LGM-Dairy

The next scheduled sales period for Livestock Gross Margin for Dairy (LGM-Dairy) is Friday, March 26. Coverage is available for up to 10 months, so you will be able to buy coverage for May 2021-February 2022. You need to select coverage in two-month increments to get a USDA premium subsidy. LGM-Dairy covers milk prices (from falling) and also includes coverage for feed prices rising. LGM-Dairy is not only a milk price put option, but a call option on the price of corn and soybean meal.

Dairy-RP

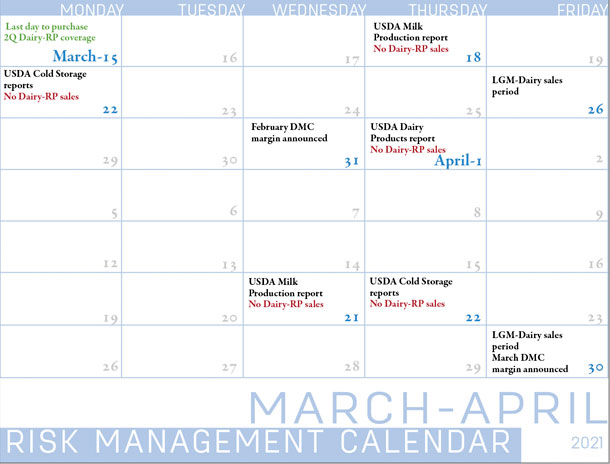

Dairy Revenue Protection (Dairy-RP) coverage is generally available for milk produced four or five quarters out in the future. Dairy-RP is available every day except holidays and USDA report days that could impact markets (see the calendar below). The deadline to purchase second-quarter 2021 coverage under the Dairy-RP program was March 15.

Dairy-RP is also not available on days when applicable futures contracts move limit-up or limit-down.

Click here or on the calendar above to view it at full size in a new window.

CDE ‘Protecting Your Profits’ webinar is March 24

Pennsylvania’s Center for Dairy Excellence (CDE) is hosting its monthly “Protecting Your Profits” webinar on March 24, beginning at noon (Eastern time). Zach Myers, CDE risk education manager, will review current data and updates about dairy markets to guide decision-making and risk management strategies.

Advance registration is not necessary. To participate in the webinar, click here or call: (646) 558-8656. When prompted, enter meeting ID 848 3416 1708 and passcode 474057.

2021 DMC enrollment inches higher

The USDA continues to enter 2021 Dairy Margin Coverage (DMC) program enrollment data. As of March 8, 18,736 dairy operations (about 73.8% of those with established milk production history) had enrolled in the 2021 DMC program. Milk production enrolled for 2021 was estimated at 162.79 billion pounds, about 79.3% of the established history. Enrollment closed on Dec. 11, 2020.

January 2021 DMC payments topped $92 million

The weekly USDA DMC updates also report state-by-state indemnity payments. The January DMC milk income over feed cost margin was just $7.14 per hundredweight (cwt), triggering indemnity payments on Tier I and Tier II milk insured at all levels above $7 per cwt.

Read: DMC starts new year with hefty payments.

That resulted in total DMC indemnity payments of more than $92.6 million, averaging about $4,944 per participating dairy operation, according to the USDA. Dairy producers in Wisconsin led all states to total payments, receiving $20.9 million. Rounding out the top five states for January indemnity payments were: New York ($8.7 million), California ($8.6 million), Minnesota ($8 million) and Pennsylvania ($6.7 million).

All 2021 DMC indemnity payments are subject to a 5.7% sequestration deduction, down from 5.9% in 2020.

State-by-state enrollment and payment information is available here.

Milk and feed price factors used to calculate February 2021 DMC margin and potential indemnity payments will be released on March 31.

Production history adjustment: No news yet

At Progressive Dairy’s deadline, there had been no scheduling announcement from the USDA for smaller dairy producers to update their milk production history baselines and become eligible for a supplemental DMC payment.

The adjustment was approved in a COVID-19 relief bill, signed into law in late December 2020. That bill called for the USDA Farm Service Agency (FSA) to establish a sign-up period within 45 days of approval.

Read: Weekly Digest: COVID-19 relief bill includes DMC milk production history adjustment.

While the original DMC program established an eligible baseline on milk production in years 2011, 2012 and 2013, the adjustment provision in the COVID-19 relief bill allows producers to use actual milk production in 2019. The adjusted milk production baseline is effective January 2021 through the life of the current farm bill and DMC program, ending in 2023. The bill limits that payment to cover 75% of the difference between an eligible dairy operation’s actual 2019 milk production and its previous DMC milk production history. No supplemental payments are permitted on milk production above 5 million pounds per year.

Once the FSA determines a sign-up period, eligible producers must contact their FSA office with 2019 actual milk production records if they wish to adjust production history on an existing operation.

Those eligible to cover additional milk under the DMC production history adjustment must already be enrolled in DMC for 2021. Coverage levels (percentage of milk production covered and margin covered) on the additional milk must be equal to the coverage selected previously for 2021 (and beyond) on the original production history.

Any increase in milk production history covered under DMC also means the producer will have to pay the additional margin insurance premiums on that milk. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke