Schools are opening, and football season is getting started. With autumn just a month away, it’s time to update Progressive Dairy’s risk management calendar and review late summer margin conditions.

Dairy margins weakened to end July, steady to start August

Dairy margins deteriorated over the second half of July as a sharp drop in milk prices more than offset feed price trends, which were generally flat, according to Commodity & Ingredient Hedging LLC (CIH). A bearish USDA Milk Production report set the tone for milk prices, although the Cold Storage report food service and restaurant demand from relaxed COVID-19 restrictions recently may have helped keep cheese inventories in check. On feed, prices for both corn and soybean meal traded in narrow ranges.

Margins during the first half of August were unchanged, with increases in milk prices largely offset by rising feed costs. Strength in cash cheese prices were supportive of CME Class III milk futures, but the overall tone of the market remained bearish with spot futures still down about $2.50 per hundredweight (cwt) from their May highs.

The USDA’s latest World Ag Supply and Demand Estimates (WASDE) report, released Aug. 12, reduced 2021 and 2022 milk production forecasts slightly on expectations of lower cow numbers going forward. However, price projections were also reduced for both years due to larger supplies and weakening demand.

Read: USDA cuts 2021-22 milk production outlook but also reduces price projections.

The bigger surprise in the WASDE report was on the feed side where the USDA cut corn and soybean yield projections. Both corn and soybean meal futures prices pushed higher following the report, and high feed costs continue to raise break-even prices for most dairy operations, according to CIH.

Federal Milk Marketing Order (FMMO) administrators reported July 2021 uniform milk prices, producer price differentials (PPDs) and milk pooling data during the week of Aug. 13. As they were in June, July baseline PPDs in all applicable FMMOs were again positive. One the other hand, uniform or “blend” prices at standardized test moved lower in all 11 FMMOs.

Read: Class III pooling, positive PPDs return but prices are lower.

The USDA’s July Milk Production report was scheduled for release in the afternoon of Aug. 19 (after the deadline for this article). Check “This Week in Dairy” on Progressive Dairy’s website for a summary.

Dairy Margin Coverage (DMC) program

On Aug. 19, the USDA released some details of a $350 million Pandemic Market Volatility Assistance Program, providing targeted financial assistance to U.S. dairy producers. The program will provide payments to dairy farmers who received lower prices for milk due to market abnormalities caused by the COVID-19 pandemic. The assistance is part of a larger package that also includes retroactive and permanent adjustments to feed cost calculations under the Dairy Margin Coverage (DMC) program. The change, to the alfalfa hay factor, will be retroactive to January 2020.

Read: USDA announces Pandemic Market Volatility Assistance Program for dairy.

Milk and feed price factors used to calculate July 2021 DMC program margin and potential indemnity payments will be released by the USDA on Aug. 31 (see Calendar).

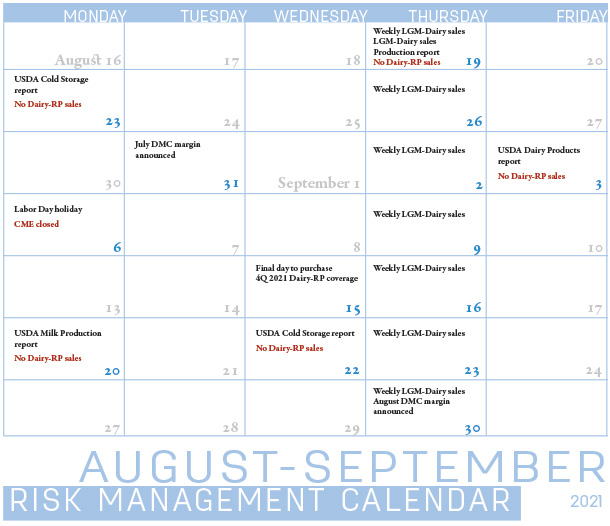

Click here or on the calendar above to view it at full size in a new window.

With July FMMO Class I base, Class III and Class IV milk prices are all down from June, the July all-milk price is likely to come in well below the level triggering indemnity payments.

As of the close of trading on Aug. 11, the DMC Decision Tool estimated July feed costs at $12.19 per cwt. At that rate, an all-milk price under $21.69 per cwt would trigger DMC indemnity payments for July milk.

One other reminder: The deadline to pay DMC premiums for producers participating in the calendar year 2021 program is approaching. Beginning Sept. 1, local Farm Service Agency offices will begin contacting producers regarding any outstanding premium payments due before Oct. 1. If not paid, outstanding premiums will be deducted from future indemnity payments. Producers with unpaid premiums for calendar year 2021 will not be approved for calendar year 2022 DMC participation until premium fees have been paid in full. Contact your local USDA office for more information.

Here’s a look at two federally subsidized dairy risk management programs, Dairy Revenue Protection (Dairy-RP) and Livestock Gross Margin for Dairy (LGM-Dairy).

Dairy-RP

One quarterly deadline is coming up: The final day to purchase Dairy-RP coverage for the fourth quarter of 2021 is Sept. 15. Dairy-RP coverage is generally available for milk produced four or five quarters out in the future. Throughout a crop year, there are always five quarterly insurance periods available for quoting premium and obtaining coverage, with the exception of June 16-30, when only four quarterly insurance periods are available.

Dairy-RP is available every day except holidays and USDA report days that could impact markets, including Milk Production, Cold Storage and Dairy Product reports. Dairy-RP is also not available on days when applicable futures contracts move limit-up or limit-down.

Dairy-RP offers two pricing options – class pricing or component pricing – designed to allow producers to customize their price elections to accurately reflect their price risk. The class pricing option uses a combination of Class III and Class IV milk prices based on insured’s declared class price weighting factor.

The component pricing option uses a combination of butterfat, protein, other solids and nonfat solid values based on the insured’s declared butterfat test, declared protein test and declared component price weighting factor.

Premium subsidies range from 44% to 55%. Dairy-RP provides protection against an unexpected decline in revenue (yield and/or price) on milk.

LGM-Dairy

Sales periods for the Livestock Gross Margin for Dairy (LGM-Dairy) program are open on a weekly basis. LGM-Dairy factors are calculated using the average closing prices for Chicago Mercantile Exchange (CME) Class III milk, corn and soybean meal futures on Tuesday-Thursday each week. The policy sales period opens on Thursday starting at 4:30 p.m., with sales ending at 9 a.m. (both times Central time) on Friday.

Unlike Dairy-RP, which is not available on the day of USDA’s major dairy reports, LGM-Dairy is available each week, even if a sales period falls on the day of a USDA report.

Coverage is available out 12 months, excluding the first month. You need to select coverage in two-month increments to get a USDA Risk Management Agency (RMA) premium subsidy.

Premium subsidies range from 18% to 50%. For example, a zero deductible policy has an 18% premium subsidy. A deductible of 50 cents per cwt has a 28% subsidy, and the $1-per-cwt deductible has a 48% subsidy. Premiums are due at the end of the coverage period. There are no transaction fees.

Both LGM-Dairy and Dairy-RP insurance policies are sold and delivered solely through private crop insurance agents. A list of crop insurance agents is available online using the RMA Agent Locator.

Other resources

- While Progressive Dairy provides analysis of monthly DMC program margins and indemnity payments, American Farm Bureau Federation assistant economist Daniel Munch also provides an additional overview here.

- Zach Myers, Pennsylvania Center for Dairy Excellence (CDE) risk education manager, hosts his monthly “Protecting Your Profits” webinar on Aug. 25, beginning at noon (Eastern time). Advance registration is not necessary. To participate in the webinar, click here or phone: (646) 558-8656. When prompted, enter meeting ID 848 3416 1708 and passcode 474057. A recording of the webinar is now available here.

- The Pennsylvania CDE will also host a Dairy Financial and Risk Management Conference, Sept. 21, 8:30 a.m. – 4 p.m. The live event will be held at the Best Western Premier – The Central Hotel & Conference Center in Harrisburg, Pennsylvania. A virtual option will also be available. Speakers will include dairy economist Marin Bozic, Pete Gelber from Barrington Dairy and Lamar King of Bare Wealth Advisors. A dairy cooperative and independent processor panel will feature Chuck Turner, Turner Dairy Farm; Jennifer Huson, Dairy Farmers of America; and Troye Cooper, Maryland and Virginia Milk Producers. Find more about the speakers and their topics on the conference registration page.