Dwight D. Eisenhower, supreme commander of Allied forces, once said, “In preparing for battle, I have always found that plans are useless, but planning is indispensable.”

While he was not preparing for future battles running a dairy operation, this quote from President Eisenhower applies to our industry as well. Many of us have spent numerous hours building the perfect plan, only to see it end up useless because our assumptions were wrong or some unforeseen disruption occurred in life. Thus, we conclude that planning is useless, a big waste of valuable management time. However, I think we are missing the point. Eisenhower said plans were useless, but the process of planning was indispensable.

Like Eisenhower, we need to accept that the world will not behave according to our forecasts. Prices will be worse or better, production challenges will happen, the chopper will need a major overhaul, weather will be favorable or horrible, a world leader may decide to invade a neighboring country, or even a world-wide pandemic could completely change our daily lives. So should we really be surprised that our perfect plan might miss the mark? The point is: We are missing the point of planning.

The value of planning is not the plan itself; it is the process of planning. The process of planning forces us to know our operation, know our vulnerabilities, know our strengths and, most of all, know how we might adapt when the world throws a curveball, which it surely will.

Because of the process of gathering facts for planning, Eisenhower knew his troop numbers, ships, tanks, strengths and weaknesses. He knew the personalities and capabilities of his generals. Through this knowledge, he and his generals were more prepared to make and implement contingencies when disruptions happened – and even turn disruption into opportunity.

Cash flow budget – a planning tool

Managers often agree on what they should do but sometimes lack the systematic process that “makes them do it.” It’s much easier to make time for production management – the hay is ready, rain is coming, it’s time to act. Those circumstances force management decisions. More challenging is the lack of any stick to “force” the process of planning. Planning is often that task we get to when everything else is done.

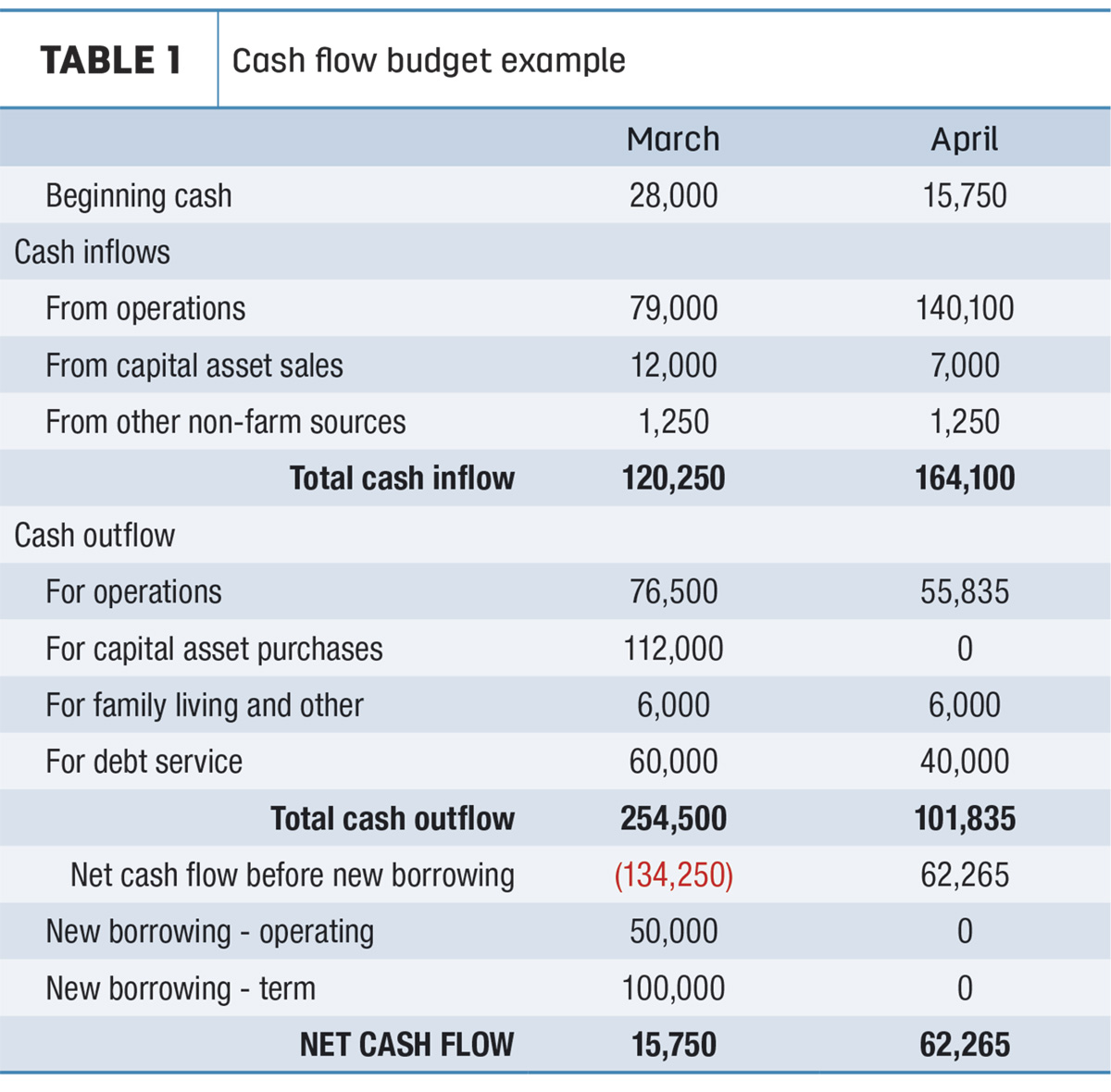

The “cash flow budget” (Table 1) is a financial tool that forces the process of planning. The cash flow budget plans the inflows and outflows of cash for the year ahead. It is a tool for managing how bills, debt service, taxes, capital asset purchases and family living will be paid.

The cash flow budget is generally separated into monthly segments. This allows the manager to plan the timing and amount of purchases, payments, draws from an operating loan or new term debt. If the spreadsheet shows a negative cash flow for some month, then the manager can plan a different timing of sales, purchases or borrowing to create a positive cash flow.

Table 1 provides a fictitious example of a cash flow budget for March and April. March begins with $28,000. After all cash inflows and outflows including debt service are accounted for, the net cash flow for March is negative $134,250. A neat little factoid about cash flows is: On a spreadsheet they can be negative, but in real life, they can never be negative. Something will happen to bring the cash flow to a minimum of zero. One way that can happen, not a smart way, is to not pay bills. Using credit cards, building accounts payable, selling market and/or capital assets are other ways the final net cash flow will be zero or higher. Or the manager can be more proactive and plan ahead by moving sales, delaying purchases or coordinating borrowing with their lender. The question is: Do you, the manager, want to be in charge of how the business will cash flow or let circumstances dictate the way?

In the case shown in Table 1, the manager knew she/he would likely have a deficit in March. They could have moved sales or delayed purchases to cover the deficit, but the manager decided the optimal course of action was to work with their lender to take out a term debt loan to cover the purchase of the new piece of machinery and took a draw from the operating loan. This need was discovered and discussed with the lender in December or January. Everyone was in the know and there were no surprises, and if some other disruption in life would have occurred, they would be ready to enact contingencies.

In April, the results were different, with a positive $62,265 cash flow, and no new borrowing was necessary. However, the manager knew that in June they would likely be deficit again, so plans were made to park the cash for quick access.

Think about what a manager must do to complete a monthly cash flow budget for the year ahead. They must estimate the number of acres of each crop, inputs that will be used, resulting yields and forecast the prices of inputs and outputs. They must estimate the number of cows, timing and cost of vet, breeding, replacements and feed rations. They must plan what capital assets will be sold, what will be purchased, when and for how much. They must plan labor needs and costs, management draws, custom hire expenses, and the list goes on. Once the cash flow budget is completed, the manager can shock test it with different production, prices and input costs. They will know where there are vulnerabilities and can be planning contingencies if needed.

If it sounds like a lot of work, it is. It was for Eisenhower, too. However, when disruption happened, he knew his strengths and vulnerabilities and could adapt quickly to turn disruption into opportunity.

For several years, my farm management students at the University of Wisconsin – Platteville conducted interviews with farm managers and asked the question, “What do successful farm managers do?” One overwhelming theme was “meticulous attention to details.” The cash flow budget is useful for many reasons, but forcing the meticulous attention to details and the process of planning is one of the most important.

The cash flow budget the manager produces in December for the year ahead may end up useless, but the process of knowledge gained, preparation and knowing where to skate to when the puck changes direction is indispensable.