- USDA addresses milk dumping under Dairy-RP, LGM-Dairy programs

- Milk prices tumble in latest USDA outlook report

- NMPF seeks H-2A visa access for dairy producers

- Drought areas expanded in March

USDA addresses milk dumping under Dairy-RP, LGM-Dairy programs

The USDA’s Risk Management Agency (RMA) is ensuring that milk producers are not inappropriately penalized if their milk must be dumped because of recent market disruptions caused by the COVID-19 pandemic.

For the 2020 calendar year, RMA is allowing approved insurance providers (AIPs) to count dumped milk toward the milk marketings for the Dairy Revenue Protection (Dairy-RP) or actual marketings for the Livestock Gross Margin for Dairy (LGM-Dairy) programs, regardless of whether the milk was sold.

“Dairy Revenue Protection is a vital risk management tool for our dairy farmers, especially during times like these, and USDA wants to ensure producers continue to get the coverage they purchased,” said RMA administrator Martin Barbre.

Producers will still have to provide to the AIPs supporting documentation from the cooperative or milk handler verifying the actual pounds dumped and that the milk was dumped.

In addition, RMA is extending inspection deadlines, waiving inspection requirements and authorizing more crop insurance transactions over the phone and electronically to help producers during the crisis.

Visit RMA’s website for additional information.

Read also: Dumping milk? Consider these recommendations and Surplus milk: Can you feed it to your dairy herd?

Milk prices tumble in latest USDA outlook report

The USDA’s March World Ag Supply and Demand Estimates (WASDE) report reduced the 2020 milk production estimate slightly based on slower growth in milk production per cow. More dramatic, however, was the much weaker outlook for milk and dairy product prices.

The 2020 milk production forecast, at 222.2 billion pounds, was down about 100 million pounds from last month’s estimate. If realized, production would be up about 1.7% from 2019’s total of 218.4 billion pounds.

Projected 2020 prices for cheese, butter and nonfat dry milk were sharply lower compared to a month ago, with the dry whey price also forecast down. Based on these estimates, the 2020 average cheese price will now be $1.38 per pound, down 37.5 cents from last month’s outlook and also the lowest annual average since 2009’s $1.21 per pound. At $1.43 per pound, the projected butter price was down 41.5 cents from the previous month, and the lowest since 2009’s $1.21 per pound.

The projected nonfat dry milk price is 95.5 cents per pound, down 22 cents from last month; dry whey, down a penny from last month at 34.5 cents per pound, would be similar to the annual average seen in 2018.

As a result, the USDA’s updated projections for 2020 milk prices are the lowest since 2009. The Class III milk price forecast is now $12.75 per hundredweight (cwt), down $3.90 from last month’s forecast. The Class IV price is $12.15 per cwt, down $3.60. The 2020 all-milk price is now projected at $14.35 per cwt, $3.90 less than last month’s forecast.

Looking back in history, the 2009 all-milk price averaged $12.83 per cwt, Class III averaged $11.36 per cwt and Class IV averaged $10.89 per cwt.

-

Beef outlook: Total red meat production for 2020 is reduced from last month as sectors at all levels adjust to COVID-19 and economic uncertainty. The beef production forecast is reduced as lower expected steer and heifer slaughter more than offsets higher cow slaughter. However, beef production declines are partially offset by heavier carcass weights. The 2020 average fed cattle price was projected at $111 per cwt, down $3.50 from last month’s forecast and about $5.75 per cwt less than the 2019 average of $116.78 per cwt. Highest prices for the year are behind us.

- Feed outlook: Impacting the cost side of the dairy income ledger, this month’s 2019-20 U.S. corn supply and use outlook shows reduced imports, greater feed and residual use, lower food, seed and industrial use, and larger ending stocks. The projected 2019-20 season-average corn price received by producers is $3.60 per bushel, down 20 cents from last month’s forecast and about even with the 2018-19 average price.

U.S. soybean supply and use changes for 2019-20 include lower exports, seed use and residual use, higher crush and higher ending stocks. The U.S. season-average soybean price received by producers for 2019-20 was projected at $8.65 per bushel, down 5 cents from the previous month’s forecast. The soybean meal price forecast was unchanged at $305 per ton.

NMPF seeks H-2A visa access for dairy producers

The National Milk Producers Federation (NMPF) is asking the USDA and U.S. Department of Labor to accept and approve H-2A visa applications from dairy farmers facing increased labor shortages as the COVID-19 crisis grows longer.

NMPF President and CEO Jim Mulhern said offering temporary immigrant farmworker employment for up to 364 days in a 12-month period would align dairy with other livestock sectors and not require a change to current rules governing the program. The H-2A visa program is limited to seasonal employees and not year-round employment required on dairy farms.

“The dairy sector, like the rest of American agriculture, is facing a labor crisis that has been ongoing for decades. The COVID-19 reality we are all trying to navigate has only exacerbated these challenges,” Mulhern wrote to the two departments. “As more and more Americans have to remain home to care for children who are out of school or care for other loved ones, there are even fewer workers available to work on our nation’s farms. Our members – and all dairy employers – need increased access to the H-2A program to meet our workforce needs.”

The letter also makes clear that hiring American workers before supplementing with H-2A continues to be the goal of farmers as well as a legal requirement of the H-2A program.

“Preserving a vibrant dairy producer community in America is indeed essential for the health of rural and urban communities across the country and critical for continued access to wholesome, fresh, nutritious food,” Mulhern wrote. “The availability of workers to help with the daily milking of our cows is crucial – it must be done.”

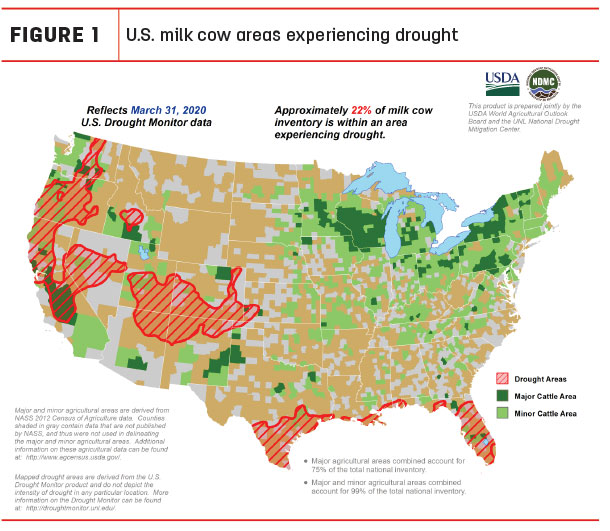

Drought areas expanded in March

The estimate of overall U.S. dairy cows located in “drought areas” increased during March, according to the USDA’s World Agricultural Outlook Board. About 22% of the nation’s milk cows were located in areas experiencing drought at the end of March (Figure 1), a 7% increase compared to a month earlier.

March brought expanding drought areas in California, Nevada, Oregon and Washington. Other large dry areas were in Florida, southern Texas, Colorado, central Idaho and Utah.

The weekly U.S. Drought Monitor overlays areas experiencing drought with maps of major production areas for hay, alfalfa hay, corn, soybeans and other crops. At 12%, alfalfa-producing areas affected by drought increased 2% from a month earlier. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke