We are springing into the next hay season and hoping for high yields and higher prices. With increased moisture conditions and the promise of green grass ahead, this month is truly the final month dependent on the 2023 hay season. Take a closer look at what prices and conditions are in each region in the Progressive Forage Forage Market Insights column as of April 9, 2024.

Moisture conditions on the rise

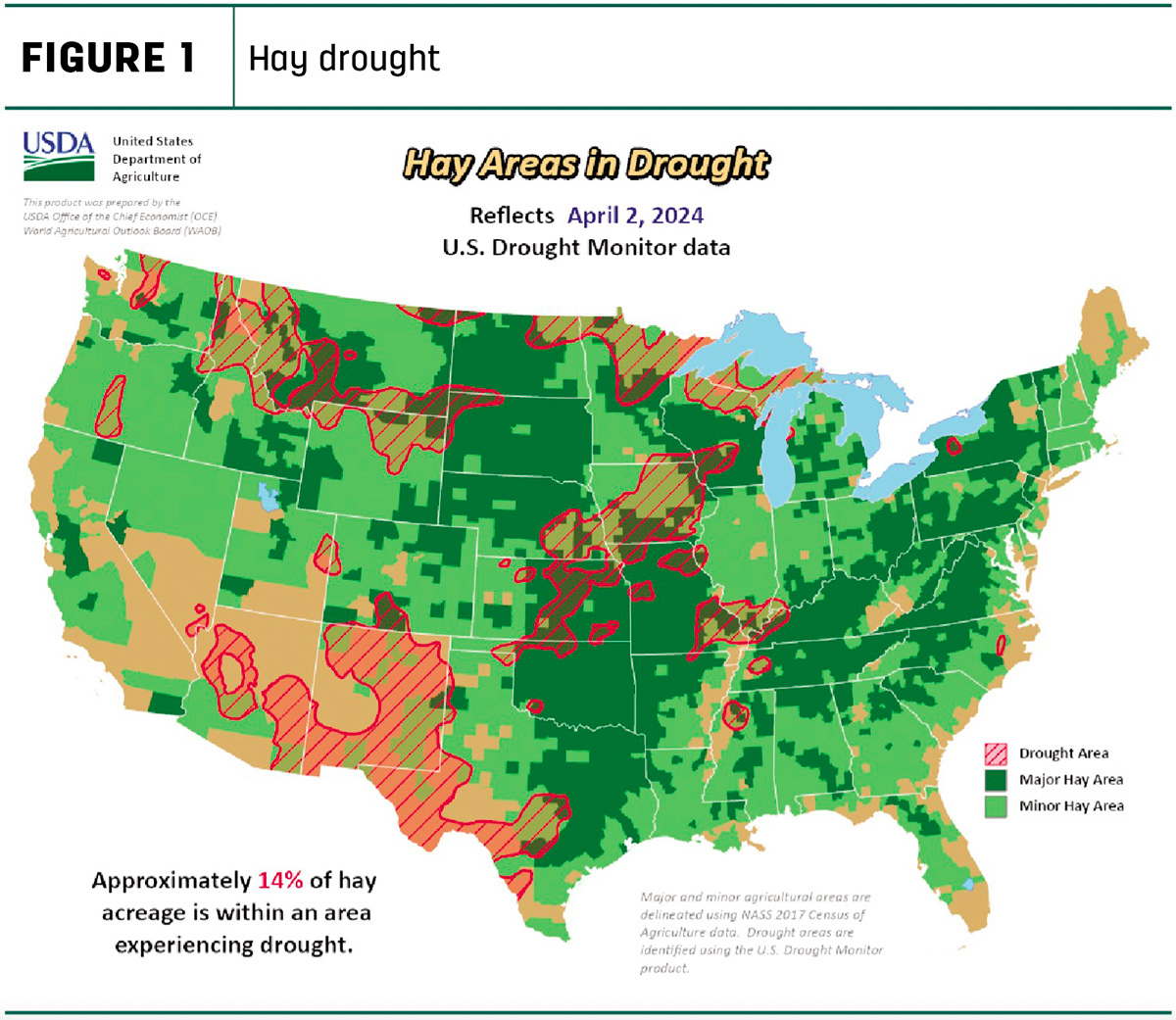

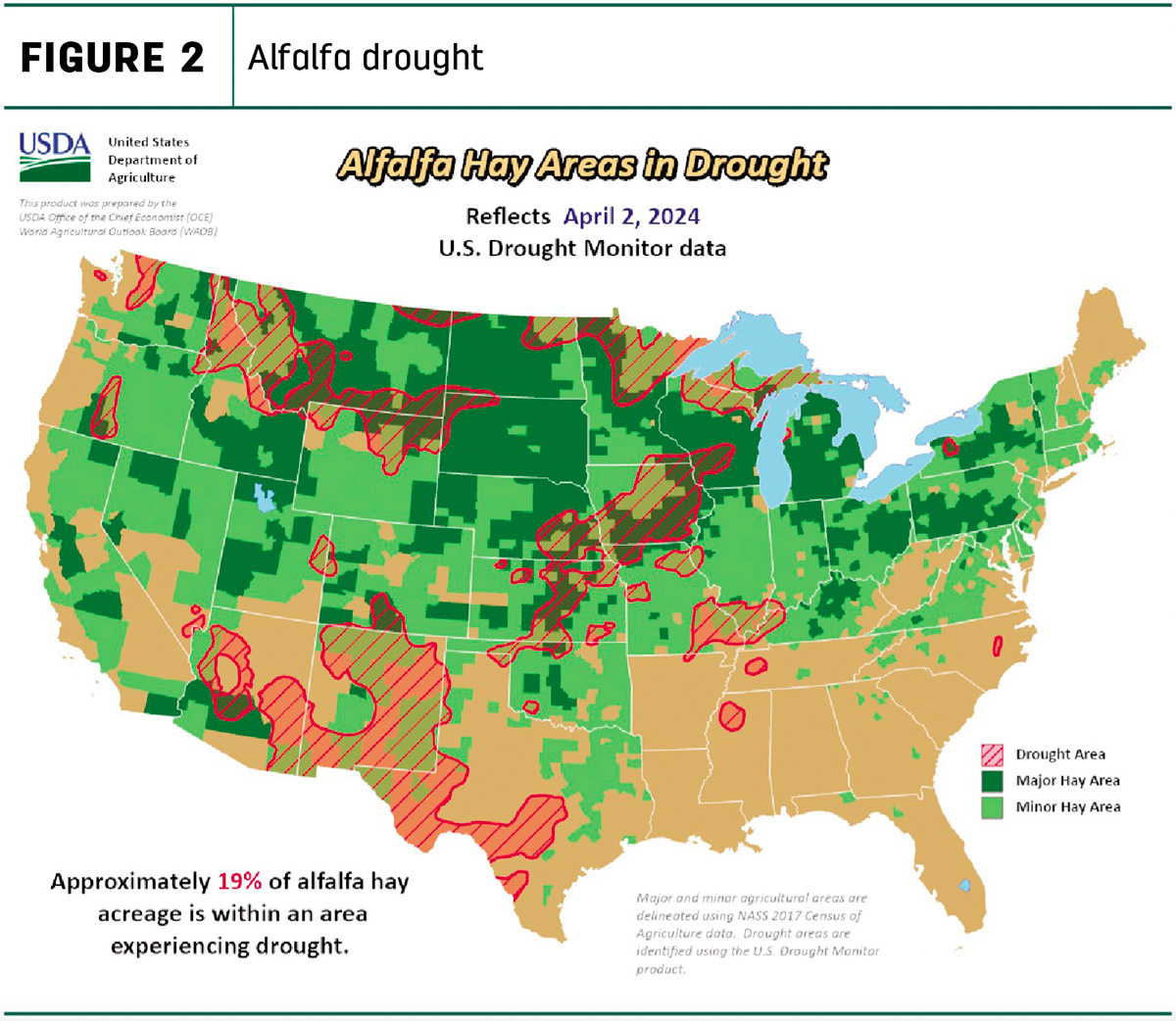

Early April showers have improved the moisture conditions. Overall, U.S. drought monitor maps indicate drought areas that are continuing along the trend of decreasing. As of April 2, approximately 14% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, with 18% being reported the month prior. The area of alfalfa hay-producing acreage (Figure 2) under drought conditions reported to be 19%, with 25% the month prior.

A snapshot of hay prices

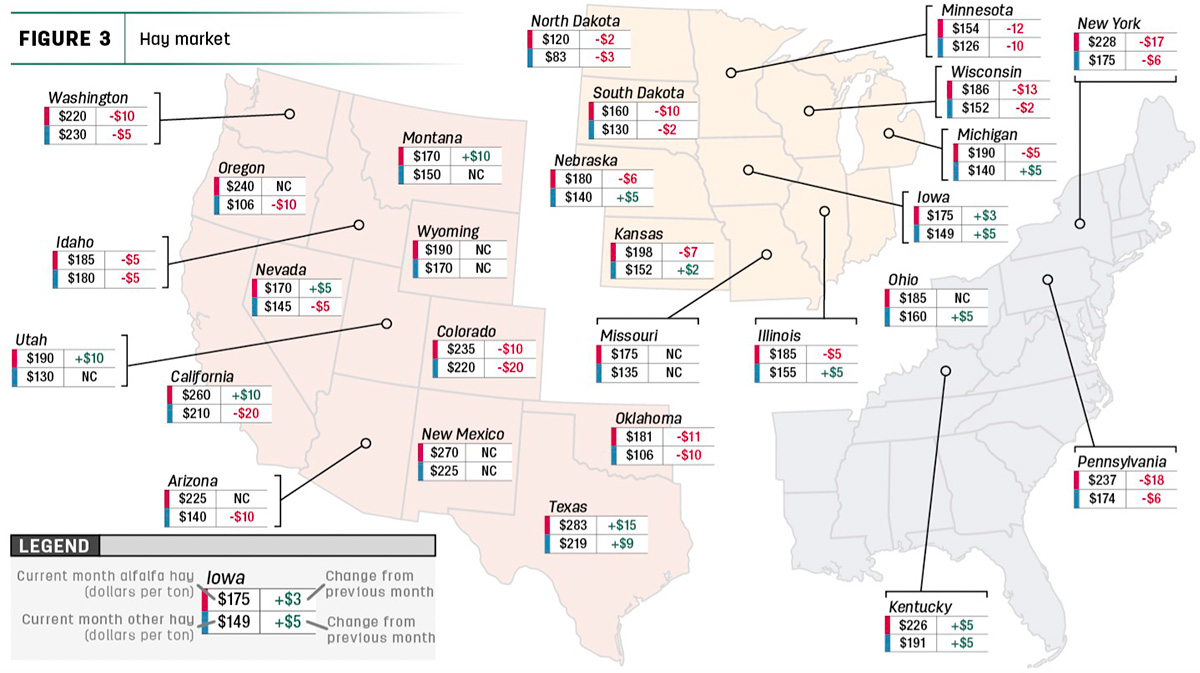

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Dairy hay

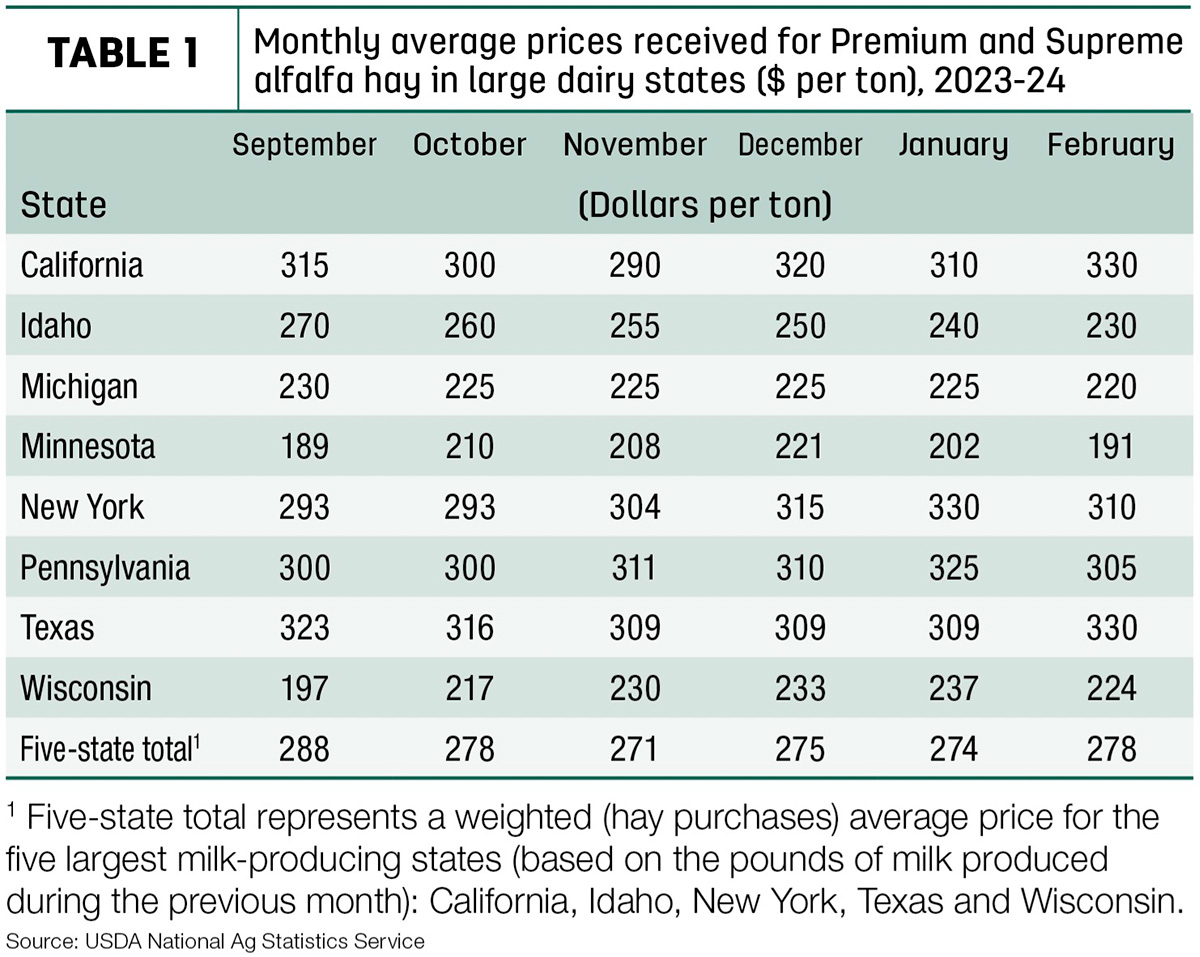

The top milk-producing states reported a price of $278 per ton of Premium and Supreme alfalfa hay in the month of February, a $4 increase from January. The price is $46 lower than what was reported in February 2023 (Table 1).

Regional markets

- Midwest: In Nebraska, alfalfa moved in an uneven yet steady pattern. Alfalfa pellets in the eastern region sold $10 lower than the state normal with consistent movement in the Platte Valley. In the west, millet hay sold $5 lower than average.

In Kansas, all hay and prices are in low to moderate demand. The lack of buying interest remains and no prices of the new crop have been reported, as most producers are trying to clear out last year's crop. Much of the state would still benefit from rainfall, but the situation is not as dire as it was for the majority of 2023.

In South Dakota, not enough information was available for a report.

In Missouri, reported storms have caused wind, hail or rain damage to crops in some parts of the state. Light snow has also been reported, and the mix of cold snaps has slowed the start of what seemed to be an early hay season. While demand and trade are still present, the pace is slowing a bit.

- East: In Alabama, hay prices are reported as fully steady with moderate supply and demand and moderate trade.

In Pennsylvania, alfalfa sold steady, yet a strong undertone is noted. Alfalfa and grass mix are selling strong. Orchardgrass was sold strong. Timothy and orchard sold strong with a strong undertone.

- Southwest: In California, trade activity and demand were moderate. Demand for retail hay was steady to good. Demand for dairy and export hay demand was moderate. A combination of several low-pressure systems across the state and reported rainfall have reduced the severity of the drought, and March was considered a relatively wet month with above-average precipitation, which has producers feeling optimistic about the upcoming growing season.

In New Mexico, no current report is available.

In Oklahoma, demand and trade are slow. With the new crop of hay on the horizon, producers are still doing their best to stretch their remaining hay stocks, causing prices to drop slightly. Producers are lowering prices to offload last year’s crop and make room for this year’s crop.

In Texas, hay prices are mostly steady to weak on old-crop hay. Trade activity was moderate on moderate demand. Hay prices are moving lower across the board as the first cutting is upcoming in a few weeks.

- Northwest: In the Columbia Basin, the last crop of timothy sold firm in a light test. Trade overall is slow, with the exception on timothy. Demand is good for high-quality hay while demand is light for hay with defects.

In Montana, generally hay sold steady this week while demand for hay remains light and was more robust compared to previous weeks. Feeder-quality hay supplies remained heavy, but a slight increase in interest and buying of those stocks is picking up and providing some much-needed relief to producers.

In Idaho, in a light test, all grades of hay sold steady while trade remains slow with light to moderate demand. New crop of timothy is in high demand.

In Colorado, trade activity was light on light to moderate demand. Horse hay sold steadily and precipitation reduced the amount of the state in the drought region.

In Wyoming, compared to last week all hay sales sold steady on a very thin test. Alfalfa pellets that were sun-cured sold $20 lower. Demand was light due to the first signs of spring offering some hope to producers, but with the continued snow they may still need to purchase some feeder hay to get through to the next crop.

Other things we are seeing

- Dairy: Dairy producers’ milk checks should improve a little based on March 2024 Federal Milk Marketing Order (FMMO) blended milk class prices. Announced on April 3, FMMO Class II, III and IV prices were also slightly higher compared to a month earlier. However, for those watching milk pools, the wide Class III-IV price spread will maintain substantial Class IV depooling incentives. Contributing to the March milk class price calculations, the value of butterfat was up from the previous month, but the protein value declined. Based on FMMO advanced prices and current futures prices, the outlook for March milk prices is mixed.

- Cattle: The Cattle on Feed report released by the USDA on March 22 shows that animals on feed for the slaughter market on feedlots with more than 1,000 head capacity in the U.S. totaled 11.8 million head on March 1. That inventory is 1% higher than the total on March 1, 2023. There was a 10% increase in February feedlot placements from 2023 to 1.89 million head, representing the most February placements since at least 1996, which is as far back as USDA Cattle on Feed data goes. Net February placements were 1.83 million head.

- Fuel: Fuel prices are increasing across the board according to the U.S. Energy Information Administration (EIA). The U.S. retail price for regular-grade gasoline averaged $3.59 per gallon. The average U.S. retail diesel price was around $4.06 per gallon.

- Trucking: Spot flatbed prices increased slightly in most regions with average prices rising, according to the DAT Freight and Analytics trendline. Regionally, average spot prices per mile were: Southeast – $2.62, South central – $2.43, Midwest – $2.68, Northeast – $2.52 and West – $2.29.