It may be hard to believe, but in the midst of a lengthy stretch of record-high temperatures, hay growers in some areas are turning attention to the arrival of frost. The Western drought sent regional hay prices higher, especially for dairy-quality hay. Demand from China pushed alfalfa exports to an 11-month high, but global sales of other hay continued to slump.

Drought improvement limited

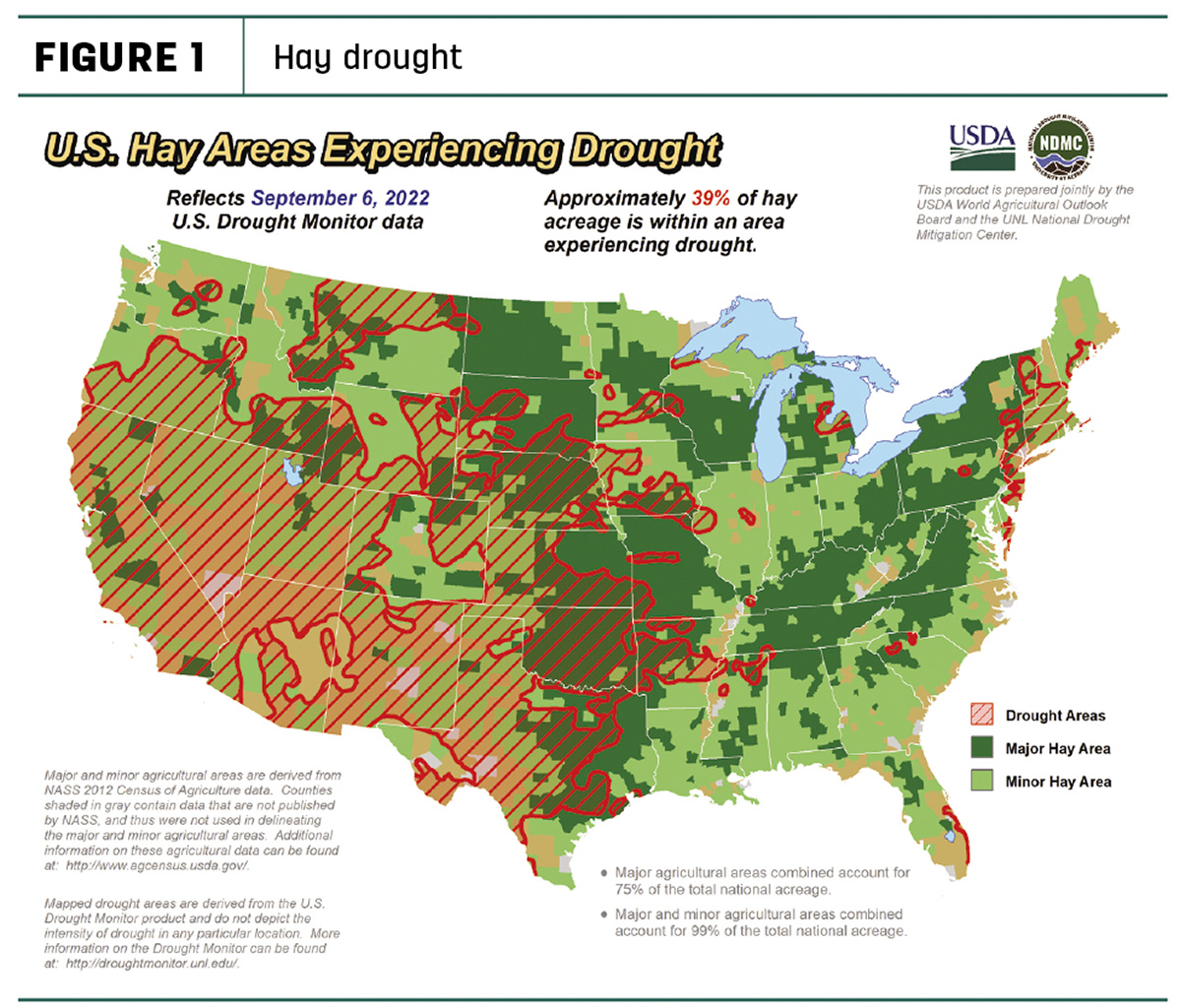

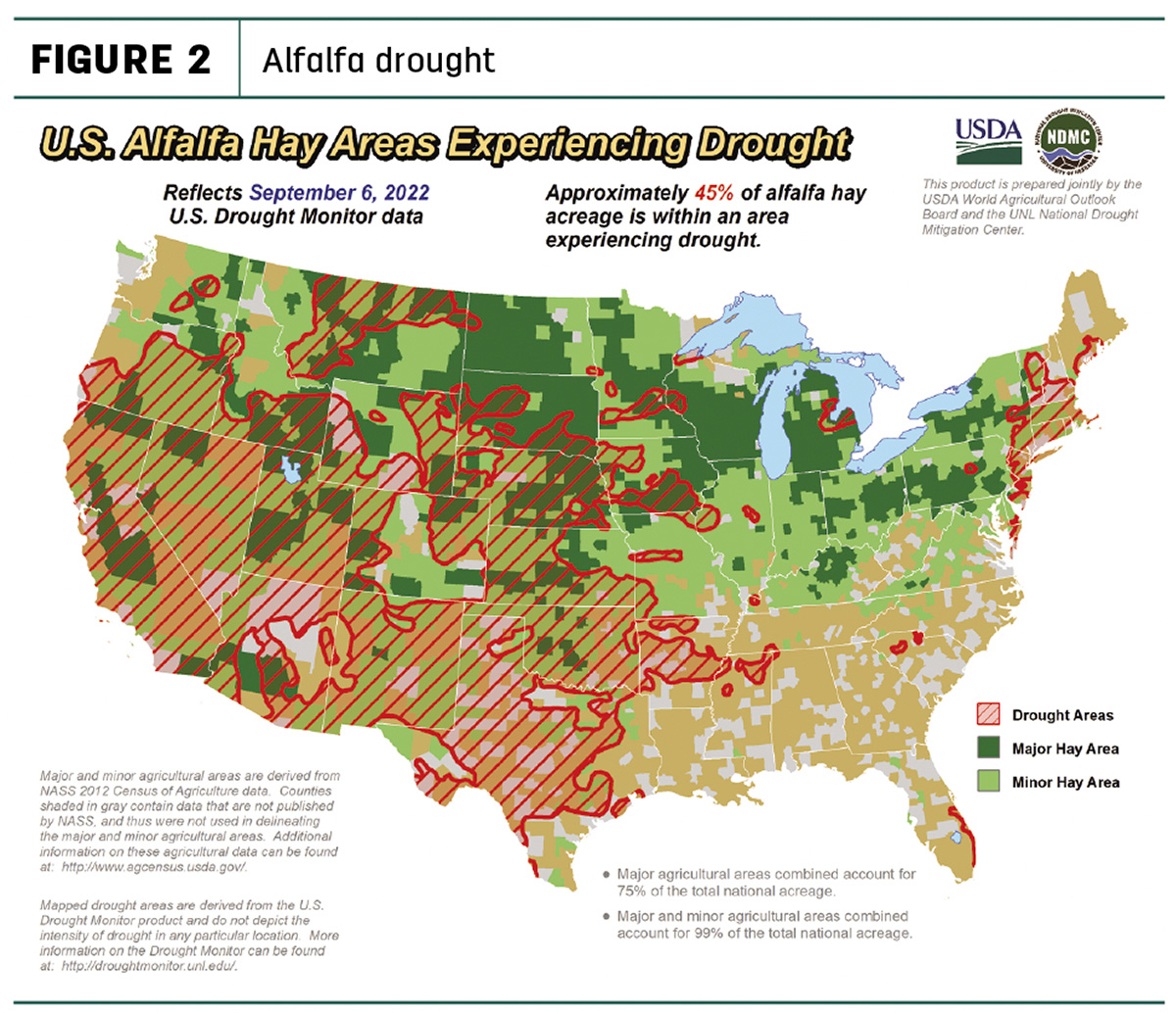

While drought intensity increased in some areas, U.S. Drought Monitor maps indicate overall moisture conditions improved over the past month, with most of the improvement in Missouri and parts of Montana. As of Sept. 6, about 39% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, 8% less than a month earlier. The area of drought-impacted alfalfa acreage (Figure 2) was unchanged at 45%.

Hay prices tracked

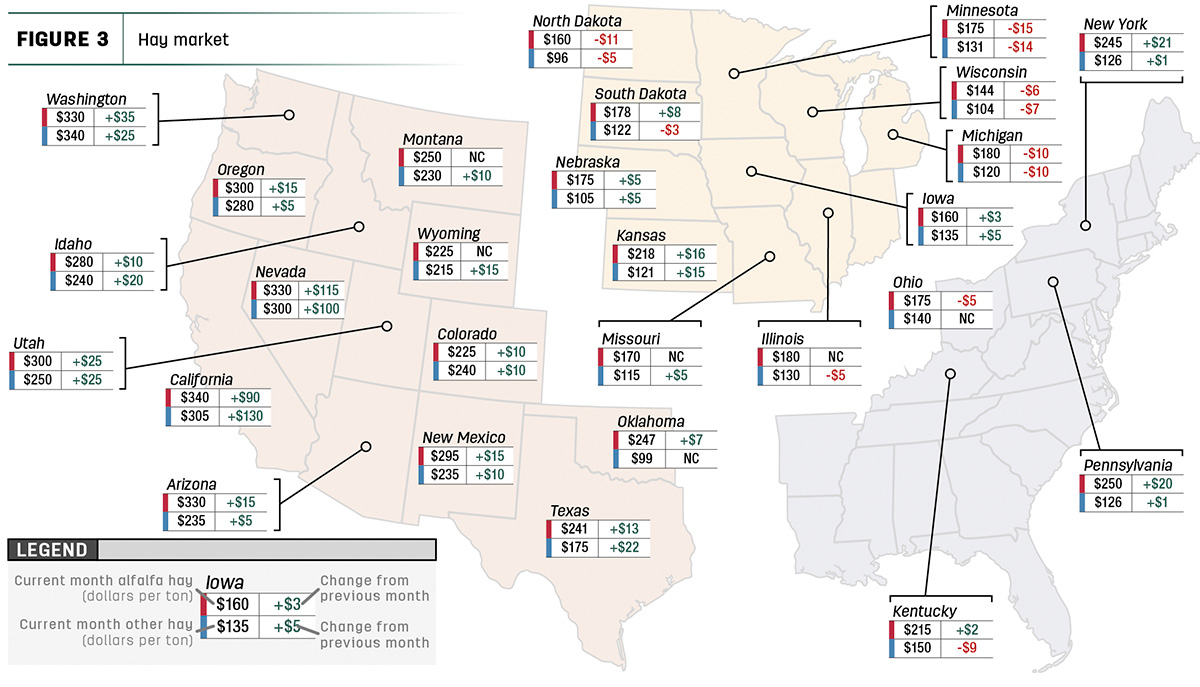

With Western surges in prices for both alfalfa and other hay, the U.S. average alfalfa price was $112 more than the average for other hay, likely an all-time record.

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Dairy hay

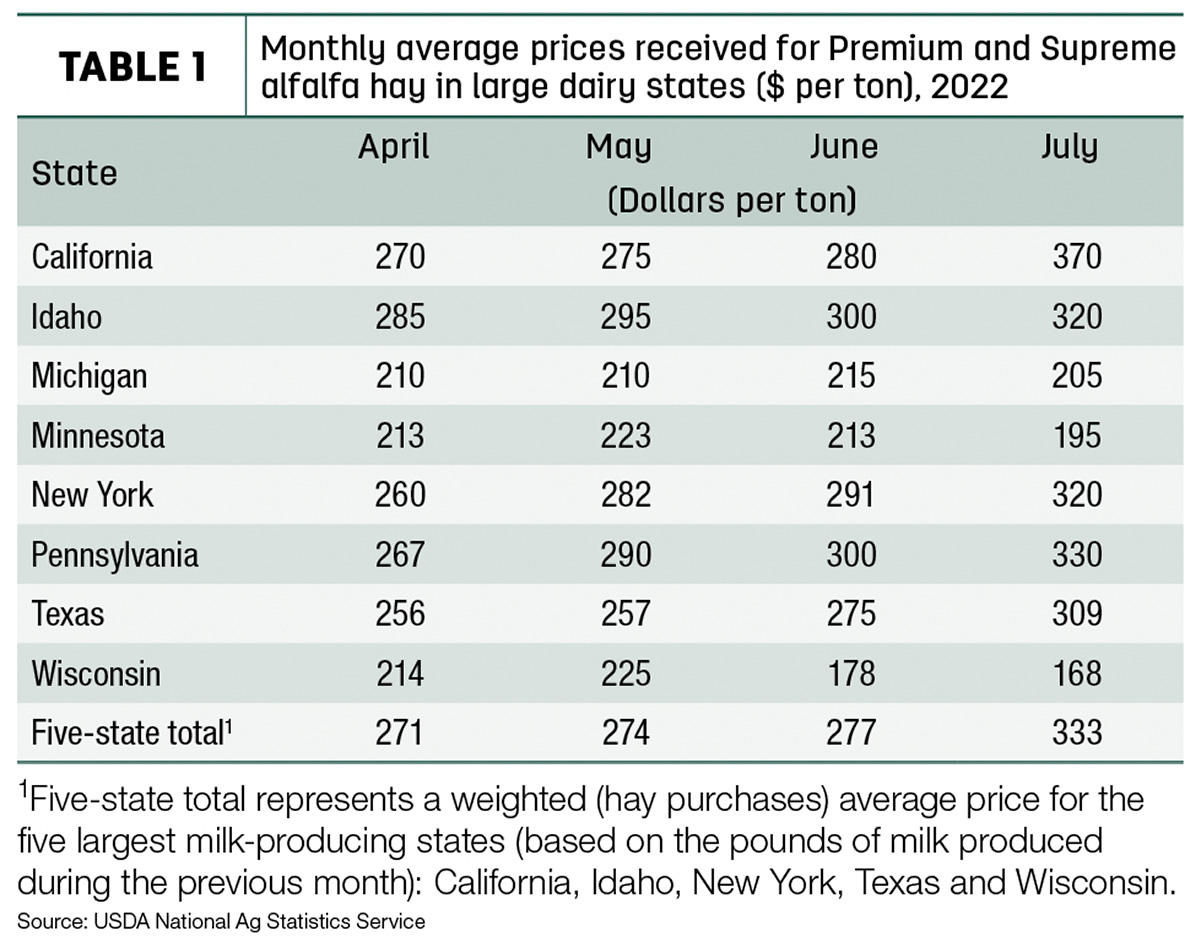

Pressured by skyrocketing prices in the drought-impacted West, July average prices for Premium and Supreme alfalfa hay in the top milk-producing states jumped $56 from June to $333 per ton (Table 1) and are up $101 per ton from a year ago.

Alfalfa

The U.S. average price for all alfalfa hay rose $31 in July to $276 per ton. Prices increased in 18 of 27 major forage states, led by Nevada and California. Prices declined in just five states, primarily in the Upper Midwest. Year-over-year price changes remained large in the West: Arizona, Nevada, Washington and California alfalfa hay prices were up $110 or more per ton compared to July 2021.

Other hay

At $164 per ton, the July 2022 U.S. average price for other hay was up $18 per ton compared to June. Prices increased in 18 of 27 major hay-producing states, with largest month-to-month increases in California and Nevada, up $130 and $100 per ton, respectively. Average prices for other hay remain $80 and $115 per ton higher than a year ago in California, Utah, Washington, Nevada, Oregon and Idaho.

Alfalfa exports higher

At 267,127 metric tons (MT), July alfalfa hay exports were up 65,000 MT from June and at an 11-month high. After slumping slightly in June, sales to China also surged to an 11-month high at 176,154 MT in July, representing 66% of total alfalfa hay exports during the month.

With the exception of the United Arab Emirates, July alfalfa hay exports to other major markets were steady to slightly lower. Sales to Japan at 34,098 MT were the lowest since August 2015.

Through July, 2022 alfalfa hay exports totaled 1.63 million MT, on pace to be the third-highest annual total on record, slightly behind export totals in 2017 and 2020. Alfalfa hay exports were valued at about $351 per ton, down about $39 from June.

July sales featured another strong month in shipments of sun-dried alfalfa meal, all to Japan. At 9,593 MT, monthly exports were just 5 MT under June’s all-time record high.

Global sales of other hay told a different story, according to Christy Mastin, sales representative with Eckenberg Farms, Mattawa, Washington. At 83,184 MT, July exports fell to their lowest level since at least 2005, according to the USDA and Progressive Forage records. Shipments to the two largest markets, Japan and South Korea, were down due to stronger domestic inventories and disadvantageous currency exchange rates. July sales to Japan totaled 48,099 MT, the lowest volume dating back to at least 2013. Sales to South Korea at 19,956 MT were the lowest since January.

Reduced availability of U.S. timothy due to consecutive years of lower harvests is also a factor, making it difficult to compete with adequate supplies of good-quality Canadian timothy and better exchange rates, Mastin said.

Through July, 2022 other hay exports totaled 788,818 MT, on pace to be the lowest annual total since 2018. Other hay exports were valued at about $392 per MT in July, steady with June.

Regional markets

Here’s a snapshot of regional markets to start September:

- Southwest: In Texas, hay prices ended August firm in all regions. Hay demand remained good on moderate-to-active trading activity. Pastures recovered across much of the state due to recent rains.

In Oklahoma, hay supplies continued to tighten while demand and prices rose. Recent rains helped but may have been too late to see another cutting of hay.

In New Mexico, alfalfa hay prices were steady with supplies tight for top-quality hay. The southern and eastern parts of the state were finished with the fifth cutting; sixth cutting was underway in some areas. Some hay producers reported an abundance of “black hay.”

In California, trade activity and demand were moderate to good. Retail hay prices were steady with tight supplies.

- Northwest: In Montana, larger supplies and lower usage weighed on the market, as most ranchers had fewer cows and calves to feed going into winter. This, coupled with lower prices from Western buyers and exporters, has slowed sales. Buyers are doing more shopping this year and buying with less urgency. Sales to Washington and Idaho have slowed as prices in those states have slid lower.

In Idaho, trade remained moderate with more pressure on rained-on supplies. Most sales were moving out of state. Demand remains good for alfalfa with no defects, even with low relative feed values.

In Colorado, trade activity was moderate on very good demand for horse hay. Abnormally high temperatures were expected to impact crop yields, pasture conditions and the need for supplemental feeding. Stored feed supplies were rated 25% very short, 22% short, 50% adequate and 3% surplus.

In the Columbia Basin, all grades of alfalfa and timothy sold steady in a light test. Relative feed values remain low due to weather conditions during the growing season.

In Washington, harvest conditions improved, but shifting winds threatened to bring wildfire smoke into the area.

In Wyoming, most hay was staying in the local trade market, with some squares going to out-of-state buyers; prices were fully steady.

- Midwest: In Nebraska, prices for all categories of hay were steady to fully steady; dehydrated alfalfa pellets sold $20 higher. Demand was good for all available forages. Southern Plains buyers looked to Nebraska for alfalfa, while hay moved into the state from the north.

In Kansas, the hay market remained mostly steady on good demand. Much-needed moisture provided little in the way of drought relief.

In South Dakota, demand was good for all types and qualities of hay. Third-cutting tonnage was limited due to the hot, dry conditions.

In Missouri, hay harvest picked up after helpful rains as producers sought to make hay before grain harvest. Counties along the Kansas border remained dry, but elsewhere, hay sales slowed as producers evaluated fall pasture growth.

In Wisconsin, prices for dairy-quality hay were steady to strong, with lower-quality hay discounted.

- East: In Pennsylvania, alfalfa and alfalfa-grass blends sold unevenly steady on light tests; large bales of grass hay sold weaker.

In Alabama, hay prices were fully steady, with moderate supply and demand.

Other things we’re seeing

- Dairy: The big jump in hay prices contributed to sharply lower monthly dairy producer milk income margins calculated under the Dairy Margin Coverage (DMC) program. July feedstuff prices yielded an average DMC total feed cost of $15.78 per hundredweight (cwt) of milk sold, an all-time record high. The July 2022 announced U.S. average milk price fell $1.20 from June to $25.70 per cwt, the lowest since February.

Based on July 2022 USDA estimates, Texas led all states in year-over-year growth in cow numbers, up 25,000 head from July 2021, followed by South Dakota, up 20,000 head, and Georgia, up 10,000 head. Compared to a year earlier, cow number declines were again heaviest in New Mexico and Michigan, down 32,000 and 19,900 head, respectively.

-

Cattle: Drought conditions, particularly in the West and southern Plains, continue to impact marketing schedules. January-July beef cow slaughter was up 281,000 head compared to the same period a year earlier. The growing number of heifers being removed from pasture and placed on feed is further reducing the potential size of next year’s breeding herd.

- Fuel: News regarding fuel costs continues to improve in small steps. The U.S. regular gasoline retail price averaged $3.75 per gallon, down 8 cents on the week but about 57 cents more than a year earlier. The U.S. average on-highway diesel fuel price was $5.08 per gallon, down 3 cents from a week earlier but still $1.71 more than a year ago.

According to the U.S. Energy Information Administration, the Brent crude oil spot price averages $98 per barrel in the fourth quarter of 2022 and $97 per barrel in 2023. The possibility of petroleum supply disruptions and slower-than-expected crude oil production growth continues to create the potential for higher oil prices, while the possibility of slower-than-forecast economic growth creates the potential for lower prices.

- Trucking: Flatbed prices were slightly lower in early September, according to DAT Trendlines. The national average price was $2.93 per mile, down 13 cents from August. Regionally, average prices per mile were: Southeast – $3.14, Midwest – $3.16, South – $3.13, Northeast – $2.92 and West – $2.66.