As national economic leaders approach their second year of battling inflation, it’s critical for ag business owners to know where the shelling is hitting hardest.

Dr. Ed Seifried, dean of the West Virginia Banking School and the Virginia School of Banking, told dairy producers at the 2023 Managers Academy that while the U.S. Federal Bank is doing all it can to fight inflation, “the chasm of collateral damage could be your business.”

Managers Academy, held Jan. 10-12, in Savannah, Georgia, brought dairy producers and industry partners for economic outlook and business training to be applied in their operations. It is hosted by Professional Dairy Producers (PDPW).

Seifried presented several economic indicators to highlight possible directions for the national economy in 2023. The inflationary battle poses threats to the ag producer on two key fronts as consumers are hit by higher prices, and the Federal Reserve (Fed) tackles inflation by lifting interest rates. That resistance can affect building and gross domestic product (GDP). The federal funds rate percentage went from 0.25% in 2021 to 4.5% in December 2022 after several percentage rate hikes.

“To you, GDP is the ability of your customers to buy your products,” Seifried said. “So when GDP doesn’t grow very much, good luck to any more sales.”

When examining that potential slowdown with more interest rate increases, including the potential for at least another round of quarter-point rate increases early this year, Seifried said the Fed must balance how much burden to place on spending as it curbs prices.

Seeing the impact of a year’s worth of increases isn’t felt immediately, he said, “It takes time to work its way through.”

Quoting Raphael Bostic, president and chief executive officer of the Federal Reserve Bank of Atlanta, however, Seifried said officials may feel inclined to keep rates high into 2024 and could rise higher than 5.5%. “This is the first indication that this inflation fight isn’t going to end this year,” Seifried said.

“So if you are hoping for a little bonus in 2024, or lower interest rates or to lower your costs with working capital, according to him it may not occur.”

Fed officials want to hit the brakes on borrowing costs, weaken price pressure by slowing down hiring and spending on investment, he said. It may feel like the bank wants to slow producers’ businesses down.

“Why? Because they think if they do, inflation will move back to normal,” he said.

Goldilocks economy and inflation

Seifried said those watching the economy need to be familiar with what Wall Street is dubbing a Goldilocks economy, or a formula that keeps unemployment low, job growth positive but wage growth relatively slow.

That formula created a stable beginning to 2023. The unemployment rate has held at around 3.5% since July 2022, and job growth remains positive with 223,000 new jobs in December and averaging 264,800 new jobs monthly since August. Average hourly wages were around $27.57 in summer, rising just barely to $28.01 in the holiday months.

“This is what we mean we say Goldilocks. Things are going a little bit better. We're having job growth, but wage growth has sort of fallen down.” The data sparked rallies on Wall Street, Seifried said, “because a Goldilocks economy is what everybody wants.”

Reviewing commodities listed in the Consumer Price Index for November 2022, Seifried identified most of the key dairy products showing unadjusted percent changes over a year’s time. While the CPI increase for all items in November was 7.1% (and dropped to 6.5% for December), the actual price felt at home for food was around 12% according to the same report.

That equated to 16.4% increase for cereals and baked goods, milk dairy was up 14.7%, cheese up 15.6%, ice cream up 17.5%, poultry up 13.1% and eggs up a staggering 49.1%.

But even if inflation continues to drop in the early months of 2023, Seifried warned that Fed bank officials may see the interest rate hikes as a form of antibiotic treatments; just because you feel better after a few doses doesn’t mean you’re healed. You have to keep taking the medication.

“They’re saying, if we see inflation come down and we can see a little bit of pain in the economy, we can't stop; we have to finish the job,” he said.

Recession watch

Seifried said the biggest discussion happening at all levels of the economy is whether GDP will begin to slow down and hit a recession. The key stages the U.S. economy could hit can be defined in one of three ways.

- Soft landing – no inflation and no recession

- Hard landing – no inflation but a recession

- Stagflation – inflation stays and a recession

The housing market’s decline in the past year is worsened by the higher interest rates, thus freezing growth for new construction and housing starts. In the ag world, higher interest rates will make business and lending harder for producers over the next two years.

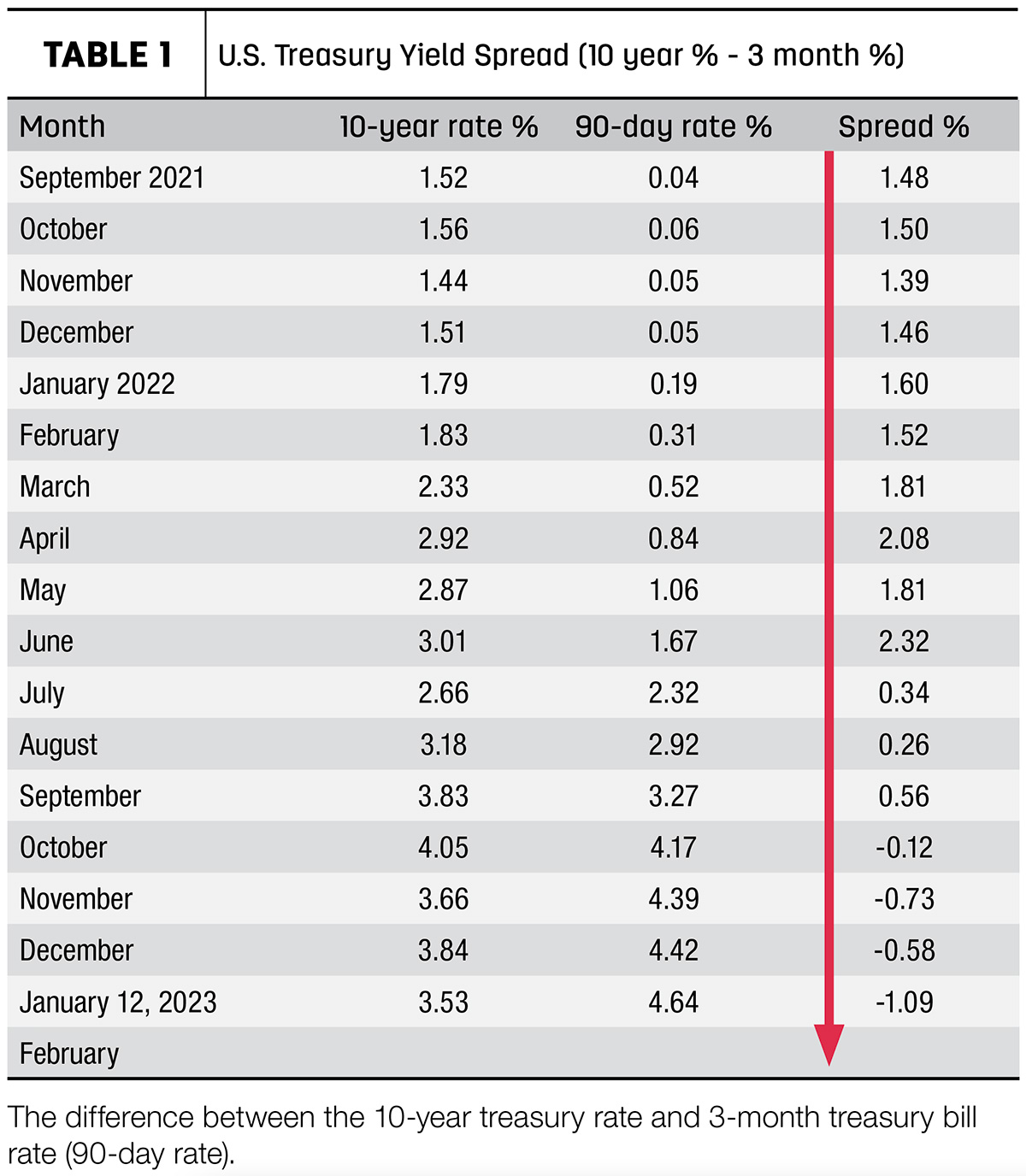

Seifried instructed those attending to keep a close watch on the interest rate spread between the dropping 10-year bond and the increasing 90-day treasury bill (Table 1).

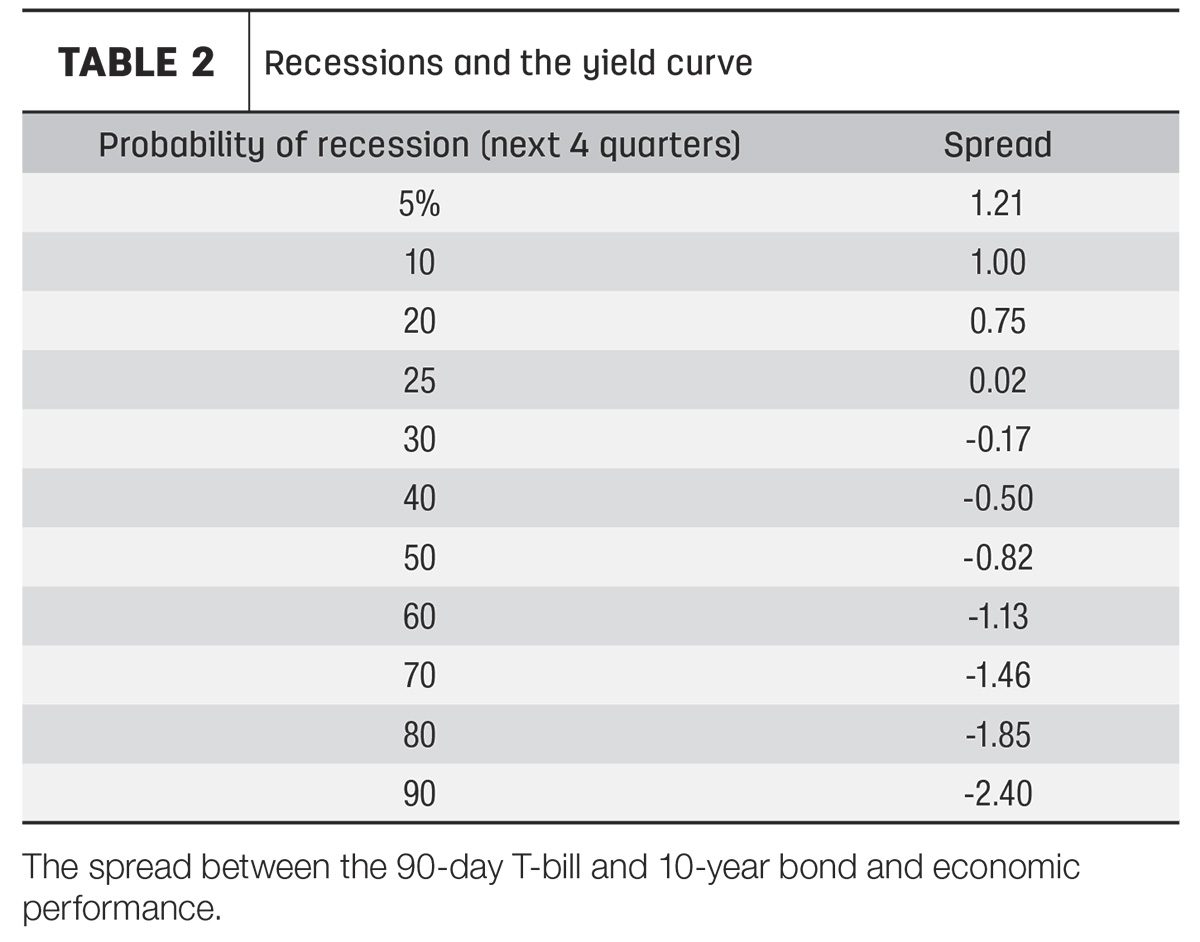

Traditionally, in stronger economic times, the 10-year bond keeps ahead of the 90-day T-bill with a spread anywhere between 0.25% and 1.48%. When the yield between the two becomes inverted, with 90-day rates climbing above the 10-year bond, odds of a recession increase (Table 2).

Traditionally, in stronger economic times, the 10-year bond keeps ahead of the 90-day T-bill with a spread anywhere between 0.25% and 1.48%. When the yield between the two becomes inverted, with 90-day rates climbing above the 10-year bond, odds of a recession increase (Table 2).

In October 2022, the 90-day rate (4.17%) outpaced the 10-year rate (4.05%) for a -0.12% spread. As of Jan. 12, 2023, the spread had grown to -1.09%.

“Something’s wrong. That shouldn’t be. We have a name for it; it’s called the inverted yield curve,” Seifried said.

“Unless this changes and changes soon, we’re going to have a recession,” he added. “If we do have a recession, that’s falling GDP, that’s falling sales.”