With spring and the 2023 cropping season approaching, planting decisions are starting to take shape. More producers are starting the year in stronger financial positions, with less carryover of unpaid operating debt. However, higher interest rates, input costs and machinery prices will lead to larger operating loans. With that in mind, here’s Progressive Forage’s monthly look at hay markets and conditions entering mid-February.

Moisture conditions inching toward improvement

With moisture improvements in Nevada, Montana, Washington and Wyoming, early February U.S. Drought Monitor maps are starting to capture the impact of recent rain and snowfall in the western half of the U.S.

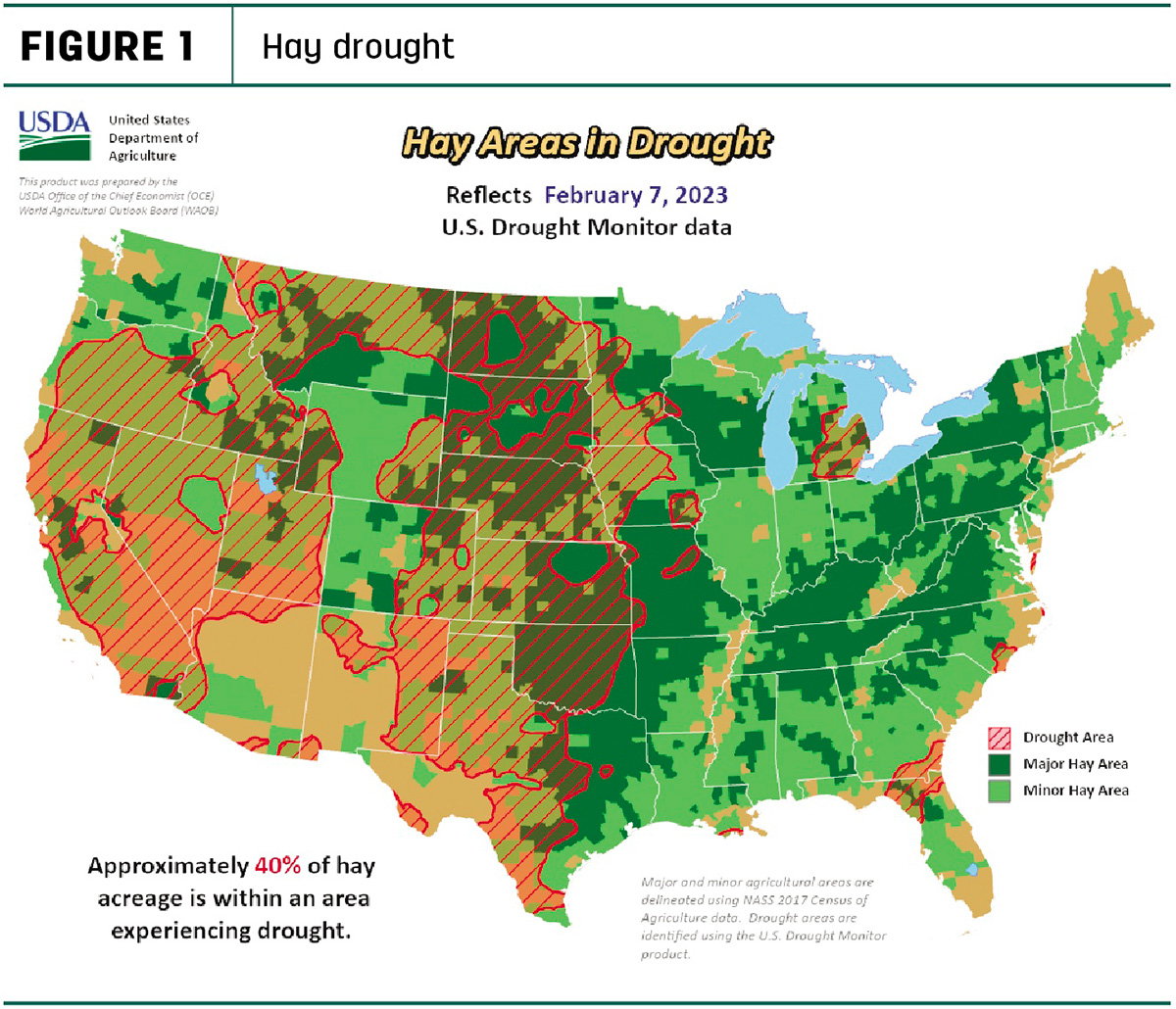

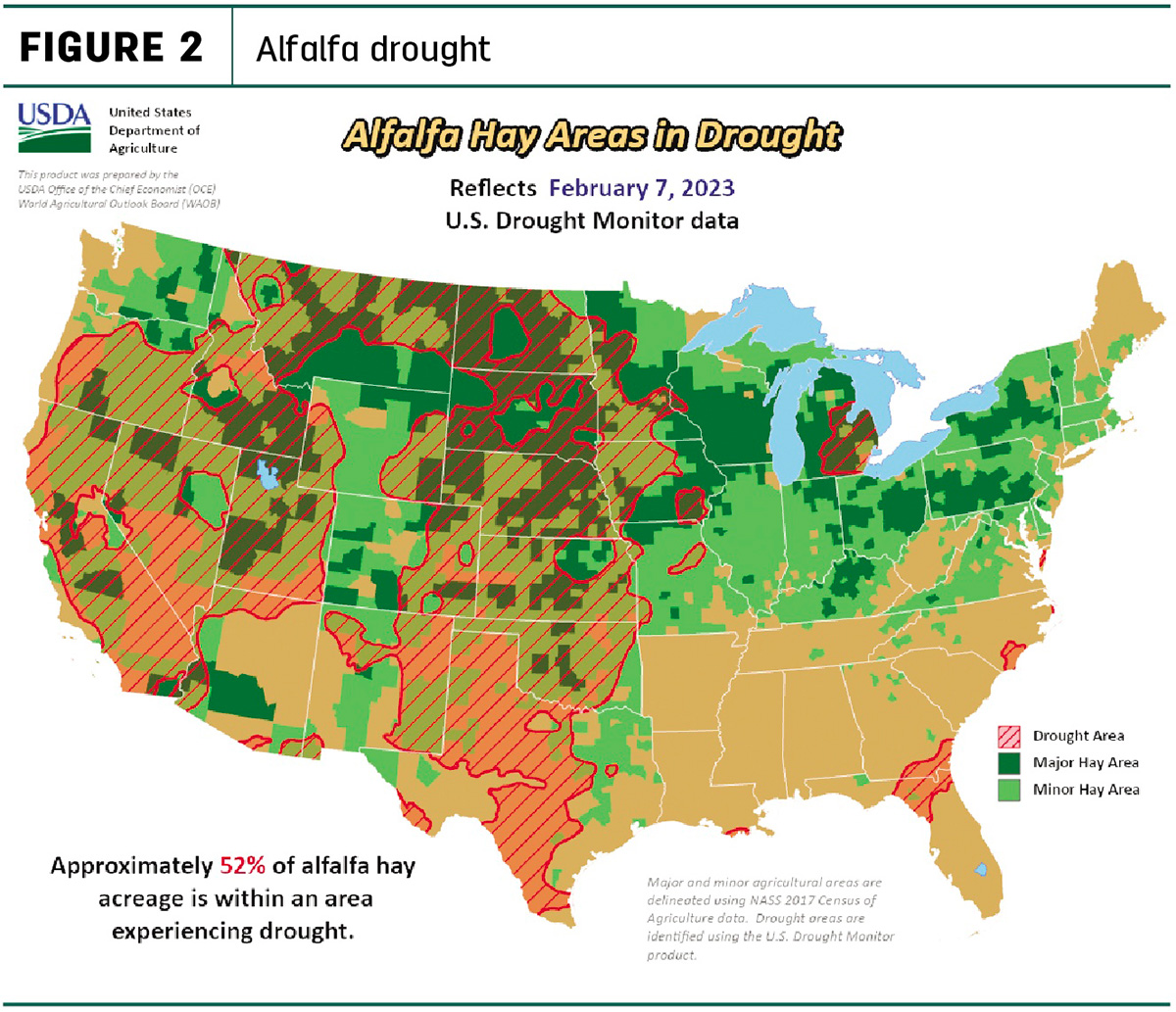

As of Feb. 7, about 40% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, 2% less than a month earlier. The area of drought-impacted alfalfa acreage (Figure 2) was down 4%, to 52%. While the improvements were small, the percentage of forage acreage considered under drought conditions nationally was the lowest since mid-September 2022.

Snow water equivalents were well above three-decade averages in central California, Nevada, Utah and northern Arizona. In the Plains, precipitation patterns were mixed. Several storms brought precipitation that was well above average, although soils are still quite dry. Snowpack was above average in the Plains but below average around the Great Lakes.

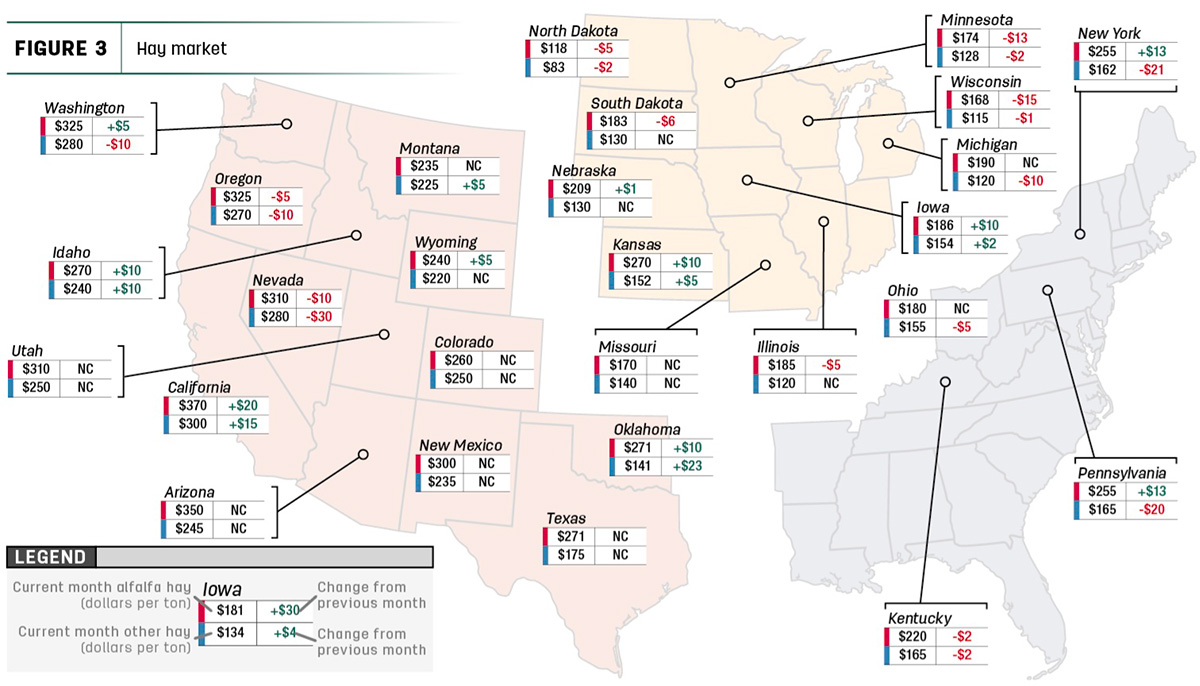

Hay prices tracked

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

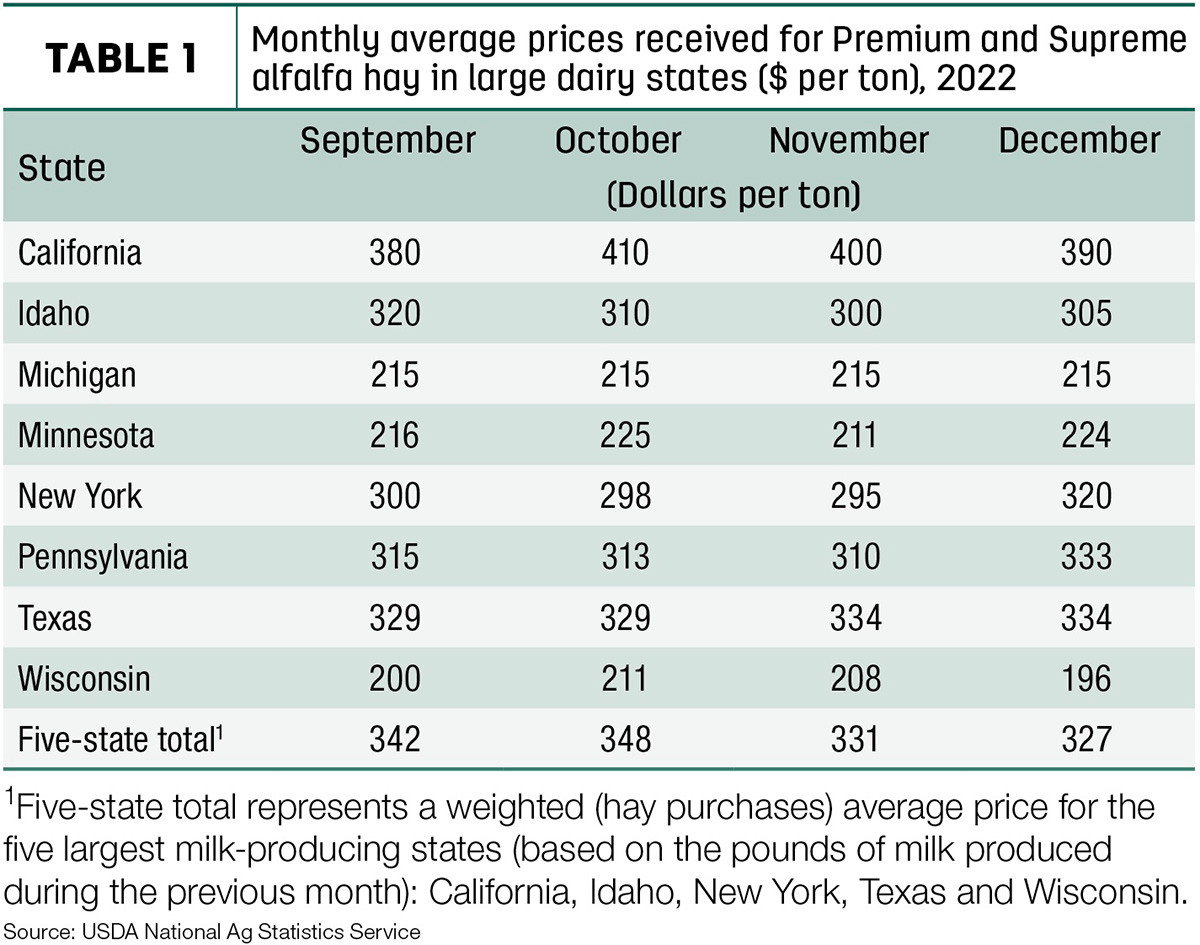

Dairy hay

At $327 per ton, December’s average price for Premium and Supreme alfalfa hay in the top milk-producing states declined $4 from November but was still $74 higher than a year ago (Table 1). December price declines in California and Wisconsin offset increases in Idaho, Minnesota, New York and Pennsylvania.

Alfalfa

The U.S. average price for all alfalfa hay rose $2 in December to $269 per ton. Prices increased in 10 of 27 major forage states, led by a $20 increase in California. Prices were lower in eight states, with Minnesota and Wisconsin down $13 to $15. Year-over-year prices were up $100 or more in Arizona and California.

The spread between U.S. average alfalfa and other hay prices rose to about $92 per ton in December and also averaged $92 for the year.

Other hay

At $177 per ton, the December 2022 U.S. average price for other hay was down $5 per ton from November. Prices increased in just six of 27 major hay-producing states, with largest month-to-month increases in Oklahoma, California and Idaho. December average prices for other hay were $95 more than a year ago in California and up $22 nationally.

Hay exports end year weaker

Easing logistical problems and strong demand from China supported alfalfa hay exports all year, but a weak December left 2022 alfalfa hay export volumes below 2021’s record high.

December 2022 exports of alfalfa hay were estimated at 189,265 MT, the lowest monthly total since January 2021. At 100,013 MT, sales to China were the lowest since January 2021. At 2.847 million MT, total 2022 alfalfa hay exports came in about 15,000 MT less than the year before. China was the destination for about 57% of all U.S. alfalfa hay exports during the year, topping 1.63 million MT. Exports of alfalfa hay peaked in August at more than 337,100 MT and averaged about 237,250 MT per month.

Exports of other hay continued to soften all year, with December’s total at just 70,640 MT, the lowest monthly total since at least 2005. Sales to the major markets of Japan and South Korea were weaker. With the annual total of just under 1.2 million MT, it was also the lowest volume in at least 17 years. Japan maintained its spot as the top market, taking about 59% of other hay shipments during the year, followed by South Korea, at 24%. Monthly exports of other hay peaked in March-May and averaged about 99,590 MT per month, down nearly 17,000 MT from 2021.

Regional markets

- Southwest: In Texas, portions of the Panhandle, west, central and northern regions received some much-needed precipitation. Hay movement remained steady as supplemental feeding continued. Most cattle producers culled herds deeper than usual to reduce the number of mouths they must feed through winter.

In Oklahoma, hay trade had picked up due to sleet and freezing weather.

In California, first cutting of alfalfa was underway in the south. Retail hay demand was good with steady prices; export and dairy hay activity was slower based on demand.

- Northwest: In Montana, demand was good to very good on limited offerings. Hay usage was due to extremely cold and snowy conditions. With historically high prices, ranchers bought hay on an as-need basis.

In Idaho, best demand was for high-testing hay, but feedlots and dairies continued to add straw to rations to lower their feed costs.

In Colorado, activity was mostly light on good demand for horse hay.

In the Columbia Basin, retail demand remained good, export shipments slowed, and domestic markets were being driven by falling milk prices. Demand remained good for high-quality small bale timothy.

In Wyoming, with many areas of the state covered in snow, demand and buyer inquiries were very good. It will be nip-and-tuck if everyone will have enough feed to make it to summer grass.

- Midwest: In Nebraska, cattle producers were going through hay reserves in a rapid rate and looking for large quantities of baled forage. Some contacts were bringing hay in from states to the north. Most types sold steady to $10 to $15 higher.

In Kansas, demand remained good and prices were steady, but trade activity was slow to moderate on limited supplies. Growers were holding on to any hay that is left for their own livestock.

In South Dakota, all types and classes of hay sold steady on very good demand. Snow cover across much of the state forced more hay to be fed to beef cattle, but stacks were harder to reach with trucks. There was very good demand for cornstalk bales for grinding and blending.

In Missouri, rain and warmer temperatures resulted in mud, limiting market activity. The supply of hay was light, demand was moderate, and prices were fully steady.

In Iowa, alfalfa sold $4 to $6 higher; grass hay sold $7 to $10 higher.

In Wisconsin, prices for dairy-quality hay were steady. Overall forage supplies were good, but lower-quality hay was discounted.

- East: In Pennsylvania, alfalfa and alfalfa-grass blends sold steady to stronger; orchardgrass sold steady with a weak undertone; prairie-meadow and orchard-timothy grass sold weak. Buyer demand was moderate on a moderate supply.

In Alabama, trade was moderate on light supply and moderate demand.

Other things we’re seeing

-

Dairy: December 2022 U.S. milk production was up from a year earlier, but the pace of growth slowed, as cow numbers declined to end the year and the increase in milk output per cow remained subdued. The USDA’s semi-annual Cattle report estimated there were 9.4 million dairy cows in the U.S. to start the year, up about 25,000 from a year earlier. Dairy replacement heifers (500 pounds or more) were estimated at 4.34 million, down 2%.

-

Cattle: With more beef cows and heifers sent to slaughter in 2022, the USDA’s semi-annual Cattle report estimated there were 28.9 million beef cows in the U.S. to start 2023, down more than 1 million head from a year earlier. Beef replacement heifers (500 pounds or more) were estimated at 5.16 million, down 6%.

-

Fuel: After rising through much of January, the U.S. Energy Information Administration (EIA) said gasoline and diesel prices declined slightly to start February. The U.S. retail price for regular-grade gasoline averaged $3.44 per gallon on Feb. 6, down a nickel from the previous week and unchanged from a year earlier. The average U.S. on-highway price of diesel was $4.54 per gallon, about 8 cents per gallon below the prior week but 59 cents more than early February 2022.

-

Trucking: Spot flatbed prices were fairly steady entering the second month of the year, according to DAT Trendlines. Regionally, average spot prices per mile were: Southeast – $2.76, Midwest – $3.05, South – $2.70, Northeast – $2.74 and West – $2.35.

- Interest rates: Meeting on Jan. 31 – Feb. 1, the Federal Reserve Board raised interest rates by 0.25%, boosting the federal funds rate to 4.75%, the highest in 15 years. The increase was the eighth since last March. The board cited easing inflation for the smaller increase relative to previous rate hikes. The next meeting of the Federal Open Market Committee is scheduled for March 21-22.

As of Jan. 1, 2023, average rates on most types of variable-rate loans were already the highest since the fourth quarter of 2007 in the Dallas and Chicago Federal Reserve districts.