Online grocery shopping is big business at about $100 billion in annual sales. But it is far from hitting its peak, with sales projected to reach $250 billion by 2025.

This means that in three years, one out of every three grocery purchasing experiences will happen from the comfort of a person’s home.

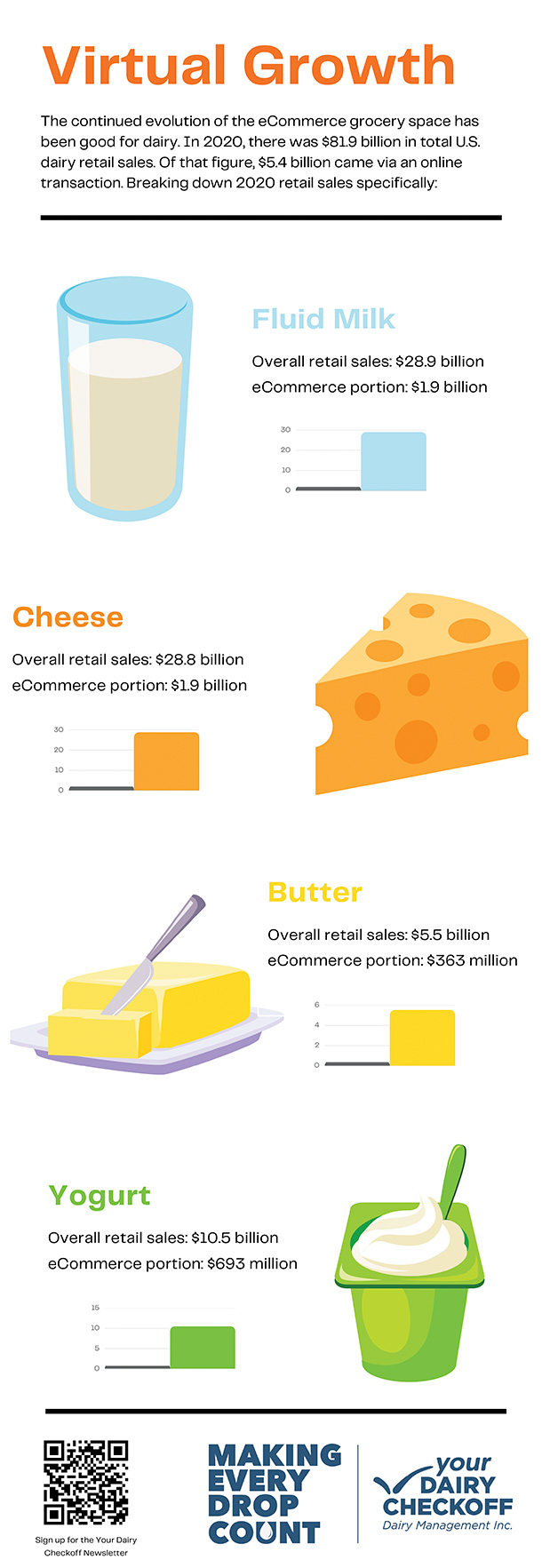

Dairy, thankfully, is entrenched in the virtual shopping experience as the second-largest department, behind dried goods with 14% of the total share. “Milk” also is the No. 1 searched term by consumers shopping on grocery retail sites.

Online retailers very much understand dairy’s value. The average online grocery order that does not contain dairy is $79. However, when dairy is included in the electronic shopping basket, that total jumps to $138.

eCommerce grocery sales had been projecting upward, but COVID-19 and its impact on human interaction sped the process along. In the pre-pandemic days, about 2% of grocery sales happened online, but that number soared to about 70% during peak lockdown times. It since has settled to about 13%, but category experts project it will only grow.

The checkoff has long understood the potential for dairy in spaces beyond the traditional brick-and-mortar store. In fact, just before COVID’s impact was felt, we had been formulating a strategy to engage with Amazon, which was well on its way to becoming an online grocery force. Amazon Fresh has since done just that with 2021 grocery sales totaling $14.5 billion. That figure is expected to hit $26.7 billion worldwide in 2026.

A breakthrough moment happened for us in May of 2019 when a team of Dairy Management Inc. (DMI) leaders and Minnesota dairy farmer Charles Krause were invited to Amazon’s headquarters for a meeting. We wanted to understand their views on dealing with a fresh product such as dairy and share how the checkoff could assist them with understanding more about the U.S. dairy industry.

We discussed dairy’s versatility and household penetration of about 94% as well as the annual increase of per-capita consumption with Amazon’s leaders. We also described dairy’s great sustainability story and how our products are produced by American farm families, with Charles sharing what it takes to operate a family-run dairy every day.

That meeting created a foundation of trust where Amazon sees us as a go-to dairy resource. We regularly offer consumer and category insights and assist with other opportunities that help sell more dairy on Amazon’s Fresh property.

Resource creation

Not long after that meeting, we created two in-depth manuals that dairy companies and local checkoff organizations can use to better understand eCommerce. Consider these “101” and “202” guides that detail everything from strategies dairy is undertaking to opportunities for exploration to who the key players are in this space.

This is, without question, dairy’s time to put a stronger grip on eCommerce opportunities as millennial and Gen Z consumers enjoy the conveniences and customized experiences that come with ordering groceries without ever leaving home.

We’re also seeing a blurring of eCommerce and social media, which provides more opportunities for dairy to engage and grow sales and trust. This is a key reason for the launching of a new wave of the checkoff-led Undeniably Dairy campaign last fall, which is using a variety of media channels and marketing strategies, including gaming, social media influencers and digital content, to engage with Gen Z consumers.

The campaign includes a partnership with Kroger Digital and Instacart, the largest U.S. online grocery platform, for content that began appearing in their retail apps and mobile sites last fall’s holiday season. Fun and engaging dairy-focused ads and messages appeared on their pages, and you will see a continued push of more work, including a back-to-school campaign with Kroger this fall that focuses on single-serve milk.

While dairy has a strong foothold in the eCommerce space, we understand this is not a time to take our foot off the gas. In fact, we need to accelerate faster and further and bring more of the industry to the virtual table. This is why we’re working with Darigold, a longtime industry eCommerce leader, to build a rock-solid case study that shows how dairy can better engage in the digital retail/social media channel. We’re going to work with social media influencers to help drive Gen Z shoppers to Instacart’s dairy landing page to learn more about their purchasing habits.

We hope our findings will demonstrate the value of eCommerce to more dairy companies and local checkoff organizations to explore how they can become more engaged in the online sale of dairy.

All of this isn’t to say the physical retail outlets don’t still play a vital role for our industry. They absolutely do. But it’s critical that we also continue adapting to the ever-changing habits of the consumers of tomorrow.

That means meeting them where they are – the virtual dairy aisle.

To learn more about your national dairy checkoff, visit U.S. Dairy or send a request to join our Dairy Checkoff Farmer Group on Facebook. To reach us directly, send an email to Talk To The Checkoff.

Your Dairy Checkoff in Action – The following update is provided by Dairy Management Inc. (DMI), which manages the national dairy checkoff program on behalf of America’s dairy farmers and dairy importers. DMI is the domestic and international planning and management organization responsible for increasing sales of and demand for dairy products and ingredients.