Two global trade analyses published in December foretell continued downward pressure on international commodity pricing through at least the first half of 2015. Supply and demand relief will come – but slowly. On the supply side, processors in New Zealand and Europe have cut farmgate milk prices, but in dairy it always takes time for the signals to translate into lower production at the farm.

Milk production from the top five exporting nations is expected to expand around 1 percent in 2015 compared with a gain of more than 4 percent in 2014, according to USDA’s latest Dairy: World Markets & Trade report.

However, international commodity price recovery will depend on how quickly buyers and sellers can work through accumulated stocks, the agency said.

Increased purchasing in regions like the Middle East, North Africa and Southeast Asia helped limit stock buildup in 2014, but inventories are likely to continue to rise in the months ahead, Rabobank noted in its December Dairy Outlook quarterly.

It might take a weak Southern Hemisphere production peak in 2015 to finally tip the balance, suggesting the fourth quarter as the most likely time for a meaningful recovery in commodity prices, Rabobank said.

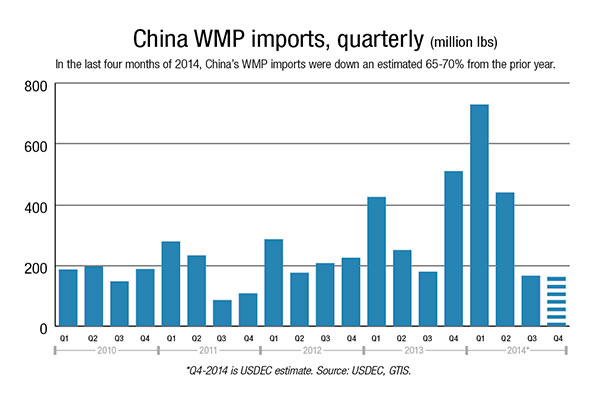

Both the USDA and Rabobank expected Chinese buyers to return to more aggressive buying habits – but not until the second half of 2015. The USDA forecasts China’s WMP imports will decline about 12 percent next year, dropping to 600,000 tons.

Rabobank rejected comparisons of the current market downturn to the problems of 2009. The world economy is expected to grow 3 to 4 percent in 2015 (after shrinking in 2009), trade credit and financing are still widely available (after freezing in 2009), and dairy trade volumes continue to expand (volume contracted for six consecutive months in 2009), the bank said. PD

U.S. export slump continues

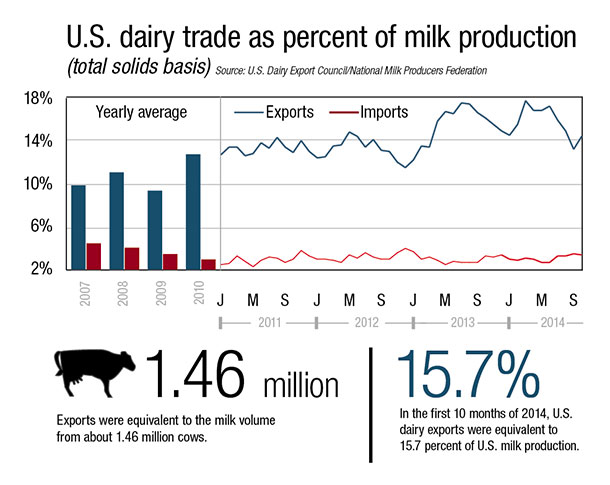

With tougher competition in an oversupplied market, U.S. export volumes in the July-through-October period were 10 percent below the prior year. This is the most significant retreat in U.S. dairy exports since 2009.

By value, dairy exports in the four months were down 9 percent – a big change from the first half of the year, when U.S. exports were up 14 percent by volume and 26 percent by value.

U.S. exports (on a total milk solids basis) were equivalent to 14.6 percent of U.S. milk solids production in July through October, nearly two points less than the first-half average. Imports were equivalent to 3.4 percent of production in July through October, up from 2.9 percent in the first half.

On a value basis, sales to Mexico (+4 percent), South Korea (+36 percent) and Japan (+41 percent) registered gains in July through October compared with a year ago, but shipments to Southeast Asia (-9 percent), China (-26 percent) and the Middle East/North Africa region (-53 percent) declined significantly.

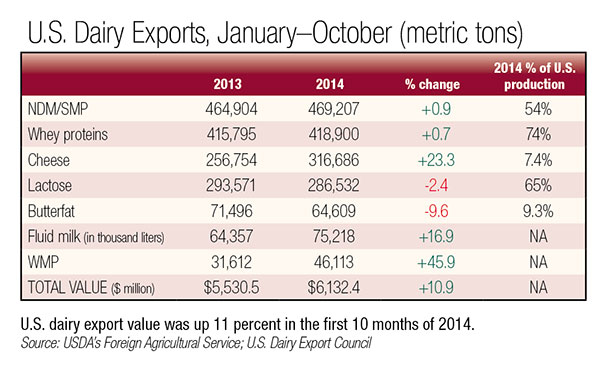

Year-to-date, exports are still up 11 percent by value and 4 percent by volume compared with last year.

Exports of nonfat dry milk/skim milk powder were up 1 percent in the first 10 months of the year, while cheese exports were up 23 percent, butterfat shipments were down 10 percent, and whey exports were up 1 percent. PD

Cheese exports reach record levels (again)

Through October, U.S. cheese exports were 316,686 tons, up 23 percent from a year ago and already a record high (with two months to go). Year-to-date, cheese exports represented 7.4 percent of U.S. cheese production, the most ever. Prior to 2010, cheese exports as a percent of production was less than 3 percent.

Gains were driven by large increases in sales to South Korea (up 51 percent from the prior year) and Japan (up 91 percent). In four of the 10 months, the U.S. shipped more to South Korea than it did to Mexico, which has always been the number one market.

In Japan, U.S. suppliers have taken share from Australia and New Zealand as their supply has diminished and their prices have increased, notes Jeff McNeill, U.S. Dairy Export Council’s Japanese representative.

In addition, Japanese customers have begun to see the need to diversify their supply base; the U.S. industry has become increasingly engaged with the Japanese trade, and the Cooperatives Working Together (CWT) program has helped encourage trial for new customers, McNeill says.

This update is provided by the U.S. Dairy Export Council (USDEC), a non-profit, independent membership organization that represents the global trade interests of U.S. dairy producers, proprietary processors and cooperatives, ingredient suppliers and export traders. Its mission is to enhance U.S. global competitiveness and assist the U.S. industry to increase its global dairy ingredient sales and exports of U.S. dairy products. USDEC programs and activities are supported by the dairy checkoff program, with additional funding from the U.S. Department of Agriculture, Foreign Agricultural Service and from membership dues. For more information, go to the website.