel, but those facilities are not yet online. Stocks of diesel fuel are currently down 17% relative to a year ago.

-

Interest rates: The Federal Reserve approved yet another 0.75% increase in the primary credit rate to 4%. It’s the fourth straight 0.75 percentage increase, pushing the rate to the highest level in nearly 15 years. The Fed also signaled another, perhaps smaller, increase is possible when it meets on Dec. 13-14.

-

Rail strike: The prospect of a rail workers’ strike is looming larger as we near the holiday season, adding threats of agricultural supply chain disruptions, according to the National Milk Producers Federation (NMPF). A work stoppage could start as soon as Nov. 19 unless 12 rail unions approve their contracts; two had already voted no as of Progressive Forage’s deadline.