Dairy producers who invested in risk management through the Dairy Margin Coverage (DMC) program in 2021 are going to see some hefty returns right out of the gate./p>

The USDA released its latest Ag Prices report on Feb. 26, including factors used to calculate monthly DMC margins and payments. The January DMC milk income over feed cost margin is $7.14 per hundredweight (cwt), triggering indemnity payments on Tier I and Tier II milk insured at all levels above $7 per cwt.

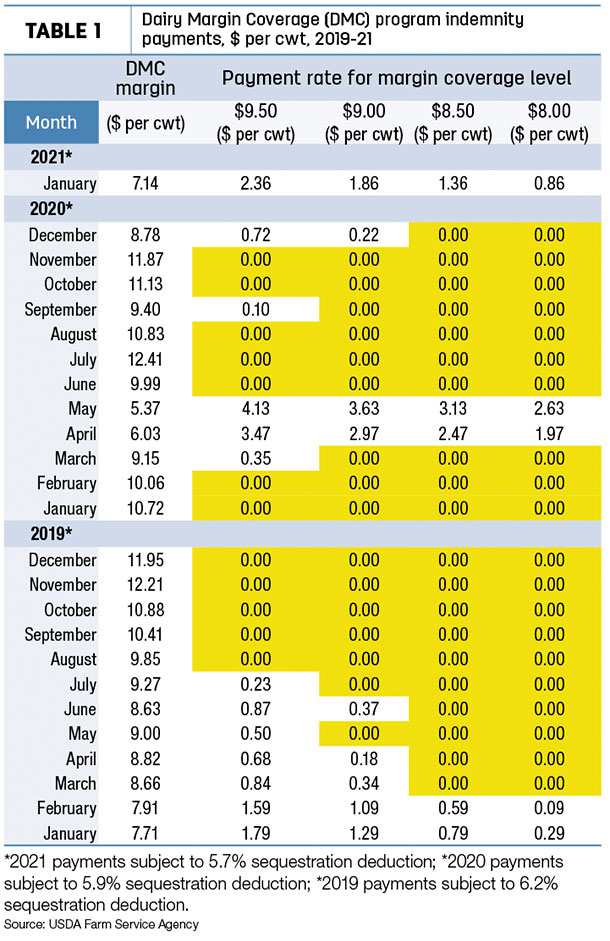

Those with Tier I (5 million pounds or less of covered production history) who are insured at the top level of $9.50 per cwt will see a payment of $2.36 per cwt (Table 1), with lesser amounts at $9 ($1.86), $8.50 ($1.36), $8 (86 cents) and $7.50 (36 cents) coverage levels. The payments are on one-twelfth of a dairy operation’s covered annual production history, and DMC payments are subject to a 5.7% sequestration deduction in 2021.

Milk price lower and negative PPDs aren’t included

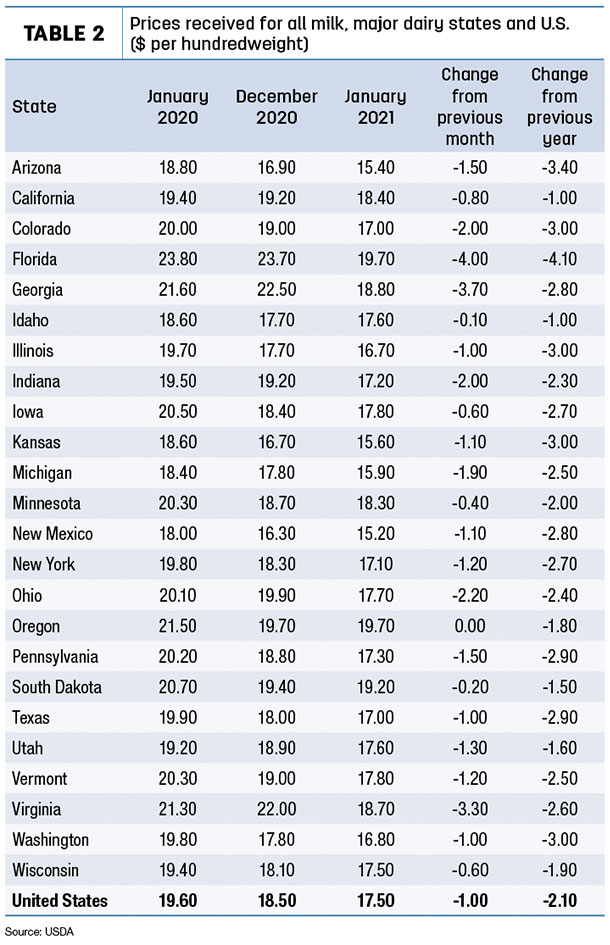

The USDA-announced January 2021 U.S. average milk price fell $1 from December to $17.50 per cwt, an eight-month low. It was $2.10 less than January 2020.

Among major dairy states, January milk prices took the biggest hits in high Class I (fluid) utilization states: Virginia, Georgia and Florida prices were down $3.30-$4 per cwt from a month earlier (Table 2).

The lowest announced price in January was in New Mexico ($15.20 per cwt); the high was in Florida and Oregon (both $19.70 per cwt).

Not included in the all-milk price calculations is the impact of negative producer price differentials (PPDs) on producer milk checks in January. After turning mostly positive in December, January PPDs were negative in all applicable Federal Milk Marketing Orders (FMMOs), ranging from -13 cents in the Northeast FMMO to -$1.80 per cwt in California FMMO. Negative PPDs also affected producers in Upper Midwest, Central, Mideast, Pacific Northwest and Southwest FMMOs.

PPDs have zone differentials, so they’ll vary slightly within each FMMO. In addition, PPD impacts on individual milk checks are based on individual milk handlers.

Feed prices higher

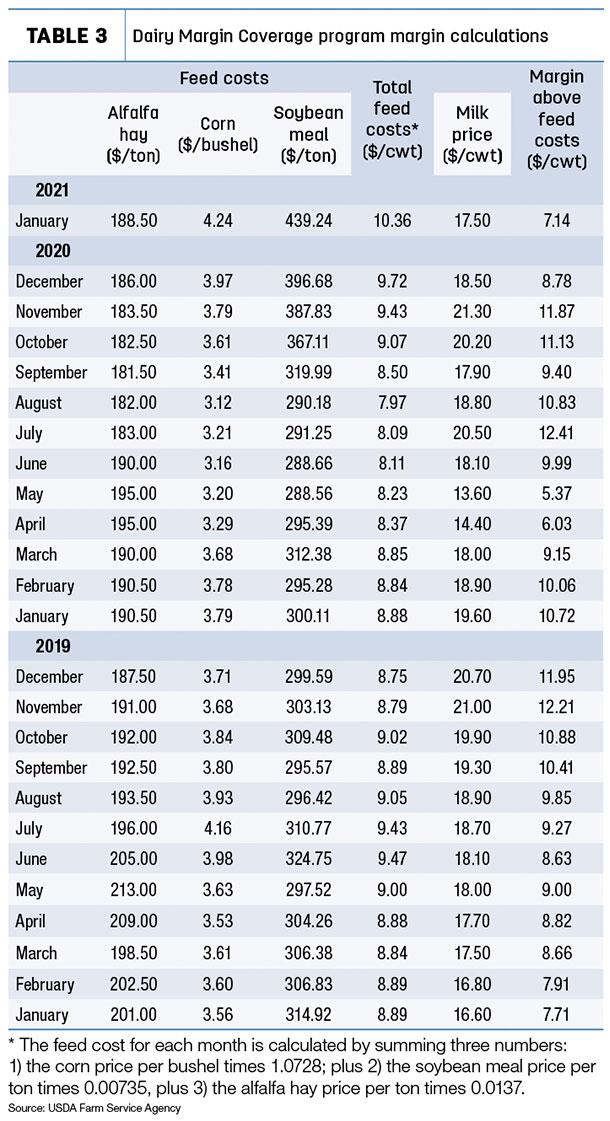

While milk prices were lower in January, U.S. average feed costs to produce that milk continued to rise to seven-year highs.

The average price for a blend of Premium and all alfalfa hay used in DMC calculations was $188.50 per ton, up $2.50 per ton from December and the highest since June.

Compared to a month earlier, the average price for corn jumped more than a quarter to $4.24 per bushel, the highest since June 2014.

The average cost of soybean meal rose more than $42.50 from December to $439.24 per ton. It’s up $156 per ton since May 2020 and the highest since November 2014.

That yielded an average DMC total feed cost of $10.36 per cwt of milk sold (Table 3), up 64 cents from December and the highest since August 2014, calculated under the old Margin Protection Program for Dairy (MPP-Dairy).

Indemnity payments expected through 2021

Based on current market conditions, DMC could pay monthly indemnity payments throughout 2021. Using the DMC Decision Tool, monthly average feed costs are expected to remain well above $10 per cwt of milk sold, topping $11 per cwt in April-August 2021. As a result, those insured at the $9.50 per cwt level would see a payment any time the monthly all-milk price falls below $20 per cwt. The February 2021 margin and any indemnity payments will be announced March 31.

Production history adjustment

Meanwhile, Progressive Dairy is checking on the status of a provision allowing smaller dairy producers to update their milk production history baselines and receive a supplemental DMC payment on a portion of any increased milk production. That adjustment was approved in a COVID-19 stimulus bill signed into law at the end of 2020. It permits smaller producers to use actual milk production in 2019, up to a maximum of 5 million pounds per year, instead of a milk production history baseline established in years 2011, 2012 and 2013. The adjusted milk production baseline would be effective January 2021 through the life of the current farm bill and DMC program, ending in 2023.