Farm liquidity has become a greater issue in recent years because of the increased volatility of earnings and cash flow. While no one knows what the future holds for sure, there are a few things we do know: 2014 was a great year for most dairies, and 2015 is shaping up to be a down year. We know good times are unlikely to continue forever uninterrupted.

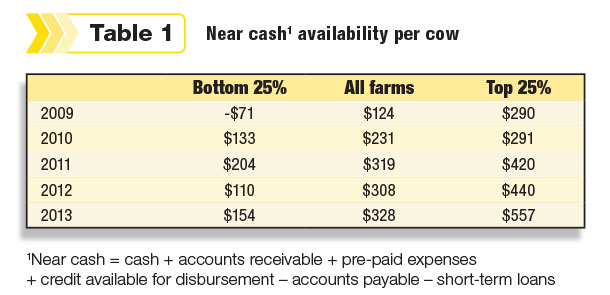

Because of this reality, producers are seeing the importance of enhancing the liquidity position of their operations. In fact, the top-profit quartile farms from our annual Northeast Dairy Farm Summary have been steadily improving their “near-cash” position over the last five years.

Near cash is a concept that captures the liquidity of a business. It is cash plus accounts receivable (which are likely to be converted to cash shortly) plus pre-paid expenses (expenses paid before they are due – usually done for tax planning purposes) plus credit available for disbursement (both operating lines of credit and revolving capital lines) less accounts payable (expenses incurred that need to be paid for) and less short-term loans, as this money is only temporary and generally must be paid back within the year.

Note that the top-profit quartile is consistently in a better near-cash position than both the average farm and the bottom-profit farms. Credit available for disbursement may be quite significant for those farms that paid extra principal on loans during 2014 as a means of managing their cash.

While re-investing in the business is important, so is having a reserve for a “rainy day.” Those producers who are able to balance equipment purchases and business investment with the need for cash reserves are likely to come through a market correction in better shape than the rest.

Additionally, having cash reserves allows for opportunistic investments during downturns, when sellers may be willing to accept lower prices. When milk prices are down, cash flow trumps earnings and a strong near-cash position helps soften a downturn in the dairy economy.

See the example belowto test your math at calculating near cash on a per-cow basis.

John is a dairy farmer with 500 cows. He checked his bank account this morning and found that he has $50,000. Last month's milk check hasn't arrived yet, but he knows his herd averaged 72 pounds of milk per cow last month. Including his bonuses, he thinks his check will be about $200,000.

He has pre-paid (pre-purchased) his corn seed and fertilizer needs at a cost of $80,000 and has credit available for disbursement of $150,000. He needs to pay his feed and vet bill today.

His feed bill is $105,000 and his vet bill is $5,000. He has two hired hands to issue checks to for the month. In total, they are due $8,000. What is John's near-cash availability per cow?

Near cash = cash + accounts receivable + pre-paid expenses + credit available for disbursement – accounts payable – short-term loans

$50,000 + $200,000 + $80,000 + $150,000 - ($105,000 + $5,000 + $8,000) = $724 per cow.

A good goal is to have near cash of $1,500 per cow. This allows a farm to absorb a $6 drop in milk price (at 25,000 pounds of milk shipped per cow) before having to borrow money to fund operations. PD

Chris Laughton is the director of Farm Credit East’s Knowledge Exchange program. John Lehr and Bill Zweigbaum are business consultants with Farm Credit East.