Individual Federal Milk Marketing Order (FMMO) uniform milk prices were slightly higher in March 2024, impacted by increased prices in all milk class prices filling the national pool.

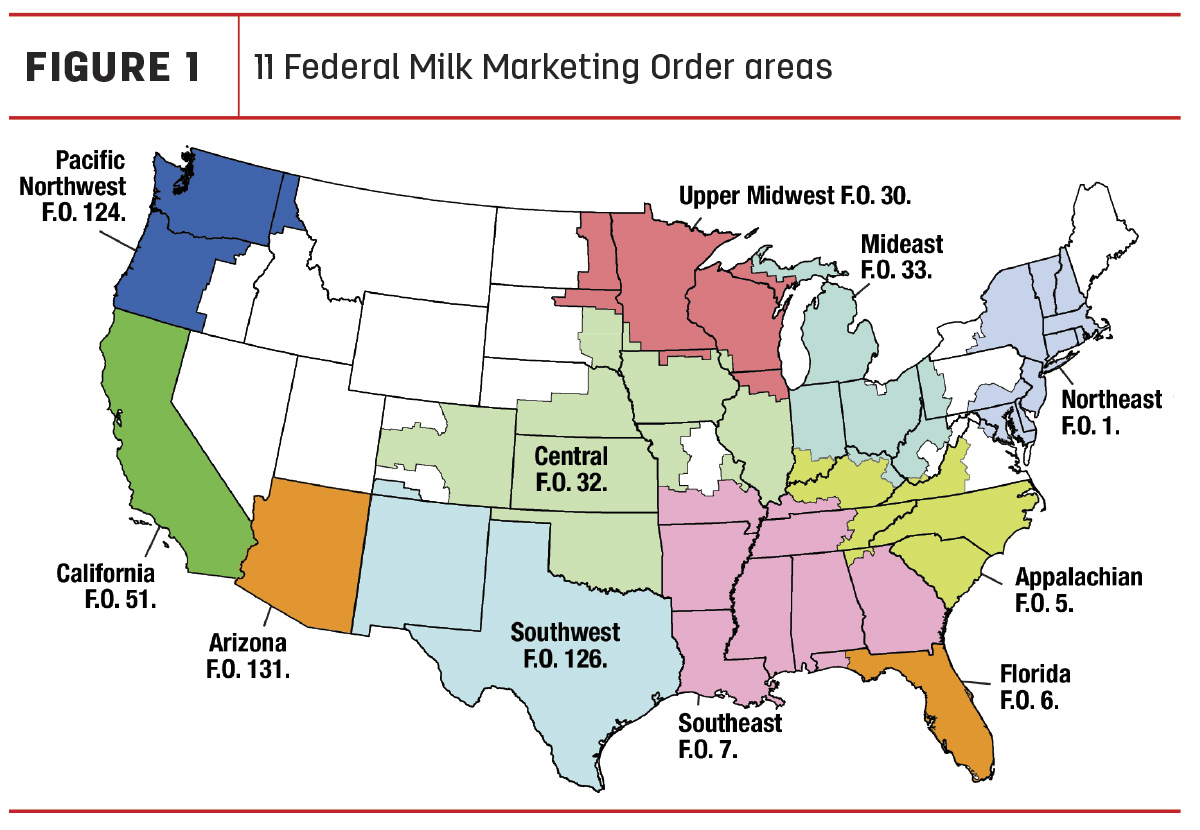

Administrators of the 11 FMMOs reported March prices and pooling data, April 10-12. Here’s Progressive Dairy’s monthly review of the numbers to provide some additional transparency to your milk check.

Uniform prices, PPDs

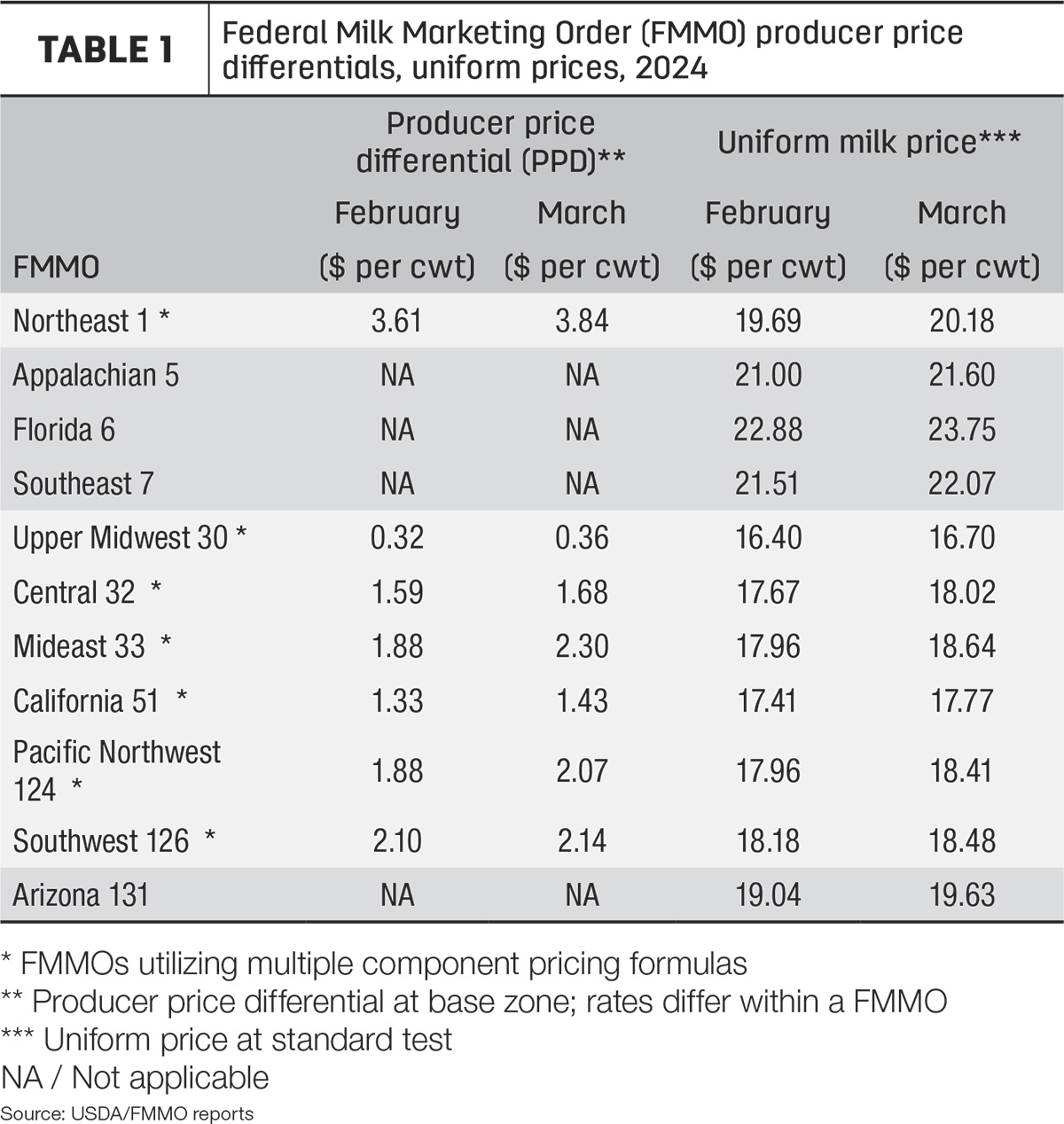

Compared with February, March 2024 statistically uniform milk prices were 30-87 cents per hundredweight (cwt) higher in all FMMOs. (Table 1). Largest gains were posted in those with higher Class I utilization.

The highest uniform price for the month was in Florida at $23.85 per cwt, with the low in the Upper Midwest at $16.70 per cwt.

March baseline producer price differentials (PPDs) were also higher across all applicable FMMOs (Table 1), with a high of $3.84 per cwt in the Northeast to a low of 36 cents in the Upper Midwest. PPDs have zone differentials, so actual amounts will vary within each FMMO. Milk handlers may apply PPDs and other “market adjustment factors” differently on your milk check.

Class prices for March

- Class I base price: The March 2024 advanced Class I base price was $18.80 per cwt, 81 cents more than February 2024 but 19 cents less than March a year ago. The Class I skim milk price was up but the Class I butterfat price is lower.

- Class I base with zone differentials: Adding zone differentials, March Class I prices averaged approximately $21.62 per cwt across all FMMOs, ranging from a high of $24.20 per cwt in the Florida FMMO to a low of $20.60 per cwt in the Upper Midwest FMMO.

- Class I mover formula: The spread in the monthly advanced Class III skim milk pricing factor ($5.38 per cwt) and advanced Class IV skim milk pricing factor ($9.41 per cwt) narrowed slightly for March but remained wide at $4.03 per cwt.

Based on Progressive Dairy calculations, the Class I mover calculated under the “higher-of” formula would also have resulted in a Class I base price of $20.02 per cwt, about $1.22 more than the actual price determined using the “average-of plus 74 cents” formula.

- At $21.12 per cwt, the March Class II milk price was up 59 cents from February and $1.60 more than March 2023. It was the highest since November 2023.

- At $16.34 per cwt, the Class III milk price rose 26 cents from February but was still $1.76 less than March 2023.

- At $20.09 per cwt, the March 2024 Class IV milk price was up 24 cents from February and $1.71 more than March 2023. It was also the highest since November 2023. Potentially affecting FMMO pooling, the March 2024 Class IV milk price was $3.75 more than the month’s Class III milk price.

Component values, tests

Contributing to the March milk class price calculations, the value of butterfat was up from the previous month, but the protein value declined.

The value of butterfat increased 13.5 cents to about $3.29 per pound. The value of milk protein fell a dime from February to about $1.27 per pound.

The value of nonfat solids was down about 2.5 cents at $1.01 per pound, while the value of other solids increased about 1.5 cents, to 28.8 cents per pound.

Affecting statistical uniform prices “at test,” March average butterfat and protein tests in pooled milk were down compared to February in nearly all FMMOs providing preliminary data, offsetting the increased values.

Pooling totals

With two more milk marketing days, the total milk volume pooled through FMMOs in March was just over 13 billion pounds, about 1.1 billion pounds more than February. The USDA releases preliminary March milk production estimates on April 22.

March Class I pooling was up about 98 million pounds from the previous month. At 3.39 billion pounds, it represented 25.9% of total milk pooled. Class II pooling was up about 169 million pounds, to 1.28 billion pounds, representing about 9.8% of the total pooled.

Compared to a month earlier, March brought more Class III and Class IV milk to the pool (Table 2). At 7.39 billion pounds, Class III pooling was up 599 million pounds and represented about 56.5% of the total pool. Class IV pooling increased 197 million pounds, to 1.03 billion pounds, and represented 7.8% of the total milk pooled.

Looking ahead

April uniform prices and pooling totals will be announced on May 11-14. Based on FMMO advanced prices and current futures prices, milk class prices are mixed, with Class IV depooling incentives climbing.

- Class I base price: Already announced, the April 2024 advanced Class I base price is $19.18 per cwt, 38 cents more than March 2024 and 33 cents more than April a year ago. It’s the first year-over-year increase since January 2022-23.

- Class I base with zone differentials: Adding zone differentials, April Class I prices will average approximately $22 per cwt across all FMMOs, ranging from a high of $24.58 per cwt in the Florida FMMO to a low of $20.98 per cwt in the Upper Midwest FMMO.

- Class I mover formula: The spread in the monthly advanced Class III skim milk pricing factor ($5.63 per cwt) and advanced Class IV skim milk pricing factor ($9.19 per cwt) narrowed slightly for April but remained wide at $3.56 per cwt.

Based on Progressive Dairy calculations, the Class I mover calculated under the higher-of formula would also have resulted in a Class I base price of $20.19 per cwt, about $1.01 more than the actual price determined using the average-of plus 74 cents formula.

- Other class prices: April Class II, III and IV milk prices will be announced on May 1. As of the close of trading on April 12, the April Chicago Mercantile Exchange (CME) Class III milk futures price closed at $15.41 per cwt, down 93 cents from March. The April Class IV milk futures price closed at $20.06 per cwt, down 3 cents.

- Class III-IV milk price spread: If those futures prices hold, the April Class III-IV spread will rise to $4.65, the widest since last October and adding further support incentives for Class IV depooling.

Looking longer term, 2024 Class III futures prices at the close of trading on April 12 averaged $17.04 per cwt; the Class IV futures averaged $20.61 per cwt. That would yield an average Class III-IV price spread of $3.57 per cwt, up from $2.10 per cwt in 2023 and maintaining Class IV depooling throughout the entire year.

Other information

- The national FMMO modernization process continues. Post-hearing briefs must have be submitted by April 1. Following that, the USDA has 90 days to issue a recommended decision in the Federal Register. That’s followed by a 60-day comment period and another 60 days for the USDA to develop their final decision. From there, the decision moves to a producer referendum. For more information, check the national FMMO hearing website.

- Last month, the Upper Midwest FMMO market administrator published policy clarification regarding acceptable milk handler reporting of minimum payments to non-cooperative producers. If a producer’s total monthly production includes milk that was pooled on FMMO 30 and milk that was not pooled, the reported payment on a hundredweight basis must be equal or greater than the FMMO minimum value for the pooled milk portion. If the combined value of the pooled and not pooled milk is less than the FMMO minimum value, then payment presentation to the producer must be separate and distinct for the pooled and not pooled production. Payment transparency is required each month so that a producer can confirm that at least the FMMO minimum value was received for their milk that was pooled. For more information, click here.

- Released April 11, the USDA’s monthly World Ag Supply and Demand Estimates (WASDE) identified milk and feed factors potentially impacting dairy producer income in the year ahead. The 2024 milk production forecast was lowered from a month earlier, with an improved butter price forecast offset by lower projected cheese, nonfat dry milk and whey prices. Compared to a month ago, the projected Class III milk price was lowered 95 cents to $16.20 per cwt and the Class IV price was raised 30 cents to $20.40 per cwt. The all-milk price was lowered 35 cents to $20.90 per cwt.

Read: Slower-than-expected growth in output per cow reduces milk forecast

Check the Progressive Dairy website for the March milk production report on April 23, and the March Dairy Margin Coverage (DMC) program margin on April 30.