For those looking for key numbers in Federal Milk Marketing Order (FMMO) reports, this month’s focus is on butterfat and Class IV milk.

FMMO administrators reported November 2021 uniform milk prices, producer price differentials (PPDs) and milk pooling data, Dec. 9-14. The ongoing run-up in butter and butterfat values reverberated throughout the numbers.

Unlike the past 17 months, it was Class IV, not Class III, where depooling was evident, possibly setting the tone for what’s ahead in 2022.

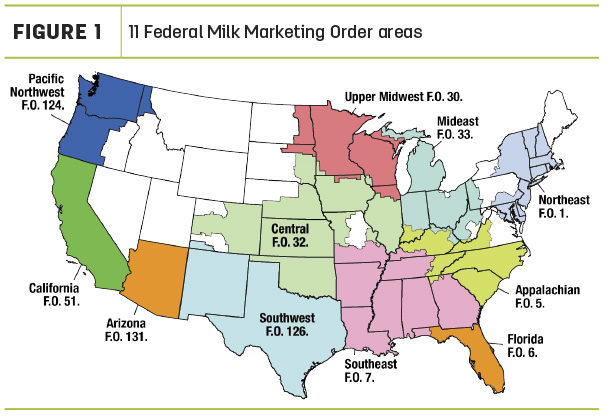

Here’s Progressive Dairy’s monthly summary of the FMMO numbers and their potential impact on your milk check.

Class prices rise

Prices for all individual classes of milk were up from October:

- The November advanced Class I base price moved to a five-month high at $17.98 per hundredweight (cwt), up 90 cents from October. When adding Class I differentials for each order's principle pricing points, the November Class I price across all FMMOs averaged $20.80, up 90 cents from October.

- November’s Class II milk price was $18.40 per cwt, up $1.32 from October.

- The November 2021 Class III price rose 20 cents from October to $18.03 per cwt, the highest since May. However, the November 2021 price was $5.31 less than a year earlier, when USDA pandemic food box purchases of cheese pushed the Class III price to $23.34 per cwt.

- The Class IV milk price moved to its highest point in more than seven years. At $18.79 per cwt, it was up $1.75 from October and up $5.49 from November 2020.

Class III-IV milk prices moved higher due to increases in values of butterfat and milk solids used in monthly milk price calculations. However, the value of protein declined. Average November butterfat and protein tests were higher among all FMMOs providing preliminary test results.

The value of butterfat rose more than 20 cents in November, topping $2.15 per pound. It was up about 60 cents from November 2020 and was the highest since December 2019. However, after surpassing $3 per pound in October, the value of milk protein slipped almost 26 cents in November to $2.75 per pound and was down $2.86 from November 2020.

Baseline PPDs positive

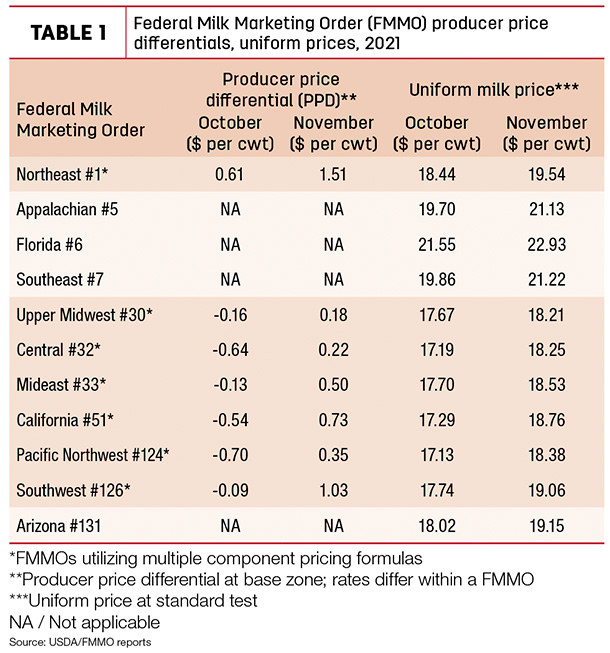

After dipping into negative territory in six of seven applicable FMMOs in October, November baseline PPDs turned positive, up 34 cents to $1.27 per cwt compared to October (Table 1).

As we remind you each month, PPDs have zone differentials within each FMMO and those with small positive PPDs will likely have some zones in which PPDs are negative. Also, whether positive or negative, individual milk handlers may apply PPDs to milk checks differently.

Uniform prices higher

With higher individual milk class prices, November blend or uniform prices at standardized test rose in all FMMOs (Table 1) and were the highest since June. When multiplied by milk class utilization in each FMMO, November uniform prices increased in a range of 83 cents to $1.47 per cwt across all 11 FMMOs compared to October. The high uniform price for November was $22.93 per cwt in Florida FMMO #6; lows of under $19 per cwt remained in five FMMOs.

Impact on pooling

One rule of thumb regarding FMMO milk marketings is that the higher the price of a Class III or Class IV price relative to the prices of other classes of milk, the greater incentive for handlers to keep that milk out of the FMMO pool (depooling) and retain the value for their milk suppliers instead of sharing it. That happened in November but somewhat dramatically different than what we've witnessed since June 2020.

During the pandemic, USDA food box purchases sent Class III milk prices skyrocketing and handlers depooled Class III milk. Now, with butter (domestically) and nonfat dry milk (exports) driving demand, Class IV milk prices have strengthened.

With the big jump in November, the Class IV price was higher than the Class III price for the first time since June 2019. In addition, the spread between November Class III-IV prices widened to 79 cents per cwt, the largest gap since June 2021. That created incentives for Class IV depooling in November.

You can get a general picture of depooling in a couple of ways: on a volume basis, comparing monthly pooling totals to previous months; and on a percentage basis, comparing the percent utilization a specific class of milk relative to all milk pooled that month.

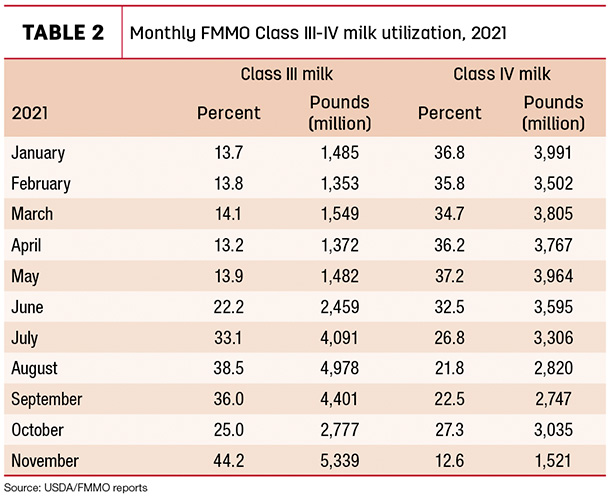

Looking at November, Class IV milk pooled across all FMMOs fell to about 1.5 billion pounds (Table 2), about half the volume for October and the lowest volume since January-February 2019. November Class IV milk utilization represented just 12.6% of total FMMO milk marketings, about one-third of the level seen in the first half of 2021, and again the lowest percentage since January-February 2019, when Class IV prices were running $1.50 to $2 higher than Class III milk.

November’s Class III-IV milk relationship had an opposite impact on Class III pooling. With the Class III milk price weaker than Class IV price, Class III handlers brought milk back to the pool. On a volume basis, Class III milk pooled in November was nearly double that pooled in October and was the highest volume pooled since mid-2019. As a percentage of utilization, Class III milk represented more than 44% of the total FMMO pool in November, also the highest since June 2019.

Looking ahead

When it comes to risk management, milk marketing surprises are not necessarily fun. So what’s ahead?

Near-term, the December Class I base price jumps $1.19 to $19.17 per cwt. Adding Class I differentials, the December Class I price will average $21.99 per cwt. December Class II, III and IV milk prices will be announced on Jan. 5, 2022.

At the close of Chicago Mercantile Exchange (CME) trading on Dec. 13, the December Class III futures price settled at $18.62 per cwt, up 59 cents from November, with the Class IV futures price settling at $19.78 per cwt, up almost $1 from November. If those prices hold, the Class III-IV price spread would be $1.16 per cwt, again adding incentives for Class IV depooling.

Longer-term, as of Dec. 13, Class III futures prices averaged $19.62 per cwt for all of 2022, with Class IV futures averaging $20.20 per cwt. The spread between the Class III-IV futures prices averages about 58 cents for the year, with a peak of 82 cents in April.

While fluctuating, that spread maintains Class IV depooling incentives. Individual FMMO pooling, depooling and repooling rules play a role in how much. And milk markets change, seemingly on a daily basis.

Class I mover

In December, the difference between the advanced Class III skim milk pricing factor ($11.40 per cwt) and the advanced Class IV skim milk pricing factor ($11.52 per cwt) was 12 cents, yielding a net benefit under the “average-of plus 74 cents” formula used to calculate the Class I mover. The January Class I base price, along with advanced Class III-IV skim milk prices used in the Class I mover, are released on Dec. 22.

Coming up: Reports and a hearing?

The USDA releases November 2021 milk production estimates on Dec. 20. USDA cold storage data covering cheese and butter inventories are released Dec. 22. The November Dairy Margin Coverage (DMC) program margin and potential indemnity payments are announced on Dec. 30.

With the Class I mover and depooling continuing to draw attention, U.S. Sens. Kirsten Gillibrand (D-New York), Susan Collins (R-Maine) and Patrick Leahy (D-Vermont) have introduced the Dairy Pricing Opportunity Act of 2021. The bill would require the U.S. Secretary of Agriculture to initiate national hearings within six months of enactment on possible FMMO reforms, with primary focus on the “Class I mover” pricing formula. Stay tuned.