Monthly year-over-year output growth has now been under 1% for eight consecutive months, with production lower than the same month a year earlier in two of those months (March and May).

Previous periods when milk production growth was less than 1% was in seven of eight months to end 2014, and nine of 11 months from June 2011-April 2012.

May 2018-19 recap at a glance

Heavy cow culling and the onset of a spring flush slowed by weather and feed factors held May 2019 milk production below year-ago levels. Reviewing the USDA estimates for May 2019 compared to May 2018:

- U.S. milk production: 19.06 billion pounds, down 0.4%

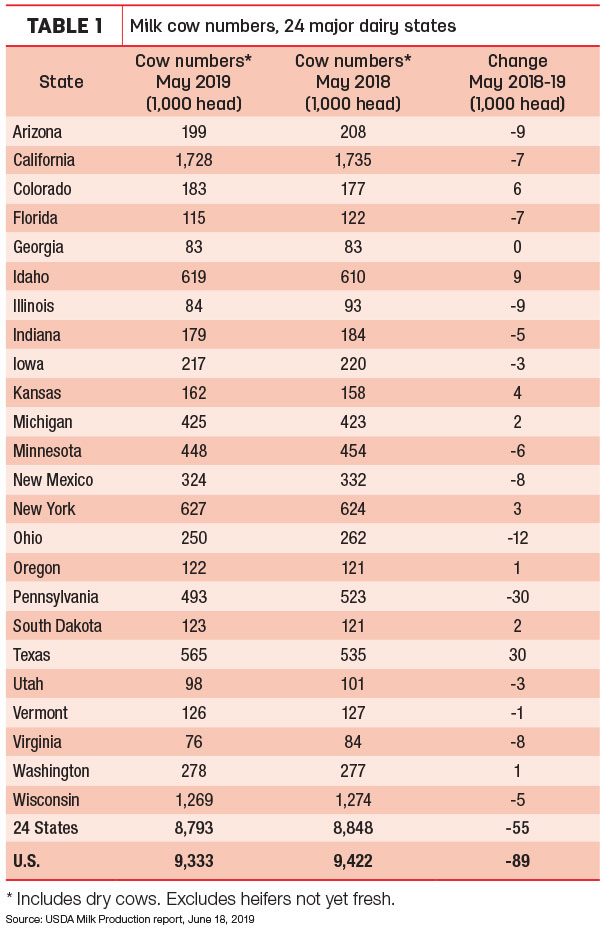

- U.S. cow numbers: 9.333 million, down 89,000 head

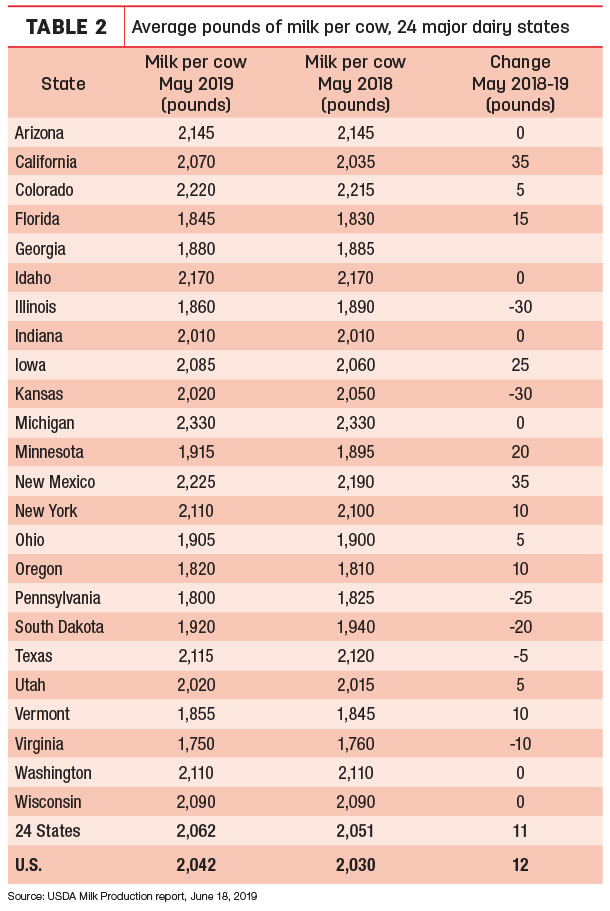

- U.S. average milk per cow per month: 2,042 pounds, up 12 pounds

- 24-state milk production: 18.13 billion pounds, down 0.1%

- 24-state cow numbers: 8.793 million, down 55,000 head

- 24-state average milk per cow per month: 2,062 pounds, up 11 pounds

Source: USDA Milk Production report June 18, 2019

U.S. dairy cow numbers reversed a four-month decline in May, rising to 9.333 million head, up 5,000 head from April’s three-year low of 9.328 million. The number of milk cows on farms in the 24 major states was 8.793 million head, also up 5,000 head from April.

Nine states increased cow numbers compared to May 2018 (Table 1), with the largest jumps in Texas (+30,000 head), Idaho (+9,000) and Colorado (+6,000). In contrast, Pennsylvania (-30,000) and Ohio (-12,000) led decliners, with Illinois, Arizona, Virginia, New Mexico, Florida and California each down 7,000 to 9,000 head. Iowa, Minnesota and Wisconsin were down a combined 14,000 head.

Cows in six states yielded less milk in May than the same month a year earlier. (Table 2). South Dakota, Pennsylvania, Illinois and Kansas saw declines of 20 to 30 pounds per cow. In contrast, California and New Mexico posted gains of 35 pounds for the month. Michigan led all states in milk production per cow for the month.

Among all major states, Texas again led in terms of both milk volume and percentage increase in May 2019, up 61 million pounds (5.4%) compared to May 2018. Pennsylvania production was down 67 million pounds (-7%).

Georgia added as a ‘major’

The other notable number in the USDA’s Milk Production report is the addition of Georgia to the list of monthly reported “major” dairy states. The home state of U.S. Ag Secretary Sonny Perdue, Georgia joins Florida and Virginia in representing the southeast U.S.

Based on 2018 USDA annual dairy statistics, Georgia ranked 25th in cow numbers, 23rd in milk production per cow, 23rd in total milk production and 26th in the number of dairy herds licensed to sell milk.

Dairy cow slaughter levels high

U.S. dairy farmers continue to move dairy cull cows to slaughter at a high rate. Federally inspected milk cow slaughter was estimated at 1.135 million through May 18, 2019, about 63,000 head more than a similar date a year earlier, according to the USDA.

Looking ahead, forage supplies and quality are raising longer-term concerns. The cool, extremely wet spring lingered into early June, putting planting season well behind schedule and delaying hay growers from taking a first cutting. Combined with severe alfalfa winterkill in parts of the Midwest, terms like “scarce” and “disaster” were being used to describe forage conditions – and raising prices.

(Read: Hay Market Insights: Spring hay prices move to five-year high.)

Previously, the USDA reduced milk production forecast for both 2019 and 2020, citing declining cow numbers and slowing growth in milk output per cow in 2019 and higher anticipated feed costs which are expected to weaken producer margins, limiting growth in the dairy cow herd and milk per cow in 2020.

(Read: USDA cuts milk production forecasts.)

Report adds to bullish outlook

May’s milk production decline has added some bullishness to the dairy market outlook. In his monthly Dairy Situation and Outlook, Bob Cropp, professor emeritus with the University of Wisconsin – Madison, said the June Class III milk price, to be announced July 3, should be about $16.30 per hundredweight (cwt). The Class IV price will improve about $16.80 per cwt.

Longer term, Cropp predicts a Class III price in the low $17s by August and in the mid- to high $17s by fourth quarter. Others are predicting Class III prices may venture into the $18s. Class IV prices could be in the low $17s by July and in the mid-$17s in the fourth quarter, Cropp said.

If those projections hold true, the Class III price would average about $16.30 per cwt for the year compared to $14.61 per cwt in 2018, and the Class IV price would average about $17.00 per cwt compared to $15.09 per cwt in 2018.

Domestically, butter and cheese sales continue to show modest growth, but fluid (beverage) milk sales continue the downward trend. While lower than a year ago, dairy exports are supportive of milk prices. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke