Suggesting that everyone could benefit from using a particular accounting technique is risky. It would have to simplify a job that “everyone” needs to do and save “everyone” a lot of time. QuickBooks is the most popular accounting software product used in farming and ranching. But many people who use QuickBooks and handle resale cattle – stockers, feeders, cull cows to feed for the white fat market or others – are unaware that QuickBooks can automate the income tax record-keeping for resale cattle. In fact, this is one of its “biggest bang for the buck” features.

If you handle resale cattle, you know you have to come up with two numbers at tax time: income from sales of resale cattle and the purchase cost of resale cattle sold during the year, known on federal tax forms as the “cost of items held for resale.” Any accounting system can give you the income number, because it’s just the year’s sales total. But coming up with the cost of items held for resale number is not as simple. If you’ve done it manually – by matching receipts from earlier cattle purchases with the groups of cattle sold during the year – you know it can be a hair-pulling experience.

With QuickBooks set up the right way, though, simply entering cattle purchases and sales will cause it to automatically keep track of both the income and the cost of items held for resale numbers you need at tax time.

A Resale Stockers ‘Item’

The key to getting this done is to set up something in QuickBooks called an “Item.” An Item is simply a name or “identifier” for something you buy or sell, which tells QuickBooks where to post income, expense or asset value when you use the Item. If you raise wheat, for instance, you might set up an Item named Wheat and associate it with an account called Grain Sales. Then when you enter wheat sales in QuickBooks, you won’t need to remember which account to use – just select the Wheat Item, and QuickBooks will know to post the income to the Grain Sales account.

QuickBooks has several Item types, including one called the Inventory Part type. That’s the one you need to use for resale cattle, because Inventory Part Items keep track of the purchase cost of things you buy; automatically post the purchase cost to an asset account, so your investment in resale cattle will show up on the ranch balance sheet; and let you keep track of resale cattle inventories (number of head bought, sold and currently on hand) right there in QuickBooks.

Now don’t be spooked by the word “inventory.” You don’t have to use the inventory features if you don’t want to. But QuickBooks keeps track of resale cattle inventories pretty much automatically as you enter purchases and sales, so most people end up using those features simply because it’s easy to do.

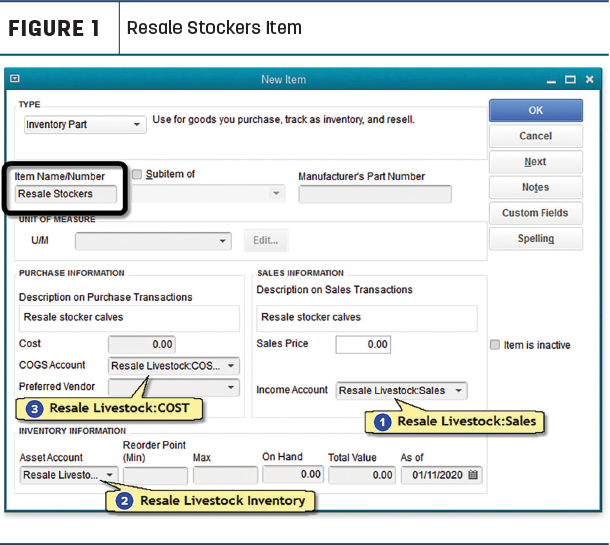

If you buy calves to sell later after a grazing or backgrounding period, you might create a Resale Stockers Item and associate accounts with it as shown in Figure 1.

1. Resale Livestock:Sales is where income from stocker cattle sales will be recorded.

2. Resale Livestock Inventory is where the cattle’s purchase cost will be posted, as an asset (to appear on balance sheet reports).

3. The COGS (Cost of Goods Sold) account, Resale Livestock:COST, needs a bit more explanation. This is where QuickBooks will accumulate the purchase cost of resale cattle sold during the year. At year’s end, your tax preparer can use this account’s balance directly as a cost of items held for resale number for filing income taxes.

(Other fields in the Item setup window are unimportant and can be left blank or with a zero amount.)

Stocker purchases

Let’s look at some transaction examples using the Resale Stockers Item in the QuickBooks desktop editions (Pro, Premier, Accountant and Enterprise) because the desktop editions are more flexible for many farm or ranch accounting activities compared to QuickBooks Online, the cloud-based version. (For resale livestock, however, the same techniques will also work in QuickBooks Online.)

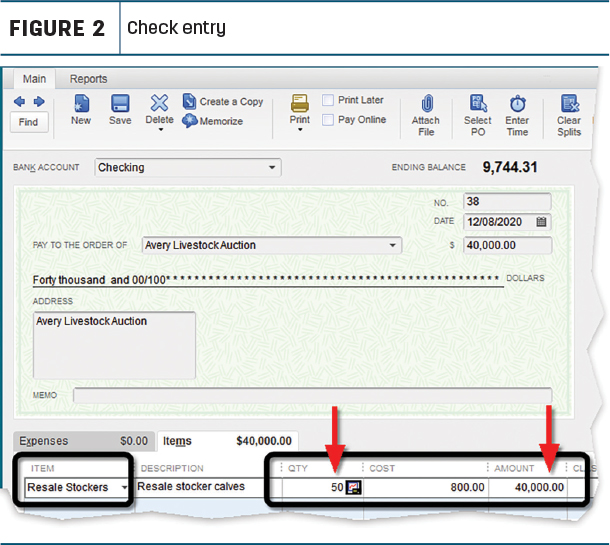

To keep things simple, let’s say you bought 50 calves and wrote a check for them. The QuickBooks entry to record the check would look something like Figure 2.

All that’s necessary for filling out the check is to select the Resale Stockers Item and enter the number of head bought and total amount paid. (The Cost column shows the average price per head, which QuickBooks calculated automatically.)

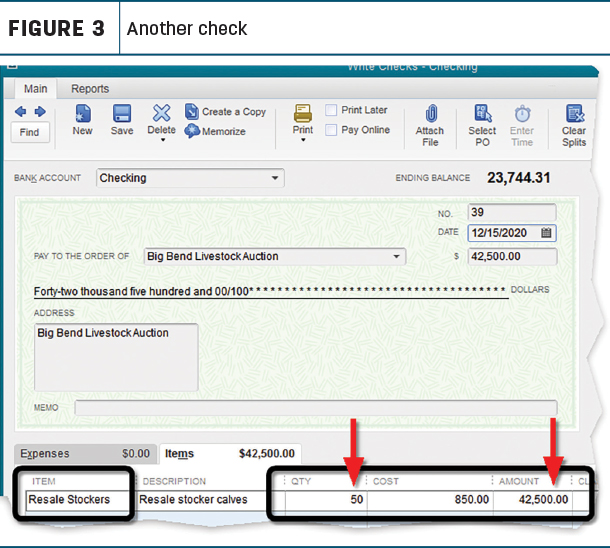

At another auction on a different day, you buy 50 more calves and enter the check for that purchase as shown in Figure 3.

It’s worth knowing that QuickBooks calculates a running average purchase cost for the Resale Stockers Item regardless of how many purchases you make or how many cattle are involved. After entering the two purchases shown above, the average is $825: 50 head bought at $800 and 50 head at $850. (QuickBooks will use this information later to calculate the cost of items held for resale as cattle are sold.)

Stocker sales

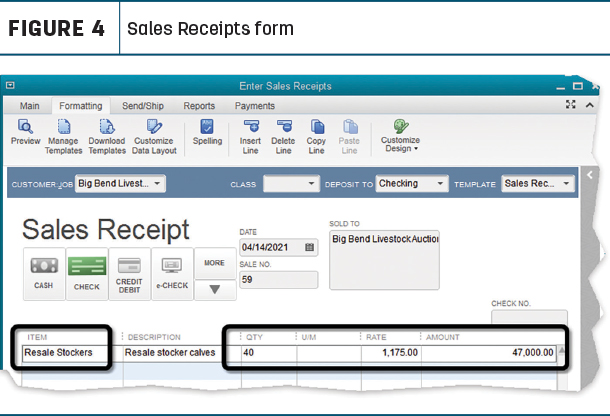

After backgrounding the calves over the winter, you decide to sell off the 40 biggest steers and keep the 60 smaller calves to graze a while longer on spring grass. The payment received for the steers would be recorded on the Sales Receipts form as shown in Figure 4, using the Resale Stockers Item and entering the quantity sold and total amount received.

The tax numbers you need

In the real world, you would probably sell the remaining 60 calves sometime later in the spring or summer. But for the sake of simplicity, let’s say that during the year, you only sold the 40 big steers.

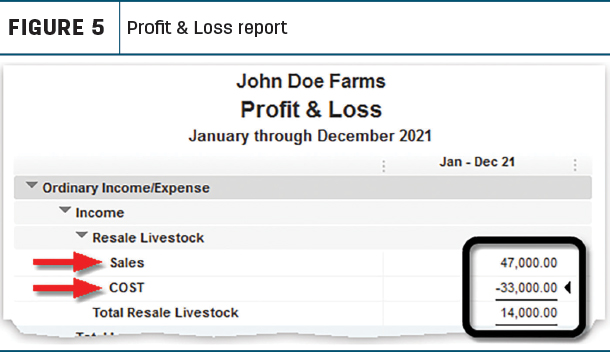

At income tax time, then, how do you get totals for resale livestock sales and their purchase cost? By looking at a Profit and Loss (P&L) report for the year, like the one in Figure 5 (which is really just a fragment of a P&L report, showing only the part we’re interested in).

Figure 5 shows resale livestock sales of $47,000, as expected, because that is the amount received for selling the 40 steers (the only resale cattle sold during the year).

But where did the cost figure come from? Remember, QuickBooks kept track of the running average purchase cost for Resale Stockers as the calves were being bought (Figures 2 and 3). When the 40 steers were sold (Figure 4), behind the scenes QuickBooks multiplied the number of head sold by their average purchase cost (40 head x $825 = $33,000) and posted that amount to the Resale Livestock: COST account. That amount appears on the P&L report and can be used directly as the year’s cost of items held for resale figure for filing income taxes.

This has been an overly simplified example, but everything would work the same way even if dozens of transactions and hundreds of cattle had been involved. The bottom line is: QuickBooks can automatically manage resale cattle cost information for you and charge off the appropriate amount to cost of items held for resale when you enter cattle sales. The only requirement is to set up an Inventory Part Item and use it when entering purchases and sales of resale cattle.