November 2022 DMC at a glance

Dairy Margin Coverage (DMC) program margin factors compared to previous month:

- Alfalfa hay: $331 per ton, down $17 from October 2022

- Corn: $6.49 per bushel, down 1 cent

- Soybean meal: $436.75 per ton, down $31.93

- Total feed costs: $14.71 per hundredweight (cwt), down 48 cents

- Milk price: $25.60 per cwt, down 30 cents

- Margin above feed cost: $10.89 per cwt, up 17 cents

- DMC indemnity payments: None

Source: USDA Farm Service Agency, Dec. 30, 2022

The USDA released its latest Ag Prices report on Dec. 30, including factors used to calculate November DMC margins and potential indemnity payments.

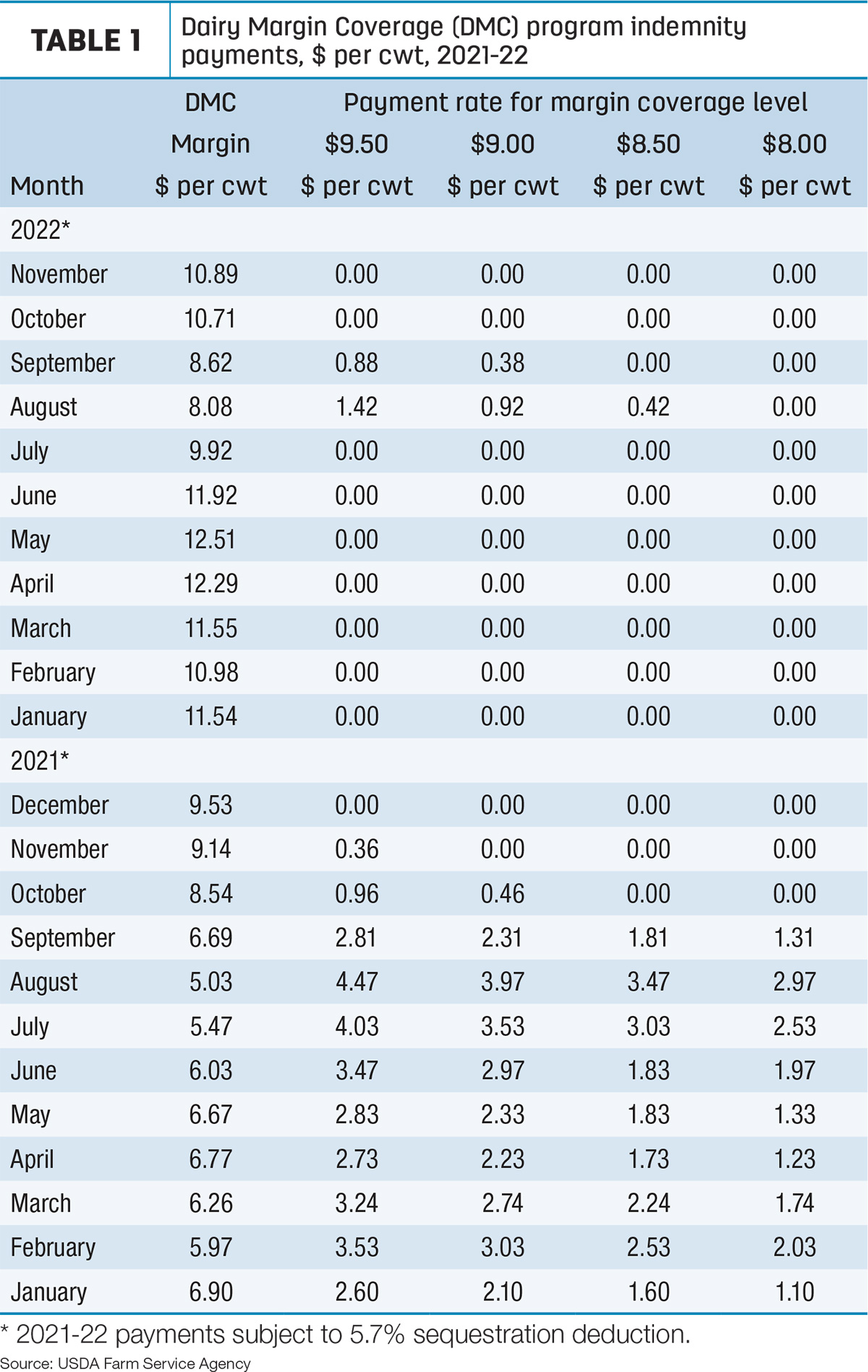

Margin and payments

With lower feed costs offsetting a lower average all-milk price, the November DMC margin was $10.89 per cwt, up 17 cents from October and well above the top Tier I coverage level of $9.50 per cwt. There will be no indemnity payments at any coverage level (Table 1).

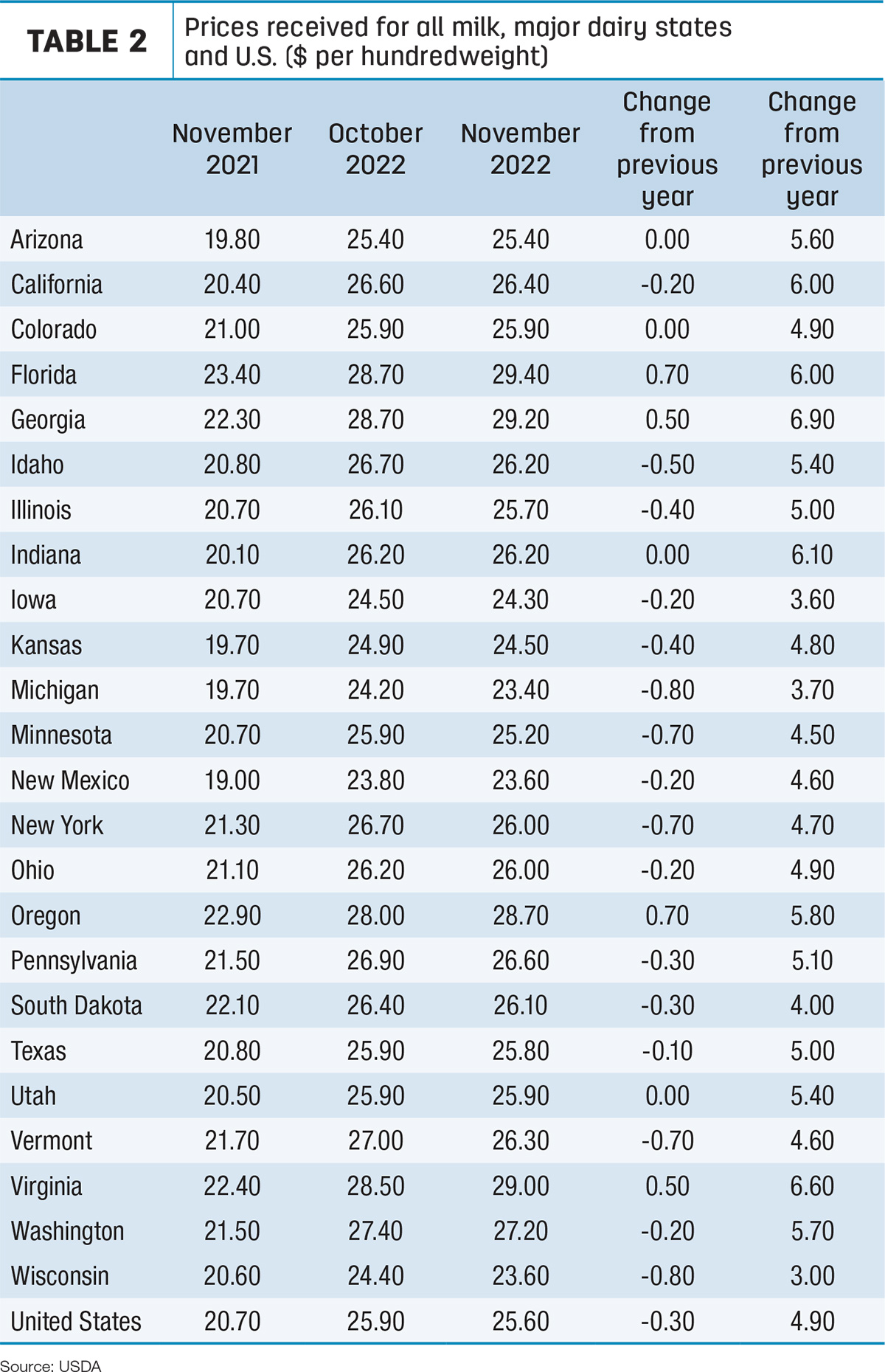

Milk prices mostly lower

The November 2022 announced U.S. average milk price dipped 30 cents from October to $25.60 per cwt (Table 2). The milk price average was still $4.90 higher than November 2021, and the year-to-date average is $25.64 per cwt, the highest January-November average on record.

November milk prices were higher than the month before in only four of 24 major dairy states: up 70 cents in Florida and Oregon and up 50 cents in Georgia and Virginia. Elsewhere, November prices were down 10-80 cents in 16 states, led by Michigan and Wisconsin (each down 80 cents) and Minnesota, New York and Vermont (all down 70 cents). Month-to-month prices were unchanged in Arizona, Colorado, Indiana and Utah.

Compared to a year earlier, November 2022’s U.S. average milk price was up $6 per cwt or more in five states, led by Georgia ($6.90), Virginia (6.60) and Indiana ($6.10).

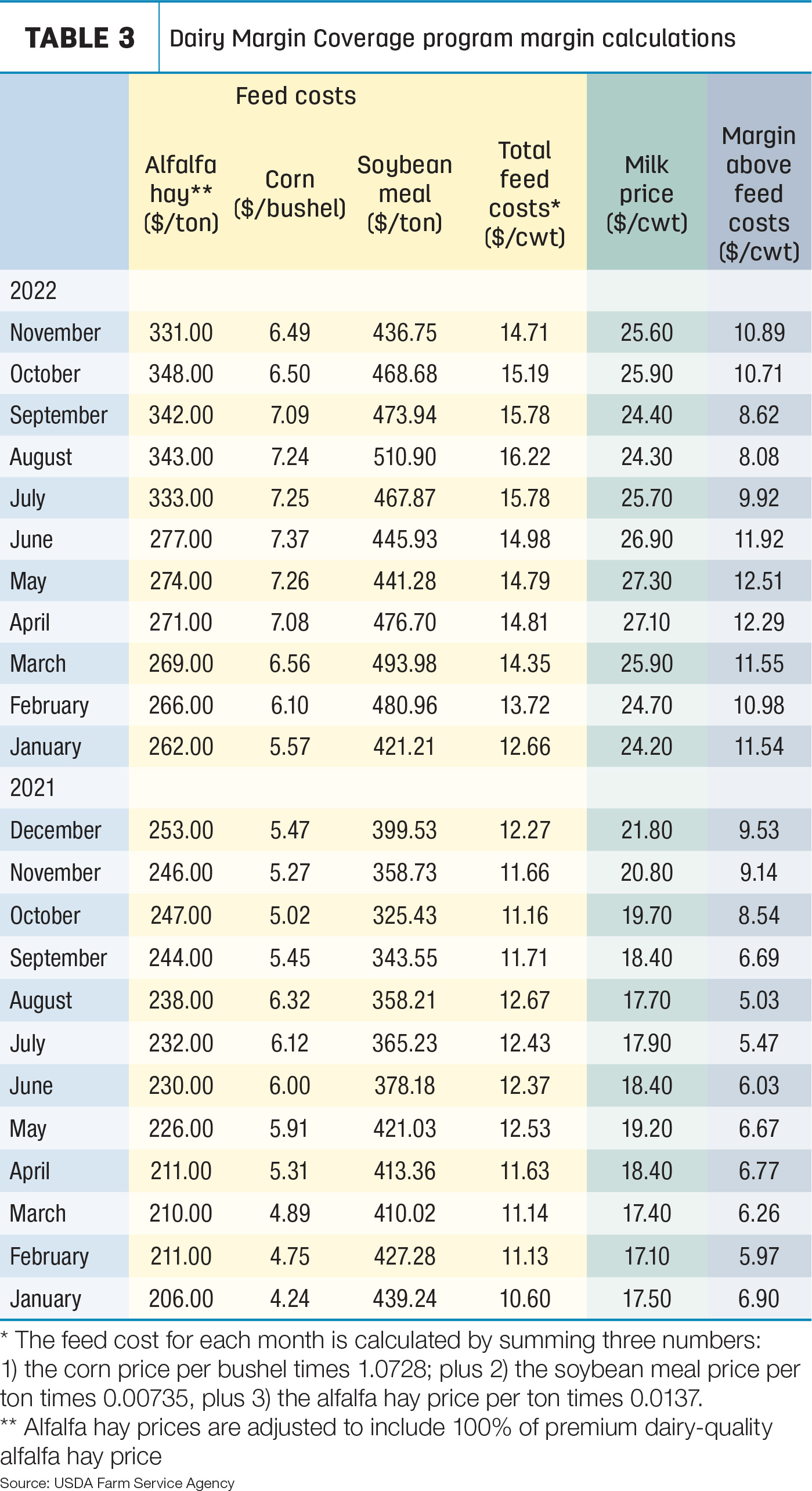

Feed costs decline

Offsetting some of the lower average milk price, the DMC margin was supported by lower overall average feed costs (Table 3).

- At $6.49 per bushel, the average price for corn was 1 cent lower than the October average and the lowest since February. It was $1.22 per bushel higher than the average price in November 2021.

- The November average price for dairy-quality alfalfa hay was $331 per ton, down $17 from October and the largest month-to-month decline in the history of DMC or its predecessor, the Margin Protection Program for Dairy (MPP-Dairy).

- The average cost of soybean meal (SBM) fell to $436.75 per ton, down $31.93 from October and the lowest since January.

The feed cost for each month is calculated by summing three numbers: (1) the corn price per bushel times 1.0728; plus (2) the soybean meal price per ton times 0.00735, plus (3) the alfalfa hay price per ton times 0.0137.

November feedstuff prices yielded an average DMC total feed cost of $14.71 per cwt of milk sold, down 48 cents from October and the lowest since March.

Looking ahead

The December DMC margin will be announced on Jan. 31, 2023. Last updated on Dec. 29, the DMC decision tool projected the December 2022 margin at $9.70 per cwt, 20 cents higher than the top $9.50 per cwt coverage trigger.

Thereafter, however, margins are forecast below $9.50 for January-September 2023, with lows of about $7.25 in February and March and $7.50 in April and May 2023 and averaging $8.46 per cwt for the year.

2023 enrollment reminder

Dairy producers have about one month to enroll and make 2023 DMC and Supplemental DMC coverage elections. The deadline is Jan. 31, at USDA Farm Service Agency offices. Producers will need to certify to commercially marketing milk, pay the $100 administrative fee and sign the DMC contract, selecting the annual milk volume and coverage level for the year.

Looking back

DMC program indemnity payments on August and September 2022 milk marketings were estimated at about $84.6 million. The August DMC margin was $8.08 per cwt, triggering indemnity payments at $9.50, $9 and $8.50 per cwt coverage levels. The September DMC margin was $8.62 per cwt, triggering indemnity payments for Tier I producers covered at the $9 and $9.50 per cwt levels.

Operating costs mixed

Outside of feed – and not factored into DMC margins – other costs were mixed. The November index of prices paid for commodities and services, interest, taxes and farm wages was unchanged from October 2022 but 11% more than November 2021. Machinery costs dipped 0.4% from October but were up 13% from November 2021. The November fuel cost index was down 0.3% from October but 22% more than November 2021. Fertilizer prices rose 0.5% from October and were 20% higher than November 2021.

Market cow prices drop

Impacting the income side of the ledger, heavier volumes of beef cull cows headed to market, pressuring prices lower. U.S. average prices received for cull cows (beef and dairy, combined) in November averaged $78.40 per cwt, down $5.70 from October and the lowest monthly average since February.

Marketing of U.S. dairy cull cows through U.S. slaughter plants declined slightly in November and remained behind last year’s pace. At 250,900 head, the November total was down 1,900 from October but about 5,600 more than November 2021.